What many just don’t comprehend

Is tariffs are not near the end

Of policy changes

As Trump rearranges

The world into foe and to friend

And while Wall Street squealed like stuck pigs

Trump’s boosters just don’t give two figs

They’re willing to try

The Trump calculi

If they see it hurts the bigwigs

I’m old enough to remember when Nonfarm Payrolls were the most important thing to market participants regardless of the asset class. Ahh, those were the days. It is remarkable that across major business headlines, I haven’t seen anything discussing the release for later this morning. Don’t misunderstand me, I’m not upset about that fact, I think there has been far too much focus on that data point for far too long, but I am surprised. This may be the best indicator that we are in a new regime for finance and economics. It appears that most of the things the analyst community used to consider important are now merely afterthoughts.

I thought the WSJ had the most consequential article in this morning’s ‘paper’ asking, who is going to buy the $400 billion of stuff that China makes that will no longer be price competitive in the US? They weren’t mentioned explicitly, but I imagine that Temu and Shein are both going to find their business models significantly impaired. But will other “free trading’ nations allow all that stuff across their borders tariff free? The Chinese mercantilist model was built with the idea that if they could produce stuff more cheaply than other nations, whether through subsidy or efficiency, other nations would welcome that stuff. It remains to be seen how well that model holds up given the changes wrought by President Trump.

On a different note, I have read many comparisons of yesterday’s market declines to the March 2020 Covid panic, but my take is it is far more akin to the September 2008 Lehman Brothers collapse, at least from the tone of the market. Covid was an exogenous event while Lehman and the tariffs were home-made. The issue with the GFC and the current time was/is that they are systemic alterations which means that things will be different going forward in finance and economics. Covid clearly changed our lives based on the government response, but it didn’t change the way markets behaved.

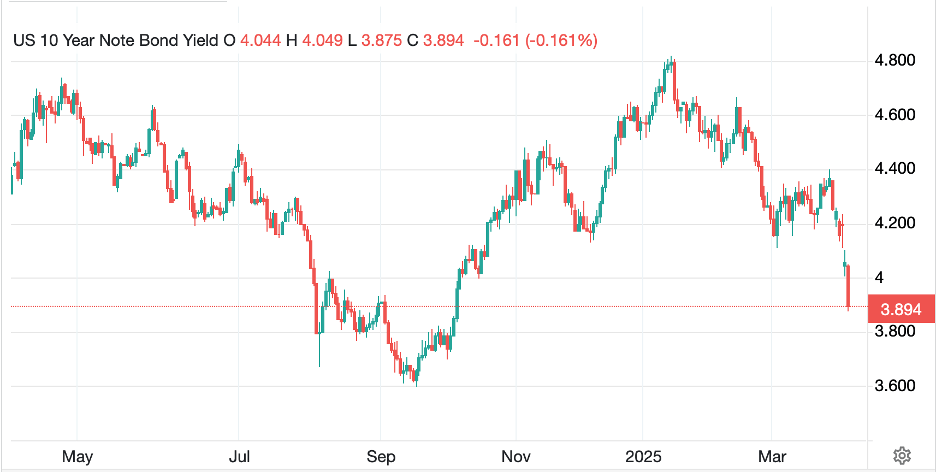

At this point, there is no indication that President Trump is going to change his tune, and why would he? Again, amongst the key financial market goals he and Secretary Bessent have touted were a reduction in 10-year yields, lower by 75bps since inauguration, (✔️), a reduction in the price of oil, lower by $14/bbl or 18%, (✔️) and a lower dollar relative to other currencies lower by 6.5%,(✔️). Ask yourself, do you really think they are unhappy with the current situation?

I have no idea how things will play out from here, and in reality, neither does anybody else. Reliance on models that were built with past assumptions does not inspire confidence. As well, we have barely seen the response to these tariffs, although just moments ago China indicated they would be imposing 34% tariffs on all US goods entering their country. But anybody who believes they know the end game is delusional. This is the beginning of the change, and there will be much more to come across many different aspects of the economy and markets as the year progresses. Interesting times indeed.

