Last month everything was just fine

As stocks traded up on cloud nine

But this week has been,

To buyers’ chagrin,

Less fun, and perhaps e’en malign

While soft is the landing of choice

And one where the Fed would rejoice

As data keeps slipping

The narrative’s flipping

Said some, in a very low voice

Oops! ADP Employment fell further last month, down to 103K, well below forecast and moving into a more dangerous territory for the growth story. Last month’s outcome was revised lower as well and the 3-month moving average is now 99K. This is certainly not a level that inspires confidence in future economic activity. Now, we all know that ADP is not the really important number, that is Friday’s NFP, but of late, the story there has also not been that fantastic either. Last month printed just 150K, and revisions for virtually the entire year have been lower. All I’m saying is that I get a soft landing requires slowing growth which will impact the employment situation. But this is a $27 trillion economy, and not something that is steered so easily. Be prepared for the narrative to start to slip from soft-landing to recession and perhaps onto deep recession.

One number does not a trend make, but as I discussed yesterday, the weight of evidence is beginning to pile up on the slowing growth story. The market that really is buying the recession story is the oil market, where prices fell a further 4% yesterday with WTI settling below $70/bbl. That is not a market that is convinced demand is going to be robust!

I guess the question is, at what point does the data stop confirming the goldilocks wishes and point to a more significant economic decline? With respect to the employment situation, I suspect we will need to see a series of negative NFP prints as the Unemployment Rate rises. While the former has not yet been seen, the Unemployment Rate has risen by 0.5% over the past seven months. While tomorrow’s rate is forecast to be unchanged at 3.9%, there will be much angst in some circles if it goes higher. As far as other metrics, Retail Sales, which had a very strong run in Q3, slipped last month and is forecast to be -0.1% when released next week. Currently, the GDPNow forecast from the Atlanta Fed is calling for a 1.3% growth rate in Q4, much weaker than last quarter but not recessionary.

Combining these ideas, plus the other ancillary ones that come from the plethora of data released each month, it is easy to understand the belief in the soft landing. But remember this, monetary policy famously works with long and variable lags. That is just as true when the Fed is easing policy as when they are tightening policy. Currently, there is an ongoing debate over whether the Fed’s 525 basis points of tightening is fully embedded in the economy, or if there is still more pain to come. But if we are already seeing economic activity slow and the Fed continues to expound its higher for longer mantra, it is easy to make the case that the slowdown will be far deeper than a soft landing.

One other thing, all this is happening while measured inflation remains well above the Fed’s target which is likely to remain a constraining factor on their behavior going forward. If pressed, I would say the economy is heading toward a more significant recession, probably starting in Q1 or early Q2 of next year unless we see a remarkable turn of events in the US. Given the intransigence that the current House of Representatives is demonstrating with respect to funding Ukraine, it appears that fiscal help may be a quarter or two later than hoped. Be prepared.

Is the BOJ

Ready to change policy?

No breath-holding please!

