There once was a time in the past

When earnings reports were forecast

If companies beat

It was quite a treat

If not, CEOs were harassed

But that was before Jensen Huang

Described the AI bell he rang

Nvidia now

Is what defines tao

Alas, last night wasn’t whizzbang

In what cannot be that great a surprise, given the remarkable hype that continues to surround Nvidia, their earnings were great, but not great enough to exceed the outsized expectations that have become commonplace. And while revenues and earnings more than doubled, and their profit margins are above 50%, it wasn’t enough to satisfy the underlying belief that exists. What is that belief? The best I can tell is that the true believers are certain Nvidia will be the only company left on earth when AI takes over, and so it’s value will equate to global economic activity, currently approximately $105 trillion, so it has much further to climb. Perhaps the oddest result was that there were actual ‘watch parties’ for the earnings release. It is not clear to me if that is more hype than a Jensen Huang fan asking him to sign her breast or not, but it is certainly a lot of hype.

And yet, the world continues to turn this morning despite the disappointment and US stock futures are actually higher after a lackluster day yesterday where all three main indices declined. As is always the case, in hindsight, the hype is revealed for just what it was, but usually the rest of our lives feel no impact. That said, it was clearly the market driver yesterday and will almost certainly continue to have an outsized impact on things for a while yet. But let’s move on.

Said Bostic, I need to see more

Results on inflation before

I’m banging the drum

For that cut to come

‘Cause I don’t know what more’s in store

Back in the macro world, we heard from Atlanta Fed president Bostic last night and he was far more circumspect of a rate cutting cycle than the market currently believes was signaled by Chairman Powell last week in Jackson Hole. As of this morning, the market continues to price a one-third probability of a 50bp cut in September, a total of 100bps of cuts in the rest of 2024 and a total of 225bps of cuts by the end of 2025. Meanwhile, Mr Bostic explained, “I don’t want us to be in a situation where we cut and then we have to raise rates again. So, if I’m going to err on one side, it’s going to be waiting longer just to make sure that we don’t have that up and down.”

Now, I know I’m not a Fed funds trader, or even a fixed income trader (I’m just an FX guy) but these comments didn’t sound like he was ready to start slashing rates anytime soon. Bostic is a voter this year, and while I’m pretty sure the Fed is going to cut next month, I remain in the 25bp camp, and I might suggest that there are still several FOMC members who see no reason to cut rates quickly. After all, absent a serious downturn in the labor market, and given the economy continues to perform reasonably well, at least according to the data they watch, what is the rationale for a cut? And remember, if the Fed is cutting rates quickly it means they are responding to economic difficulties. That doesn’t seem like an outcome we want to see.

Beyond those two stories, though, once again, there is a dearth of new information on which to make decisions. China continues to struggle and there are now more bank analysts (UBS being the latest) who are lowering their forecasts for GDP growth there to the 4.5% range, well below President Xi’s 5.0% target. The ongoing implosion of the Chinese property market continues to weigh heavily on the economy there and, as the chart below shows, the Chinese stock market.

Source: Bloomberg.com

Aside from the irony of a strictly communist country even having the very essence of capitalism, an equity market, I believe the incredibly poor performance in Chinese shares is an ongoing signal that not all is well in China, regardless of what official statistical data they present. President Xi has many problems to address, and I expect he will spend far more of his time trying to smooth international trade relations than anything else for the time being. After all, the blank paper protests that led to the end of Covid restrictions in China are evidence that Xi is still subject to some popular sentiment. If the economy were to crater, it would become a major problem for his power, and potentially his health.

Ok, let’s run through the overnight price action. Asian markets were a mixed bag overnight with Japan essentially unchanged while China (-0.3%) continues to lag virtually all other markets. The Hang Seng (+0.5%) managed a rally alongside India and Singapore, but there were more laggards including Australia, Korea, Indonesia and New Zealand. But that is not the story in Europe this morning with all markets in the green led by the CAC (+0.7%) and DAX (+0.6%) on the back of somewhat softer German state inflation data (the national number is released at 8:00am) and what appears to be modestly better than expected Eurozone sentiment indices regarding services and industry, although consumers are still a bit unhappy.