With that in mind, let’s see how day two of the new world order is playing out (and to think, there were all those conspiracy theories about a new world order before, but this was not what they had in mind.) Green is a hard color to find on screens again today as after yesterday’s rout in US markets, the follow-through in Asia was almost complete. Indonesia (+0.6%) managed a gain somehow, but every other major market declined, some quite substantially. Singapore (-3.0%), Thailand (-3.6%) and Tokyo (-3.1%) were the biggest losers, but shares everywhere fell with most declining more than -1.0% on the session. Interestingly, European shares are having a much worse session today than yesterday with Italy’s FTSE MIB (-7.1%) leading the way although Spain’s IBEX (-5.5%), the DAX (-4.5%), CAC (-3.8%) and FTSE 100 (-3.5%) are not exactly loving life today either. As to US futures, they are pointing much lower again today, -3.0% or so for all the major indices.

Bonds, however, are in great demand with yields virtually collapsing as investors seek anyplace that is not equities to find shelter from this storm. Treasury yields have fallen a further 15bps this morning and you can see in the chart below, just how large this decline has been. In fact, yields have almost retraced to the level just before the Fed started cutting rates last September!

Source: tradingeconomics.com

But bonds everywhere in the world are in demand with yields on European sovereigns lower by between -7bps (Italy and Greece) and -15bps (Germany) as credit quality has also entered the picture there. Finally, JGB yields have also tumbled, down -18bps overnight, as Japanese investors flee global markets and bring their money home.

Arguably, though, the biggest move has been in oil (-6.9%) which is now down to levels not seen since it was rebounding from Covid inspired lows back in 2022.

Source: tradingeconomics.com

I would contend this is almost entirely a recession fear, lack of forward demand story, although I believe OPEC+ is still planning on reducing its production cuts as the year progresses. I imagine the latter is subject to change based on the economic outcomes. In the metals markets, gold (+0.15%) after a sell-off yesterday, is consolidating for now. Given the amount of leverage that abounds and given that when margin calls come, folks sell what they can, not what they want to, I suspect much of gold’s selling yesterday was forced rather than based on fear. Rather, I suspect gold will outperform as it maintains its ultimate haven status. The same, though, is not true for other metals with silver (-1.5%) and copper (-4.2%) both sharply lower this morning. Certainly, in copper’s case, given the increased recession fears, it can be no surprise that its price is declining.

Finally, turning to the dollar, after a sharp decline yesterday, largely across the board, this morning the picture is a bit more mixed with a rebound against some currencies (AUD -3.0%, NZD -2.5%, SEK -1.7%, NOK (-2.1% although also inspired by oil’s precipitous decline.). However, both the yen (+1.0%) and Swiss franc (+1.25%) are continuing to display their haven attributes, while the euro (-0.1%) seems caught in the middle. In the EMG bloc, though, the dollar is quite solid this morning with MXN (-1.9%), ZAR (-1.7%) and CLP (-1.0%) all falling. Of note, CNY (0.0%) has barely moved throughout the entire process.

As I mentioned above, today we do see the NFP report, although my take is a strong report will be ignored as old regime, while a weak report will be ‘proof positive’ a recession is near. Here are the expectations as of this morning:

| Nonfarm Payrolls | 135K |

| Private Payrolls | 127K |

| Manufacturing Payrolls | 4K |

| Unemployment Rate | 4.1% |

| Average Hourly Earnings | 0.3% (3.9% Y/Y) |

| Average Weekly Hours | 34.2 |

| Participation Rate | 62.4% |

Source: tradingeconomics.com

Will the data really matter? I don’t think so, at least not to policy makers as they realize (I hope) the world today is different than when this data was collected. At this point, the market is now pricing in a full 75bps of rate cuts by year end from the Fed with a ~30% probability of a cut early next month. But Powell and company don’t have any idea how this will play out either. I fear that we are in a market situation where volatility is the dominant theme, in both directions. Remember, Donald Trump is best thought of as the avatar of volatility. He has earned that nickname. This is why I harp on maintaining hedges, the world is a tricky place.

Good luck and good weekend

Adf