While yesterday, there was one story

‘Bout silver and gold and their glory

By end of the session

The dollar’s depression

Was headlining comments quite gory

The narrative now speaks of trends

Which lead to a dollar that ends

The problem they’ve got

Is history’s taught

That cycles and dollars are friends

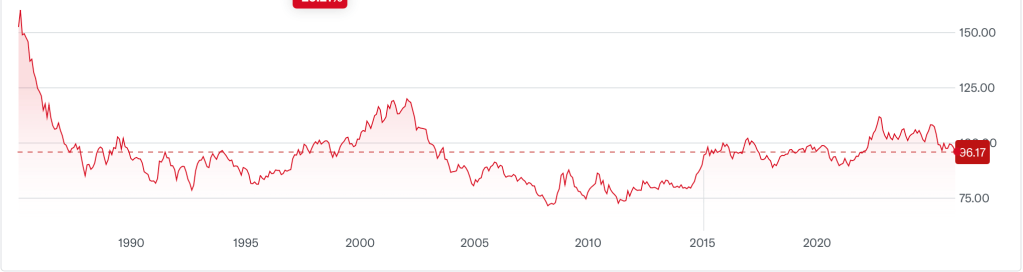

The dollar is clearly under pressure lately as discussed here yesterday morning. Using the DXY as our proxy, it has traded and closed through the recent double bottom (see chart below), and the doomsayers are licking their chops that their views of the demise of the dollar are finally coming to fruition.

Source: tradingeconomics.com

And I am not here to say the dollar is about to reverse course higher. While I remain medium and long-term bullish on the buck, it doesn’t feel like the time to get long. However, look at the chart below, to get a longer-term perspective on the dollar’s history. This chart starts back in 1985, which is just before the Plaza Accord where it was agreed the dollar was too strong and central banks around the world intervened and altered policy to change it. But here we are at 96ish in a market that has spent no little time below 80 with several drops below 75. My point is, the dollar tends towards long cycles. It is entirely possible that we peaked in late 2022 for this cycle and are now heading lower from there. But I remain highly confident that it will reverse course and rebound. Not tomorrow, but this is not the end. Just remember that when you read the eulogies for the buck.

Source: finance.yahoo.com

One other thing that seems to be getting headlines is that the president was asked his views on the dollar’s recent weakness and was (rightly) nonplussed over the issue as described here. After all, this is a man who constantly rails against the artificial weakness of the yen and the yuan, and who is seeking to rebalance the trade account. All that points to a weaker dollar, so it beggar’s belief that this is a surprise to the market.

One last thing while I’m on my high horse. I couldn’t help but notice this article about Banque de France chief Villeroy explaining that the weakening dollar may impact ECB policy-making with a throwaway line about diminishing confidence in the dollar stemming from the unpredictability of US economic policy. First off, US policy is very clear, run it hot! And second, it is remarkable that when the euro was tumbling, we never saw this same introspection about Eurozone/EU economic policy and their self-destructive energy policies. My point is, nothing we are currently witnessing is new in any way at all, but rather part of the longer-term cycle of FX markets.

OK, how has this dollar move impacted other markets? Well, yesterday’s US equity session was marked by a rotation back to tech as the NASDAQ (+0.9%) had a fine day while the DJIA (-0.8%) fell hard. This led to a mixed session in Asia with the Nikkei little changed (although other indices there were under steady pressure), while HK (+2.6%) exploded higher on news that China has licensed its first Nvidia H200 chips to Alibaba and someone threw money at China Vanke, one of the collapsing Chinese real estate firms. The mainland was modestly higher (+0.25%) but there was strength in Korea (+1.7%), Taiwan (+1.5%) and India (+0.6%). On the downside, Indonesia (-7.3%) tumbled after MSCI indicated they may downgrade the market there to frontier status due to lack of liquidity.

