The data was hot yesterday

And that put the pressure on Jay

It shattered his dreams

‘Bout all of his schemes

To help keep inflation at bay

By now, I am sure you are aware that the CPI data was higher than forecast, and certainly higher than would have made Chairman Powell comfortable. The outcome, showing Headline rising to 3.0% and core rising to 3.3% with correspondingly higher monthly rises was sufficient to alter the narrative at least a little bit. Chair Powell even mentioned it in his House testimony, noting, “We are close, but not there on inflation…. So, we want to keep policy restrictive for now.” Essentially, the data makes clear that the Fed is not going to be cutting the Fed funds rate anytime soon. The futures market got the message as it is now pricing just 29bps of cuts this year, with December the likely date.

It will be no surprise that the stock market’s initial response was to sell off substantially, but as per the chart below, it spent the rest of the day clawing back the losses and wound up little changed on the day. This morning, it remains basically unchanged as well.

Source: tradingeconomics.com

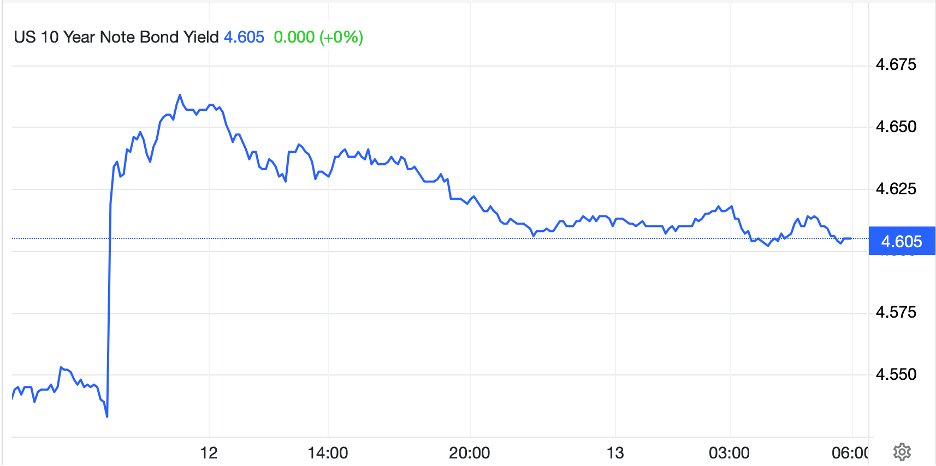

Treasury bonds, though, had a less fruitful session, falling (yields rising) sharply on the print, but never really regaining their footing with yields jumping almost 15bps at one point although finishing the day about 10bps higher and have given back 2bps more this morning.

Source: tradingeconomics.com

Now, we all know that the Fed doesn’t target CPI, but rather PCE. However, after this morning’s PPI data release, most economists (although not poets) will be able to reasonably accurately estimate that data point for later this month, as will the Fed. And that number is not going to be moving closer to their 2.0% target. What seems very clear at this point is that every Fed speaker for the time being is going to be harping on the caution with which they are going to move forward.

If we look at this from a political perspective, something which is unavoidable these days, it is important to remember that Treasury Secretary Bessent has made clear that he and the president are far more focused on the 10-year yield than on the Fed funds rate. To that end and given the fact that all this data was from a time preceding President Trump’s inauguration, I don’t think they are too worried. I would look for the President to continue his drive to reduce waste and fraud in the government and attack that deficit. Certainly, the news to date is there is a great deal of both waste and fraud to reduce, and if the president is successful, I believe that will play out in significantly lower 10-year yields, if for no other reason than the deficit is reduced or closed. This story is just beginning to be written.

Now, Putin and Trump had a call

As Trump tries to end Russia’s brawl

They’re slated to meet

So, they can complete

A treaty with Europe awol

Under any interpretation, I believe the news that Presidents Trump and Putin are going to meet in an effort to hammer out an end to the Russia/Ukraine war is good news. Beyond the simple fact that less war is an unadulterated good, I think it is very clear that this particular war has had significant market impacts, hence our interest here. Obviously, energy prices have been impacted, as both oil and NatGas prices are higher than they would otherwise be given the removal of some portion of Russia’s exports from the global markets and economy. As such, the end of this conflict, with one likely consequence being Western Europe reopening themselves to Russian energy imports, is likely to see prices decline.

