The PMI data is in

And so far, it’s not really been

A sign of great strength

When viewed from arm’s length

No matter the punditry’s spin

That said, we are not near collapse

Despite many trade woes and scraps

And stocks keep on rising

So, t’will be surprising

For all when we see downside gaps

It was a quieter weekend than we have seen recently in the global arena with no new wars, no mega protests and no progress made on any of the major issues outstanding around the world. Thus, the US government remains shut down, the war in Ukraine remains apace and the AI buzz continues to suck up most of the oxygen when discussing markets.

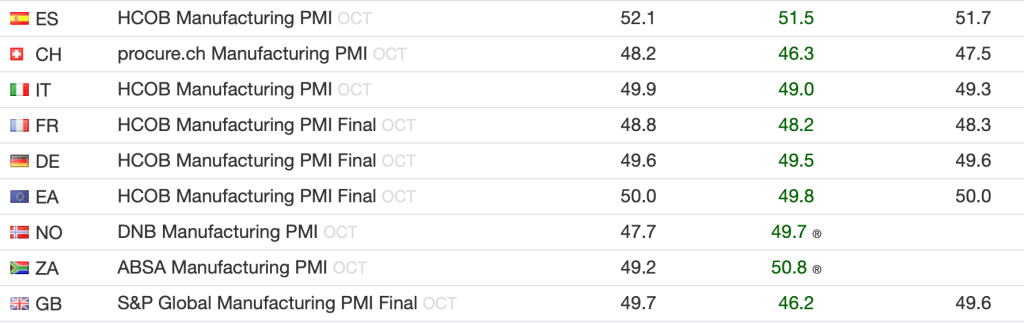

With this as background, arguably the most interesting market related news has been the manufacturing PMI data released last night and this morning. starting in Asia, the story was some weakness as Chinese, Korean and Australian data all fell compared to last month, although India and Indonesia continued along well. Meanwhile, in Europe, the data improved compared to last month, but the problem is it remains at or below 50 virtually across the board, so hardly indicative of strong economic activity.

Current Previous Forecast

Source: tradingeconomics.com

I don’t know about you, but when I look at the releases this morning, I don’t see a European revival quite yet, not even if I squint.

I guess the other thing that has tongues wagging is Election Day tomorrow with three races garnering the focus, gubernatorial contests in New Jersey and Virginia and the mayoral race in New York City. The first two are often described as harbingers of a president’s first year in office and I think this time will be no different. But will they impact market behavior? This I doubt.

So, let’s get right into markets this morning. Friday’s further new record highs in the US were followed by strength through much of Asia (Tokyo was closed for Culture Day) with China (+0.3%), HK (+1.0%), Korea (+2.8%) and Taiwan (+0.4%) leading the way with only the Philippines (-1.7%) bucking the regional trend as earnings growth in the country continues to disappoint relative to its peers around the region. Europe, too, has seen broad based gains with the DAX (+1.2%) leading the way higher and gains in the IBEX (+0.45%) and CAC (+0.3%) as well. I guess the PMI data was sufficient to excite folks and despite Europe’s status as a global afterthought, at least in terms of geopolitical issues, their equity markets have been rising alongside the rest of the world’s all year. And you needn’t worry, US futures are all higher at this hour (6:50), with the NASDAQ (+0.7%) leading the way.

Perhaps more interesting than equities though is the fact that government bond markets are doing so little. Treasury yields jumped ~10bps in the wake of the FOMC meeting and, more accurately, Chairman Powell’s ostensible hawkishness. However, as you can see in the below tradingeconomics.com chart, since then, nothing has happened.

Recall, the probability of a December rate cut by the FOMC also fell from virtual certainty to 69% now. In fact, if you think about it, that 30% probability decline translates into about 7.5bps, approximately the same amount as 10-year yield’s rose. It appears that the market is consistent in its pricing at this point, and when (if?) data starts coming back into the picture, we will see both these interest rates rise and fall in sync. As to European sovereigns, they continue to track the movement in the US and this morning, this morning, the entire bloc has seen yields edge higher by 1bp, exactly like the US.