In Europe, red is today’s color led by Spain (-1.1%) and France (-1.0%) with the latter seeing weakness in luxury stocks while the former appears to be unwinding some of its recent strength with no particular catalyst, merely a negative view overall in Europe. Germany (-0.2%) and the UK (-0.4%) are also softer without anything specific. As to US futures, at this hour (6:40) they are pointing higher with NASDAQ (+1.1%) leading the way again. As an aside, the S&P 500 futures are above 7000 now, and the cash market looks set to break that big round number this morning.

In the bond market, as we await the FOMC policy decision (no change expected) and the subsequent press conference, Treasury yields are unchanged this morning after having edged higher by 2bps yesterday. European sovereign yields are all basically softer by -2bps, perhaps on the back of the euro’s strength. After all, Villeroy hinted that if the euro remains strong, they may need to cut rates again. Interestingly, JGB yields (-5bps) fell after BOJ Minutes from the December meeting (remember, they already met again last week) indicated that some members were concerned over the weaker yen driving inflation higher. Talk about stale news. My sense here is this is much more about the election and JGB’s will track Takaichi-san’s support level with lower yields coincident with weakening support, potentially preventing her Liz Truss moment.

In the commodity space, oil (0.0%) is unchanged this morning but has rallied more than 7% in the past month after a solid session yesterday. Looking at the chart, the trend clearly remains lower, but the short-term reversal is also quite clear.

Source: tradingeconomics.com

The dollar’s recent weakness is supporting all commodities (given they are generally priced in USD, other nations can afford more with the dollar’s slide), but the bigger picture remains that there is an extraordinarily large amount of the stuff around and much of the angst over its recovery is political (look at Europe) rather than geologic. Nat Gas (-4.5%) is backing off its extended levels as temperatures are forecast to rebound early next week (cannot happen soon enough for me, where’s global warming when you need it?), but the long-term story here remains positive as it continues to be the energy source of choice for timely access with the least environmental impact.

Turning to metals, gold (+1.6%) continues to trade to new highs on the ‘all of the above’ thesis (weak dollar, debasement trade, geopolitical risk, central bank buying) and shows no signs of slowing down. Silver (-0.1%), however, has been so incredibly volatile it is starting to become a concern for all involved. It is not normal for 10%-12% daily moves in any product, let alone one with so much involvement from both retail and institutional players.

Source: tradingeconomics.com

The silver market has gone into backwardation which means that there is significant demand for the actual metal. And prices in Shanghai trade at a significant premium to the COMEX. Shanghai is a delivery market. We will need to watch deliveries at futures expirations closely going forward.

Finally, the dollar today is bouncing off yesterday’s session lows but remain under pressure overall. After trading through 1.20 yesterday, the euro (-0.6%) has backed off a bit and we have seen similar moves through much of the rest of the G10 (GBP -0.6%, SEK -0.7%, NOK -0.7%, CHF -0.9%). The yen (-0.3%) continues to be caught between potential intervention fears and fears of unfunded spending. In the EMG bloc, we have seen CE4 currencies all suffer on the order of -0.7% or so, although APAC currencies are little changed this morning. The one currency bucking the trend is CLP (+0.2%) which remains closely connected to copper (+1.0%).

On the data front, yesterday’s Consumer Confidence Index fell sharply, a further indication that there is a split between most of the economic numbers and people’s beliefs. Today, aside from the Fed, we hear from the BOC (no change expected) and we get EIA oil inventories with a small draw forecast after several weeks of large builds. Too, later in the day the Banco do Brazil will announce their policy (no change expected).

The thing that makes me happy is the Fed is an afterthought today. While the cacophony of noise that comes from media is extremely difficult to parse given the biases underlying almost all one reads or hears, to me, the question will be whether people start to believe things are getting better, and that is more political than economic in my view. In the meantime, the dollar appears to be set for a bit of further weakness, but do not mistake this for the end of the dollar or the dollar’s role in the global economy.

Good luck

Adf