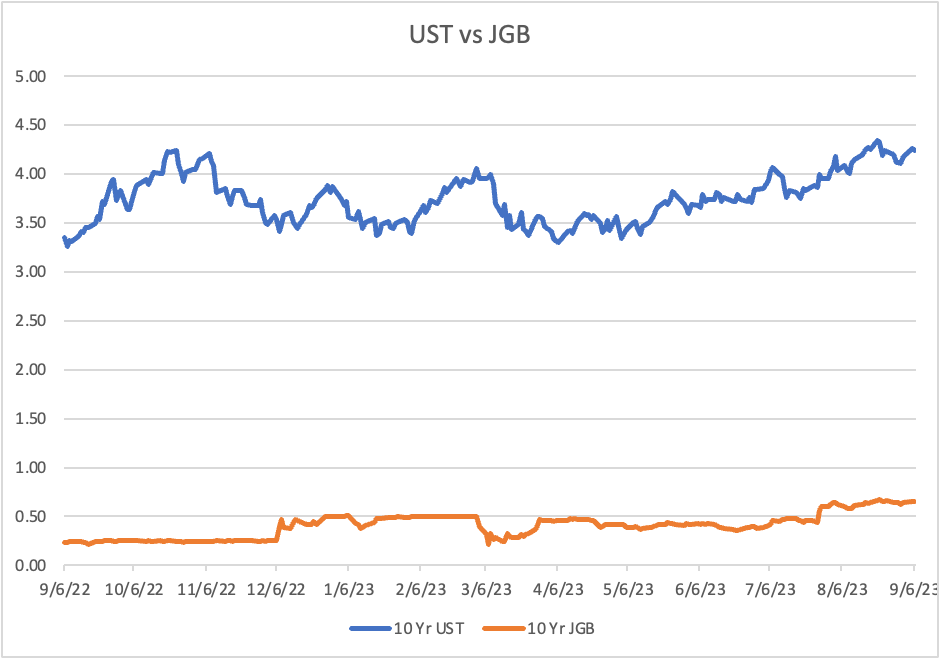

One other thing of note was an article in Nikkei Japan that discussed recent comments from Governor Ueda as well as Deputy Governor Himino, where the implication seems to be that the committee there is contemplating the idea of raising their base rate to 0.0% or even 0.1% from its current -0.1% level. Certainly, the market is willing to believe this story as evidenced by the moves last night where 10-year JGB yields jumped 11bps while the Nikkei fell 1.75%. As to the yen, this morning it is the outlier in the FX market, with a 1.4% rally and is now trading back to its strongest level (weakest dollar) since August. While the most recent inflation data from Japan has continued to show consumer prices rising above the BOJ’s 2% target, 19 straight months now, wages remain more benign and that is a key metric there. While I’m sure that the BOJ will alter policy at some point, it still feels like it is a mid 2024 event.

And one other thing to note with respect to USDJPY, tomorrow the December futures options on the CME expire and there is some very substantial open interest at strike prices right here. Apparently, a single buyer purchased upwards of $2 billion notional of JPY calls with strike prices ranging from 145.50 down to 144.75 back in mid-November, which are now at- and in-the-money. The thing to look for here is a choppier market as dealers hedge their gamma risk. And don’t be surprised if we see another leg lower in USDJPY before they expire tomorrow.

Ok, let’s look at how all the other markets have behaved overnight as we await today’s Initial Claims data, but more importantly, tomorrow’s payroll report. After another soft showing in the US yesterday regarding equity markets, Asia, aside from Japan were broadly weaker, albeit not dramatically so. In Europe, the screens are all red too, but the losses are quite small, between -0.1% and -0.2%. Adding to the idea that there is very little ongoing, US futures, at this hour (7:30) are essentially unchanged.

Turning to the bond markets, Treasury yields, which had fallen below 4.10% briefly yesterday, have bounced on the day and are firmer by 5bps. But European sovereign bonds are little changed on the day with only UK Gilts (+5bps) an outlier here. Perhaps that move was on the back of the Halifax House Price Index, which rose slightly more than expected, but I suspect it has more to do with position adjustments ahead of tomorrow’s US payroll data. After all, remember, the US is still the straw that stirs the drink.

After a horrific day yesterday, oil (+0.6%) is trying to stabilize although WTI remains below $70/bbl. There is now talk in the market that OPEC+ is going to cut production further, although given they just held their monthly confab last week, this seems premature. Gold (+0.4%) is finding support again after its wild ride earlier in the week, and copper and aluminum are both showing green today.

Finally, the dollar, away from the yen, is mixed with modest weakness vs. most G10 currencies, and a completely uncertain picture in the EMG bloc. For instance, MXN (-0.5%) is under pressure this morning while ZAR (+0.9%) is putting in quite a performance. Looking at the entire space, it is hard to characterize a general theme here today. As such, it strikes me that choppiness ahead of tomorrow’s data is the most likely outcome in the session.

As mentioned before, Initial (exp 222K) and Continuing (1910K) Claims are the only data this morning although we do see Consumer Credit ($9.0B) this afternoon at 3:00pm. Right now, the dollar is trendless, except perhaps against the yen, although that means that hedging should be quite viable right now. As to the broader economic trend, tomorrow’s data will really set the tone for the FOMC meeting next week, and for Q1 next year.

Good luck

Adf