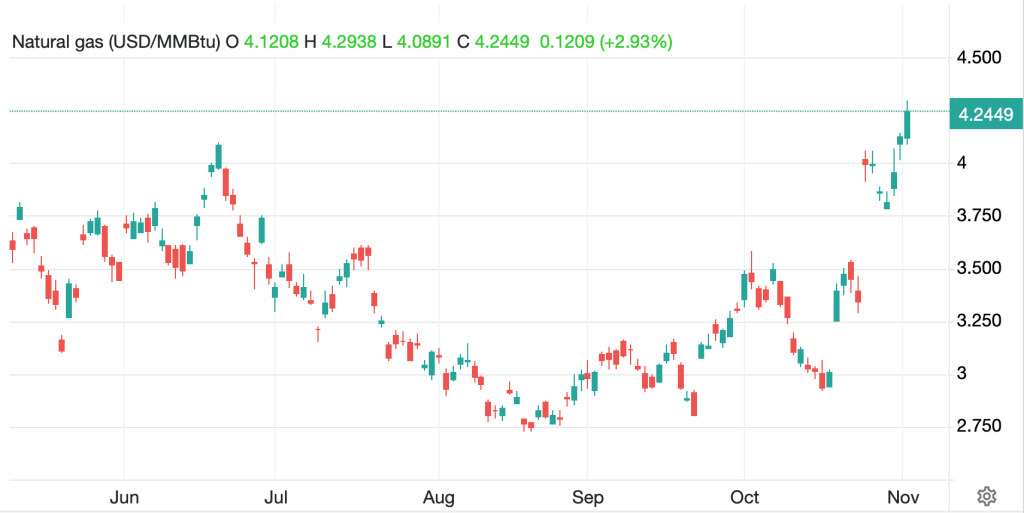

Commodities remain the most interesting place, although the dollar is starting to perk up a bit. Oil (-0.3%) slipped overnight after OPEC+ indicated they were increasing production by another 137K bbl/day, although there would be no more increases for at least three months given the seasonality of reduced oil demand at this point on the calendar. Something I have not touched on lately is NatGas, which traded through $4.00/MMBtu late last Thursday, and is now up to $4.25. in fact, in the past month it has risen nearly 27%, which given it is massively underpriced compared to oil (on a per unit of energy basis) should not be that surprising. Nonetheless, sharp movements are always noteworthy, and this is no different.

Source: tradingeconomics.com

Certainly, part of this is the fact that winter is coming and seasonal demand is rising in the US.

Combine that with the European needs for LNG, of which the US is the largest provider, and you have the makings of a rally. (I wonder though, did the fact that Bill Gates changed his tune on global warming no longer being an existential threat signal it is now OK to burn more fossil fuels?)

Turning to the metals markets, the ongoing fight between the gold bugs and the powers that be continues as early in the overnight session, gold was lower by nearly -1% but as I type, just past 7:00am, it is slightly higher (+0.1%) compared to Friday’s closing levels. Silver (+0.1%) has seen similar price action although copper (-0.5%) appears more focused on the economic story than the inflation story.

Which takes us to the dollar and its continued rally. Using the DXY (+0.1%) as our proxy, it is higher again this morning and pushing back to the psychological 100.00 level. Now, I have made the case several times that the dollar has done essentially nothing for the past six months, and the chart below, I believe, bears that out. We have basically traded between 96.5 and 100 since May.

Source: tradingeconomics.com

You will also recall that there is a narrative around about the end of the dollar’s hegemony and how nations around the world are trying to exit the USD financial system that has been in place since Bretton Woods, or at least since the fiat currency world took off when President Nixon closed the gold window. And there is no doubt that China is seeking to become the global hegemon and thus wants a renminbi-based system to use to their advantage. However, let’s run a little thought experiment.

The Trump administration has embraced the cryptocurrency space, and especially the use of stablecoins. Legislation has been passed (GENIUS Act) to help clarify the legal framework and the SEC has been solicitous in its willingness to ensure that these creations are not securities, thus placing them outside the SEC’s oversight. When looking at the world of stablecoins, their current total value is approximately $311 billion (according to Grok) of which only ~$1.2 billion are non-USD.

Now, if stablecoins represent the payment rails of the future, an idea that is readily believable, and the stablecoin market is virtually entirely USD, with massive first mover advantage, is it not possible that economies around the world are going to find it much easier to dollarize than to maintain their own native currency? While there are calls for Argentina to dollarize, what would the world look like if the EU fell apart (an entirely possible outcome given the inconsistencies in their current energy and immigration policies and the stress within the bloc) and the euro with it? Would smaller nations opt for their own currency, or would they see the value of having a dollarized economy given the many efficiencies it would present, especially for their export industries?

While I have no doubt that China will never accept that outcome for themselves, is the future a world where there are two currency blocs, USD and CNY, and everything else simply disappears? Remember, we are merely spit balling here, but if that is the outcome, demand for dollars will continue to rise, and the value of other currencies will continue to decline until such time as they succumb.

Again, this is a thought experiment, but one that offers intriguing possibilities for the future. And one where the foreign exchange market may ultimately meet its demise. After all, if there are only two currencies, that doesn’t make much of a market.

One other thing I must note, in the stablecoin realm, there is a remarkable product, USDi (usdicoin.com), which tracks US CPI exactly, yet can fit within those same payment rails. If you are looking into this space, USDI is worth a peek.

Ok, back to the markets, looking across the FX space, +/-0.2% is today’s theme virtually across the board, with the more important currencies slipping against the dollar (EUR, GBP, JPY, CHF, CAD) than rising vs the greenback (MXN, CLP, NOK, CZK), although the magnitudes are similar.

With the government still closed, there is no official data, but we do get ISM Manufacturing (exp 49.5) with the Prices Paid subindex (61.7) released at the same time. There are two Fed speakers today, Daly and Cook, and then 9 more speeches throughout the week. We also get the ADP Employment data on Wednesday (exp 24K), but I imagine that will get more press after the election results are learned Tuesday evening.

It is hard to get excited about things today, but nothing points to a weaker dollar right now.

Good luck

Adf