His swords were words he wielded well

He spoke his truths, but would not yell

His followers enrapt

His enemies then snapped

And undeservedly he fell

RIP Charlie Kirk

A score plus four of years have passed

Since thousands died, we were aghast

No logic could be found

For those at, zero, ground

Society is falling fast

A generation after the horrific events of September 11, 2001, it appears that memories have faded. Personally, having observed those events from one block away, it is indelibly imprinted on my brain. But now, in the course of a week we have seen several senseless murders make the news as whatever decorum may have existed at the turn of the century is long gone. Messrs. Howe and Strauss were always quite clear that the 4thTurning involved chaos and the destruction of institutions. I fear the process is accelerating. I also fear that it must play out to get through to the other side. Civil war feels excessive as a description, but as I have forecast for the past year or two, one of the major political parties was likely to explode. Right now, it feels like the Democrats are on that path. I don’t know what will replace it, but something must, and it would behoove us all if there is some coherence in their policies when it appears. I remain confident that Socialists are not the answer, nor will they be embraced across the nation.

The reason I discuss this, which seems outside the bounds of my market perspective, is that it is going to impact markets even more than it already has. The ongoing politicization of the media, businesses and entertainment does not lead to kumbaya, but rather volatility and distress. If you wonder why gold continues to perform well, look no further. Whatever the data, whatever the Fed does, whatever Trump and his administration do, or what Congress tries to do, gold has a history of maintaining value for the past 5 millennia. Everything else is new and prices are all relative to gold. Remember that as you approach your day job and your investments, whether you hedge for a living, or simply are trying to make a living.

There are now two things on the docket

That could lead risk assets to rocket

First, CPI comes

The Jay and his bums

Decide what gets put in our pocket

Considering these very serious issues, it seems almost ridiculous to discuss markets, but they will continue to trade and the ability to keep your eye on that particular ball is still critical to financial outcomes. So, let us turn to the two stories (well, maybe two and a half stories) that have the potential to change some viewpoints. The first is today’s CPI, then next week’s FOMC meeting with a half nod given to today’s ECB meeting.

Regarding the least important, the ECB is almost certainly going to leave policy unchanged. The only opportunity for anything new will come from Madame Lagarde’s press conference and if she displays a new tone, whether hawkish (I doubt) or perhaps more dovish as European data continues to ebb.

But let’s move on to CPI. After yesterday’s much lower than expected PPI data, where the M/M numbers for both headline and core were -0.1% compared to +0.3% expected, there has been some talk on the margins that we could see much softer CPI data. However, it is worth knowing that for the inflation cognoscenti (e.g., @inflation_guy) PPI data is seen as a random number generator with very little direct impact on the consumer data. (In fact, after my look at NFP data, aren’t all the data points random?) With that in mind, current median expectations remain as they were earlier in the week (0.3% M/M for both headline and Core with the Y/Y numbers expected at 2.9% and 3.1% respectively).

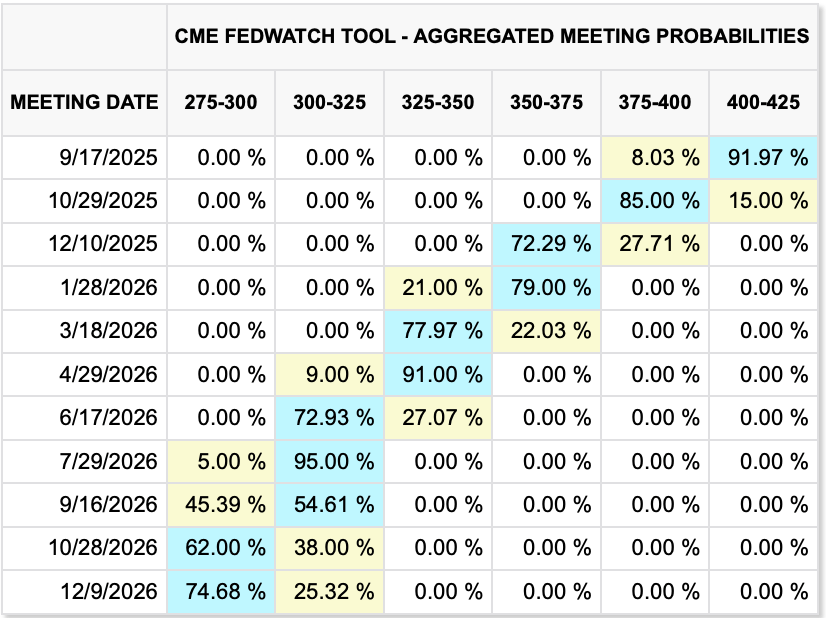

Given the market is currently pricing a full 25bp cut with an 8% probability of 50bps, my take is the only way to change things would be for CPI to also print like the PPI data as negative numbers. If that were to be the case, and I do not anticipate that outcome by any stretch, it would give Chairman Powell ample opportunity to cut 50bps with the market welcoming the outcome along with President Trump. On the flip side, I don’t think CPI can print a high enough number to remove the 25bp cut. As a reminder, below are the cumulative probabilities for future Fed funds rates based on the CME’s futures contract. A total of 75bps remains the default view for the rest of 2025.

