Excitement does not quite portray

The thirst for risk shown yesterday

Though media cried

Investors took pride

In Trump, sure that he’ll save the day

So, next Chairman Jay and the Fed

Will try to explain that instead

Of further rate paring

They might soon be erring

On side that Fed rate cuts are dead

Wow! That is pretty much all one can say about yesterday’s equity market response to the confirmation that Donald Trump will be the next president of the United States. The DJIA rose 3.6%, far outpacing both the S&P 500 (+2.5%) and the NASDAQ (+3.0%) but even that paled in comparison to the Russell 2000 small-cap index which jumped nearly 6% on the day! Investors are all-in on the idea that Trump will seek to bring home as much manufacturing and economic activity as possible via tariff policies and small caps and old-line companies are the ones likely to benefit.

But boy, bonds had a tough day with yields across the curve rising between 10bps (2yr) and 20bps (30yr) with the 10yr gaining 15bps on the day. It is all part of the same mindset, higher economic activity and no slowdown in spending leading to rising inflation and, correspondingly, rising yields.

The other area that really suffered were the metals markets, with gold (-3.3% or $90/oz), silver (-4.7%) and copper (-5.0%) all getting hammered. The best explanation for the gold price’s decline I have heard is the idea that with Trump coming into office, the prospects for a nuclear war have greatly diminished. Certainly, based on the fact that there were no new wars during his last term and one of his promises is to end the Russia/Ukraine war on the first day, perhaps that is correct. As well, consider that the dollar exploded higher, something which had lately been a benefit for metals, but historically has been a negative, and at least we can make some sense of things here.

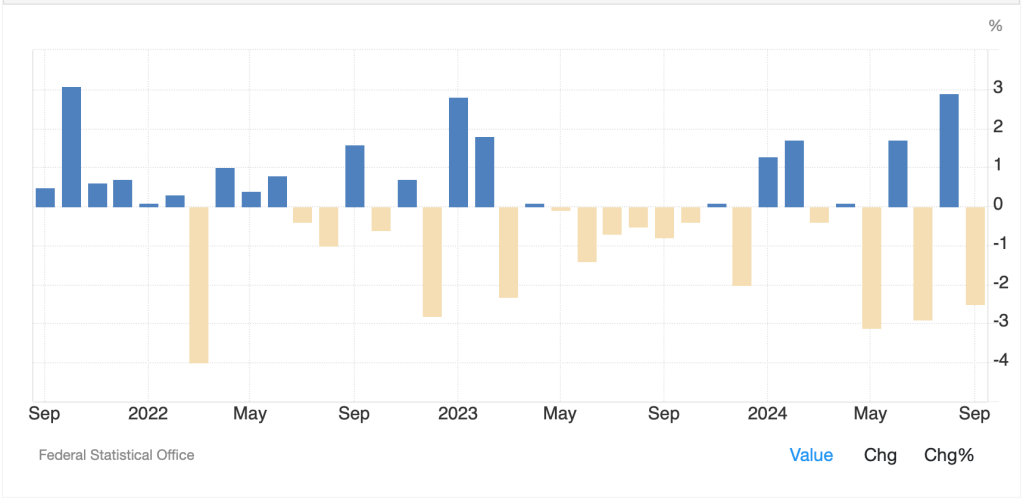

So, where do we go from here? That, of course, is the $64 billion question. Reactions around the world are still coming in and I would characterize them as a mix of stoicism and fear. Perhaps a good place to start is Germany where the governing coalition just collapsed as Chancellor Sholz fired the FinMin who was the head of the FDP, one of his coalition’s groups. Their problem is that the German economic model is crumbling, and the population is unhappy with the current situation. The former can be demonstrated by today’s data showing the Trade Surplus fell more than expected while IP fell back into negative territory again, an all-too-common occurrence over the past three years as can be seen below, and hardly the best way to improve the productivity of your economy.

Source: tradingeconomics.com

Meanwhile, politically, the country is seeing a widening of views across the spectrum with the combination of the anti-immigration parties, AfD on the right and BSW on the left, garnering support of about 25% of the population and preventing any meaningful coalitions from being formed.

If Germany continues to lag economically, it will negatively impact the whole of the Eurozone. The divergence between the US economy, which has all the hallmarks of faster growth ahead, especially under a new administration, and the European economy, which continues to struggle under a suicidal energy policy that undermines any chance of industrial resurgence, and therefore a significant rebound in economic activity could not be greater. While much ink has been spilled regarding the prospects that the dollar is going to collapse because of the debt situation and the BRICS are going to create something to replace it, the reality is the euro is in far more dire straits. The ECB is going to be much more aggressive cutting rates than the Fed and the market is starting to price that in. The below chart from Bloomberg this morning does an excellent job showing the change in market pricing over the past month.

