The people of Germany voted

With Friedrich Merz, at last, promoted

The nation, to lead

Though sure to misread

The sitch, with the Right still scapegoated

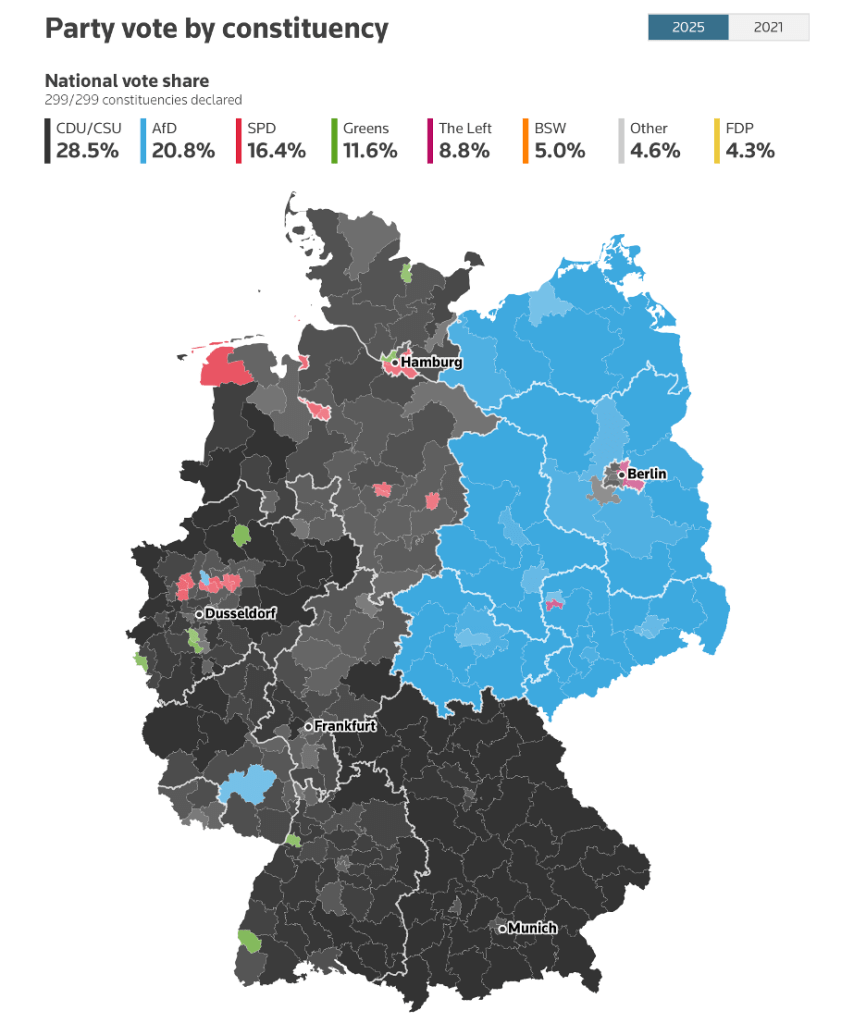

The result of the German Federal elections was very much as expected, the CDU/CSU won 28.5% of the votes and the largest share while AfD garnered 20.8%, the SPD just 16.4% (it’s worst showing in modern times) and the Greens gaining 11.6%. A tail of other mostly very left-leaning parties made up the balance. However, one cannot look at a map of the distribution of votes without noticing that the part of the country that was East Germany prior to the fall of the Berlin Wall, still sees things very differently than the rest of the nation.

Source: Reuters.com

Regardless of the distribution, however, the outcome will result in some sort of coalition government, almost certainly to be a combination of the CDU and SPD. On the surface, it would seem this left-right coalition will be doomed to failure, and that could well be the case, but because the consensus amongst the ‘right-thinking’ people in politics is that AfD is the devil incarnate, or perhaps more accurately, Hitler incarnate, Herr Merz will not be able to rule with a sure majority of conservative voters.

