Though Friday will lack NFP

We still will have something to see

The States and Iran

Will meet in Oman

To talk about nuke strategy

But til they, in fact, do sit down

Be careful as crude moves around

And what if talks fail

To find holy grail

Beware oil shorts and their frowns

With that as the background today

The narrative has gone astray

’Cause all kinds of tech

Resemble a wreck

While metals are fading away

Sometimes it’s hard to determine which stories are really driving markets as there are so many that have potential conflicts between them. With that in mind, I will start with oil this morning, which has seen a bit of choppiness during the past week on the back of on-again, off-again, on-again talks due to be held between the US and Iran. See if you can guess where the worries about a US military strike gained ground, were quashed by news of potential talks, saw a military skirmish in the Strait of Hormuz and then when talks were reconfirmed.

Source: tradingeconomics.com

Net, there is still an underlying concern about the situation, which is why, I believe, the price of crude (-1.1%) is still above $64/bbl. Remember, it was not that long ago when it had seemed to find a comfort zone below $60/bbl. It strikes me that if some type of accommodation is reached at these talks, where Iran gives up its nuclear weapon dreams and stops funding terrorism (I believe these are the administration’s goals) then there is plenty of room for oil prices to slide back below $60/bbl and continue what had been a longer term down trend as per the below chart.

Source: tradingeconomics.com

After all, given the fact that Venezuelan oil is going to be returning to the market, the continued expansion of production in Guyana, Brazil and Argentina, and now the idea of welcoming Iran back into the good graces of nations, that is a lot of potential supply that is currently not available. My concern is if Iran agrees to those terms, it may be an existential threat to the theocracy, so I guess they need to weigh that risk vs. the risk that the US does escalate militarily, which could also be an existential risk to the theocracy. Net, choppiness seems to be the likely road ahead.

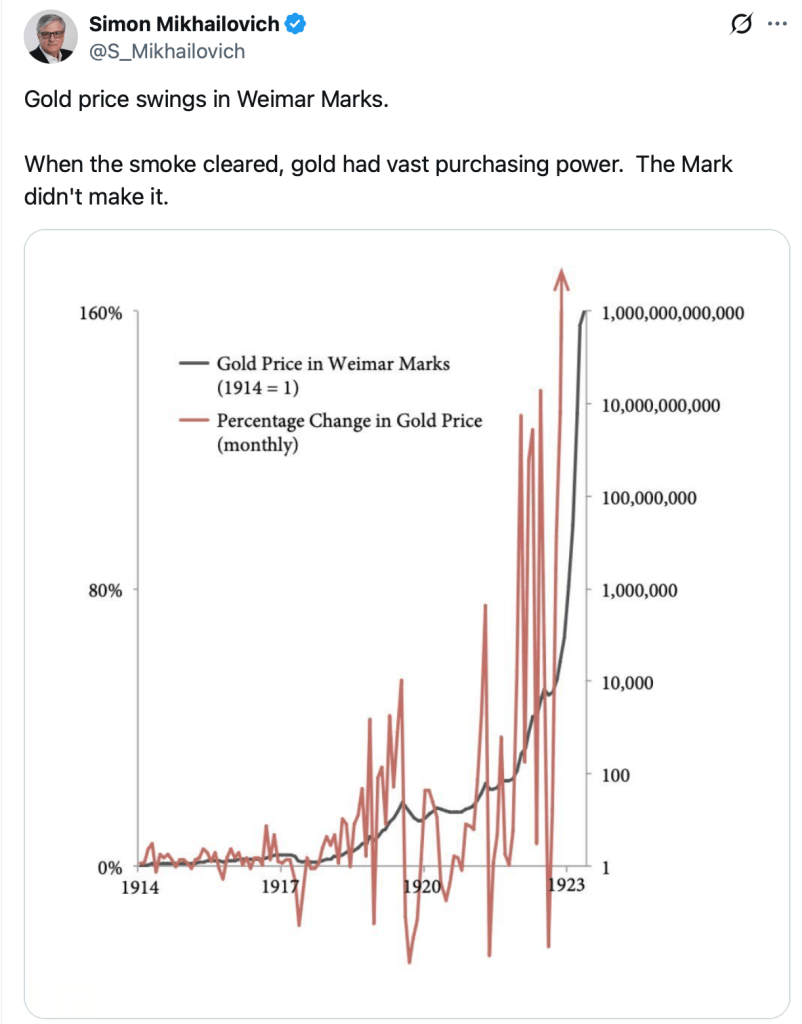

Finishing commodities, precious metals have reversed the reversal and are down sharply this morning (Au -1.7%, Ag -11.0%, Pt -4.4%). Volatility remains extremely high and given the competing narratives of a) it was a bubble, and b) the fundamentals remain in place, I expect we will continue to see price action like this for a while yet. Although remember my strong belief that markets can only maintain volatility of this nature for a few weeks as at some point, all the participants simply become too tired to trade. There was a very interesting chart I saw on X this morning that showed the price action in gold during the German hyperinflation of the Weimar Republic a bit over 100 years ago.

I’m not implying we are heading to a hyperinflation, just that gold (and silver and platinum) prices can move very far in short order, as we’ve seen. In the end, nothing has changed the fundamentals with demand for gold still price insensitive, demand for silver still greater than mining supply with the same true for platinum. But it will be a rough ride for a little while yet.

