Though not getting near as much press

A shutdown, once more’s, added stress

To labor releases

And so, we’ll miss pieces

Of data. For Wall Street, a mess

But once again, I need inquire

Are shutdowns a bane and hellfire?

Or are they instead

A way to spearhead

More funding cuts we should desire?

It seems that once again, the government shut down, at least partially, on Saturday night because the Senate refuses to pass the required funding legislation. At this point, 6 of the 12 funding bills are already signed into law, so the shutdown is not as extensive. But more interestingly, it is not garnering nearly the headlines that this situation did last autumn.

In fact, I only mention it because the most direct impact we are likely to see is that, once again, the BLS will not be releasing data on time, notably today’s JOLTS Job Openings report and Friday’s NFP data. So, while Ken Griffin will miss more opportunities to make money via his HFT algorithms front running retail traders, the rest of us probably don’t care all that much.

Which brings me to the question of the size of the federal government. Stick with me here. Along these lines, I want to highlight a very interesting piece written by Michael Nicoletos which is well worth reading on the subject of naming Kevin Warsh as the next Fed chair. Prior to reading this article, I had come to the view that while Warsh would not technically be joining the Cabinet (Fed independence and all that), he is going to be working shoulder to shoulder with Treasury Secretary Bessent (they have worked together before and are close friends apparently) to achieve their goal of restructuring the way the US economy functions.

Much has been made of how it will be impossible for Warsh to cut rates (as Trump desires) while reducing the Fed’s balance sheet, which is something for which Warsh has repeatedly called. The missing piece of the puzzle, which I have rarely seen mentioned other than in this article, is regulations, specifically bank regulations. If the Fed reduces the need for banks to hold Treasuries for safety/liquidity reasons, it allows them to lend more money to the real economy which will support actual economic activity. The result can be that instead of Fed primed monetary stimulus, the nation could see business investment (consider the amount of promised inward investment to the US on the back of the trade deals) which can result in sustainable growth with less monetary support. This is a completely different framework than we have seen since, arguably, Paul Volcker, as it was Alan Greenspan who first created the Fed put. Frankly, it is the most bullish prospect I have seen in a long time. Read the article!

One other thing Warsh is keen to do is near and dear to my heart, reduce the size of the Fed and the Fed’s transparency of thought. Less press conferences, less interviews, ending forward guidance, and less Fedspeak overall would be a blessing for us all!

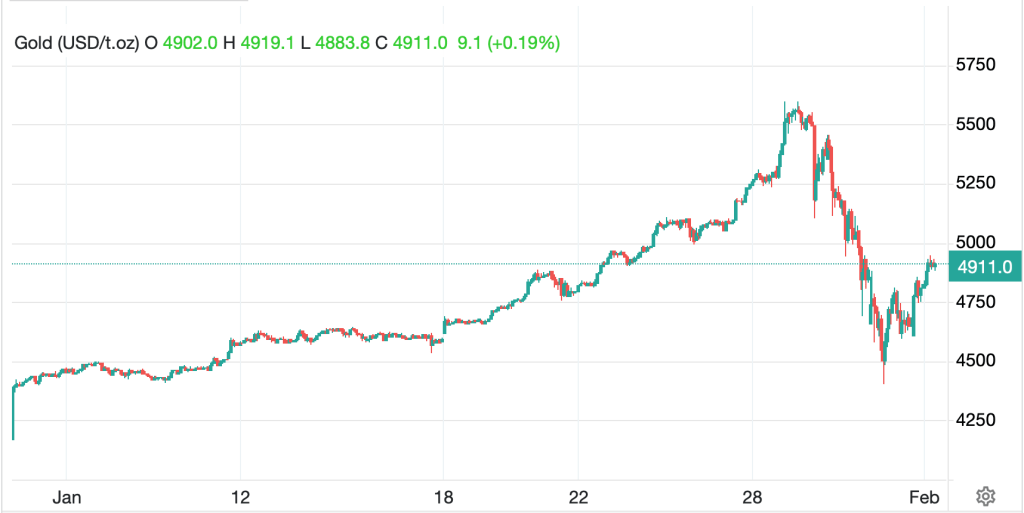

Ok, on to markets. Precious metals continue to be the major mover and shaker across all markets with the last several days declines being sharply reversed this morning. I think gold (+5.3%) and silver (+8.3%) deserve their own charts (from tradingeconomics.com) given the extraordinary nature of the recent price action. While the volatility here has been extreme, as I have repeatedly said throughout this move, the fundamentals have not changed, so demand for metals, especially silver into a deficient market, remains the ultimate driver.

