Ishiba explained

He was just kidding about

Tight money…surprise!

So, yesterday’s biggest mover was JPY (-2.1%), where the market responded to comments by new PM Ishiba that all his previous comments regarding policy normalization were not really serious (and you thought Kamala flip-flopped!)

Here are his comments in the wake of that massive 12% decline in the Nikkei back in early August:

“The Bank of Japan (BOJ) is on the right policy track to gradually align with a world with positive interest rates,” ruling party heavyweight Shigeru Ishiba told Reuters in an interview.

“The negative aspects of rate hikes, such as a stock market rout, have been the focus right now, but we must recognize their merits, as higher interest rates can lower costs of imports and make industry more competitive,” he said.

And here are his comments after meeting with BOJ Governor Ueda Wednesday morning in Tokyo:

“From the government’s standpoint, monetary policy must remain accommodative as a trend given current economic conditions.”

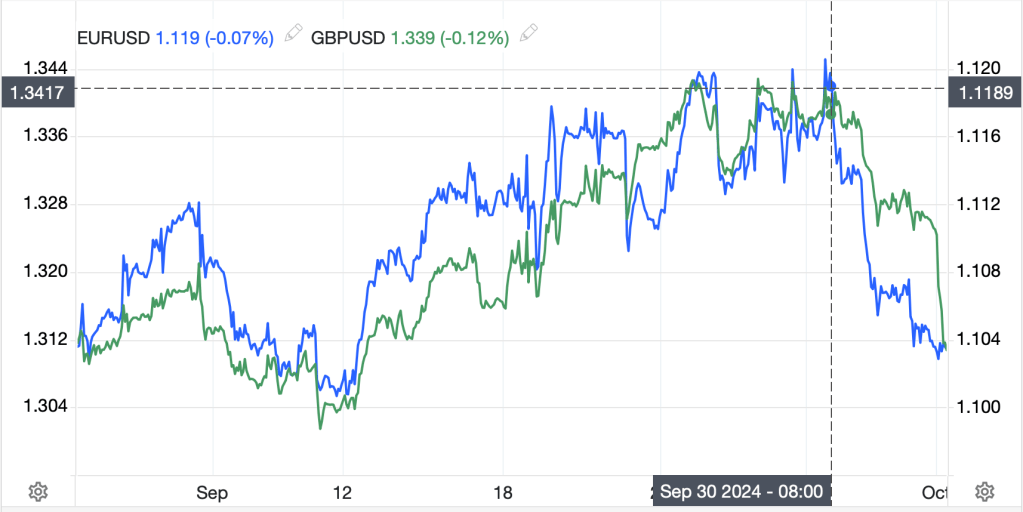

See if you can tell the difference. The below chart includes the market response to his election last week as well as its response since uttering those last words early yesterday morning.

Source: tradingeconomics.com

Remember the idea that the carry trade was dead and completely unwound? Well, now the talk is its coming back with a vengeance between Powell sounding less dovish, Ishiba sounding more dovish and then yesterday’s ADP Employment Report printing at a higher-than-expected 143K. Maybe all those rate cuts that had been priced are not going to show up in traders’ Christmas stockings after all. Certainly, the Nikkei (+2.0%) was pleased with the weaker yen which has fallen further this morning (-0.2%) after further comments from BOJ member Noguchi calling for more time to evaluate the situation before considering tighter policy. In fairness, though, Noguchi-san is a known dove and voted against the rate hikes back in July. Summing it all up here, it is hard to make a case currently for the yen to strengthen too much from here. Rather, a test of 150 seems the next likely outcome.

In England, the Old Lady’s Guv

Explained that he’s really a dove

He’ll be more aggressive

Though not quite obsessive

While showing investors some love

The other big mover this morning is the British pound (-1.1%) which is responding to an interview BOE Governor Bailey had in The Guardian where he explained he could become “a bit more aggressive” in their policy easing stance provided inflation data continues to trend lower. Now, prior to the interview, the OIS market was already pricing in a 25bp cut at the next meeting in November, and 45bps of cuts by year end, and it is not much changed now. But for whatever reason, the FX market decided this was the news on which to sell pounds.