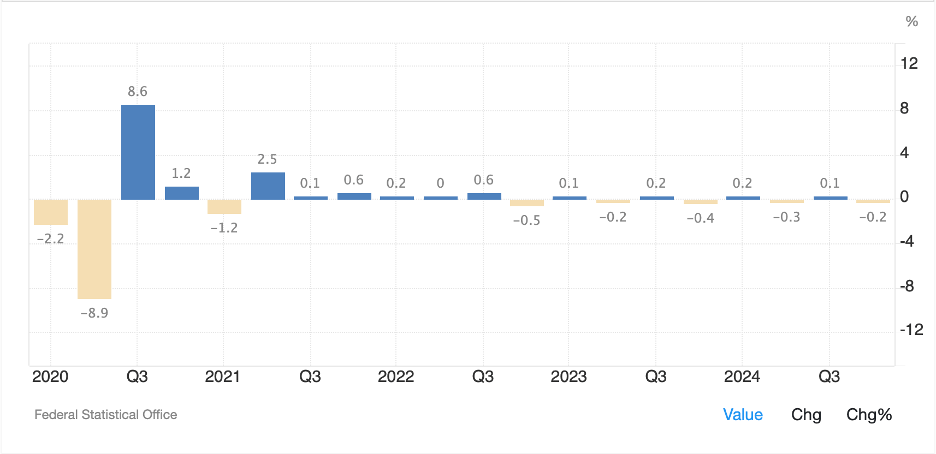

As with virtually every election, the economy is a top priority of the voters, especially since GDP growth, as measured, has essentially been zero for the past three years as per the below chart, and is mooted to stay there on present policies.

Source: tradingeconomics.com

One of the key issues that is currently under discussion there is the constitutionally enshrined ‘debt-brake’ which prevents the German government from running deficits of greater than 0.35% of GDP in any fiscal year. In order to change the constitution, there needs to be a 2/3’s approval in the Bundestag, but AfD holds a blocking minority and one of their policy platforms has been fiscal prudence.

Arguably, this begs a larger question, what exactly constitutes economic growth? For instance, if government debt is rising more quickly than economic output, is that actually a growing economy? And is that process sustainable going forward? It is quite interesting to look at the government debt dynamics of different nations and ask that question, especially since Germany’s situation really stands out.

Perhaps, after looking at this group of charts, it is worth reevaluating exactly how much actual growth has been occurring and how much economic activity has simply been government borrowing recycled into the economy across all these nations. Of course, this process has not been restricted to G-7 nations, it is a global phenomenon, with China doing exactly the same thing as are virtually all nations. In fact, Germany is unique amongst large nations for bucking the trend.

The reason this issue matters is there is a limit to how far a government can increase its leverage ratio. At some point, investors will stop buying debt which will force the central bank to buy the debt. Of course, they will do so by printing more money and devaluing the currency. We know this because we have seen it happen before many times throughout history with Germany’s Weimar Republic in 1923, Argentina in the 1980’s and Zimbabwe in 2007-2008 as just the most recent examples. In fact, the reason the Germans have the debt brake is that there is a national memory of that hyperinflation from a century ago.

Circling back to the growth question, what is it that constitutes economic growth? If you remember your college macroeconomics classes, this is the equation that is used to calculate economic activity in an economy:

Y = C + I + G + NX

Where:

Y = GDP

C = Consumption

I = Investment

G = Government spending

NX = Net Exports

This equation is taken as gospel in the economics and political worlds. However, it is not often recalled that it was created in the 1930’s by John Maynard Keynes. It is not a law of nature, but merely was Keynes’ way of expressing something that had not been effectively measured previously. Nearly 100 years later, though, perhaps it is time to reevaluate the process. Remember, economies grew prior to Keynes creating this equation when government activity was a much smaller proportion of the economy. But as we can see by the dramatic rise in government debt, that is no longer the case. Perhaps Germany is a peek behind the GDP curtain that shows absent constantly increasing government borrowing, economic growth is stagnant. Neil Howe’s Fourth Turning could well be the conclusion of this period of government excess, where things will be extremely volatile during the change, but less government will be the norm on the other side, at least for a few generations!

