Though debt round the world keeps on growing

The equity run isn’t slowing

But what’s more insane

Is yields slowly wane

Despite signs inflation ain’t slowing

The French are the latest to hear

Their credit’s somewhat less sincere

But CBs this week

Seem likely to tweak

Rates lower, and markets will cheer

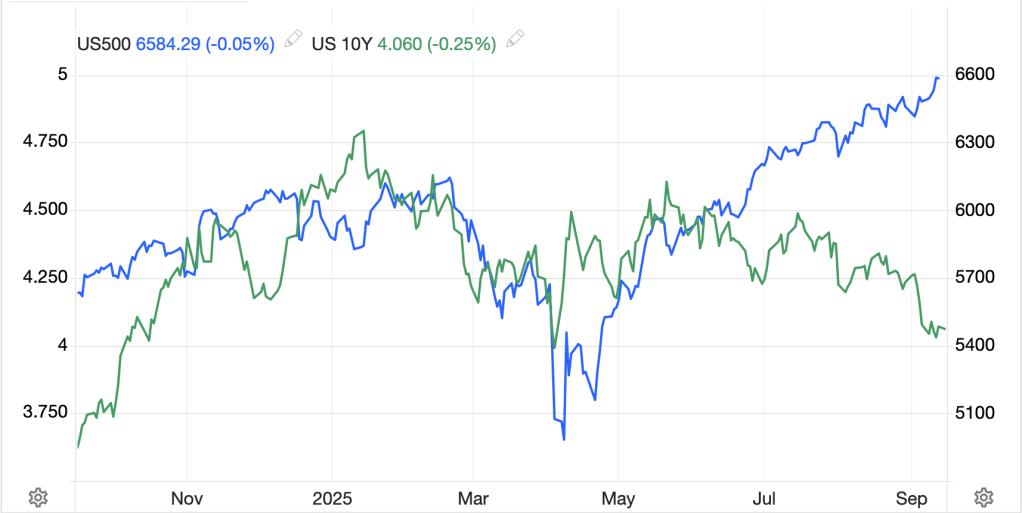

Something is rotten in the state of financial markets, or at least that is the conclusion this poet has drawn (and please do not think I am trying to compare myself to Shakespeare). No matter what my personal view of the economy may be, I cannot help but look at the recent performance of the equity market and the bond market and be extremely confused. The chart below shows the past year’s price action in the S&P 500 (blue line) and US 10-year yields (green line).

Source: tradingeconomics.com

Since early June, the two price series, which have historically had a pretty decent correlation, have gone in completely opposite directions. Equity markets continue to trade to new highs on a regular basis as earnings multiples continue their expansion. Typically, multiples only expand when growth expectations are rising, and the economy is in an uptrend. Ergo, if multiples are high and rising, it seems equity investors believe that is the case. I understand that view as there are strong indications the administration is going to continue to ‘run the economy hot’ meaning do all it can to increase economic activity and allow inflation to rise as well, counting on the fast growth to offset the pain.

However, 10-year Treasury yields have been sliding steadily for the past three months despite the equity market belief in running it hot. Bond yields have historically been far more sensitive to inflationary pressures and the fact that yields have been declining, down >40bps since early June, would lead to a very different conclusion about the economy, that it is going to see much slower growth and by consequence, reduced inflationary pressures.

I have discussed the asynchronous economy in the past and I believe this is more proof of that thesis. The equity markets are still being largely driven by the AI/Tech sector and while that is a huge portion of the equity market, its size within the overall economy is pretty small. Given the capital weightings of both the S&P 500 and NASDAQ, strength in that sector has clearly been sufficient to drive stock indices higher. However, much of the rest of the economy is not seeing the same benefits, and in fact, there is a portion suffering as AI takes over roles that had been filled by people thus increasing unemployment. That segment of the economy is much larger, and it seems there is a growing probability that a recession may be coming there.

Or not, if the administration is able to run it hot. Ultimately, the thing the makes the least sense to me is that there is no indication that inflation is slowing anywhere back toward the Fed’s alleged 2% target. Rather CPI looks far more likely to coalesce around the 3.5%-4.0% level which means that PCE, even on a core basis, is going to be hanging around 3.0%. If the Fed is getting set to cut rates, and by all indication they are going to cut at least 25bps on Wednesday, I think it is clear that 3.0% is the new 2.0%.

And here’s the problem with that. When inflation is low, 2% or less, equities have historically been negatively correlated with bond prices, so if stocks fell, bonds rallied and the 60:40 portfolio had an internal hedge. But when inflation is higher, and it doesn’t need to be 10%, 4% is enough to change the relationship, equity prices and bond prices tend to move in sync. This means, if stock prices fall because of a recession, so do bond prices with yields rising. In that situation, the 60:40 portfolio suffers greatly. Just think back to 2022 when both equities and bonds fell -30% or so. Where was inflation? Right, we were in the throes of the Fed’s last mistake regarding the word transitory. The below chart is the best I could find to show how things behaved in the 60’s and 70’s with inflation running hot and then how things changed after Mr Volcker began to squash inflation.