Obviously, both metals remain far below their recent peaks, seen just last Thursday, but recall, parabolic tops always see retracements of this nature. My expectation going forward is that both these metals, and copper (+3.2%) and platinum (+6.2%) will be heading higher again, albeit not quite as quickly as we saw during January. One other thing adding to the bullishness is the announcement of Project Vault, a US stockpile of strategic minerals including copper and silver as well as a long list of rare earth elements. Remember what happens when a price insensitive buyer enters the market. You want to be long!

As to energy markets, oil (+0.35%) and NatGas (-1.2%) are both a bit less active this morning as the latter, which tumbled 25% yesterday on the end of the cold wave, is finding a new home while oil continues to soften based on the upcoming talks between the US and Iran which has reduced concerns of a military intervention there.

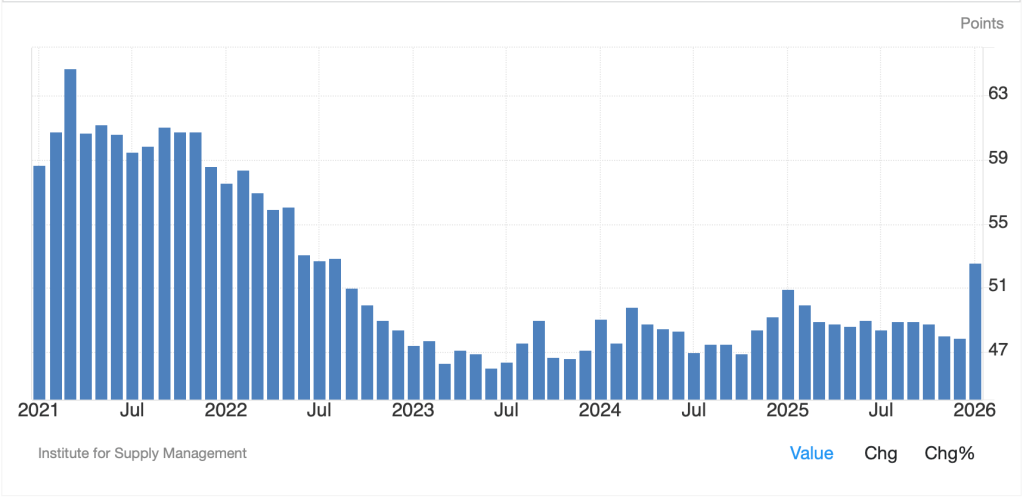

Compared to the commodities space, the rest of the markets are quite dull, indeed. Turning to the stock market, yesterday saw solid gains in the US after much stronger than expected ISM Manufacturing data (52.6 vs expected 48.5) which was the strongest reading since August 2022. As you can see from the below chart of this statistic, the US manufacturing sector has suffered greatly for more than 3 years, and that is true in the employment statistics there as well. Is this the beginning of the great reshoring? It is too early to tell, but if we see this for the next several months, you can be sure the narrative is going to change.

Source: tradingecommics.com

In Asia, Tokyo (+3.9% and a new all-time high) rallied on the stronger US market, the ISM data and the weaker yen supporting profitability of Japanese exporters. Korea (+6.8%) saw a huge move on the back of semiconductor makers Samsung and SK Hynix, while the government there seeks to get investors to bring money home to support the currency. India (+2.5%) rallied on the news of a trade deal with the US that reduces tariffs to 18% and gets them to stop purchasing Russian oil, buying from the US instead and generally, there were gains everywhere in the region, even Australia despite the RBA hiking their base rate (as expected) but sounding more hawkish than traders assumed.

