Today begins Trump 2.0

And pundits are trying to show

Their ideas are sound

As how he’ll redound

On policies he will bestow

But this poet can’t comprehend

How anyone thinks what they’ve penned

Is likely to be,

To any degree,

Correct. ‘Stead, let’s look at the trend

As Donald Trump prepares to take the oath of office today, there has been a non-stop barrage of pundits putting forth their views as to how policy proposals that were made during the campaign, and even since the election, are going to impact the economy as well as equity, bond and FX markets. But I would take exception to all these as, if we learned nothing else from Trump’s first term in office, we have no idea how he may try to do the things he says he is going to do. Are tariffs a funding process? Are they negotiating tactics? Are they punishment? Since we have no idea at this point (all three of those ideas have been floated by “insiders” and pundits), how can we meaningfully forecast the impact tariffs may have going forward? So, I won’t even try.

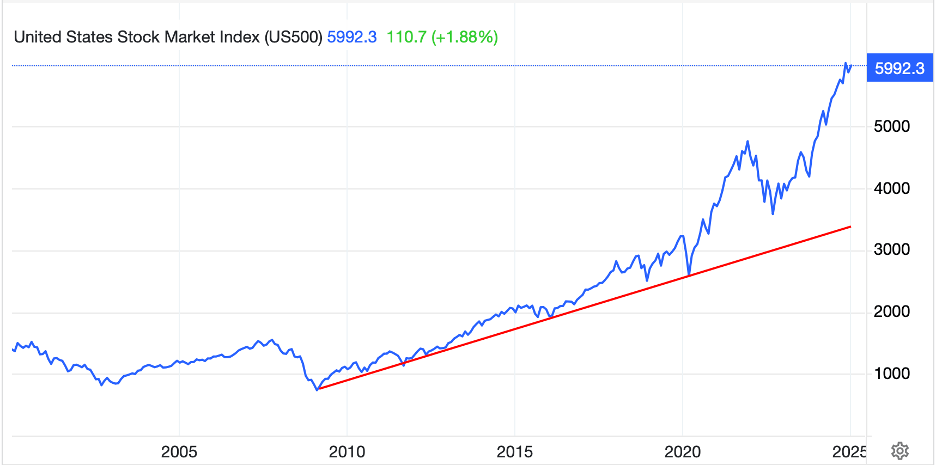

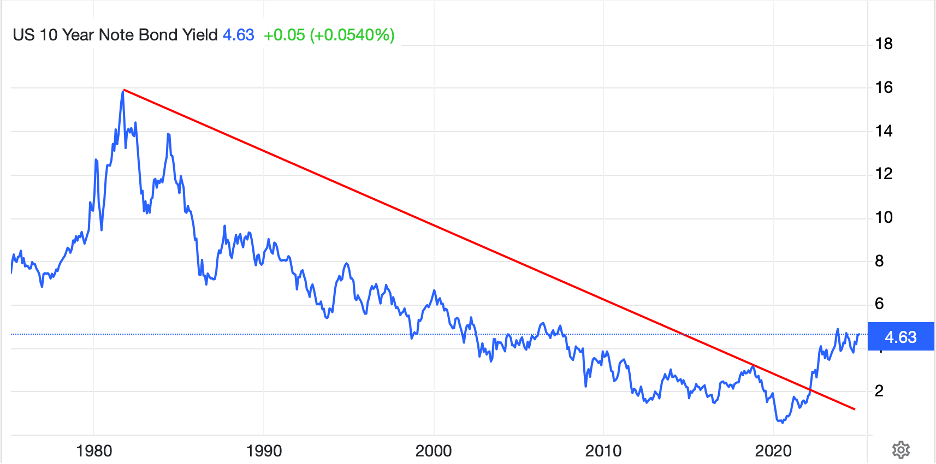

Rather, I think there is much to be learned from looking at the long-term trends in markets and perhaps trying to come up with reasons that these trends may be changing, or not, going forward. As such, take a look at the charts below, all from tradingeconomics.com, where I have tried to highlight the long-term trend in the dollar (EURUSD), the S&P 500, 10-Year Treasury Notes, oil and gold.

My first observation is that over the past twenty-five years, oil has traded both higher and lower with no discernible direction. Certainly, we are higher now than 25 years ago, but we have been both much higher and lower in the interim. Now, if Trump is successful at freeing up more drilling opportunities, removing the offshore drilling ban that Biden imposed last week, and reducing the regulatory structure such that the cost of drilling declines, my take is increased supply will result in some downward pressure. As well, if he is successful at bringing an end to the Ukraine war, it seems probable that Russian oil may no longer be sanctioned, and that, too, would pressure prices lower. But will he impose tariffs on Canada, a key source of sour crude used to refine diesel? That could easily pressure prices higher. And what of Venezuela? As I said, no way to know. In the end, my take is that the most likely outcome is that oil will continue to demonstrate its inherent price volatility given its price inelasticity. I think you can equally make the case for $50 oil as well as $100 oil based on many idiosyncratic issues that have nothing to do with Trump.

The only noteworthy change we have seen is in 10-Year Treasury yields, which after a 40-year downtrend following the back-to-back recessions in 1980-1982 and Fed Chair Volcker’s policy tightening, look very clearly to have reversed course. I am not the first to notice this but believe that it is an important feature of markets going forward. There are virtually two generations of traders and investors who have only ever seen interest rates decline and have created their mental investment models on that underlying thesis. If the future is going to bring about higher interest rates over time (and given my view that inflation is not going to disappear and that will be a key driving force), then investment models in a higher inflation, higher yield environment are going to be different than what we have seen up through 2022.

