Apparently, President Xi

Is starting to listen to me 🤣

His currency’s falling

As he stops forestalling

The weakness in his renminbi

But it’s not just yuan that is weak

The havoc the dollar will wreak

Is set to keep growing

As funds keep on flowing

To US investments, still chic

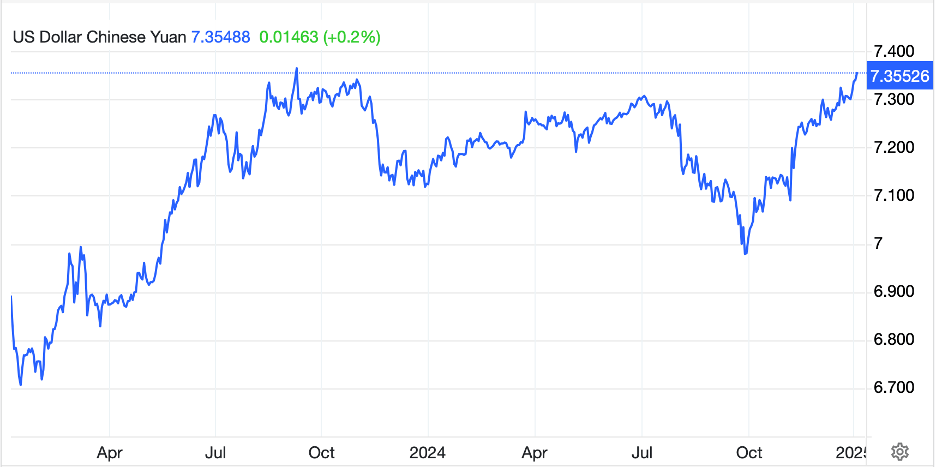

It seems that one of President Xi Jinping’s New Year’s resolutions was to finally allow the renminbi to resume its longer-term decline. While 7.30 has been the line in the sand for a while, as can be seen from the first chart below, suddenly, as the calendar page turned to 2025, it appears that the PBOC is going to allow for the renminbi to weaken further. Thus far, the PBOC has been adamant about fixing the Chinese currency at levels much stronger than anyone wants to pay for it, and even last night that was the case, with a fixing rate of 7.1878. However, while the onshore market must trade within +/- 2% of that fixing rate, no such restriction limits the offshore market, and this morning, the offshore renminbi is trading 2.3% weaker than the fixing, above 7.35 to the dollar.

Much has been made of the “chess” moves that are ongoing between the US and China regarding currency policy with many pundits blankly claiming that if Trump is to impose the threatened tariffs, the renminbi will simply weaken to offset them. However, while I do believe the CNY has much further to fall, that is not the driving case I see. Rather, Xi’s problem is that his economy is not in nearly as good condition as he needs it to be and confidence in the consumer sector continues to wane. This is largely a result of the ongoing destruction of the property bubble that was blown for decades.

Remember, Chinese investors have tied up significant personal wealth in second and third homes as stores of value. This was encouraged as cities could sell property to developers, get paid a bunch to help finance their operations, and since demand was so high, prices kept rising so everyone was happy. Alas, as with all bubbles (I’m looking at you, too, NASDAQ) eventually the air comes out. For the past three years the Chinese have been trying to deal with this collapsing property market, but house prices continue to decline thus reducing investor wealth and confidence. I read that there are an estimated 80 million empty homes that have been built over the past decades and are now in disrepair in the countryside. These are the ghost cities that were all part of the Chinese growth miracle, but in fact were simply massive malinvestment.

While the prescription for China has long been to increase its consumer sector of the economy, Xi and his minions at the central committee have no idea how to do that (given they are communist, this is not that surprising) and so continue to support the means of production. The problem is they have now seemingly gone too far in that space as well with not merely the Western world, but also much of the developing world starting to push back on all the excess stuff that is coming from China.

Xi’s other problem is that as he rails against the dollar and seeks others to use the renminbi in their trade, if the currency starts to fall sharply, that will be a difficult ask. Given the US FX policy remains benign neglect, it is entirely upon China to solve their own problems. While it is unlikely to happen in a big devaluation a la August 2015, weakness is the trend to bet here this year.

