Complaints among traders are rising

That markets are demoralizing

Liquidity’s shrinking

And now they are thinking

They might need to alter trade sizing

But can anyone be surprised

That markets are not immunized

From ongoing impacts

Of tariffs and new tax

Which President Trump advertised?

While headlines around the world have focused on the ongoing trade war negotiations, and peace talks between Russia and Ukraine and all of the political machinations in the US as President Trump continues to fight both the courts and Democrats to implement his agenda, markets are generally at a loss as to what to do. Is the news bullish for stocks? Bearish? What about bonds or the dollar or oil? I cannot remember a time when there was so little clarity on expected future outcomes. Well, I can actually, but it was a very long time ago. Prior to the Black Monday stock market crash in the US in October 1987, the reality was there were many views fighting to be heard, but rarely consensus as to what would happen in markets. Successful traders were those with trading intuition and positions were sized much smaller because you never knew when you might need to reverse course.

Since then, however, we have seen a steady diet of central bank intervention every time there is an indication that growth may be slowing, or markets may be having a bad day. This process went into overdrive in the wake of the GFC (which, BTW, was a product of that central bank intervention warping markets) when QE was implemented in the US and then elsewhere throughout the G10. In fact, then Chairman Bernanke was explicit that this was his goal. He called it the portfolio rebalance channel and the idea was the Fed would buy all the Treasuries, driving yields lower and promise to keep rates very low for a long time thus forcing encouraging investors to move up the risk scale to corporate debt, high-yield debt and equities. As well, QE pumped enormous amounts of liquidity into the financial system. This combination of actions led to a huge expansion of risk taking and the creation of strategies like risk parity which were designed to lever up assets to increase returns.

It was all great as long as the Fed and other central banks kept expanding the available liquidity. Alas, trees don’t grow to the sky and when the Fed, in 2018/19 tried to finally reduce the balance sheet and initiated their first QT program, things got hairy in September and halted them in their tracks. It turns out that markets had become addicted to liquidity continually increasing and like any addict, responded negatively to the loss of its fix.

Of course, Covid ensued and the next gusher of liquidity, this time both fiscal and monetary, was initiated by governments and central banks around the world, so any idea that investors and traders were chastised by the events of 2019 were quickly forgotten and position sizes ramped up again along with market performance.

But there is a new sheriff in town, as has been mentioned by many in the Trump administration, and the old rules are not likely to work in the new environment. As the US government has taken hold of virtually all the market’s bandwidth, relegating the Fed to a sideshow, traders and investors are suddenly finding that the old ways of doing things, buy the dip and lever up, are no longer the best way to get along. With the ongoing efforts by the Trump administration to shrink the government and reduce flows to financial markets, the lessons of the post-GFC financial market are losing their validity.

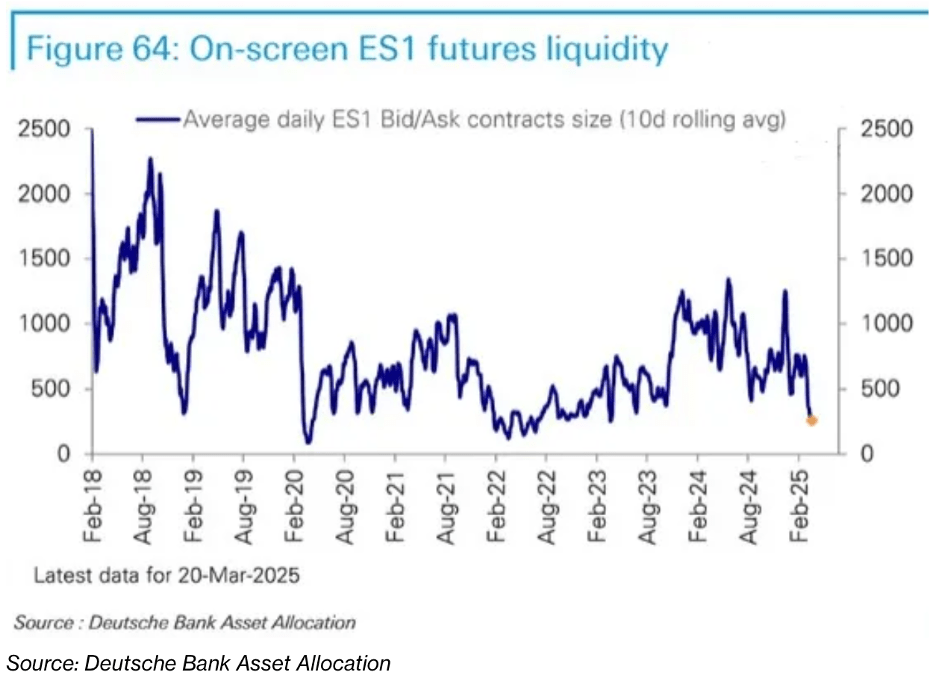

This was perfectly expressed in a Bloomberg article this morning where traders were complaining that when they wanted to adjust a position they had to “wait longer to execute an order until there’s better liquidity in certain instances.” Of course, we all know how difficult it is to wait so I’m sure that you are just as sympathetic towards these traders as I am. There was an interesting chart in the article (below) showing that futures liquidity in S&P 500 contracts had fallen to the lowest in two years and was clearly at the lower end of the recent spectrum. Doesn’t your heart just bleed?

