Said Xi, we’ll sell rare earths no more

Said Trump, well that means we’re at war

The stock market puked

As traders got spooked

And Trump imposed tariffs galore

The question is just why would Xi

Get feisty when things seemed to be

Improved for both sides

With fewer divides

Did Mideast peace kill his esprit?

Let’s talk about markets for a moment. Sometimes they go down and go down fast when you’re not expecting it. That is their very nature, so it is important to understand that Friday’s price action, while dramatic relative to what we have seen over the past 6 months, is not that uncommon at all over time. It appears the proximate cause of the market decline was the word from China that they would stop selling and exporting rare earth minerals.

It can be no surprise that President Trump immediately responded by threatening an additional 100% tariffs on all Chinese exports and new controls on software, all to be implemented on November 1st. There is a lot of tit-for-tat in the dueling messages from China and the Trump administration and it is hard to tell what is real and what isn’t. However, equity markets clearly weren’t prepared for a break in the previous expectations that the US and China were closing in on a more lasting trade stance.

But weekends are a long time for markets as so much can happen while they are closed. This weekend was a perfect example. After the carnage on Friday, we cannot be that surprised that both sides of this new tiff modified their responses.

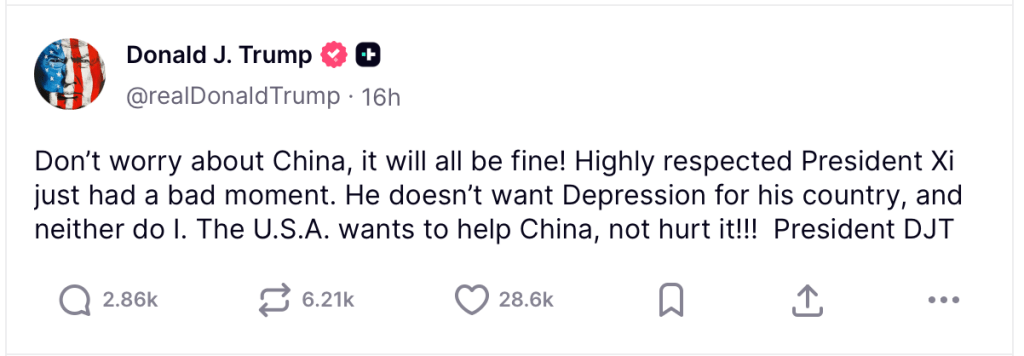

First we saw this on Truth Social:

Then China backed off clarified that what they are really doing is require licensing for all rare earth minerals and products that contain them in exports. China claims that applications that meet regulations will be approved although the regulations have not yet been defined. Ostensibly this is for national security reasons, and it is unclear exactly who will receive licenses, but this is clearly not the same as ending exports.

And just like that, many of the fears that were fomented on Friday have been alleviated as evidenced by this morning’s equity market moves in the futures markets.

Source: tradingeconomics.com

But why did Xi make this move in the first place? I have no idea, nor does anyone but Xi, although here are two completely different thought processes, one very conspiratorial and one rooted in the broader escalation of geopolitical affairs.

As to the first, (Beware, you will need your tinfoil hat here!) consider if the Israel-Gaza peace settlement, (with the hostages returned as of the time I am writing this morning at 5:30) does not serve China’s interest. First, the one Middle East nation that will be on the outside is their ally, Iran. Second, the ongoing problems there were always a distraction for the US, something that clearly suits Xi and China. After all, if the US is focused there, they will have more difficulty paying attention to things Xi cares about like Taiwan and the South China Sea. If the peace in Israel-Gaza holds, and the Abraham Accords extend to the bulk of the rest of the region, Xi loses a major distraction that cost him virtually nothing. Plus, this opens the door for tightening sanctions on Iran even further, which could negatively impact China’s oil flows.

The second is much more esoteric and I read about it this weekend from Dr Pippa Malmgren, someone who has a deep insight into global politics from her time as a presidential advisor as well as from her father, Harold Malmgren, who advised four presidents. In her most recent Substack post she explained the importance of Helium-3 (3He), a rare isotope of helium that has major energy and military implications and where the largest deposit of the stuff known to man is on the moon. Her claim is this is the foundation of the recent acceleration in the space race between the US and China and without rare earth minerals, the US ability to achieve its goals and obtain this element would be greatly hampered opening the door for China to get ahead.

