The FX Poet will be in Nashville at the AFP Conference October 21-22, speaking about effective ways to use FX options in a hedging program. Please come to the presentation on Monday at 1:45 in Grand Ballroom C1 if you are there. I would love to meet and speak.

While here in the States we have seen

Inflation that’s nearly obscene

In Europe, inflation

In ‘bout every nation

Has fallen much more than foreseen

The narrative there has adjusted

As all of their models seem busted

So, cuts with more speed

We’ll soon see proceed

Though central banks still aren’t trusted

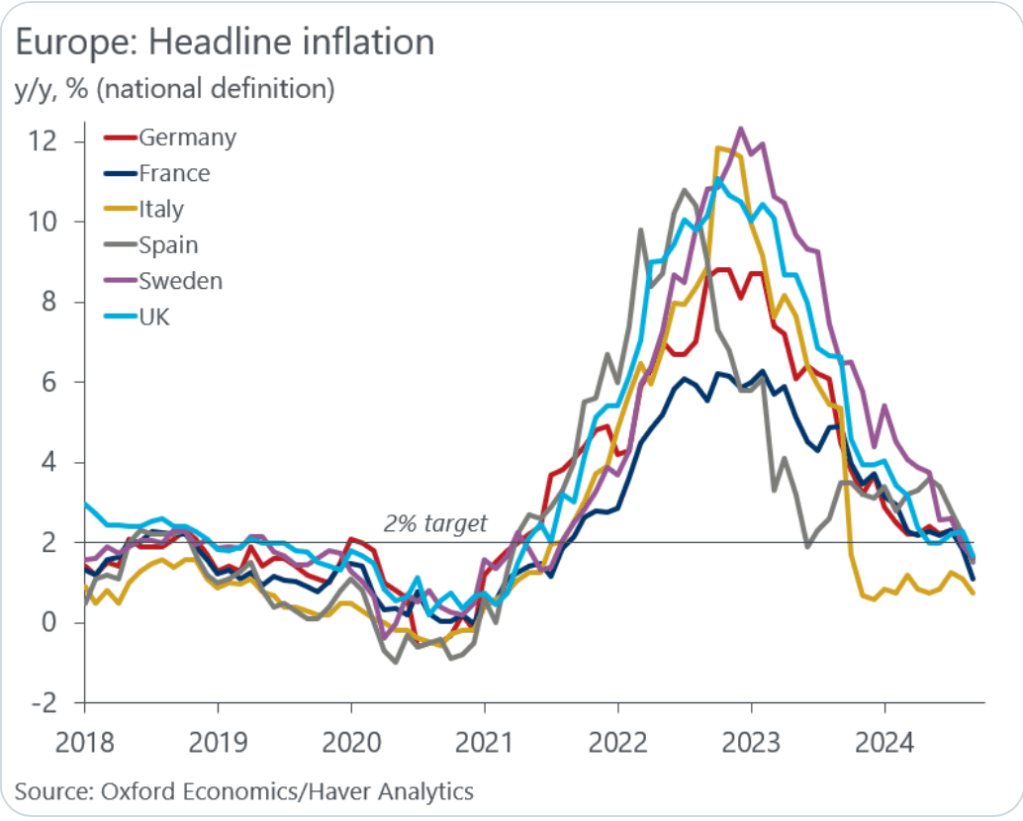

While Fed speakers are trying to claim victory over inflation, whether or not that is reality, the situation in Europe is a bit different. In fact, headline inflation has fallen quite dramatically virtually across the board as evidenced by the below chart.

Now, a critical piece of this decline is the fact that energy prices have fallen dramatically in the past year with Brent Crude (-16.5%) and TTF NatGas (-18.9%) leading the way lower. In fact, core inflation data, for the few nations that show it, remains above that 2% target with the UK (Core 3.2% Y/Y) the latest to report this morning. One other thing to remember is that in the wake of the Covid pandemic, no nation printed and spent nearly as much money as the US on a relative basis, let alone an absolute basis, so there was less fiscal largesse elsewhere.

Yet, the fact remains that headline inflation throughout Europe and the UK has fallen below the 2% targets and so the narrative has now shifted to see more aggressive rate cuts by the central banks everywhere. This will be part of the discussion tomorrow at the ECB, where most analysts are looking for a 25bp cut although some are calling for 50bps, and the market is pricing more than 40bps at this point.