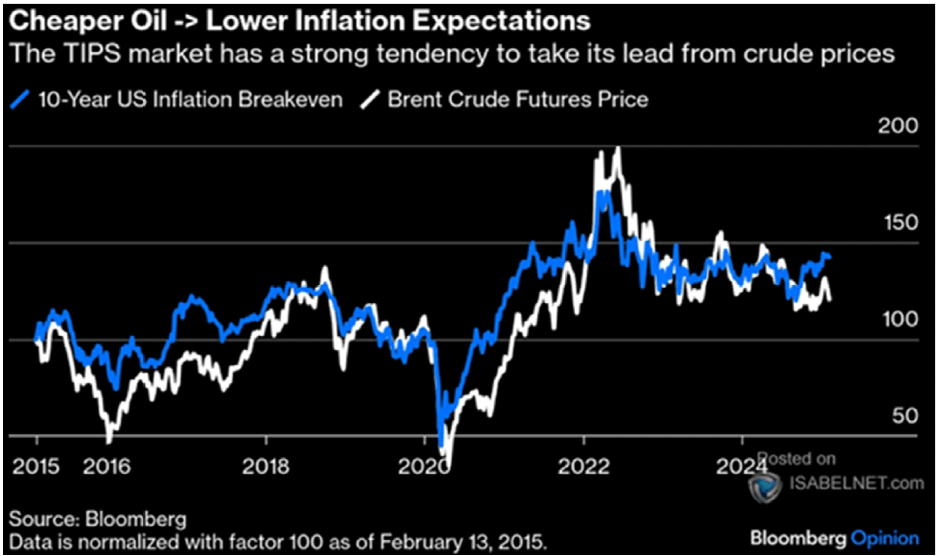

This matters for more reasons than the fact it will be cheaper to fill up your tank at the gas (petrol) station, it is very likely to have a very positive impact on inflation writ large. As you can see from the chart below, there is a very strong correlation between the price of oil and US inflation expectations. Declining oil prices are very likely to help people perceive a less inflationary future and will reduce the rate of inflation by definition.

Source: ISABELNET

Inflation is an insidious process, and once entrenched is very hard to reduce, just ask Chairman Powell. I also know that there has been much scoffing at President Trump’s claims he will reduce inflation, especially with his imposition of tariffs all over the place. (It is important to understand that tariffs are not necessarily inflationary by themselves as well explained by my friend the Inflation guy in this article.). However, between his strong start on reducing government expenditures and the potential for an end to the Russia/Ukraine war leading to lower energy prices, these are longer term effects that may do just that.

Ok, let’s move on to the market activities in the wake of yesterday’s CPI and ahead of this morning’s PPI data. As discussed above, yesterday’s US markets rebounded from their worst levels of the morning and closed modestly lower with the NASDAQ actually unchanged. In Asia, Japanese shares (+1.3%) had a solid day as the weak yen helped things along although Chinese shares (HK -0.2%, CSI 300 -0.4%) did not fare as well on the day with tariffs still top of mind. Elsewhere in the region, other than Korea (+1.4%) movement was mixed and modest. In Europe, the possibility of peace breaking out in Ukraine has clearly got investors excited as both Germany (+1.5%) and France (+1.2%) are seeing strong inflows. The UK (-0.7%) however, continues to suffer from economic underperformance with no discernible benefits shown from the governments weak efforts to right the ship. GDP was released this morning and while they avoided recession, it’s very hard to get excited over 0.1% Q/Q growth. As to the US futures market, at this hour (7:20), they are essentially unchanged.

In the bond market, we’ve already discussed Treasury yields, but another benefit of the prospects for a Ukrainian peace is that sovereign yields have fallen substantially, between -5bps and -8bps, throughout the continent. Once again, the impact of that phone call between Trump and Putin has been quite significant. Consider that not only are energy prices likely to slide, but the required government spending to prosecute the war is likely to diminish as well.

In the commodity markets, it should be no surprise that oil (-1.3%) prices are sliding as are NatGas prices in Europe (TTF -7.5%) as the opportunity for cheap Russian gas to flow to Europe is once again in view. To highlight the impact that this has had on Europe, prior to the Ukraine war and the halting of gas flows, the TTF contract hovered between €5 and €25 per MWh. Since the war broke out, even after the initial shock, it has been between €25 and €55 per MWh. This is all you need to know about why Europe, and Germany especially, is deindustrializing. As to the metals markets, after a few days of consolidation, gold (+0.4%) is on the move again although it has not yet recaptured the highs seen early Tuesday morning. Give it time. Copper (+0.6%), too, is back on the move and indicating that economic activity is set to continue to grow.

Finally, the dollar is mixed this morning, although arguably a touch softer overall, as the Russia news has traders looking for less negativity in Europe. So modest gains in the euro and pound, about 0.15% each is offsetting larger losses in AUD (-0.3%) and NZD (-0.6%), although given the much smaller market size of the latter two, they matter much less. JPY (+0.4%) is rebounding after yesterday’s sharp decline on the back of the jump in Treasury yields, and it is noteworthy that CHF (+0.65%) is gaining after its CPI data showed a decline in prices last month. In the EMG bloc, CLP (+0.7%) is stronger on that copper rally, while ZAR (+0.1%) seems to be edging higher as gold continues to perform well. MXN (-0.4%) though is still struggling with the potential negative impact of tariffs and otherwise, there is not much to report.

This morning brings PPI (exp 0.3%. 3.3% Y/Y headline; 0.3%, 3.5% Y/Y core) as well as the weekly Initial (215K) and Continuing (1880K) Claims data. There are no Fed speakers on the docket, but at this point, I expect the Fed will be fading into the background since they are clearly on hold and President Trump commands the spotlight. Unless the data starts to veer dramatically away from what we have seen, it appears that the market is going to continue to respond to Trumpian headlines, which of course are impossible to predict. But remember, most of the rest of the world is still in cutting mode so the dollar should continue to hold its own.

Good luck

Adf