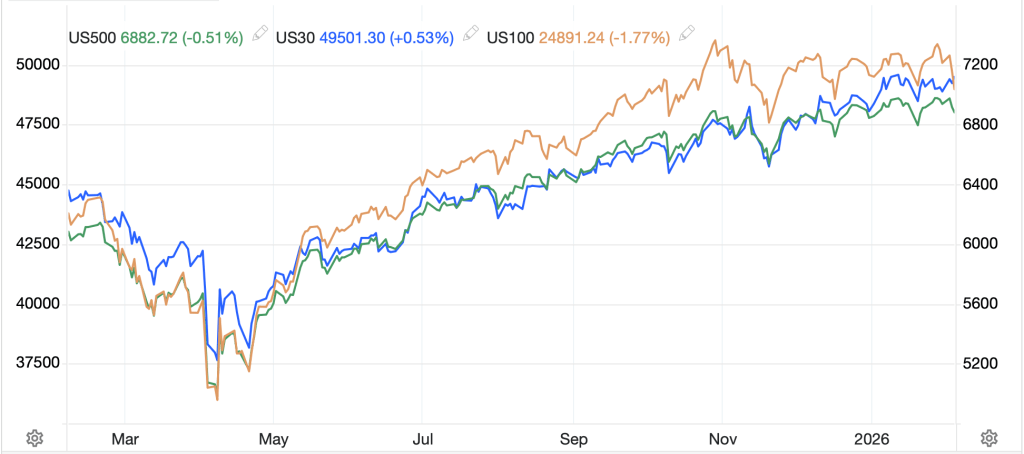

So, let’s turn to the equity markets, where there are far more plugged-in analysts than me, but I want to take a higher-level look. While yesterday’s price action was mixed (NASDAQ and S&P lower, DJIA higher) it seems to indicate that there is an ongoing rotation out of tech stocks into other areas, amongst them consumer staples, energy and defensives. What I find so interesting about this, though, is that if I look at a chart of the three major US indices, they are all the same chart.

Source: tradingeconomics.com

Granted, the NASDAQ had the highest high back in November, but, in reality, they all move very much in sync. This begs the question, what can we expect going forward? At the end of the day, I still believe that stocks represent the value created in the economy. As such, if the Trump administration’s plans to reduce regulations and encourage banks to lend more to the real economy, rather than purchase financial assets, can be implemented effectively, that is a very real positive for equity markets over time. However, that probably means a much less steady climb, especially if the Fed is not explicitly supporting assets as the new Chair, Warsh, tries to shrink the balance sheet. It is going to be messy and there are going to be a lot of cross narratives and claims, so at any given time, the only reality will be increased volatility. But at least there’s a plan.

As to the rest of the world’s equity markets, it does appear as the bifurcation between those nations that are willing to work closely with the US and those working closely with China is likely to continue. It remains to be seen which bloc will outperform, although I like the US odds given the legal structure and the demographics.

With all that in mind, let’s look at the overnight price action. Asia had a tough go of it given the high proportion of tech names there. While Tokyo (-0.9%) slipped along with China (-0.6%) the real laggards were Korea (-3.9%) and Taiwan (-1.5%) and there were far more laggards (India, Australia, Malaysia, Indonesia) than gainers (Singapore, HK). This is the tech story writ large. In Europe, even though they largely lack tech, weakness is the norm (Spain -1.1%, Germany -0.2%, UK -0.3%) although the French (+0.3%) have managed to buck the trend. It is not clear why Spain is lagging so badly, although perhaps PM Sanchez’s efforts to import 500K new people while unemployment remains at 10%, the highest in the EU, has some concerned. As to US futures, at this hour (7:15), they are pointing higher by about 0.2%.

In the bond market, once again there is nothing going on. Treasury yields are almost exactly unchanged since early Friday morning, although we did see a dip and rebound after the Warsh announcement.

Source: tradingeconomics.com

The US yield curve is steepening as 30-year yields edge higher although those remain below 5.0%, a level that many are watching closely as a signal of a bondmageddon. On the continent, European sovereign yields have edged higher by 1bp to 2bps, but activity is muted ahead of the ECB meeting announcement (exp no change) scheduled later this morning. UK yields have edged lower by -1bp after the BOE left rates on hold, as expected, with a 5/4 vote, the 4 looking for a cut. I continue to believe that the odds are for the ECB to cut rates again far sooner than the market is pricing. And JGB yields slipped -2bps overnight as market participants await Sunday’s election results. Given PM Takaichi is forecast to win with an increased majority, it is hard for me to believe that if she does, JGB’s will sell off sharply on the idea she has promised more unfunded spending, they already know that.

Lastly, the dollar is firmer this morning, continuing to defy all the calls for its demise. The pound (-0.8%) is the laggard after the BOE sounded a bit more dovish than expected, but we are seeing losses across the entire G10 bloc. As to the EMG bloc, ZAR (-0.7%) is the laggard, but given the dramatic reversal in precious metals, that is no surprise. Otherwise, losses on the order of -0.3% or so are the norm.

On the data front, Initial (exp 212K) and Continuing (1850K) Claims lead the way and later we see the JOLTs Job Openings Report (7.2M). The word is that the NFP report will be released next Wednesday with CPI next Friday. Atlanta Fed president Bostic speaks later this morning, but I continue to believe that until we hear from Mr Warsh, the Fed’s words have very little impact. Arguably, the neutering of the Fed is why the bond market remains so quiet. Traders have lost their cues.

Risk attitudes are getting revisited around the world as the seeming permanence of increased risk appetite is starting to be called into question. There is no better signal of this than Bitcoin, which has broken back below $70K this morning to its lowest level since October 2024.

Source: tradingeconomics.com

It was January 2024 when the ETF, IBIT, started trading and BTC was about $43K at that time. As BTC is a pure risk asset/vehicle, it’s recent decline may well be the biggest signal that risk-off is coming. That could well impede the Trump efforts to rebuild the US manufacturing base, but perhaps, it could also encourage it, as business risks are easier to understand than market risks. The volatility is not over.

Good luck

Adf