The risks to our mandates appear

More balanced so let us be clear

We’re still cutting rates

Which just demonstrates

We’re clueless and shaking with fear

To absolutely nobody’s surprise, the Fed cut the Fed funds rate by 25bps yesterday. The accompanying statement explained, “The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance.” The implication is that they remain confident that inflation is slowly heading to their 2.0% target, and they are keeping a close eye on the Unemployment Rate, especially after the terrible number last week. Of course, the combination of the Boeing strike and the impact of the two major hurricanes, Helene and Milton, were likely responsible for a significant portion of that underperformance, so we will need to see how the November report, published on December 6th plays out. There is a lot of time between now and then so the narrative could easily change prior to the release. Be vigilant.

The press conference consisted of a lot of self-congratulatory comments about how they have done a good job “recalibrating” policy and continuing to insist inflation is dying, although not quite dead yet. The market response was to continue the US equity rally, with the NASDAQ (+1.5%) leading the way higher and to reverse some of yesterday’s bond losses with 10-year yields slipping -8bps. In the commodity markets, yesterday saw all of them rebound, recouping roughly half of their losses from Wednesday and the dollar gave back some of those initial gains as well.

At this stage, the market is pricing a two-thirds probability of another 25bp cut at the December meeting, and all eyes are now going to turn to Trump and whatever policy prescriptions he starts to tout. The early indication is that people expect more growth in the US from his policies as the no-landing scenario seems to be the favorite. We shall see.

Investors had high hopes that Xi

Would give away more renminbi

Instead, in a flop

They’ve spurred a debt swap

While stimulus, no one can see

The other story of note overnight was the final statement of the Standing Committee in China, where many had expected hoped the elusive Chinese Bazooka would be fired. It was not. Instead, they gave more details on an effective debt swap that they will permit for local governments.

A brief tutorial: Chinese cities and regions had typically financed infrastructure investment via local government funding vehicles (LGFV) which issued debt to investors that was backed by the government entity, but not officially on their balance sheet. This model evolved because there were restrictions on how much debt these cities/regions were allowed to issue. These entities would then sell land to developers to service and pay off the debt. It all worked great while the property bubble in China was inflating and nobody was the wiser. But now that property prices have been falling for 3 years, it is a major problem because the cities/regions aren’t generating the property sales and revenues needed to repay the debt.

The solution that Xi came up with is to allow the cities/regions to issue debt on the balance sheet, upwards of CNY 10 trillion over the next 5 years, and replace the off-balance sheet stuff from the LGFVs. And that’s it! A debt swap that will likely lower interest rates slightly and save somewhere along the lines of CNY 600 billion over 5 years. While the central government claims there is only a total of CNY 14.3 trillion in these LGFVs, most analysts put the number at around CNY 60 trillion. This is not really that stimulative, will not help Chinese consumers nor factories in any way, and is very likely to have only a tiny impact.

Cagily, the Standing Committee didn’t announce this until after local markets closed for the weekend, so the fact that stocks on the mainland and in Hong Kong only fell -1.0% does not represent the totality of the disappointment. I expect we will see further declines next week. President Xi has some tough sledding ahead for his economy.

And that was really the news of note. Literally everything else you can read is a post-mortem of the election. So, let’s look at how markets behaved overnight. Away from the Chinese share declines, there were more winners than losers in Asia, with those nations that seem to have closer ties to the US benefitting (Taiwan, Australia, Singapore, New Zealand) while others which are more neutral or in China’s sphere of influence under pressure (India, Thailand, Vietnam). The other noteworthy news was that the Chinese Current Account hit its second highest surplus ever last month, but with most people expecting significant tariff implementation when Trump takes office in January, I suspect those numbers will decline.

Meanwhile, European bourses are almost entirely under water this morning with most lower by -0.9% although Spain’s IBEX is unchanged on the day. There hasn’t been much in the way of new data, and I sense that investors are starting to price in more difficult relations with the US now that it seems clear the Republicans will win the House as well, giving Trump the ability to implement his vision. Meanwhile, at this hour (6:50) US futures are little changed, consolidating ahead of the weekend.