Ok, sorry for the history and theoretical discussion, but that chart of German government debt vs. the rest of the world was really eye-opening. Let’s turn to markets from the overnight session.

After Friday’s sharp downward movement in the US, the picture in Asia was far more mixed. Japan (+0.25%) managed a small gain while Hong Kong (-0.6%) and China (-0.2%) both lagged. Elsewhere in the region, New Zealand (-1.8%) stood out for its weakness, although Korea, India and Taiwan were all softer in the session as well. Ironically, it seems that better than expected Retail Sales data in NZ hurt sentiment for further policy ease by the RBNZ and concerns over trade with China given US pronouncements is also hurting the situation there, at least for today.

In Europe, Germany’s DAX (+0.9%) is leading the way higher after IfO Expectation data was released a touch better than forecast at 85.4. However, it is important to remember that while this was a positive outcome, the average reading prior to Covid was between 95 and 103. As to the rest of Europe, there are more gainers than laggards but little of real note absent any other data. US futures at this hour (7:00) are pointing higher by at least 0.5% across the board.

In the bond market, Friday saw a very sharp decline in yields, -10bps in Treasuries, after weak readings in the Flash PMI data, especially services at 49.7, Existing Home Sales and Michigan sentiment. That helped bring global yields lower. This morning, Treasuries have bounced just 1bp and we are seeing similar rises in most of Europe. JGB yields are also unchanged and have continued to consolidate near recent highs.

In the commodity markets, after a sharp sell-off on Friday on the back of stories about increased supply from Kurdistan, oil (0.0%) is unchanged this morning. Meanwhile gold (+0.5%) is rebounding from its regular Friday sell-off, almost as though there were efforts by some to depress the price at the end of every week. It will be interesting to see what happens this Friday which is month end as well. As to silver and copper, they are little changed and dull this morning.

Finally, the dollar is asleep this morning, with very limited movement vs. almost any of its counterparts. USDJPY remains below 150, but the yen has actually fallen -0.3% on the session, while the biggest movers are in Eastern Europe (CZK +0.8%, HUF +0.4%, PLN +0.35%), perhaps on the back of the German election results offering hope for a more useful German government. We shall see about that. Otherwise, nobody is concerned over the dollar right now.

On the data front this week, it is a quiet one with PCE data the highlight on Friday.

| Today | Chicago Fed Natl Activity | 0.21 |

| Tuesday | Case Shiller Home Prices | 4.4% |

| Consumer Confidence | 103.0 | |

| Wednesday | New Home Sales | 680K |

| Thursday | Initial Claims | 220K |

| Continuing Claims | 1874K | |

| Q4 GDP (2nd look) | 2.3% | |

| Real Consumer Spending | 4.2% | |

| Durable Goods | 2.5% | |

| -ex Transport | 0.3% | |

| Friday | Personal Income | 0.3% |

| Personal Spending | 0.2% | |

| PCE | 0.3% (2.5% Y/Y) | |

| Core PCE | 0.3% (2.6% Y/Y) | |

| Chicago PMI | 41.5 |

Source: tradingeconomics.com

In addition to the data, we also hear from seven Fed speakers over 9 venues, but again, are they really going to change the cautious approach at this stage? And does it even matter? For now, financial markets are far more focused on President Trump and his cabinet’s activities than interest rate policy which seems set to remain in place for a while.

When it comes to the dollar, nothing has changed my perspective on relative interest rates in the front end, with US rates likely to be far stickier at current levels than others, but the back end has a potentially different outcome. Recall that Bessent and Trump are focused on the 10-year yield and getting that lower and seem far less concerned over the Fed for now. To achieve that they will need to demonstrate the ability to reduce spending and the deficit situation. While a promising start has been seen with DOGE, we are still a long way from a balanced budget. My take is the dollar, writ large, is going to take its cues from the 10-year yield for now, so bonds are the market to watch. If we see yields head back toward 4.0%, the dollar will decline and any significant move higher in yields will likely see the dollar climb as well.

Good luck

Adf