The question on tariffs today

Is what will the Court, Supreme, say

Will they agree Trump

Has power to pump

Up taxes with no Senate sway?

Or otherwise, will the top court

Decide to, Trump’s tariffs, abort?

And if they decide

That Trump is offside

Is it time to buy or go short?

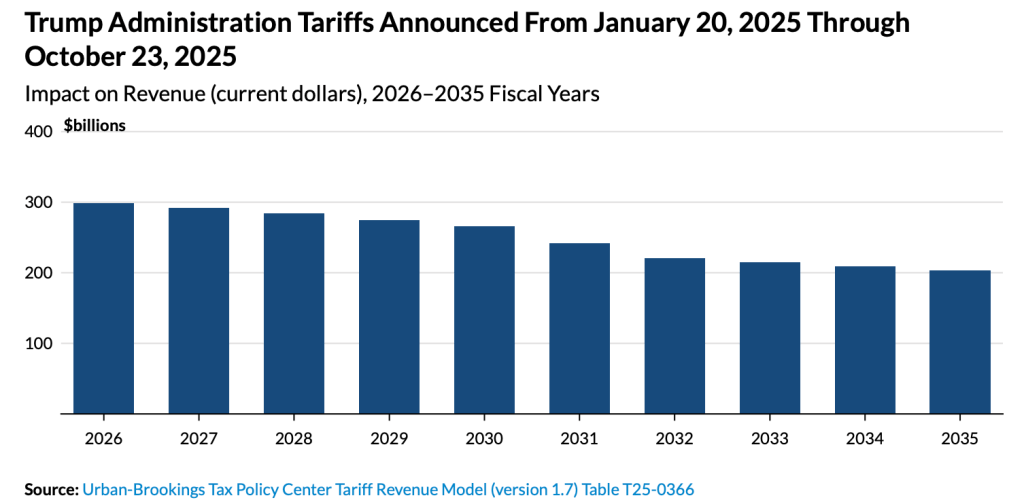

As testament to the idea that no matter the shock to a system, if it is a dynamic system, it will manage to adapt to the new reality, today’s existential question is, what happens if the Supreme Court decides that President Trump’s tariffs are unconstitutional? Let’s forget for a moment, the fact that they have generated approximately $200 billion in government revenue since their imposition and are forecast to generate upwards of $300 billion next year and $2.5 trillion in the next decade, at least according to the Tax Policy Center (see chart below from taxpolicycenter.org). Obviously, this is a good chunk of change for a government that has been running $2 trillion annual deficits.

Rather, let us consider the features that have accompanied the tariff negotiations, notably the promised inward investment to the United States. Although there are several figures that have been mooted, with President Trump claiming $10 trillion, it appears that a fair estimate of the number is half that, so $5 trillion, to be invested in the US, notably in manufacturing capabilities, over time. That, my friends, is a lot of money.

Now, we all remember what happened when Mr Trump announced those tariffs on Liberation Day back in April, but here is a chart of the S&P 500 to remind us of the size of the initial decline in equity markets.

Source: tradingeconomics.com

The decline from the close on April 2nd to the low on April 7th was ~12%, at which point, things were put on hold for 90 days and a series of furious negotiations began. But we saw similar dramatic moves across all markets. For instance, 10-year Treasury yields fell 33bps during that time, before rebounding sharply.

Source: tradingeconomics.com

Oil also collapsed on the news, falling from nearly $72/bbl to $56/bbl in that stretch as the announcement shook up virtually all financial markets around the world.

Source: tradingeconomics.com

Perhaps the most surprising outcome was that the dollar actually fell about 3% during that period despite every economist and every textbook explaining that the impact of tariffs on currency markets would be that those countries whose goods were tariffed would see their currencies decline while the one imposing the tariffs would see strength. (Yet another reason to pay little heed to economists and their theories which sound great but rarely seem to describe reality.)

Source: tradingeconomics.com

I highlight all this movement because the market behavior since then has been nothing but positive. Equity markets have decided that things are great and rallied dramatically. Bond markets have absorbed the information and decided it doesn’t matter that much or perhaps priced in the new revenue model as part of finding a new equilibrium around 4%. Oil markets have other things about which to worry, with the current theme the alleged glut of oil that is around, and the dollar, while it continued to decline a bit further over the ensuing three months, has now seemingly found a bottom, and if anything looks like it is preparing to climb.