I find it hard to see how the euro can benefit in this environment regardless of the dollar’s performance against other currencies given the more limited economic prospects on the continent. They are dealing with an existential crisis because of Russia’s more aggressive stance since the invasion of Ukraine combined with an undermining of their economic model which was based on exporting high value items to China and the rest of the world. The problem with the latter is China has become a huge competitor and a shrinking market for their wares, and they have limited other markets. If Trump holds to his word and imposes 20% tariffs on European imports to the US, the euro is likely to fall even further.

That is just a microcosm of one area and its response to the US election, but one that may well be a harbinger for many others. The US stance in the world is changing and other nations are not really prepared. Expect more financial market volatility, in both directions, as these changes become more evident and play out over time.

Ok, let’s see how other markets behaved with confirmation of the Trump victory. In Asia, the Nikkei (-0.25%) slid but other indices rallied indicating a mixed picture. Meanwhile Chinese shares rallied sharply (CSI 300 +3.0%, Hang Seng +2.0%) as expectations grow that the Standing Committee will expand the stimulus measures in the wake of the election. Remember, the Chinese had delayed this annual meeting by a week to capture the results of the US election and now traders are betting on a bigger response. As well, the Chinese Trade Surplus expanded far more than forecast, to its third highest monthly reading of all time at $95.3B. As to the rest of the region, the picture was very mixed with some gainers (Singapore +1.9%, Taiwan +0.8%) helped by the China story and some laggards (India-1.0%, Philippines -2.1%) with the latter suffering from a much weaker than expected GDP report.

In Europe, interestingly, most markets are performing well this morning led by the DAX (+1.3%) although the rest of the continent’s bourses are only higher by around 0.5% or so. The laggard here is the FTSE 100 which is unchanged on the day in the wake of the BOE’s widely expected 25bp rate cut. Although, there were apparently some looking for a 50bp cut as stocks fell a bit in the wake of the news and the pound jumped 0.3%, a clear sign of a minor surprise.

Speaking of currencies, the dollar which has had quite a run in the past two sessions is backing off overall this morning although remains well above the pre-election levels. In the G10, NOK (+1.3%) is the leader as the Norgesbank left rates on hold and indicated that was likely their stance going forward, while AUD (+1.0%) seems to be benefitting from both the rebound in metals prices and the potential Chinese stimulus. Otherwise, currencies have rallied between 0.3% and 0.5% in this bloc. In the EMG space, ZAR (+1.4%) is the biggest gainer, also on the precious metals rebound, while MXN (+1.2%) is next, although that is simply a continuation of the retracement from the post-election decline. Bigger picture, I think the dollar remains well bid, but not today.

In the bond market, Treasury yields are unchanged this morning, consolidating their gains from the past week and waiting for the Fed this afternoon. However, European sovereign yields have all rallied substantially, between 6bps and 9bps, which looks, for all intents and purposes, like the continent’s catch-up trade to yesterday’s US movement. Nothing has changed the view that Treasury yields lead bond market moves in the G10.

Finally, in the commodity space, oil (-1.0%) is a bit lower this morning although yesterday it recouped most of its early losses and closed lower only minimally. Yesterday also saw a surprising inventory build in the US which would be expected to weigh on prices. In the metals markets, after a virtual collapse yesterday, this morning is seeing stabilization in precious metals and a sharp rebound in copper (+2.3%) as hopes for that Chinese stimulus spread to this market as well.

In addition to the FOMC meeting this afternoon, we see regular Thursday morning data of Initial (exp 221K) and Continuing (1880K) Claims as well as Nonfarm Productivity (2.3%) and Unit Labor Costs (1.0%). However, despite all the recent activity, and the fact that a 25bp cut is a virtual certainty, Chairman Powell’s press conference will still have the trading community riveted to see how he describes any potential future paths in the wake of the election results. Given the recent data and the estimate prospects of a Trump administration’s efforts to goose growth further, it is hard to see how the Fed can really discuss cutting rates much further. In fact, I will go out on a limb and say I expect forecasts of the neutral rate are going to consistently climb higher and reach 4% before the end of 2025. And that means, as is evident by both the economy and the stock market, the Fed has not tightened financial conditions very much at all.

Good luck

Adf