We will learn about the outcome at 8:30 this morning and I have no particular insight into whether those median forecasts are high, low or on the money. This is a wait and see situation.

As to the FOMC meeting, it has the opportunity to be far more impactful. While 25bps is currently baked in the cake, I remain of the opinion that 50bps is a very viable outcome. Recall, the most recent Fed discussions were about the importance of the employment portion of their mandate as opposed to the inflation portion. With the newly revised reduction in NFP over the past twelve months, characterizing the employment situation as solid or strong seems unreasonable. Weakening would seem a more apt description and should have the discussion be between 25bps or 50bps. We already know there are at least two governors, Bowman and Waller, who wanted to start cutting last time, and it appears that Stephen Miran, Trump’s current head of the CEA, is going to get approved by the Senate in time to sit in the meeting next week. One would assume that is a vote for easier policy.

ITC Markets has a very nice table on the perceived hawkishness/dovishness of FOMC members, and it shows that the governors, as a whole, live in the dovish camp with only a few regional presidents as known hawks. In fact, one of the remarkable things about the entire Lisa Cook affair is that she was always one of the more dovish members of the board and the fact that she was not pushing for cuts never made any sense. At least based on her background and history. However, if you take politics into account, and the idea that she didn’t want to cut because President Trump wanted a cut, it begins to become clearer. At any rate, it strikes me that based on this table, which feels reasonable, 50bps is in play.

With all that in mind, let’s take a quick turn around the markets to see what is happening ahead of this morning’s data. As seemingly always, equity markets rallied in the US yesterday, well mostly. The DJIA slipped, but the other indices managed to continue their hot streaks. It is very hard to link economic activity to equity market outcome these days, at least to my eyes.

But on to Asia, where Japan (+1.2%) had a solid session on the back of the remarkable rise in Oracle shares and the idea that Japanese tech companies will benefit. China (+2.3%) was the beneficiary of the story that President Xi is now looking to have banks prop up local governments that have stopped paying contractors now that their property sale gravy train has derailed. It seems that they have figured out if you don’t pay people, they don’t consume anything. So, upwards of CNY 1 trillion will be injected into local government coffers specifically to pay these late bills and try to kickstart consumption. But, as I look through the rest of the region, it was a much more mixed picture with some gainers (Korea, Indonesia, Thailand), some laggards (HK, Malaysia, Australia) and many markets that barely moved.

In Europe, all the major markets are green this morning led by the CAC (+0.85%) and UK (+0.5%) with the others showing much smaller gains (DAX +0.2%, IBEX +0.25%). There is no obvious reason for the gains as expectations for the ECB remain static and there has been no data of note released. Meanwhile, US futures are higher by 0.25% at this hour (7:30).

Bond markets remain frozen as Treasury yields have edged higher by just 1bp and European sovereign yields are +/-1bp from yesterday’s close. As you can see from the chart below, the range on 10-year Treasuries has been fairly narrow for the past week. Perhaps today’s CPI will shake things up.

Source: tradingeconomics.com

In the commodity space, oil (-1.25%) is giving back the gains it saw earlier in the week but basically remains unchanged overall. If fears grow that a recession is upon us, I could see a rationale for oil to decline, but it is hard to get excited about the market right now. Gold (-0.6%) is backing off its most recent all-time high, but is still firmly above $3600/oz. Given the recent run, it is no surprise it takes a breather here and there is no reason to believe that precious metals are topping out. In fact, a look at the charts tells me that there is plenty of upside left across the space.

Source: tradingeconomics.com

Finally, the dollar is a bit firmer this morning, probably one reason the precious metals are under some pressure, but here too, if we use the DXY as our proxy, the range is pretty clear.

Source: tradingeconomics.com

JPY, INR and ZAR are the largest movers this morning, each declining -0.4%, while the rest of the world is mostly softer by -0.1% to -0.2%. Broad based dollar strength but no depth whatsoever. We shall see how things behave after the CPI release.

And that’s really it. For now, the big picture remains the same, where the prospects of an easier Fed will weigh on the dollar and support commodities. Equities will like that for now, at least until inflation picks back up, and bonds feel subject to manipulation so I’m just not sure.

Good luck

Adf