This morning the temperature’s rising

With Trump and his allies devising

An alternate way

For him to axe Jay

But this move is quite polarizing

The market response has been clear

It’s given the move a Bronx Cheer

Both stocks and the dollar

Are feeling a choler

But gold, everybody holds dear

The financial world is aghast this morning as last night, Chairman Powell revealed that the Fed has been served with grand jury subpoenas threatening criminal indictment regarding Chairman Powell’s testimony to the Senate Banking Committee last June. The issue at hand is ostensibly the ongoing renovations at the Marriner Eccles Building, including their cost, and how that differs from Chairman Powell’s testimony.

Chairman Powell offered a video response last night explaining he will not be cowed into cutting rates because the President wants lower rates, but will continue their work of setting policy based on their assessments of the economy. One cannot be surprised that this has raised an entirely new round of screaming about President Trump’s tactics, although what I did see this morning was that Florida House Representative Anna Paulina Luna took credit for referring the case to the DOJ.

While I have strong opinions on Chairman Powell’s effectiveness, or lack thereof, this is certainly a new level of pressure. In fact, if you listen to the video above (it’s just 2 minutes) Powell explicitly claims that this is entirely about the Fed not cutting rates further. But I am not going to discuss the legality, or tactics here, our focus is on the market’s response.

Starting with the dollar in the FX markets, it has fallen almost universally, and while it hasn’t collapsed, we are looking at a 0.3% to 0.5% decline pretty much everywhere. Using the euro (+0.4%) as our proxy, you can see from the chart below that in the context of the past year’s price activity, this move is indistinguishable from any other move.

Source: tradingeconomics.com

This is not to imply that the Administration’s actions are insignificant, just that despite the rending of garments by the punditry, the market hasn’t determined it matters that much, at least not yet. I have maintained my view that the dollar remains the best of a bad bunch of fiat currencies given the prospects for US economic activity compared to the rest of the world. However, it is quite possible that foreign investors will view this action as far too detrimental to the structure of US financial markets and seek to exit, thus driving the dollar much lower. I did not have this on my bingo card at the beginning of the year, so my views of dollar strength are somewhat tempered at this point. It will certainly be interesting to see as we go forward.

One other thing to note is that CPI is released this week (exp 2.7% for both headline and core) and Truflation came out last week at 1.8%. Now, I don’t put great stock in Truflation but there are many who do. For that contingent, I assume they are aligned with President Trump in his views that Fed funds are too high. After all, with Fed funds at 3.75%, that is nearly 200bps above the Truflation number. I have always understood the “appropriate” relation to be closer to 75bps to 100bps above inflation, which if you believe Truflation, means you are looking for cuts. (PS, this is not my personal view, I am simply highlighting part of the market thought process.)

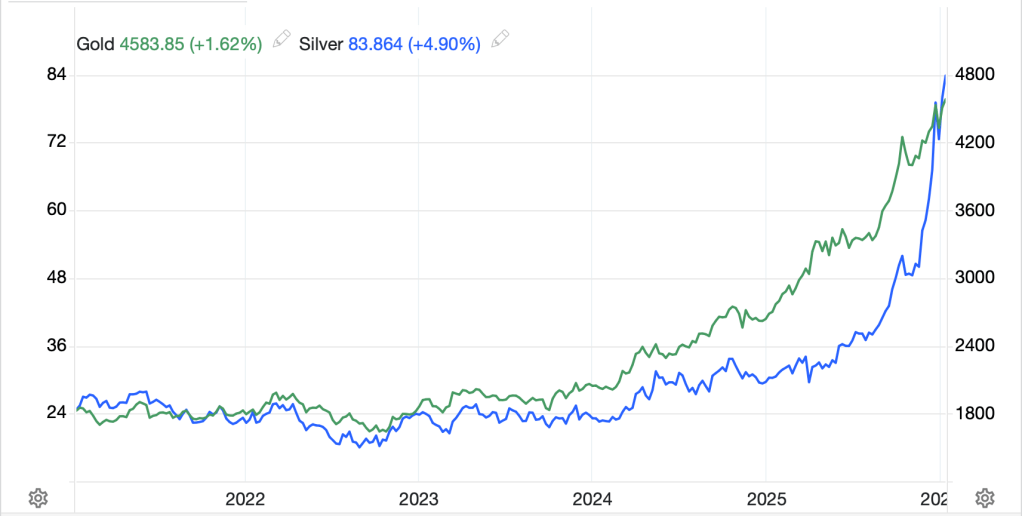

At any rate, the dollar is under pressure this morning but remains well within its recent trading range. Turning to commodities, though, that is where the real price action is, with precious metals exploding higher on this news. We are looking at record highs for gold (+1.6%), silver (+4.6%) with platinum (+3.2%) also much richer, although not back to all-time highs. If we look at a chart of both gold and silver below, we can see the parabolic nature of silver’s recent move, a situation which should make everyone uncomfortable as parabolic moves frequently signal the end of the line.

