No matter the asset you trade

For weeks, every move’s been a fade

As headlines decry

Each thing Trump does try

Investors are feeling betrayed

They want to go back to the time

When markets did, every day, climb

But that time has passed

And I would forecast

We’ve entered a new paradigm

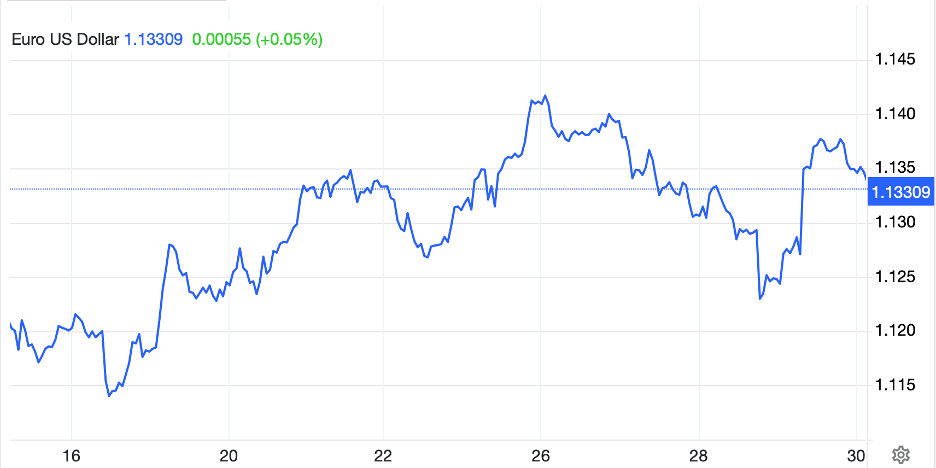

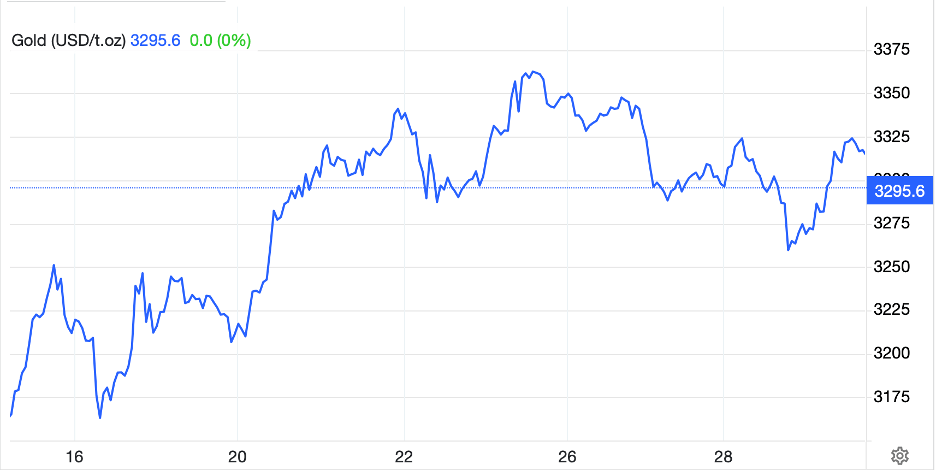

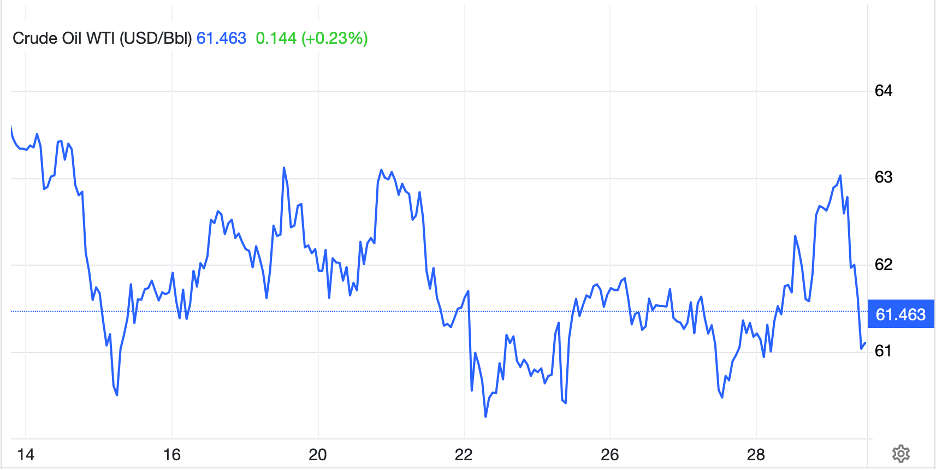

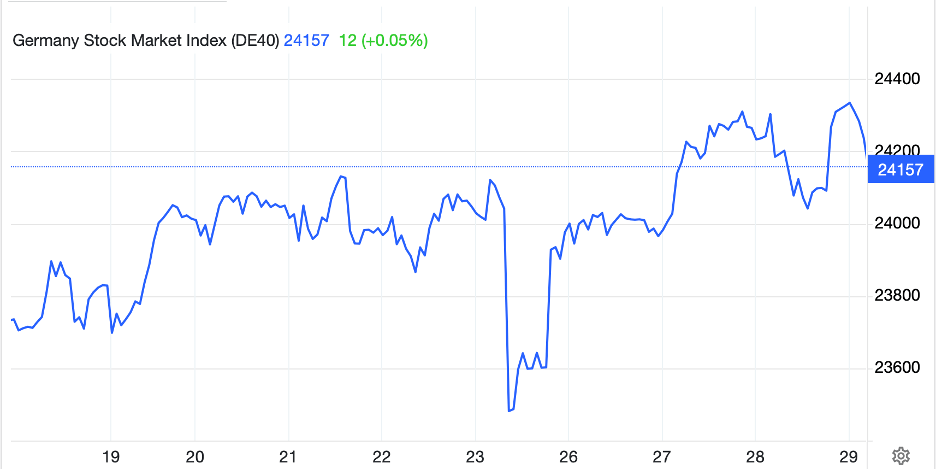

The following onslaught of charts from tradingeconomics.com are meant to highlight that for the past several weeks, basically nothing has gone on in markets. Every day is like every other, and the only trend is a horizontal line.

Now, this is not to say that each movement is identical, just that any longer-term trends that may exist are not evident lately. For traders, this can be terrific because there has been volatility which can be captured. Of course, since much of the volatility has been headline bingo, that reduces the appeal. But for longer term investors, it is a more difficult situation as those same headlines can call into question the underlying thesis of any or every trade.

Are the tariffs here to stay? Or will they be overruled? Is the “Big Beautiful Bill” going to be a benefit? Or are there too many things hidden within that will impact the economy, markets and investor behaviors? Is there going to be a Russia/Ukraine peace? Is Iran going to sign a deal? Will the US and China agree a trade deal? Obviously, there are many very large issues currently outstanding with no clear resolutions in any of them as of now. When you consider not only that the future is uncertain (which is always true) but the potential outcomes are diametrically opposed, it is easier to realize why markets are stuck in the mud. But hey, nobody ever said trading was supposed to be easy!

There is, however, one issue I think worth highlighting that has seen an increase in discussion, and that is Section 899 of the reconciliation bill. It is titled, “Enforcement of Remedies Against Unfair Foreign Taxes” and Bloomberg has a solid description here. The essence of this clause is it increases taxes on nations, and individuals in those nations, who discriminate against US companies. The idea is that Europe, especially, is busy enacting “Digital Services Taxes” which are designed to extract revenue from the large US tech companies that dominate particular spaces, like Meta, Google and Microsoft. But these tax laws have thresholds such that essentially no other companies will be impacted. This is the US response.

