Most focus is still on the Fed

And what every Fed speaker said

But do not ignore

The Whisperer’s roar

That Jay’s got the votes, rates to shred

And this is why markets are soaring

While bond vigilantes are snoring

But, too, it’s why gold

Is bought and not sold

The question is, whose ox Jay’s goring?

One thing that is very clear right now, the demand for lower interest rates is extremely widespread, regardless of one’s political persuasion. People may despise everything that President Trump has done or claims he will do, but those same folks are desperate for him to be able to force the Fed to cut rates further. At least that’s my observation.

But putting that aside, the narrative around next month’s FOMC meeting seems to be coming to a clearer point; a cut is in the cards, but a potentially long delay in the next move will follow. While there were no Fed speakers on the calendar, at least the calendar I use, yesterday, we did hear from two more, the presidents of San Francisco and Boston, and though the former, renowned dove Mary Daly, was far more forthright in her views a cut was appropriate, the latter, centrist Susan Collins, clearly was amenable to the idea, though not forcefully so. But we know that Chair Powell cares since the Fed Whisperer, Nick Timiraos, got top billing in this morning’s WSJ with the following article, “Fed Chair Powell’s Allies Provide Opening for December Rate Cut.”

As this story was coming into view yesterday, we saw equity markets rise sharply in the US, or at least the tech portion (the DJIA managed only a 0.4% gain compared to the NASDAQ’s 2.7% jump). We also have seen the Fed funds futures market up the pricing of a rate cut to 81% as of this morning, with the concerns last week about Powell’s hawkishness quickly forgotten. One other thing of note was the strong rally in precious metals, with gold (0.0% this morning, +1.8% yesterday) and silver (-0.3% this morning, +2.6% yesterday) responding to the imminent further debasement of the dollar. While both remain somewhat below their October highs, nothing indicates that their trends higher have ended.

Source: tradingeconomics.com

There continues to be a lot of discussion on two fronts, the state of the economy and the rationale for further equity market gains, and interestingly, they are completely independent discussions. For the former, the dribs and drabs of data that have been released since the end of the government shutdown have been inconclusive as to what is going on, at least officially. Yesterday brought nothing new, although this morning we are due to see September data on Retail Sales (exp 0.3%, 0.3% ex autos), PPI (2.7% for both headline and core) and House Prices (+1.4% Case Shiller) along with November Consumer Confidence (93.5, down slightly from last month). It hardly seems this will change any views

But the market conversation is completely different. Between talk of a Santa rally, the popping of the AI bubble (assuming there is such a thing) and growing certainty that a Fed cut will help goose the stock market, that economic uncertainty means nothing. There remains a large swath of investors who are certain the Fed will not allow equity markets to fall in any meaningful fashion and who are prepared to continue to buy the dip.

Interestingly, the place where these two issues meet, earnings forecasts, shows that while fixed income investors may feel uncertain about the economy’s future, 2026 earnings estimates of 14% growth have equity investors in a very different place. While I don’t know which side is correct, I suspect that the ‘run it hot’ philosophy which has been driving everything this administration does will favor equities over bonds. While a correction is still likely in my mind, there is still nothing to stop this train!

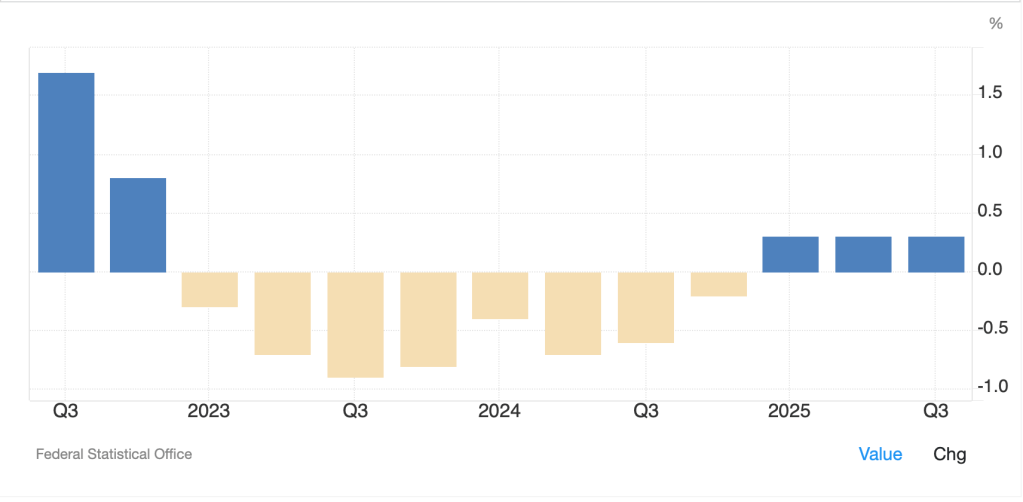

Ok, let’s turn to market performance overnight. Japan (+0.1%) didn’t love the US tech story, which is somewhat surprising, although that may be because there continues to be growing concern regarding the JGB market and the spat with China. China (+1.0%) and HK (+0.7%) however, both rallied on the US rate cut plus tech rally story. Taiwan (+1.5%) and Thailand (+1.3%) also liked that story, but the rest of Asia was nonplussed, and more exchanges saw weakness than strength. As to Europe, nobody there has a strong view this morning with every major bourse +/- 0.15% or less. The only data was German GDP, which rose to…0.0% for Q3 and clocked in at +0.3% Y/Y! Look at the history of German economic activity over the past 3 years below and ask yourself if this is the powerhouse of Europe, why would anyone want to own any European assets?