Remember, as I’ve repeatedly explained, the dollar’s demise is likely to be far slower than dollar bears believe because now that the Fed has begun cutting rates, and nothing is going to stop them going forward for a while, other central banks will feel empowered to cut as well. The only way the dollar falls sharply is if the Fed is the most dovish central bank of the bunch, but Monday, Chairman Powell made clear that was not the case. In fact, yesterday, Richmond Fed president Barkin was the latest to explain that things look good, but they are in no hurry to cut aggressively. Other central banks are now in a position to ease policy more aggressively, something many had been seeking to do as economic activity was slowing in their respective countries, without the fear of a currency collapse.

It was just a few days ago that I highlighted key technical levels the market was focused on, which if broken might herald a much weaker dollar. Across the board, we are more than 2% from those levels (EUR 1.12, GBP 1.35, DXY 100.00) and traveling swiftly in the other direction. A quick peek at the chart below shows that while the exact timing of these moves was not synchronized, the outcome is the same.

Source: tradingeconomics.com

Moving beyond the FX market, where the dollar is stronger literally across the board, the economic story continues to muddle along. Services PMI data was released this morning with most of Europe looking a bit better, although the Italians were lagging, but not enough to get people excited about European assets in general. Equity markets on the continent are mixed with both the DAX (-0.6%) and CAC (-0.8%) under pressure while Spain’s IBEX (+0.1%) and the FTSE 100 (+0.25%) buck the trend on the back of Spain’s best in class PMI data and, of course, the UK rate cut frenzy. As to last night’s Asian markets, while China remains closed, the Hang Seng (-1.5%) gave back some of yesterday’s gains and the rest of the region was unconvinced in either direction. While US markets eked out the smallest of gains yesterday, futures this morning are pointing lower by -0.4% or so at this hour (6:45).

In the bond market, Treasury yields are higher by 3bps this morning, as the market absorbs the idea that the Fed may not be cutting in 50bp increments each meeting and traders responded to a much better than expected ADP Employment Report yesterday (143K, exp 120K) so are prepping for a good NFP number tomorrow. Meanwhile, European sovereign yields are all higher by between 5bps and 7bps as they catch up to yesterday’s Treasury move, much of which occurred after European markets were closed. One thing to keep in mind here is that bond markets, at least 10-year and longer maturities, are far more concerned with the inflation outlook than the central bank discussion. Right now, as the world awaits Israel’s response to the Iranian missile attack, concerns are rife that oil prices could move much higher and take inflation readings along for the ride. If you add that to the idea that 3% is the new 2% for central bank inflation targets, something which is also gaining credence in the market, the case for higher bond yields is strong.

Speaking of oil markets, once again this morning the black sticky stuff is higher (+2.0%) amid those Middle East conflagration fears. As I highlighted yesterday, if Israel were to attack Iran’s oil fields and knock a large portion offline, I would expect oil to get back to $100 in a hurry. And if the damage was sufficient to keep it offline for many months, we could stay there. However, the combination of the stronger dollar and higher oil prices has taken a toll on the metals markets with all the major metals weaker this morning (Au -0.5%, Ag -1.1%, Cu -1.5%). This strikes me as a short-term phenomenon as the fundamental supply/demand issues remain in favor of higher prices and anything that drives inflation higher will help price as well. But not today.

As to the dollar, I have already discussed its broad-based strength with gains against literally all its G10 and EMG counterparts. It will take some pretty bad US data to change this story today.

Speaking of the data, as it’s Thursday, we get the weekly Initial (exp 220K) and Continuing (1837K) Claims data as well as ISM Services (51.7) and Factory Orders (0.0%). Yesterday, in a surprise, EIA oil inventories rose, a welcome outcome, but not enough to offset the Middle East fears. The only Fed speaker on the calendar today is Atlanta Fed president Bostic, one of the more hawkish members, so my guess is he is likely to continue to preach moderation in rate cuts. Speaking of the Atlanta Fed, their GDPNow reading fell to 2.5% for Q3 after the weaker than expected construction spending the other day, but it remains above the Fed’s estimated long-term trend growth rate.

Putting it all together, I can see no good reason for the dollar to reverse this morning’s gains absent a Claims number above 250K. The hyper dovishness that had been a critical part of the dollar decline story has been beaten back. Of course, tomorrow brings the NFP report, so anything can still happen.

Good luck

Adf