Though data is scarce on the ground

This week has the chance to astound

Four central banks meet

And when it’s complete

Two cuts and two stays ought abound

Meanwhile, Mr Trump’s signing deals

In Asia, an act that reveals

His fervent desire

To drive markets higher

As foes let out curses and squeals

Some days, there’s very little to note, with the news cycle a rehash of stories that have been festering for weeks. This is especially true in the political sphere, but also on the economic front. As well, given the ongoing government shutdown and the lack of government data being released, a key market focus is missing. But not today!

News across the tape moments ago is that President Trump has agreed a trade deal with South Korea, although the details of the deal are yet to be revealed. When it comes to Trump and trade deals, it is always difficult to get through the hype to determine if things will actually improve, but if we use the KRW as a proxy for market sentiment, as you can see in the chart below, the announcement was seen as a benefit to the won.

Source: tradingeconomics.com

This is hardly definitive, and the nature of a trade deal is that it takes time to be able to determine its benefits for both sides, but for now, it appears markets are giving it the benefit of the doubt. As well, it continues to be reported that Presidents Trump and Xi will be sitting down tomorrow (tonight actually) and that a trade framework has been agreed by Secretary Bessent and Chinese Vice Commerce Minister Li Chenggang which includes reduced tariffs, fentanyl, soybeans, semiconductors and rare earth minerals as key pieces of the puzzle.

The ongoing competition between the US and China is not about to end with this deal, but perhaps it will be able to revert to a background issue rather than a headline one, and that is likely a positive for all. Certainly, equity markets continue to believe that this dialog is a benefit as evidenced by their daily trips to new highs.

Which takes us to the other key discussion point in markets, central banks. Over the next twenty-seven hours (it is 6:30am as I type) we are going to hear four major central banks explain their latest policy steps starting with the Bank of Canada (expected 25bps cut) at 9:45 this morning, then the FOMC at 2:00 this afternoon with their 25bps cut. This evening at 11:00, NY time, the BOJ is expected to leave rates on hold, although there are those who believe a 25bps hike is possible, and then tomorrow morning at 9:15 EDT, the ECB will also leave rates on hold.

While this is certainly a lot of new information, the question is, will it have any market impact? Given the market pricing of these events, if any of the central banks do something different, you can be sure its markets will respond. If I had to assess what might be different, both the BOC and FOMC could cut more than 25bps, and the ECB could cut 25bps rather than standing pat. In all those cases, the currency would likely weaken sharply at first, although if all those things happened, I suppose it would simply create a new equilibrium. But understand, I don’t think any of that WILL happen.

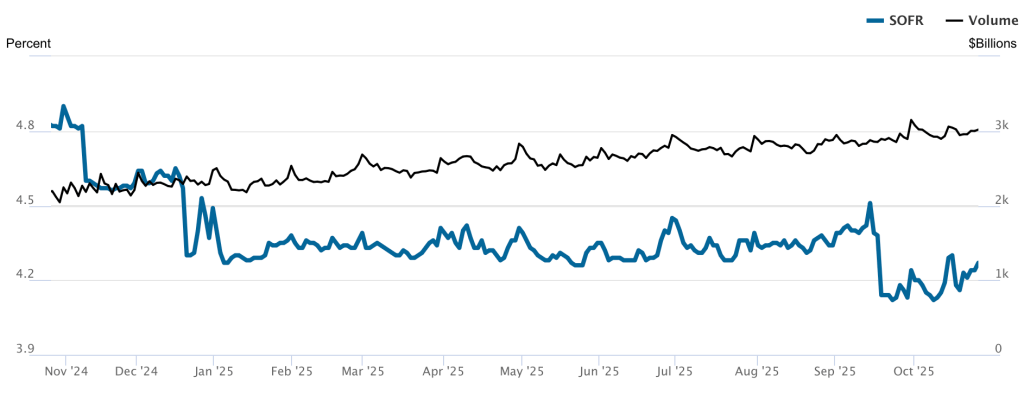

Regarding the Fed, though, there is another question and that is, what is going to happen to QT and the balance sheet. Lately, there has been a great deal of discussion regarding how much longer the Fed will allow the balance sheet to shrink. Last week I discussed the difference between ample and abundant reserves, but in numeric terms, the signals are coming from the SOFR (Secure Overnight Financing Rate) market, the one that replaced LIBOR. It seems that there is increasing concern over the recent rise in the rate. This is seen by numerous pundits, as well as by some in the Fed, as a signal that the reserve situation is getting tighter, thus offsetting the Fed’s attempts at ease.