I have been clear that President Trump is the virtual avatar of volatility and one of the key characteristics of a volatile market is that liquidity dries up. While prices may not move much on a particular day, trends disappear and when moves occur, they tend to be large, and often discontinuous. This is true in all markets, so be prepared as we go forward.

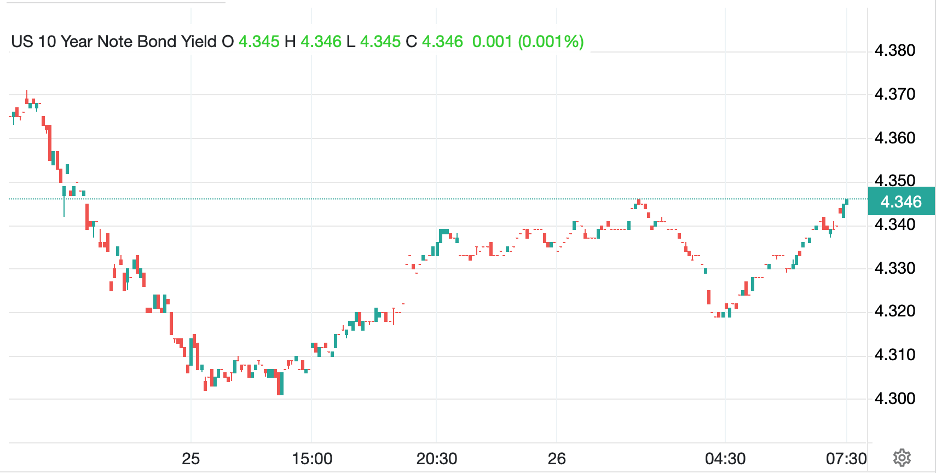

As it happens, yesterday was a day with very little net movement, although some decent gyrations intraday in some markets. For instance, in the bond market, yields, which opened the day much higher fell sharply after weaker than anticipated data then rebounded throughout the day finishing little changed from Monday’s levels. The chart below shows the 7bp range resulting in zero movement net.

Source: tradingeconomics.com

Too, US equity markets traded both sides of unchanged all day, with some choppiness but no net directional movement.

Source: tradingeconomics.com

My point is that this is likely a portent of the future. There are too many known unknowns for traders and investors to have confidence in taking a side. Now, we are only two months into the new administration, and they have been working hard to get things done quickly. It is possible that the fight drags on for the rest of the year or longer, with no clear outcomes on key issues regarding extending the tax cuts and a finalized tariff policy. In this case, I would anticipate market activity to continue to be lower volumes and choppy price action with a lack of direction. Or perhaps, lower risk asset prices as investors get scared. The lesson is the processes that had become normalized in the post GFC world are clearly no longer in play. Hedge accordingly.

So, as we look at overnight activity, yesterday’s US market activity didn’t inspire much movement in Asia where we saw some gainers (Nikkei +0.65%, Hang Seng +0.6%) and laggards (CSI 300 -0.3%, India -0.9%) but no consistency at all. The PBOC is subtly altering their monetary policy toolkit which some are seeing as a modest ease, but clearly equity markets didn’t get that message. Meanwhile, comments from the newest BOJ member, Koeda, explained she was not sure her previous analysis of the economy leaving the zero-rate world is valid now that rates are all the way up to 0.50%!

European shares are softer on the continent, down about -0.5% in most places but UK shares have gained slightly, +0.2%, after inflation data was released a tick lower than expected across both headline and core measures. While the BOE stood pat last week, as expected, this has encouraged some traders to believe that a cut could come sooner than previously thought. As to US futures, at this hour (7:45), they are basically unchanged.

Treasury yields, after yesterday’s choppiness, are creeping higher today (+3bps) but that is not following through in Europe, where sovereign yields are all flat to slightly lower today. It seems difficult for investors to get excited about Germany’s rearming plan if the overall economy remains in the doldrums. As well, tariff tensions have investors uncertain what to do, so doing nothing is the default.

In the commodity markets, oil (+0.9%) is higher from the close yesterday, but yesterday’s close was slightly softer than when I last wrote. As such, we have still not quite made it to $70/bbl. There are many crosscurrents in this market between tariffs, sanctions, potential Ukraine peace and Trump’s goal of drill, baby, drill. As to metals, the star of the show continues to be copper (+1.5% today, +15% in the past month) which is now trading at all-time highs across the entire curve. This has helped support both gold (+0.3%) and silver (+0.3%) although the former doesn’t need that much help, I think.

Finally, the dollar is mixed this morning, with the pound (-0.3%) lagging on the idea that the BOE may ease again sooner than previously thought, while AUD (+0.3%), CAD (+0.2%) and CLP (+0.3%) are all firmer on the commodity market strength. Here, too, I expect that liquidity will diminish and trends will be hard to find until there is more clarity on policy outcomes in the US.

On the data front, this morning brings Durable Goods (exp -1.0%, +0.2% ex Transport) and then the EIA oil inventory data with a small build expected. We also hear from two more Fed speakers, but they are just not driving markets right now. Choppiness is the rule here, with short-term direction very difficult to discern. I am still on board my ultimate lower dollar, higher commodity train, but that is subject to change if policies change as well.

Good luck

Adf