Source: tradingeconomics.com

Source: tradingeconomics.com

Away from that news, though, the year is starting off in a fairly modestly. Most of the world’s focus is on the upcoming Trump inauguration as well as the political machinations that will begin today as Trump’s Cabinet nominees start to go through their paces in front of the Senate. New Year’s Eve’s horrifying terrorist attack in New Orleans has just upped the ante with respect to Trump getting his picks through the process.

So, let’s review the overnight market activity to get a sense of what today could bring. The first day of the US trading year resulted in modest declines across the board in equities, although as I type (7:30), they appear to be retracing those losses and are slightly higher. The bigger news was from Asia where both the Nikkei (-1.0%) and CSI 300 (-1.2%) showed weakness with the former feeling the pain of some profit taking after gains last week, although Chinese shares seem to be succumbing to the troubles I have described above. Elsewhere in the region there was no consistency with gainers (Hong Kong, Taiwan, Korea and Australia) and losers (India, New Zealand, Malaysia) with other exchanges little changed. In Europe this morning, there is more red than green with the CAC (-0.8%) the biggest laggard amid concerns over the fiscal situation in France. But the DAX (-0.35%) and FTSE MIB (-0.45%) are also lagging with only Spain’s IBEX (0.0%) bucking the trend.

In the bond market, Treasury yields have slipped 2bps this morning, but remain above 4.50%, something that continues to vex Chairman Powell as he and the Fed seemed certain that by cutting the Fed funds rate, he would drive the entire yield curve lower. I wonder if he will learn this lesson about the relation between a made-up rate (Fed funds) and market rates (bond yields) anytime soon. In Europe, French yields are 2bps higher, widening their spread vs. German bunds and perhaps more remarkably, at least from a nominal perspective, well above Greek government bond yields now! (Remember, there are far fewer GGB’s around than OAT’s so there is a scarcity bid there). Certainly, Madame Lagarde must be getting a bit concerned over her native nation’s profligacy and I suspect that the fiscal ‘need’ for lower Eurozone interest rates is one of the features of the discussion regarding the ECB’s future path (lower). As to JGB’s, they are unchanged, sitting at 1.07% and showing no sign of rising anytime soon. One last thing, Chinese 10yr bonds now yield a new record low of 1.61%, 2bps lower on the day and pretty convincing evidence that not all is well in the Middle Kingdom’s economy.

On the commodity front, oil (-0.2%) is consolidating yesterday’s strong gains which were ostensibly based on the idea that President Xi will successfully implement more stimulus and aid growth in China. History shows otherwise, but we shall see. Gold (-0.1%) is also consolidating yesterday’s strong gains as it appears there has been renewed central bank buying activity to start the year. The other metals also benefitted yesterday with silver (+0.8%) continuing this morning.

Finally, the dollar is retracing some of yesterday’s gains but remains much stronger than we saw just last week, and certainly since the last time I wrote. Looking at the Dollar Index, it is hovering near 109 this morning, having traded well above that yesterday afternoon. The next obvious technical target is 112, about 3% higher and there are now many calls for a test of the 2002 highs of 120. I assure you, if the DXY gets to those levels, EMG currencies are going to come under a great deal of pressure. As an example, we already see several EMG currencies (CLP, BRL) trading at or near all-time lows (dollar highs) and there is nothing to think this will change soon. As well, check out the euro at 1.03 this morning, which while 0.3% higher on the session, appears as though it could well test those October 2022 lows (dollar highs) sooner rather than later, especially if the ECB continues to lean more dovish than the Fed. If you are a receivables hedger, currency puts seem like a pretty good idea these days.

On the data front, ISM Manufacturing (exp 48.4) and Prices Paid (51.7) are all we have today and late this morning Richmond Fed president Barkin speaks. Interestingly, tomorrow evening and Sunday we hear from SF Fed President Daly and tomorrow evening Governor Kugler will be joining Daly. I guess they can’t go but so long without hearing their voices in the echo chamber!

There is nothing to suggest that the dollar, while modestly softer today, is set to turn around soon. Keep that in mind.

Good luck and good weekend

Adf