The below chart from the NY Fed shows the daily wiggles, but also, it is pretty clear that the recent trend has been higher. You can see the September Fed funds cut in the sharp drop, and the first peak after that was September 30th, the quarter-end when banks typically look to spruce up their balance sheets, so borrow more aggressively. But since then, this rate has been edging higher, an indication that there may not be sufficient reserves available for the banking system.

This begs the question; will the Fed end QT today? Or wait until December? My money is on today as they are growing concerned about the employment situation with the uptick in recent layoff announcements, and the pressure on SOFR is the best indicator they have that things have reached the point where their balance sheet no longer needs to shrink. One other thing to keep in mind, at some point, it seems likely that the Fed is going to need to find more buyers of Treasuries as the market may develop indigestion given the amount being issued. That pivot back to QE, whatever it is called, is easier if they are not simultaneously reducing their own balance sheet.

And one final point on the Fed. Apparently, when they cut today, it will be the twenty-second time the Fed will have cut with stock indices at all-time highs, and of those previous twenty-one, twenty-one times equity markets were higher one year later. Let’s keep that party rolling!

Ok, let’s look at how things have gone overnight. Tokyo (+2.2%) was basking in the glow of all the love between President Trump and PM Takaichi, as it, too, traded to new all-time highs. China (+1.2%) gained on the news of the trade framework, but interestingly, HK (-0.3%) did not follow suit. And it should be no surprise that Korea (+2.1%) rallied on that trade news with India and Taiwan rising as well. Australia (-1.0%) though, had a rougher go after a higher than forecast inflation print (3.5%) put paid to the idea that the RBA would be cutting rates again soon.

In Europe, Spain (+0.65%) is rallying on solid GDP data (1.1% Q/Q) although the rest of the continent is doing very little with virtually no change there. In the UK, the FTSE 100 (+0.6%) is rallying on stronger corporate earnings from miners (metals are higher) and pharma companies. As to US futures, at this hour (7:30) they are all nicely in the green, about 0.35% or so.

In the bond market, Treasury yields have backed up 2bps, but are still just below the 4.00% level, hardly signaling major concern right now. European sovereign yields are all essentially unchanged this morning and overnight, only Australia (+5bps) moved after that CPI data Down Under.

Turning to commodities, oil (+0.5%) is bouncing after a couple of weak sessions, but net, we are right back to the $60 level which appears to be a comfortable level for both buyers and sellers. It is also a high enough price to encourage continued exploration, so my take is we are likely to trade either side of this level for quite a while going forward. My previous bearish views are being somewhat tempered, although I don’t foresee a major rally of any note.

Source: tradingeconomics.com

In the metals markets, gold (+1.7%) is bouncing off its recent trading low and currently back above $4000/oz. A look at the chart for the past month shows just how large the movements have been as the parabolic blow-off to near $4400 was seen through the middle of the month, and after a second try, the rejection was severe. I don’t believe the long-term story in the precious metals has changed at all, the idea that fiat currencies are going to maintain their current status as reserve assets is going to be more and more difficult to defend with gold the natural replacement. But in a market with a history of manipulation, don’t be surprised to see many more sharp moves ahead.

Source: tradingeconomics.com

As to the rest of the metals, they are all higher this morning with silver (+2.1%) leading the way and copper (+0.6%) and platinum (+1.6%) following in its wake.

Turning to those fiat currencies, the dollar is broadly firmer this morning, with only AUD (+0.15%) managing any gains against the greenback after that inflation print got traders thinking about higher rates Down Under. But otherwise, in the G10, the dollar is ascendant. In the EMG bloc, we already discussed KRW, but ZAR (+0.2%) is also gaining today on the back of the metals bounce. Elsewhere, though, modest dollar strength is the rule. What makes this interesting is the dollar is back to rallying alongside precious metals.

Ahead of the Fed, we only see EIA oil inventories with a small draw expected. In theory, with President Trump in South Korea, one would expect him to be sleeping throughout most of today’s session, but apparently the man rarely sleeps.

The big picture is that run it hot remains the play, and that means equities should benefit, bonds should have a bit more trouble, but the dollar and commodities should do well. I see no reason for that to change soon.

Good luck

Adf