Much of the discussion thus far has focused on the idea that this will discourage investment in US financial assets, potentially reducing the market for Treasury bonds and adding to the destruction of American exceptionalism in financial markets. And it may well do that. However, the thing to consider is that one of the reasons that the US has drawn so much investment is that there are so many investable securities here in the US, and that property rights remain sacrosanct. Yes, taxation matters, but if you are a sovereign wealth fund with $100 billion in assets or more, where are you going to invest that money if not in the US, at least in some part? And remember, this is only to be focused on nations with discriminatory taxes vs. US companies. So, the Saudis, for example, or the Japanese need not worry. It strikes me that at the margin, this could have a modest impact on prices, perhaps softening the dollar some and reducing future gains, but this is unlikely to end investment into the US.

Ok, let’s quickly run through the lack of overall movement last night. Yesterday’s early US equity gains (triggered by the tariff ruling) faded all day and markets here closed very modestly higher. In Asia, gains from yesterday were largely reversed as an appeals court stayed the ruling, so the tariffs remain in place as of now. Thus Japan (-1.2%), Hong Kong (-1.2%) and China (-0.5%) basically reversed yesterday’s closings. In Europe, though, things are a bit brighter. With gains across the board as inflation data released showed that it continues to drift lower across the continent. This has encouraged traders to believe that more ECB rate cuts are coming, which was confirmed by the Bank of Italy’s Fabio Panetta, an ECB Governing Council Member, who exclaimed that inflation is nearly beaten. Meanwhile, bank economists are now warning that further rate cuts need to come more quickly. All this, of course, is music to equity investors’ ears. As such, gains range from +0.3% (France) to 1.0% (Germany) and everywhere in between. As to US futures, they are unchanged at this hour (7:30).

In the bond market, Treasury yields are unchanged this morning after sliding 8bps yesterday. Interestingly, European sovereign yields, which also fell yesterday, have rebounded 3bps this morning despite the happy talk of more ECB rate cuts and the imminent death of inflation. Too, last night saw yields decline in Japan (-3bps) and Australia (-11bps), following in the footsteps of yesterday’s Treasury market.

In the commodity markets, oil (+1.3%) is higher after EIA data yesterday showed modest inventory draws while gold (-0.75%) is giving back yesterday’s gains which came on the back of a weak dollar. But as mentioned at the beginning of this piece, in the end, trends in both directions are on hold for now.

Finally, the dollar is firmer this morning, unwinding some of yesterday’s declines which grew throughout the day. Right now, in the G10, the euro (-0.3%) is a pretty good proxy for the entire bloc, although JPY (+0.15%) is sticking out like a sore thumb. In the EMG bloc, we see declines on the order of -0.5% (KRW, PLN, ZAR) although MXN (+0.2%) is also an aberration this morning. Alas, I see no particular reason for this move. However, as mentioned above, the recent trend is flat, although I cannot get over the idea that the dollar has further to decline going forward.

On the data front, this morning brings Personal Income (exp 0.3%), Personal Spending (+0.2%), PCE (0.1%, 2.2% Y/Y), and Core PCE (0.1%, 2.5% Y/Y) as well as the Goods Trade Balance (-$141.5B) all at 8:30. Then we see Chicago PMI (45.0) and Michigan Consumer Sentiment (51.0) at 10:00. There is one final Fed speaker this week, Atlanta’s Bostic this afternoon. However, when it comes to the Fed, again yesterday we heard that patience is the watchword with no hurry to adjust policy right now. As well, we learned that Chairman Powell had lunch with President Trump yesterday, where Trump asked him to lower rates, and Powell said they are following their long-proscribed tasks of responding to economic outcomes.

There is nothing that seems likely to excite anyone today, so I look for a quiet session overall. It seems unlikely that anything of note will be resolved, whether on a political or international relations basis, so look for a quiet session and a relatively early close as traders and investors head out for a summer weekend.

Good luck and good weekend

Adf