So, CPI didn’t decline

And may not be quite so benign

As Jay and the Fed

Consistently said

When hinting more rate cuts are fine

However, that will not deter

Chair Powell, next month, to confer

Another rate cut

Though it is somewhat

Unclear if his colleagues concur

Despite the fact the narrative is pushing Unemployment as the primary focus of the FOMC, yesterday’s CPI report, which seemingly refuses to decline to the Fed’s preferred levels, had Fed speakers beginning to hedge their bets regarding just how quickly rates would be coming down from here. [Emphasis added.]

St. Louis Fed President Alberto Musalem explained, “The strength of the economy is likely to provide the space for there to be a gradual easing of policy with little urgency to try and find where the neutral rate may be.”

Dallas Fed President Lorrie Logan commented (using a series of maritime metaphors for some reason) “After a voyage through rough waters, we’re in sight of the shore: the FOMC’s Congressionally mandated goals of maximum employment and stable prices, but we haven’t tied up yet, and risks remain that could push us back out to sea or slam the economy into the dock too hard.”

Finally, Kansas City Fed President Jeff Schmid told us, “While now is the time to begin dialing back the restrictiveness of monetary policy, it remains to be seen how much further interest rates will decline or where they might eventually settle.”

If we ignore the oddity of the maritime metaphor, my takeaway is that the Fed is still looking to cut rates further as directed by Chairman Powell, but the speed with which they will act seems to be slowing down. As I have maintained in the past, given the current data readings, it still doesn’t make that much sense to me that they are cutting rates at all, but arguably, that’s just another reason I am not a member of the FOMC. Certainly, the market is on board as futures pricing increased the probability of that cut from 62% before the release to 82% this morning. There is still a long way to go before the next meeting, with another NFP, PCE and CPI report each to be released, as well as updates on GDP and Retail Sales and all the monthly figures, so this story is subject to change. But for now, a rate cut seems likely.

One other thing, I couldn’t help but notice a headline that may pour a little sand into the gears of the rate cutting apparatus at the Eccles Building. This is on Bloomberg this morning: Manhattan Apartment Rents Rise to Highest Level Since July. Again, the desperation to cut rates seems misplaced.

Despite the fact rate cuts are coming

The dollar just keeps right on humming

This morning it’s rising

Which ain’t that surprising

As more depths, the euro is plumbing

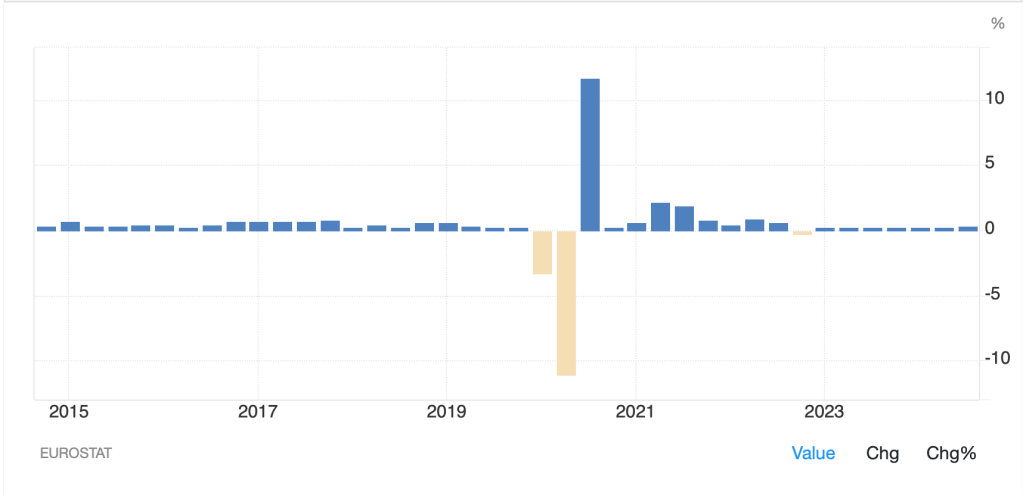

Turning our attention to the continent, European GDP figures were released this morning, and they remain disheartening, to say the least. While the quarterly number rose to 0.4%, as you can see from the chart below, it has been several years since the continent showed any real growth, and that was really just the rebound from the Covid lockdowns. Prior to Covid, growth was still lackluster.