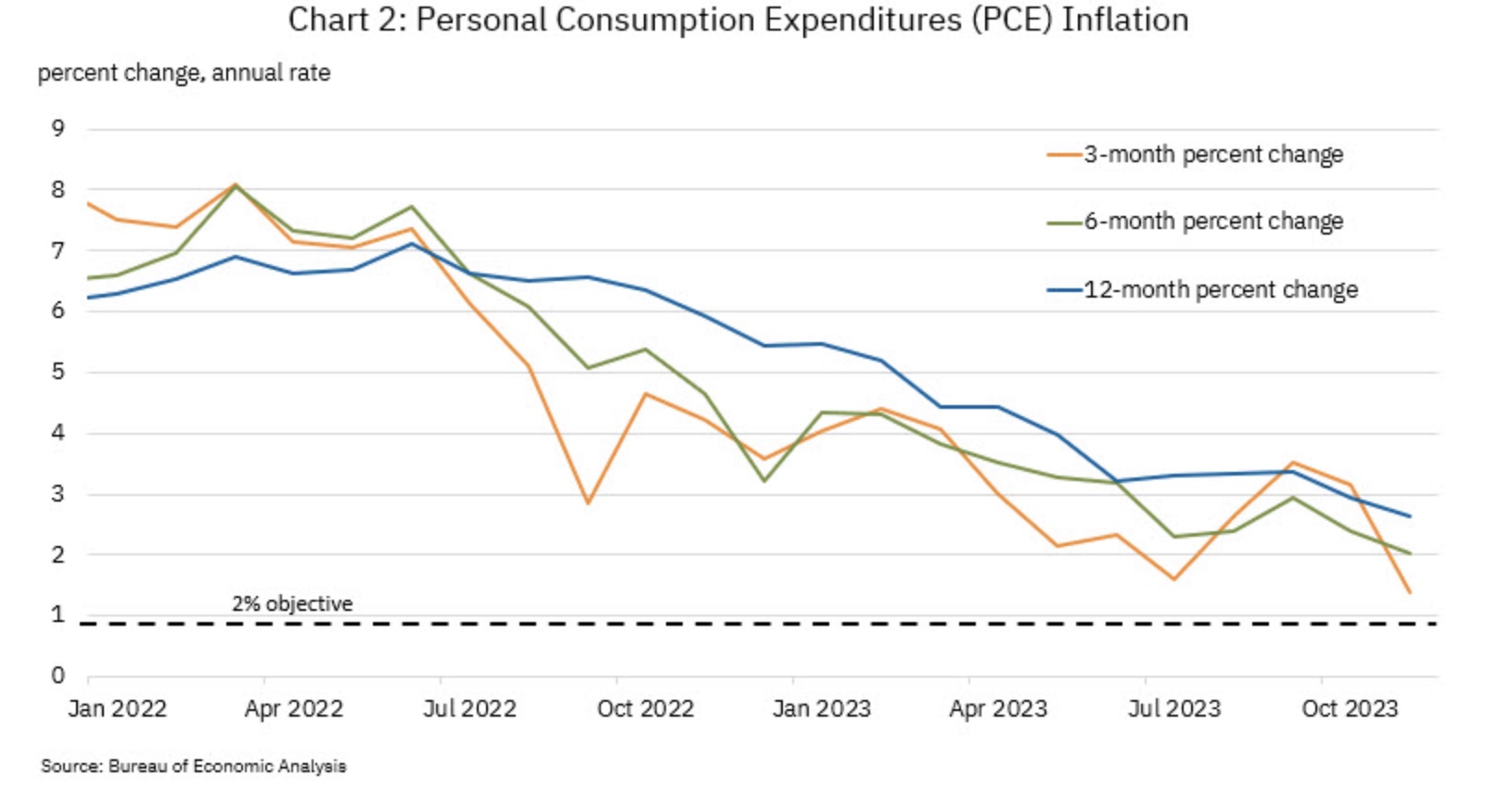

In the bond market, everyone is asleep it seems as there has been no movement of more than 1 basis point in any major market. Given the lack of new economic inputs, this should not be a great surprise. I suspect that this morning’s US data, and especially tomorrow’s PCE data may shake things up if there are any unusual outcomes.

In the commodity markets, oil (+0.3%) has stopped falling for now as yesterday’s EIA inventory data showed a total draw of more than 4 million barrels, the 9th drawdown in the past 10 weeks and an indication that supply is falling to meet the alleged weakening demand. Gold (+0.6%), which started off under pressure yesterday rebounded in the afternoon and continues this morning dragging silver along for the ride. Copper (-1.9%) however, remains under pressure on both the softening demand story and a technical trading move.

Finally, the dollar, at least the DXY, is continuing to rebound from its Tuesday lows although there is a lot of mixed activity here with some gainers (AUD +0.55%, NZD +0.5%, ZAR +0.85%, CNY +0.6%) and some laggards (EUR -0.25%) along with the CE4 showing weakness. The big outlier is CNY, which is showing one of its largest single day gains in the past year. This seems a bit odd given the ongoing lackluster equity market performance and the data showing that foreign investment into China has reversed course and is now divestment. None of that speaks to a currency’s strength, but as yet, I have not found a good rationale for the renminbi’s strength. I will keep looking.

On the data front, we finally see some things this morning starting with Initial (exp 232K) and Continuing (1870K) Claims, the second look at Q2 GDP (2.8%) and all the attendant data that comes with that release (Real Consumer Spending +2.3%, PCE +2.6%, 2.9% core). As well, Mr Bostic as back at it this afternoon at 3:30.

My take is given the elevated importance of the employment report, today’s data that really matters will be the Claims numbers with any substantial miss (>15k different than forecast) leading to some price action and potential concerns. But otherwise, Bostic certainly won’ change his tune in less than 24 hours, and the current market zeitgeist appears to be that the dollar, while headed lower, is going to chop to get there. If we do see a high Claims number, above 245K, look for the dollar to fall more sharply, retracing its overnight bounce.

Good luck

Adf