Are either of these correct? It is not clear, but I would contend each contains some logic. In the end, though, as evidenced by the quick retreat on both sides, I suspect that the trade situation between the US and China will move forward in a positive manner, although there could well be a few more hiccups along the way. And those hiccups could easily see equity markets decline such that there is a real correction of 15% to 20%. Just not today.

So, what is happening today? Let’s look. First, I would be remiss if I didn’t highlight the following Bloomberg headline: ‘Buy the Dip’ Call Grows Louder as China Selloff Seen Contained, as it perfectly encapsulates the ongoing mindset in equity markets. At least in US equities. Asia had a much rougher session despite the backtracking with HK (-1.5%) and China (-0.5%) under pressure and weakness virtually universal in the time zone (Korea -0.7%, India -0.2%, Taiwan -1.4%, Australia -0.8%). Tokyo was closed. It appears there are either still concerns over the trade situation, or perhaps the fact that globally, markets have had long rallies has led to some profit taking amid rising uncertainties.

European bourses, though are all in the green, with the continent seeing gains of 0.5% or so across the board although the UK is lagging with a miniscule 0.05% gain at this hour (6:30). As to US futures, as seen above, gains range from 1.0% (DJIA) to 2.0% (NASDAQ).

Meanwhile, bond yields also saw a dramatic move on Friday, tumbling -8bps and back to their lowest level seen in a month as per the below chart from tradingeconomics.com

This morning, those yields are unchanged. European sovereign yields, which followed Treasury yields lower on Friday are also little changed at this hour, down another -1bp as concerns begin to arise that economic growth is going to be impaired by the escalation in trade tension between the US and China.

I would argue that commodities are the one area where the back and forth is raising the most concern. At least that is true in metals markets, with gold, which rallied 1% Friday amid the equity carnage, higher by another 1.6% this morning, to more new highs and we are seeing silver (+1.6%), copper (+4.2%) and Platinum (+3.6%) all in sync. To me, this is the clearest indicator that there is an underlying fear pervading markets. Oil (+1.8%) has rebounded from Friday’s rout as the easing of trade tensions appears to have calmed the market somewhat, although WTI remains just below $60/bbl at this point.

Finally, the dollar is firmer again this morning as, although it softened slightly Friday, it has since regained most of those losses and is back on its recent uptrend as you can see below.

Source: tradingeconomics.com

While Tokyo was closed overnight, we did see further JPY weakness as the yen retraced most of its Friday gains like the rest of the market. The biggest G10 mover was CHF (-0.9%) followed by AUD (-0.7%) and JPY (-0.7%) with other currencies less impacted and NOK (+0.2%) benefitting from the oil rally. However, the EMG bloc has seen a much wider dispersion with MXN (+0.5%), ZAR (+1.1%) and CLP (+0.8%) all rallying sharply on the metals rally while PLN (-0.5%) and CZK (-0.4%) lag as they follow the euro lower.

And that’s enough for today. With the government still on hiatus, no official statistics will be released although we do get a little bit of stuff as follows:

| Tuesday | NFIB Small Business Index | 100.5 |

| Wednesday | Empire State Manufacturing | -1.8 |

| Fed’s Beige Book | ||

| Thursday | Philly Fed Manufacturing | 9.1 |

Source: tradingeconomics.com

But, with the lack of data, it appears Chairman Powell has instructed his minions to flood the airwaves with a virtual cacophony of speeches this week, I count 18 on the calendar including the big man himself on Tuesday afternoon. It seems difficult to believe that their opinions on the economy will have changed very much given the lack of new data. The market is still pricing a 98% chance of a cut at the end of this month and another 91% chance of a cut in December. With the increased trade tension, there is much more discussion regarding a slower economic course ahead, which would play into further rate cuts. However, while that would clearly help precious metals as it ends any ideas of an inflation fight, it is not clear it will weaken the dollar very much as everybody else will almost certainly follow along.

Good luck

Adf