Source: tradingeconomics.com

As well, the increased focus on a potential peace in Ukraine may be a negative for the continent. While it has the potential to help them on the energy side, much of the rally seen across these nations was predicated on the military buildup that was coming. However, if there is peace, I sense it will be difficult for a group of nations that are massively in debt to convince their populations to borrow more to defend themselves since the threat has abated. After all, I’m willing to wager there isn’t a single person in the EU who if given the choice between defense spending for a potential future threat or an increased pension will opt for the former. As to US futures, at this hour (7:25) they are unchanged.

In the bond market, Treasury yields are unchanged this morning after slipping another few basis points yesterday and are sitting at 4.03%. Either the market is sanguine about the ongoing federal deficit spending or…everybody assumes the Fed is going to restart QE in some form or another if things start to deteriorate. European sovereign yields are slipping this morning, down between -1bp and -3bps, with the UK on the larger end despite (because of?) tomorrow’s Budget announcement.

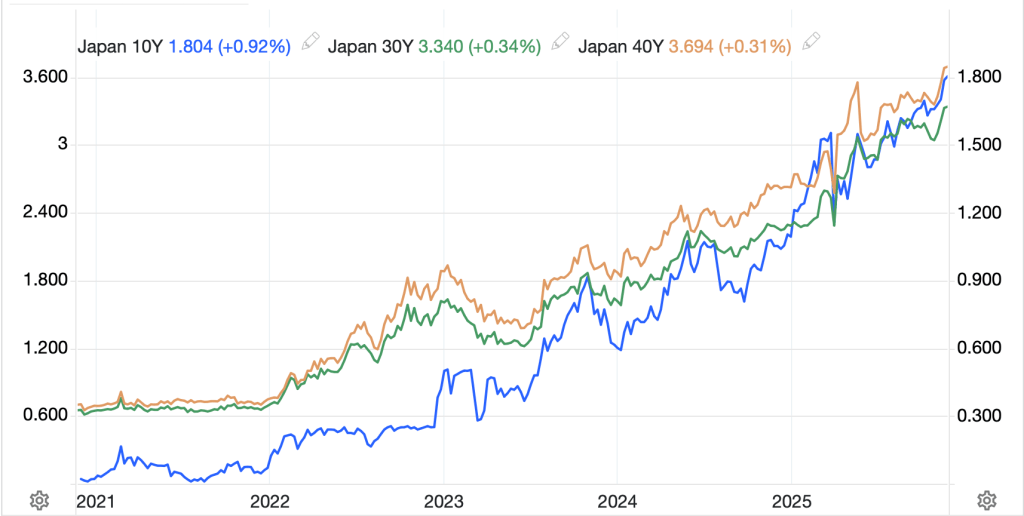

While you may think the US has a fiscal problem, and it does, at least it has the global reserve currency and with it, the ability to live beyond its means for a long time. The UK, however, simply has the first part, a fiscal problem, which they have exacerbated by adopting the most idiotic energy policies in the world (who would ever have thought that solar power made sense in the UK given the fact it rains, on average, 50% of the days in the year.) It is unclear to me what the UK can do to right the ship with the current government and its stated priorities. I suppose that we will see new regulations requiring UK financial institutions to hold more Gilts as otherwise nobody will buy them. Before I leave this asset class, I cannot ignore the JGB market where back-end yields continue to climb. As you can see from the below chart, the 10-, 30-, and 40-year yields are all at record highs and show no signs of stopping their multi-year rise.

Source: tradingeconomics.com

I had a long conversation with Charlie Garcia on Substack, someone you should all follow as he has very sharp ideas, on the causes, ramifications and potential outcomes of this unprecedented rise in yields there. Needless to say, the end game will not be very good for anyone, but the timing remains in question. As Keynes warned us all, markets can remain wrong longer than you can remain solvent. But Japan has its own, unique fiscal problems along with every other nation in the world.

Turning to commodities, oil (-0.3%) continues to be the least interesting thing around, drifting slowly lower, but at an increasingly leisurely pace. The glut narrative has calmed down, but I think there is more concern over the weakening economic story. Hard for me to say from the outside, but lower is the direction of travel here. The opposite is true for NatGas (-3.3%) which despite today’s decline is up 55% since October 16th!

Finally, the dollar is under modest pressure today with both the euro and pound stronger by 0.2%, a move that describes almost the entire G10. One outlier here is NOK (-0.2%) which is clearly suffering on oil’s ongoing weakness. In the EMG bloc, though, there has been more substantial movement with KRW (+0.7%) rising as traders position for the BOK to remain on hold while the Fed gets ready to cut, thus reversing some of the recent 7% decline in the won over the past quarter. The CE3 have also rallied nicely, on the order of 0.5%, as they continue to demonstrate their excessive beta with the euro and even CNY (+0.3%) is moving this morning on the back of a potential thaw in relations between the US and China after Presidents Xi and Trump spoke by phone yesterday. While my long-term perspective on the dollar remains positive, if the Fed does get aggressive, the greenback can certainly come under short-term pressure.

And that’s really all there is today. With Thanksgiving coming, I expect that volumes will begin to decline so keep that in mind when trying to execute any trades.

Good luck

Adf