At one time, not long in the past

New York was a finance dynast

But yesterday’s vote

Does naught to promote

Its future. The world is aghast

As well, yesterday, Chairman Jay

Had nothing of note new to say

He’s watching quite keenly

And somewhat serenely

But rate cuts are not on the way

I must start this morning on the results from the NYC mayoral primary election where Zohran Kwame Mamdani won the Democratic primary and is now favored to win the general election. His main rival was former NY state governor, Andrew Cuomo, a flawed man in his own right, but one with the usual political peccadillos (greed, grift and sexual misconduct). Mamdani, however, is a confirmed socialist whose platform includes rent freezes, city owned grocery stores (to keep costs down) a $30/hour minimum wage (not sure how that will keep grocery prices down) and a much higher tax rate, especially on millionaires. In addition, he wants to defund the police. Apparently, his support was from the younger generations which is a testament to the failures of the education system in the US, or at least in NYC.

I mention this because if he does, in fact, become the mayor of NYC, and can enact much of his agenda, the financial markets are going to be interrupted in a far more dire manner than even Covid or 9/11 impacted things. I expect that we will see a larger and swifter exodus from NYC of both successful people and companies as they seek other places that are friendlier to their needs.

Now, even though he is running as a Democrat, it is not a guarantee that he will win. Current mayor, Eric Adams is running as an independent, and while many in the city dislike him, he may seem to be a much better choice for those somewhere in the middle of the spectrum. As well, even if he wins, his ability to enact his agenda is not clear given his inexperience and lack of connections within the city’s power centers. Nonetheless, it is a real risk and one that needs to be monitored closely.

As to Chairman Powell, as well as the other six FOMC members who spoke yesterday, the generic view is that while policy may currently be slightly tight, claimed to be 25bps to 50bps above neutral across all of them, they are in no hurry to adjust things until they have more clarity regarding the impact of tariffs on inflation and the economy. They paid lip service to the employment situation, explaining that if things took a turn for the worse there, it would change the calculus, but right now, they’re pretty happy. It can be no surprise that there were zero deep questions from the Senate committee members, and I expect the same situation this morning when he sits down in front of the House.

Since the cease fire between Iran and Israel seems to be holding, market participants are now searching for the next catalyst for market movement. In the meantime, let’s look at how things are behaving. The “peace’ in the Middle East saw the bulls return with a vengeance yesterday in the US, with solid gains across all major indices, but the follow through was less robust. While Chinese shares (Hang Seng +1.2%, CSI 300 +1.4%) both fared well, the Nikkei (+0.4%) was less excited and the rest of the region was more in line with Japan than China, mostly modest gains. From Japan, we heard from BOJ member Naoki Tamura, considered the most hawkish, that raising interest rates was necessary…but not right away. That message was not very well received.

However, Europe this morning is on the wrong side of the ledger with Spain’s IBEX (-1.25%) leading the way lower although other major bourses are not quite as poorly off with the DAX (-0.4%) and CAC (-0.2%) just drifting down. NATO is meeting in The Hague, and it appears that they are finalizing a program to spend 5% of respective national GDP’s on defense, a complete turnaround from previous views. This is, of course, one reason that European bond markets have been under pressure, but I expect it would help at least portions of the equity markets there given more government spending typically ends up in that bucket eventually. As to US futures, at this hour (7:10) they are little changed to slightly higher.

In the bond market, US Treasury yields continue to slide, down another -1bp this morning and now under 4.30%. Despite President Trump’s hectoring of Chairman Powell to lower Fed funds, perhaps the fact that Powell has remained firm has encouraged bond investors that he really is fighting inflation. It’s a theory anyway, although one I’m not sure I believe. European sovereigns have seen yields edge higher this morning, between 1bp and 2bps as the spending promises continue to weigh on sentiment. However, even keeping that in mind, after the spike in yields seen in early March when the German’s threw away their debt brake, European yields have essentially gone nowhere.

Source: tradingeconomics.com

While this is the bund chart, all the major European bond markets have tracked one another closely. Inflation in Europe has fallen more rapidly than in the US and the ECB’s base rate is sitting 200bps below Fed funds, so I suppose this is to be expected. However, if Europe actually goes through with this massive military spend (Spain has already opted out) I expect yields on the continent to rise. €1 trillion is a quite significant ask and will have an impact.