But…what if the tariffs must go? And what if the government must repay those already collected? If you recall, the narrative about tariffs back in April was that they were the end of the US economy and a disaster. Obviously, that has not turned out to be the case. Is the new narrative that the end of tariffs will be a disaster? That feels like a pretty big reversal of opinion.

To my thinking, one of the keys to the recent optimism for the US economy, at least for those who are optimistic, is that the inward investment is going to have very positive medium- and long-term impacts on the economy. They are going to be critical in the reshoring of American manufacturing, whether Japanese investment into US Steel, or Korean investment into shipbuilding or Taiwanese investment into semiconductor manufacturing. All these things are unalloyed positives for the nation and its future. But if the tariffs are revoked, will the investments disappear? That is the $5 trillion question, and one that I believe would be incredibly detrimental to both the nation and its financial markets. Stocks would fall sharply and so would bonds as growth prospects would shrink and the fiscal imbalance likely grow even further. The dollar would suffer between the capital outflows, and the fiscal problems and oil would likely fall amid a dramatic reduction in US demand. Arguably, the only thing that would prosper would be gold, the historic safe haven.

Which brings the question back to the Supremes (not these Supremes, although the sentiment is right!), will they unleash that chaos? Or will they find a way to avoid it?

With so much to consider, let’s do a brief twirl around the world overnight. Yesterday saw a solid US equity rally across the board which was followed by strength throughout most of Asia (Nikkei +1.3%, Hang Seng +2.1%, CSI 300 +1.4%) with generally lesser gains elsewhere in the region. Europe, though, is on its back foot with modest declines (UK -0.4%, Germany -0.1%, France -0.4%) after weaker than expected Construction PMI data across the board. As to US futures, at this hour (7:00) they are very slightly firmer across the board, 0.1% or so.

In the bond market, yesterday saw US yields climb about 6bps after the ADP Employment data was released at a stronger than expected 42K with modest revisions higher to the previous months. Remember, last month’s revisions lower were for an entire year, not specifically the past two months, so it appears that job growth is still decent, just not quite as strong as last year. That data helped push yields up around the world, notably with JGB yields higher by 3bps. But this morning, yields have backed off -3bps in the US and are unchanged across the entire continent and UK. As to the UK, they left rates on hold at 4.0%, as expected, but the vote was 5 – 4 with 4 votes looking for a cut, so a more dovish signal.

In the commodity markets, oil (+0.8%) is rebounding after a decline yesterday based on a much larger than expected build in EIA inventories while NatGas also climbed on forecasts for colder weather and increased LNG demand in Europe and Asia. Gold (+0.9%) and silver (+1.4%) continue their rebound from recent lows and seem like they are getting comfortable in their new “homes” of $4000 and $48.00 respectively.

Finally, the dollar is under modest pressure this morning, with the DXY slipping barely below the 100.00 level (currently 99.94) while the euro (+0.25%) and pound (+0.2%) both edge higher. It appears that the dollar’s recent strength is on hold for today, although my take is it will resume shortly. While a negative Supreme Court ruling on tariffs is likely to really undercut the greenback, I don’t see anything else in the near term to do the job.

There is no data of note to be released today, but we have an onslaught of Fed speakers, six in total starting at 11:00 this morning. The Fed funds futures contract is now pricing just a 65% probability of a rate cut next month, as the ADP number encouraged some folks to change their views. My take is we are going to hear a lot about caution given the absence of data, but I might contend the market is already somewhat cautious, at least the bond market is.

The thing about the tariff issue is it won’t be decided for at least several weeks, if not months, so may hang over the market like the Sword of Damocles. I have no idea how they will rule, and the commentary from observers of the hearing gave different views based on their political biases, so it is hard to know. But it is going to matter a lot. In the meantime, I expect the recent trends to remain in place, so equity strength, little bond movement, little oil movement and dollar strength.

Good luck

Adf