In the bond market, yields which backed off in the wake of the FOMC meeting yesterday have edged 2bps lower this morning and are now sitting at 4.30%. This is the level, when first reached a week ago, set hair on fire as to the dichotomy between the Fed cutting rates and longer-term yields rising. My view continues to be that yields have higher to climb over time as the Fed’s inflation fight is not won, and it will become evident that is the case going forward. As to European sovereign yields, they are all lower by -4bps this morning as they are simply following Treasury yields but had to catch up given the FOMC meeting occurred after their close yesterday.

In the commodity markets, it appears that nobody wants to own ‘stuff’ anymore as they are back under real pressure. Oil (-1.4%) is sliding although that makes sense as a Trump administration is very likely to support as much production as possible thus increasing supply. But metals prices are also under pressure (Au -0.5%, Ag -1.5%, Cu -2.2%) which makes less sense as if economic expansion is the view, I would expect these to perform well. Of course, it is possible that this is a reaction to the damp squib from China last night, but I expect these items to gradually regain lost ground.

Finally, the dollar is gaining some strength this morning, rising against most of its G10 counterparts with AUD (-0.6%) the worst performer, although JPY (+0.5%) and CHF (+0.2%) have managed to climb. It’s almost as if this is a classic risk-off scenario in the FX markets. Certainly, EMG currencies are under pressure this morning with ZAR (-1.1%) the laggard, but declines across the board, notably CNY (-0.3%) and pushing back toward the 7.20 level. But the dollar is strong everywhere in this bloc.

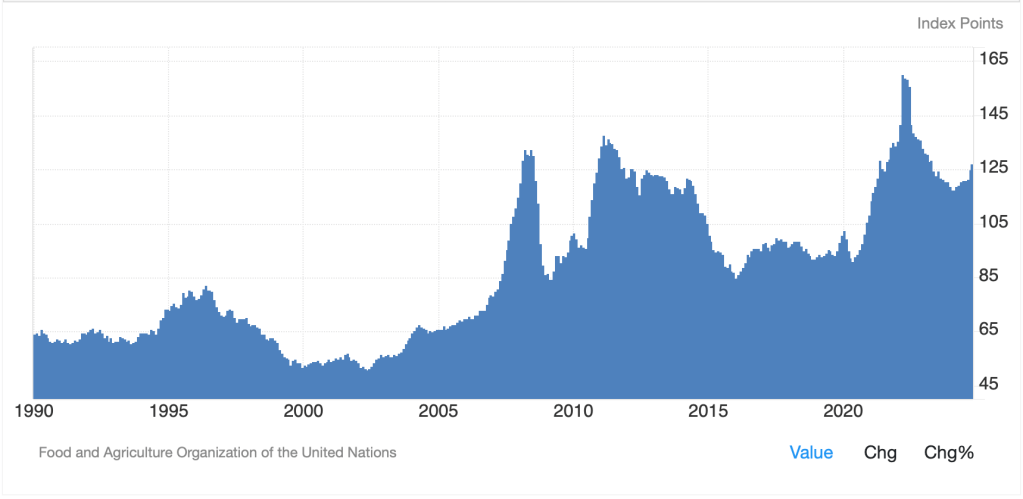

On the data front, Michigan Sentiment (exp 71.0) is all we get this morning although we also get our first Fed speaker, Governor Bowman, who has been one of the more hawkish voices. One other thing to note is that the FAO’s Food Price Index was released this morning, climbing 2% to 127.4. as you can see from the chart below, while this is not as high as prices reached in the immediate aftermath of the Russian invasion of Ukraine, this level is still in the upper echelons of where things have been over the past thirty-four years.

Source: tradingeconomics.com

It is worth remembering that the Arab Spring in 2011 was partially driven by rising food prices with large scale protests upending several governments. Given how unhappy people around the world have been with their leadership, as evidenced by the number of governments that have been kicked out of office in recent elections and given that rising food prices have been a constant complaint, this needs to be kept in mind for how events unfold in the future. To me, the market implication is that more volatile politics around the world will feed into more volatile financial markets as uncertainty grows. In times of stress, the dollar remains the haven of choice, so this is just another reason to keep looking for the dollar to outperform in the medium term.

Good luck and good weekend

Adf