Source: tradingeconomics.com

But perhaps what makes this more interesting is that there is a substantial amount of supply in both gold and silver due to enter the market as the BCOM index rebalancing began last Friday and continues through Thursday. Given the dramatic rallies in both metals last year, there is a significant amount to be sold by those funds that track the index. Estimates are for a total of nearly $7 billion of gold and silver to be sold for the rebalancing, and many expected the metals markets to decline under that pressure. And perhaps they still will, but today’s moves are the clearest signal that there are many investors who are uncomfortable with the Fed situation.

Remarkably, Venezuela and oil markets have basically disappeared from the conversation at this point. However, this morning WTI (-0.9%) is giving back some of last week’s gains, and remains well within its recent downtrend, but shows no signs of a sharp break in either direction.

Turning to the other risk spot, equity markets, while US futures are all lower by -0.5% to -0.6% at this hour (7:10), the Fed news has had a mixed impact elsewhere around the world. For instance, Japan (+1.6%), HK (+1.4%) and China (+0.65%) all had solid sessions with that being the case throughout the region. Even India (+0.4%) finally managed to go green last night. And all of this occurred after the Fed news. One possible explanation is that foreign investors are running home, hence bidding up local shares. Of course, it is also possible that they don’t believe there is much there, there, and are simply ignoring the news.

In Europe, the situation is different with weakness the general trend as Spain (-0.4%), France (-0.3%) and Italy (-0.15%) all slipping although Germany (+0.3%) has managed to buck the trend absent any specific macro catalyst. German defense stocks are modestly higher this morning and perhaps threats by President Trump to aid the fomenting Iranian revolution have investors looking for more gains there. As I often say, markets can be quite perverse for no apparent reason at all.

Finally, bond markets are not really responding to the news in any substantial manner. Treasury yields have backed up 3bps this morning, but at 4.19%, remain within that long-term trading range and are not signaling flight. European sovereigns have seen yields edge lower by -1bp across the board, so while modestly better, hardly the sign of massive buying. And JGB yields were unchanged overnight. Bonds remain the least interesting space there is of all the markets.

Which takes us to the data this week.

| Tuesday | NFIB Small Biz Optimism | 99.5 |

| CPI | 0.3% (2.7% Y/Y) | |

| -ex food & energy | 0.3% (2.7% Y/Y) | |

| New Home Sales | 710K | |

| Wednesday | Retail Sales | 0.4% |

| -ex Autos | 0.3% | |

| Existing Home Sales | 4.2M | |

| Fed’s Beige Book | ||

| Thursday | Initial Claims | 219K |

| Continuing Claims | 1918K | |

| Empire State Mfg | 1.0 | |

| Philly Fed | -2.0 | |

| Friday | IP | 0.1% |

| Capacity Utilization | 76.0% |

Source: tradingeconomics.com

In addition, we get PPI data on Wednesday, but it is all old data, for October and November and, as such, I don’t think it will matter very much at all. We also hear from 10 different Fed speakers, some several times, over the course of the week. It will be very interesting to hear how they address the major news overnight regarding the subpoenas, or if they even touch on them. I expect there will be oblique references to Fed independence at most.

And remember, none of this even considers the ongoing revolution in Iran, which appears to be gaining strength in its third week. If the theocracy in Iran falls, that will have a very different impact on oil markets than the Venezuela situation. First, they are currently producing far more oil. Second, the removal of sanctions there would seemingly reduce the amount of ultra cheap oil that China can import, adding pressure to the Chinese economy, as well as help pressure oil prices lower in general, which would negatively impact Putin’s war chest. (If Iranian oil is no longer black market, it raises China’s cost, but lower overall prices will reduce further Russia’s sanctioned sale prices).

As to the dollar on the FX markets, this move certainly gives me pause regarding my bullish view, but there seems to be a long way to go before anything really comes of it. As well, grand jury testimony is secret, so we won’t know about anything that is said anytime soon. Ultimately, nothing may come of this, no charges of any sort. Remember, this is a Washington DC grand jury, and so many there disagree with everything that President Trump does, they may not indict for that reason alone.

I’m not willing to make a sweeping statement at this time, but caution in positioning seems like a sensible view.

Good luck

Adf