One of the keys is that the idea behind the 60/40 portfolio, where declines in stock prices were offset by rises in bond prices, turns out to only really be true in a low inflation environment, sub 2.5%. If inflation is going to run at 3.5% – 4.5% going forward, then all the strategies that incorporated that 60/40 basis are going to have an awfully difficult time, again, regardless of what Trump does. The one caveat here is if he is successful in driving inflation back to that <2.0% level, but that seems highly unlikely in the near term given how sticky inflation has proven to be even without any new policies.

Now, if we look at the dollar, that trend has been very consistent and remains in place with the dollar seemingly set to continue to appreciate. Given Trump’s stated desire to reshore American manufacturing and reduce the trade deficit, he almost certainly would like to see the dollar decline. However, at this point, it’s not clear what policies are going to drive that. Historically, loose monetary and tight fiscal policy will weaken a currency, and that could well be what we see, except that is likely to create a burst of inflation before the tight fiscal policy reins that in. And you know as well as I that Trump will be very displeased with that outcome.

It is certainly possible that the Treasury could intervene to weaken the dollar, but that is also something that is exceedingly rare in this country. Perhaps the most likely situation here would be a Mar-a Lago (?) Accord, or something like that akin to the Plaza Accord of 1985, where the G7 at the time all agreed that the dollar needed to decline. Now, on the one hand, given the weakness in the other G10 economies currently when compared to the US, my take is those nations are pretty happy to have weak currencies to help support their domestic industries. On the other hand, I suspect the EMG bloc who have funded themselves in USD are really interested in seeing a weaker dollar to help them get easier access to dollars to service and repay their debt. My take is that until there is a definitive policy pronouncement, and this will require something like that as quiet policy adjustments are likely to be missed by the FX market, this trend will remain intact.

Finally, a look at both equities and gold shows basically the same chart, with both showing accelerating price increases and both now significantly above their long-term trend lines. The question, of course, is can this continue? Keynes was reputed to have told us that markets can remain irrational longer than you can remain solvent, implying just because market pricing doesn’t make fundamental sense doesn’t mean it cannot continue further. But in the end, trees don’t grow to the sky, and corrections in these markets seem somewhat overdue. Consider the S&P 500 chart, where we see the sharp decline in 2022. Many remember that as the worst market since the GFC crash, and yet on the chart, it looks like a modest correction. Consider also, that if the market were to decline to the trend line I have drawn, it would be nearly a 50% correction, and that just puts it back on trend! Again, volatility seems the watchword going forward, but until we see something that is going to change opinions, the trend in both stocks and gold seems higher.

OK, as we await the official change in presidency here, let’s review the overnight price action, which was generally positive following Friday’s US equity rally. Remember, too, it is MLK Day, and markets are closed in the US.

Asian markets saw broad gains with the Nikkei (+1.2%) and Hang Seng (+1.75%) leading the way while mainland shares (+0.45%) lagged but were still in the green. Away from the major markets, there were far more gainers than laggards, but the biggest moves were on the order of 0.4%, nothing of real note. Positive Japanese data was the driver in Tokyo (Machinery Orders +3.4%) while HK and Chinese shares benefitted from the news that Presidents Trump and Xi spoke, hopefully in a prelude to less tension. In Europe, markets are essentially unchanged across the board this morning as it seems investors cannot discern whether Mr Trump will be beneficial for the continent or not. Certainly, I continue to read about a number of European leaders who are unhappy at the prospects of a Trump presidency (specifically PM Starmer who has ostensibly said the US-UK relationship is destined to diminish). While that may be true, my take is it will not help the UK very much. And, while US markets are closed today, US futures are pointing modestly higher this morning.

In the bond market, yields are edging higher in Europe, up between 1bp and 2bps on the continent while UK Gilt yields are higher by 3bps. Overnight saw JGB yields slip 1bp and, of course, with banks closed in the US, Treasury yields are unchanged in the cash market. However, bond futures are pointing to a 1bp rise as well.

In the commodity markets, oil is little changed on the day while NatGas (-4.4% after a -6.0% decline on Friday) is falling on news that weather models, which had been calling for another cold spell in February, have changed and are now saying temperatures will be milder then. In the metals markets, gold (+0.3%) is edging higher while both silver (-0.3%) and copper (-0.4%) are slipping a touch, but given their inherent volatility, arguably these are unchanged on the day.

Finally, the dollar is under some pressure this morning with then euro (+0.5%) leading the G10 higher although similar sized gains are seen across the board with only JPY (0.0%) failing to go along for the ride. EMG currencies are also picking up led by HUF (+2.0%) as it seems there is excitement in Hungary regarding the inauguration as PM Orban seems to share many of President Trump’s views on various geopolitical issues. But CZK (+0.9%) and PLN (+0.6%) are also rallying alongside KRW (+0.5%), although MXN (-0.3%) seems to be showing concerns regarding how that relationship will evolve. Certainly, as I mentioned above, President Trump will not be unhappy to see the dollar slide a little, but I don’t see this as the beginning of a new trend.

With no data today, and a light week in general, and given how long this missive has already become, I will lay out the data releases tomorrow. Today, all eyes will be on the ~200 Executive Orders President Trump will sign and I expect it will take a little time to digest it all, so we will see how things really begin tomorrow.

Good luck

Adf