While crime throughout DC has dropped

And Trump’s Fed demands haven’t stopped

The story today

That really holds sway

Is whether Nvidia’s topped

The war in Ukraine doesn’t matter

Nor does if the yield curve is flatter

‘Cause stonks must go higher

And that does require

Good news, or the zeitgeist could shatter

Some mornings things just are not that interesting in markets despite the ongoing events happening around the world. Arguably, the biggest headlines revolve around the remarkable decline in crime in Washington DC, which while most of the mainstream media decried the President’s actions at first, has grown in popularity, even amongst his foes. From a market perspective, the number of stories and editorials written about President Trump’s efforts to fire Fed governor Lisa Cook has risen exponentially, with many still trying to explain the Fed will lose its independence if Trump is successful. (Given they have not been independent since 1987, I would take this with a grain of salt). The other noteworthy story is that the EU is going to fast-track legislation to remove all tariffs throughout the EU on US industrial good imports, one of the results of the trade negotiations.

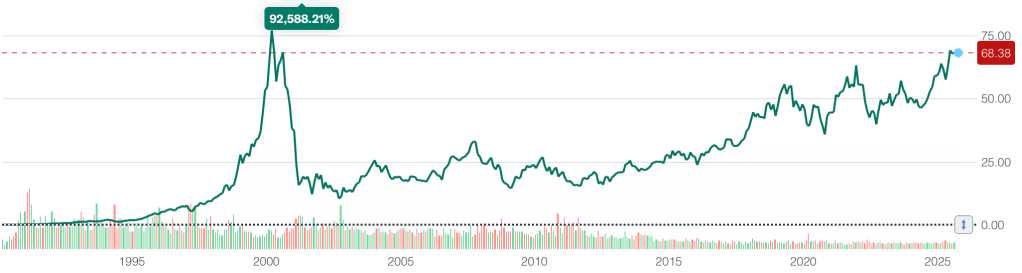

But, while those may be of passing interest, the thing in markets that really has tongues wagging is the fact that Nvidia is set to release their Q2 earnings this afternoon after the equity markets in the US close. I must admit, thinking back to the tech bubble in 2000-01, I do not remember any single company garnering the amount of attention that Nvidia gets these days. Perhaps Cisco Systems is the closest analogy, but it was nowhere near this level of interest and excitement. While this is an imperfect analysis, I think it is worth looking at the charts of both Nvidia and Cisco (from finance.yahoo.com) to help you see the magnitude of the rise in each case. It is certainly not hard to draw the conclusion that Nvidia may be peaking. After all, if it declines by 75%, it will still have a market cap > $1 trillion!

NVDA

CSCO

I think it is reasonable to ask whether AI is a bubble. I also think it is reasonable to ask whether the so-called hyperscalers, Meta, Microsoft, Alphabet and Amazon, are spending too much on building out their AI platforms. This would be the case if the promised revenues never materialize. Certainly, other than for Nvidia, those revenues are paltry at best so far. But these are all observations from a poet who doesn’t follow the stock closely and simply cannot avoid some of the story because it is so prevalent everywhere. FWIW, which is probably not very much, my take is that history has shown that new innovations, e.g. the automobile, electricity, the internet, can have remarkably wide-ranging implications but usually take far longer to achieve those ends than equity investors assume. In other words, the idea that the megacap companies are overvalued seems pretty compelling.

Enough of my amateur equity analysis, and I’m sorry, but that is all that seems to be of interest today. So, let’s look at how markets have behaved overnight ahead of the news this afternoon. After modest afternoon rallies resulted in higher closes in the US yesterday, Japan (+0.3%) followed suit as did Australia (+0.3%), but both China (-1.5%) and Hong Kong (-1.3%) fell sharply, reversing some of their recent gains as Chinese industrial profits fell -1.7%, a worse than expected outcome, and it seemed to have triggered some profit taking. With that in mind, I have read a number of analysts who have become of the opinion that Chinese equities are setting up for a much larger move higher based on additional stimulus as well as the fact that Chinese interest rates are the lowest in the world right now (ex-Switzerland). Elsewhere in the region, India (-1.0%) lagged alongside China and most of the others had much less movement in either direction.

In Europe, the picture is mixed with the CAC (+0.4%) the leading gainer which looks very much like a reaction to the past two sessions’ sharp declines. Spain (-0.4%) is lagging, although there is no particular news, and Germany (-0.15%) is also softer after the GfK Consumer Confidence report was released at a weaker than expected -23.6. As to US futures, at this hour (7:25) they are ever so slightly higher.

In the bond market, despite all the anxiety over the Fed and Trump’s attempt to remove Governor Cook, 10-year yields are higher by 1bp after falling 3bps yesterday. European sovereign yields are lower by -1bp across the board and JGB yields are unchanged. In other words, while the media’s hair is on fire, clearly the market’s is not.

In the commodity space, oil (-0.1%) is little changed this morning, maintaining yesterday’s declines which appear to have been a result of Russia seeking to export more crude after Ukrainian attacks on Russian refineries have slowed output. Gold (-0.6%) which saw a strong rally yesterday is falling back a bit, but remains in that tight range I showed yesterday, although both silver (-0.9%) and copper (-1.3%) are under more pressure this morning, likely on the back of a stronger dollar.

Speaking of the dollar, it is firmer across the board this morning, rising 0.5% vs. the euro, yen and Aussie, with slightly smaller gains vs. the other G10 currencies. In emerging markets, ZAR (-0.85%) is the laggard, not surprisingly on the back of weaker precious metals prices, but PLN (-0.75%) is also under pressure on a combination of the weak euro and concerns over the lack of progress in the Russia/Ukraine war. Even CNY (-0.15%) is weaker despite a renewed belief that China is going to allow the yuan to strengthen as part of any trade deal.

There is no front-line data to be released today, with only EIA oil inventories expecting a modest net draw. Richmond Fed president Barking speaks at 12:45 but given he just explained his views yesterday, that he didn’t foresee much change in rates at all given the current state of the economy, I cannot imagine he will have changed that view.

And that’s all we have today. I anticipate a lackluster session in all markets as traders await the Nvidia numbers later. Of course, President Trump could surprise us all with an announcement on Russia, the Fed, or any of a number of other situations, but those are outside my ability to anticipate. The market is still pricing an 87% chance of a September cut and an 80% chance of two cuts by December. If the Fed gets aggressive, for whatever reason, the dollar will suffer. But that is not yet the case, so range trading seems the best bet.

Good luck

Adf