Original source: Isabelnet.com

And what of the dollar you may ask? Well, theoretically, rising inflation should undermine the currency, but rising rates, when central banks fight inflation, should help support it. However, this time, with rising inflation and the Fed set to cut, it seems the dollar may have some trouble, although as other central banks follow suit, and they will, the dollar will find support.

Ok, let’s see how things behaved overnight. While Friday’s US session was mixed with only the NASDAQ managing to gain, there was more green in Asia and Europe. The Japanese celebrated Respect for the Aged Day, so markets there were closed. However, both HK (+0.2%) and China (+0.25%) managed modest gains despite (because of?) weaker than expected Chinese economic data. Every aspect of the data, IP, Retail Sales, Investment and Unemployment, printed worse than forecasts and has now encouraged investors to look for further Chinese government stimulus to support the economy. That theory helped Korea, Malaysia and Indonesia, all showing solid gains, but did nothing for the rest of the region, perhaps most surprisingly Taiwan.

In Europe, Fitch cut France’s credit rating to A+ from AA- based on fiscal deficits and political turmoil (aka no government), yet equity investors saw that as a buy signal with the CAC (+1.15%) leading European shares higher. The DAX (+0.4%) and IBEX (+0.6%) are also doing well although the FTSE 100 (0.0%) is just treading water. There has been no data of note, so it appears investors there are anticipating good things from the US where futures are higher by 0.2% at this hour (7:30).

Bond yields in the US are unchanged this morning, but European sovereign yields have slipped -2bps across the board, despite France’s downgrade. I am really at a loss these days to understand the mind of bond investors. I guess there is a growing belief that central bank rate cuts are going to help!

In the commodity sector, oil (+0.4%) has edged higher this morning but remains firmly in the middle of its 3-month trading range and is showing no desire to move in either direction. Metals markets, meanwhile, are basically unchanged this morning, simply sitting at their recent highs with the latest contest on Wall Street being who can forecast the highest price for gold in 2026. Goldman just explained that $5000/oz is reasonable if just 1% of risk assets move into the relic.

As to the dollar, while it did little most of the evening, as NY is walking in, it is slipping a bit, with the euro (+0.25%) and pound (+0.5%) leading the way higher in the G10, and truthfully across the board as the largest EMG moves are KRW (+0.4%) and HUF (+0.4%) while the rest have moved on the order of 0.1% to 0.2%. There has been growing chatter that China is now going to allow the renminbi to start to strengthen more steadily (in fairness, it has been strengthening modestly since the beginning of 2025, up about 3% since then), and that this is part of the trade negotiations ongoing with the US currently taking place in Madrid. But remember, while CNY has been creeping higher this year, a quick look at the chart below shows it has fallen substantially since 2022, having declined more than 17% between 2022 and the beginning of this year.

Source: tradingeconomics.com

On the data front, in addition to the FOMC, there are several other central bank meetings and some important data as follows:

| Today | Empire State Manufacturing | 5.0 |

| Tuesday | Retail Sales | 0.3% |

| -ex autos | 0.4% | |

| Control Group | 0.4% | |

| IP | -0.1% | |

| Capacity Utilization | 77.4% | |

| Wednesday | Indonesia Rate Decision | 5.0% (Unchanged) |

| Housing Starts | 1.37M | |

| Building Permits | 1.37M | |

| Bank of Canada Rate Decision | 2.5% (-0.25%) | |

| FOMC Decision | 4.25% (-0.25%) | |

| Brazil Rate Decision | 15.0% (unchanged) | |

| Thursday | BOE Rate Decision | 4.0% (unchanged) |

| Initial Claims | 240K | |

| Continuing Claims | 1950K | |

| Philly Fed | 2.3 | |

| South Africa Rate Decision | 7.0% (unchanged) | |

| Leading Indicators | -0.1% | |

| BOJ Rate Decision | 0.5% (unchanged) |

Source: tradingeconomics.com

So, while Retail Sales may give us some more color on the strength of the economy, it is really a week filled with central bank policy decisions and the ensuing discussions they have to spin things as they desire. I imagine we will be getting an article from Nickileaks this afternoon or tomorrow to get Powell’s message out, but it remains to be seen if we are watching bond traders buy the rumor and they are set to sell bonds on the news, especially if the Fed goes 50bps, something that remains a real possibility in my mind, though the futures market is pricing just a 4% chance of that as of this morning.

A 50bp cut will undermine the dollar in the short run and may put pressure on the BOE to cut more rather than hold. Until then, though, I suspect there will be little net movement in either direction.

Good luck

Adf