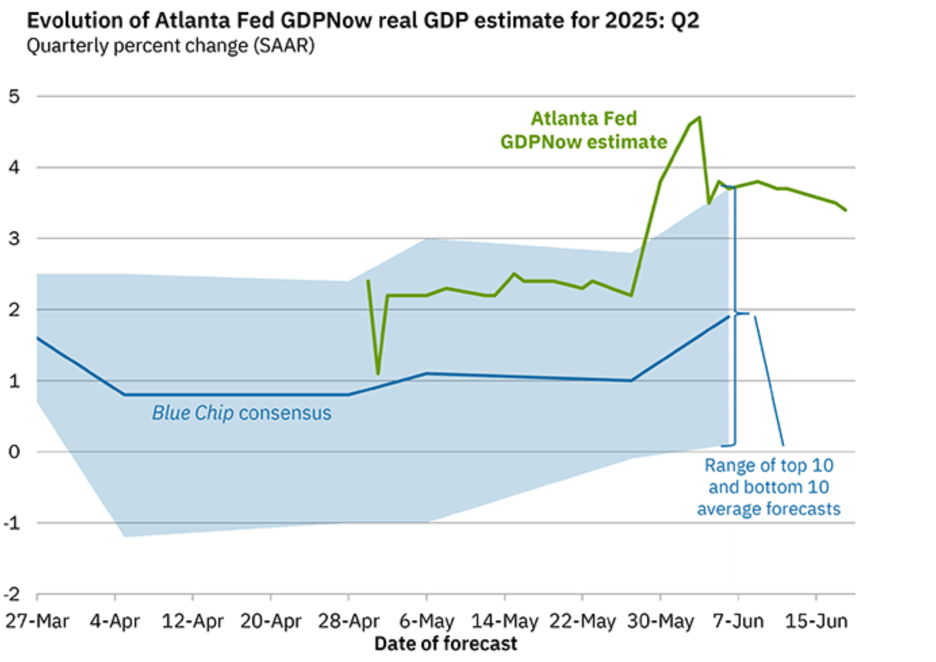

Moving to commodity markets, after its dramatic decline yesterday, oil (+0.8%) is bouncing somewhat, but that is only to be expected on a trading basis. Again, absent the closure of the Strait of Hormuz, I suspect that the supply/demand dynamics are pointing to lower prices going forward, at least from these levels. In the metals markets, gold (+0.15%) which sold off yesterday as fear abated, is finding its footing while silver (-0.5%) is slipping and copper is unchanged. It feels like metals markets are looking for more macroeconomic data to help decide if demand is going to grow in the near term or not. A quick look at the Atlanta Fed’s GDPNow estimates for Q2 show that growth remains quite solid.

Source: atlantafed.org

However, another indicator, the Citi Economic Surprise Index, looks far less promising as it has moved back into negative territory and has been trending lower for the past 9 months.

Source: cbonds.com

At this point, my take is a great deal depends on the outcome of the BBB in Congress and if it can get agreed between the House and Senate and onto President Trump’s desk in a timely manner. If that does happen, I think we are likely to see sentiment increase, at least in the short term. That should help all economically sensitive items like commodities.

Finally, the dollar is modestly firmer this morning, rebounding from yesterday’s declines although still trending lower. The price action this morning is broad based with modest moves everywhere. The biggest adjustment is in JPY (-0.6%) but otherwise, 0.2% pretty much caps the movement. Right now, the dollar is not that interesting, although I continue to read a lot about how it is losing its luster as the global reserve currency. There is an article this morning in Bloomberg explaining how China is trying to take advantage of the current situation to globalize the yuan, but until they open their capital markets, and not just for $50K equivalents, but in toto, it will never be the case.

On the data front, aside from Chair Powell’s House testimony, we see New Home Sales (exp 690K) and then EIA oil inventories with a modest draw expected there. There are no other Fed speakers and certainly Powell is not going to change his tune. To my eyes, it is setting up as a very quiet session overall.

Good luck

Adf