You know what else is pricing a larger rate cut by the ECB? The FX market. Yesterday, the euro fell below the 1.09 level for the first time in more than two months (remember that chart of the double top formation from Monday?) and the single currency has fallen more than 2% in the past month. Similarly, the pound, after today’s softer than expected CPI readings, has fallen -0.35% this morning, the worst performer in the G10, and is now lower by nearly -1.5% in the past month and looking like it has reversed the uptrend that existed through the summer and early autumn.

Ultimately, my point is that the narrative about rate cuts is shifting to a more accelerated mode in Europe and the UK (where talk of a 50bp cut is making the rounds as well) while here in the States, a 25bp cut is not fully priced in even after yesterdays’ much weaker than expected Empire State Manufacturing Index (-11.9 vs. exp 3.8 and last month’s +11.5). If you want a reason to explain the dollar’s resilience, you could do worse than the fact that economies elsewhere in the world are lagging the performance here.

Speaking of the Fed, yesterday’s surprise Fedspeak came from Raphael Bostic, Atlanta Fed president, when he explained that he only foresees one more rate cut in 2024. That is quite a different story than we have been hearing from the rest of the FOMC speakers, who seem completely on board with at least 50bps of cuts and seemingly could be persuaded to head toward 75bps. There is still much to learn between now and the next FOMC meeting the day after the election here, but despite Bostic’s comments, I believe the minimum we will see before the end of the year will be 50bps.

Ok, that was really all the action overnight. Yesterday’s disappointing US equity performance, with all three major indices lower by at least -0.75% (I thought that was outlawed 🤣) was followed by similarly weak performance in Asia with the Nikkei (-1.8%) leading the way lower as tech shares underperformed, but further weakness in China (-0.6%) as Godot seems more likely to arrive than the Chinese stimulus. Throughout the region, only Thailand (+1.2%) managed any gains after the central bank there cut rates 25bps in a surprise move seeking to foster a better growth situation. In Europe, only the UK (+0.6%) is rallying on the strength of the idea that lower inflation will encourage a 50bp cut from the BOE when they meet the day after the Fed. But otherwise, red is the color of the day in Europe with losses ranging from -0.1% (Spain) to -0.6% (France). Meanwhile, US futures are a touch firmer at this hour (7:15), by just 0.2%.

In the bond market, yields are lower across the board after that weak Empire State number encouraged the slowing economy narrative and the lower inflation prints in Europe and the UK have weighed on yields there this morning. So, Treasury yields (-2bps) are lagging most of Europe (Bunds -3bps, OATs -3bps) and UK Gilts (-8bps) are all about the data this morning. Even JGB yields (-1bp) got into the act.

In the commodity space, oil (-0.5%) is continuing its recent decline, although yesterday it managed to bounce a bit and close above the $70/bbl level where it still sits, barely. But the metals complex is having another good day with gold (+0.6%) pushing to new all-time highs as western investors are finally following Chinese and Indian investors as well as global central banks. The lower interest rates certainly help here. Similarly, we are seeing gains in the other metals (Ag +1.2%, Cu +1.1%) as stories regarding shortages for both metals in the long-term resurface given the lack of new mining activity and increased demand driven by the idea of increased solar and electricity needs respectively.

Finally, the dollar, overall, is little changed, holding onto its recent gains although with a mixed performance this morning. ZAR (+0.5%) is this morning’s leader on the back of the metals market gains, and we have seen strength in KRW (+0.3%) as well. However, elsewhere, movement is small and favoring the dollar (HUF -0.2%, CZK -0.2%) and we’ve already discussed the euro and pound. Interestingly, the THB (+0.45%) rallied after the rate cut on the back of equity inflows.

There is no major data set to be released this morning and no Fed speakers on the current calendar, although as always, I suspect we will still hear from some of them. Madame Lagarde speaks this afternoon, and given the ECB meeting tomorrow, there will be many interested listeners.

Overall, the themes seem to be that Eurozone inflation is sinking and rate cuts are coming. That should keep some downward pressure on European currencies vs. the dollar, at least until we see or hear something that describes a more aggressively dovish Fed. The one truly consistent feature of these markets has been the rally in gold which seems to benefit from fear, inflation and lower rates, all of which appear to be in our future.

Good luck

Adf