Source: tradingeconomics.com

While these are the quarterly numbers, when looking at the Y/Y results, real GDP grew less than 1% in Q3 for the past 6 quarters and, in truth, shows little sign of improving. After all, virtually every nation in the Eurozone is keen to continue their economic suicide via energy policy and regulation. This thread on X (formerly Twitter)is a worthwhile read to get an understanding of the situation on the continent. I show it because this morning, the euro has fallen yet further, and is touching the 1.05 level, seemingly on its way to parity and below. It highlights that since just before the GFC, the Eurozone economy has fallen from virtually the same size as the US economy, to just 60% as large, and explains the key reasons. Read it and you will be hard-pressed to consider the euro as a safe store of value, at least relative to the dollar. And remember, the dollar has its own issues, but at least the US economy remains dynamic.

But the dollar is king, again, this morning, rising against virtually all its counterparts on the session. Versus the G10, the average movement is on the order of 0.3% or so, but it is uniform. USDJPY is now pushing 156.00, the pound seems headed for 1.2600 and Aussie is below 0.65. My point is concerns about the dollar and its status in the world seem misplaced in the current environment. If we look at the EMG bloc, the dollar is stronger nearly across the board as well, with similar gains as the G10. MXN (-0.5%), ZAR (-0.4%) and CNY (-0.2%) describe the situation which has been a steady climb of the greenback since at least the Fed rate cut, and for many of these currencies, for the past 6 months. Nothing about President-elect Trump’s expected policies seems likely to change this status for now.

If we look at equity markets, yesterday’s US outcomes were essentially little changed on the day. However, when Asia opened, with the dollar soaring, we saw a lot more weakness than strength, notably in China with the CSI 300 (-1.7%) and Hang Seng (-2.0%) leading the way lower although the Nikkei (-0.5%) also lagged along with most other Asian markets. While there were some modest gainers (Australia +0.4%, Singapore +0.5%) red was the predominant color on screens. In Europe, however, investors are scooping up shares with the DAX (+1.2%) leading the way although all the major bourses are higher on the session. It seems that there is a growing consensus that the ECB is going to cut 25bps in December and then another 25bps in January, which has some folks excited. US futures, meanwhile, are slightly firmer at this hour (7:00).

All this is happening against a backdrop of a continued climb in yields around the world. Yesterday, again, yields rose with 10yr Treasuries trading as high as 4.48%, their highest level since May, and that helped drag most European yields higher as well. This morning, we are seeing some consolidation with Treasury yields backing off 1bp and European sovereign yields lower by -2bps across the board. The one place not following is Japan, where JGB yields edged higher by 1bp and now sit at 1.05%. Consider, though, that despite those rising yields, the yen continues to slide. In fact, that is the correlation that exists, weaker JPY alongside higher JGB yields as you can see in the below chart.

Source: tradingeconomics.com

While it is open to question which leads and which follows, my money is on Japanese investors searching for higher yields, selling JGB’s and buying dollars to buy Treasuries.

Finally, the commodity space continues to get blitzed, or at least the metals markets continue that way as once again both precious and industrial metals are all lower this morning. In fact, in the past week, gold (-5.7%), silver (-6.4%) and copper (-9.1%) have all retraced a substantial portion of their YTD gains. It is unclear to me whether this is a lot of latecomers to the trade getting stopped out or a fundamental change in thinking. My view is it is the former, as if the Trump administration is able to support growth, I expect that will reveal the potential shortages that exist in the metals space. Oil (+0.4%) is a different story as it continues to consolidate, but here I think the odds are we see lower prices going forward as more US drilling brings supply onto the market.

On the data front, this morning brings the weekly Initial (exp 223K) and Continuing (1880K) Claims data along with PPI (0.2%, 2.3% Y/Y) and core PPI (0.3%, 3.0% Y/Y). In addition, the weekly EIA oil data is released with modest inventory builds expected and then we hear from Chair Powell at 3:00pm this afternoon. Arguably, that is the event of the day as all await to see if the trajectory of rate cuts is going to flatten out or not.

I cannot look at the data and conclude that the Fed will be very aggressive cutting rates going forward. The futures market is now pricing in about 75bps of cuts, total, by the end of 2025. That is a 50bp reduction in that view during the past month and one of the reasons the dollar remains strong. I would not be surprised if there are even fewer cuts. Right now, everything points to the dollar continuing to outperform virtually every other currency.

Good luck

Adf