In Europe, the picture is more mixed and far less impressive with gains and losses on the order of +/-0.2% across the board. While earnings data has been solid generally, there is ongoing concern about the outcome of Russia/Ukraine talks and a mix of data with French inflation falling to 0.3% Y/Y and Spanish Unemployment rising although the ECB, which meets Thursday is not expected to adjust policy. As to US futures, at this hour (7:10) they are higher by 0.25% or so.

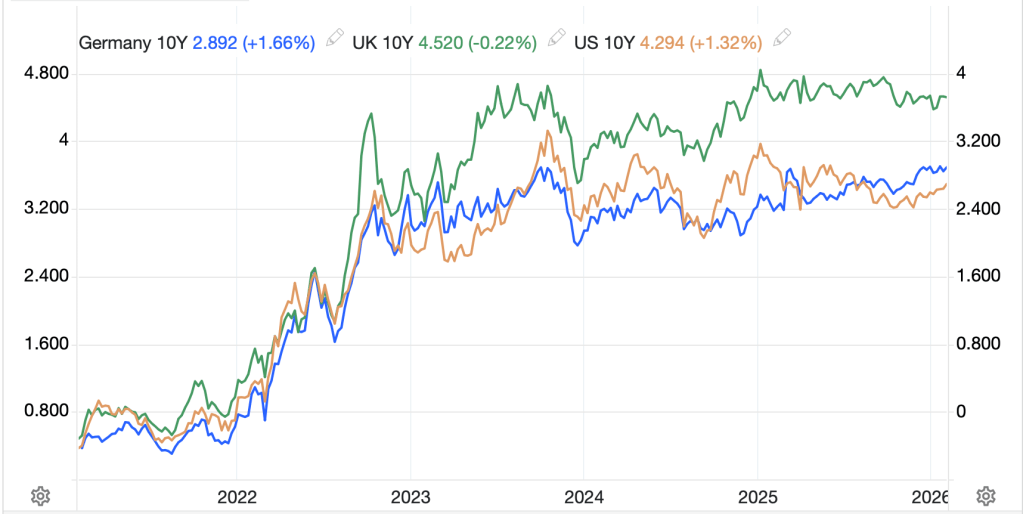

In the bond market, the strong ISM data saw 10-year yields back up 4bps yesterday, and they have edged a further 1bp higher this morning. European sovereign yields are higher by 2bps across the board, as are JGB yields. It seems we may be seeing the initial pricing of stronger economic activity. However, if we take a longer-term perspective of bond yields, as per the below chart, it shows us that, frankly, while there have certainly been some ups and downs, yields are little changed overall in the past 2 ½ to 3 years on a net basis.

Source: tradingeconomics.com

As I wrote in the beginning, there are changes afoot in policy making circles, certainly in the US which drives the entire global financial markets, so it remains to be seen how this all plays out. While I think there is scope for a period of higher rates in the short term, if the administration is successful in their playbook, that would likely indicate lower yields over time.

Finally, the dollar continues to defy every call for its demise. This morning, the DXY is unchanged and back toward the middle of its trading range. The big mover overnight was AUD (+0.8%) which dragged NZD (+0.6%) along for the ride. As well, LATAM currencies (MXN +0.4%, BRL +0.4%, CLP +1.0%) continue to perform well, as they have over the past year. Of course, real interest rates in Mexico (+3.3%) and Brazil (+10.75%) are far higher than in the US and that has been drawing in a great deal of investment while CLP continues to track copper prices. Again, I am confident that President Trump is unconcerned that the dollar is declining vs. Mexico and Brazil as it helps US export competitiveness. As to the euro, remember that when it pressed 1.20, the first thing we heard was how the ECB may need to respond if the euro becomes too strong. My money is still on the next ECB move being a cut.

And that’s all there is today. Data has gone missing and I cannot believe that anybody cares what Richmond Fed president Barkin has to say at this stage of the game. That means we are back to headline bingo to drive movement. Through all this, nothing has changed my view that the dollar is still the cleanest dirty shirt in the laundry. And if Bessent and Warsh can get things done as they perceive, it will simply be the only clean shirt around.

Good luck

Adf