The data from China reflected

That tariffs have hurt, as expected

It’s likely more pain,

On China, will rain

As both nations are so connected

Meanwhile, in a German surprise

Herr Merz failed to get his allies

To name him to lead

Which seemed guaranteed

Could this presage his quick demise?

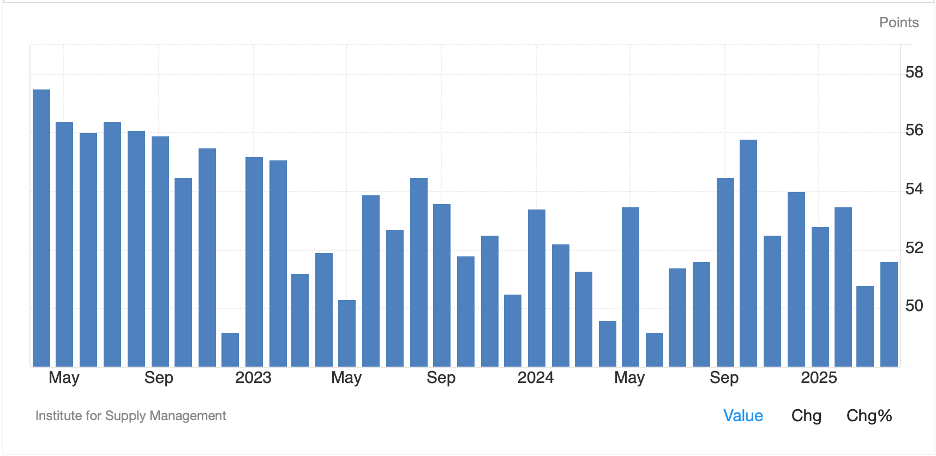

In the battle being waged between the US and China via tariffs, the first data indications have shown that the US is faring a bit better. Yesterday’s ISM Services data was stronger than expected, remaining well above the 50 level although arguably slightly below the recent average reading.

Source: tradingeconomics.com

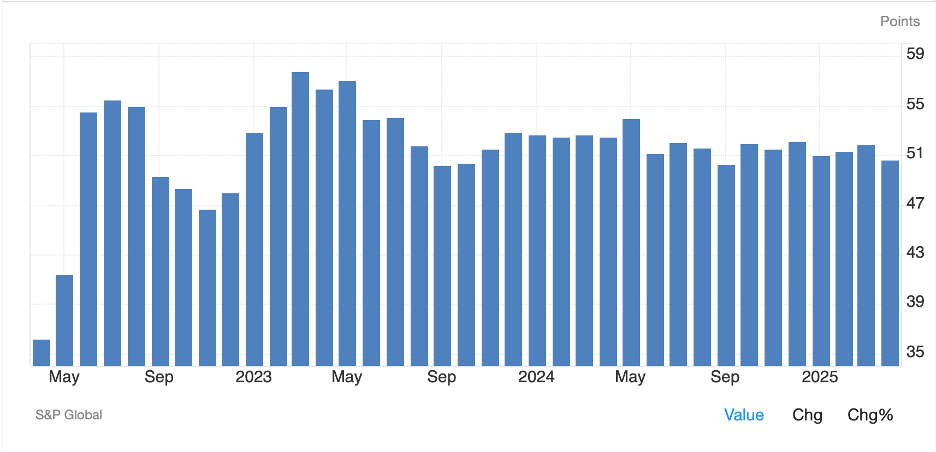

Meanwhile, last night, the Chinese Caixin Services PMI fell to 50.7, missing expectations and continuing its drift lower over time.

Source: tradingeconmics.com

Are things really worse in China than the US, at least from the perspective of data releases? I think both nations will suffer during this period as the impacts of the tariffs and reduced trade bleed into the data over the next months, but so far, it seems the US is holding its own. One of the problems with analyzing the issue is that as the WSJ pointed out yesterday, when the data in China gets bad, they simply stop releasing it, so it may be difficult to see.

Now, last night, Chinese shares did manage a nice rally with the CSI 300 higher by 1.0% but that follows six consecutive down sessions, albeit of modest size.

Source: tradingeconomics.com

As to the renminbi, after a 1% gain last Friday, it has done little and remains very much in line with its levels of the past year. The thing about China is that nothing there moves quickly, so absent a policy announcement of some type, I expect this activity will continue to gradually adjust to the realities as they become clear to the market. If President Trump reduces tariffs, as he implied he would eventually, things could work better, but again, given the time lags of moving products across the Pacific, we have a lot of time between now and whatever the new normal turns out to be.

But the more interesting story to me overnight was that Friedrich Merz, the ostensible winner of the German elections last month failed to achieve the votes to be named Chancellor despite his coalition having a 12-seat majority in the Bundestag. As it was a secret ballot, nobody knows who didn’t support him, but this outcome certainly calls into question both his ability to lead Germany effectively, and correspondingly, Germany’s ability to lead Europe in the new world order.

Recall, Germany remains keen to support Ukraine in its ongoing war with Russia and even destroyed their once sacrosanct fiscal responsibility in order to be able to pay for that support. But if they do not have an effective leader, one who can command their parliament to enact his policies, it is not clear why other European nations would follow their lead on anything. It should not be surprising that the DAX (-1.3%) fell sharply when the news was released, and that has helped drag most European shares lower (CAC -0.7%, IBEX -0.3%, Poland -3.3%). As to the euro, you can see from the below chart that the response, when the news was announced, that it slipped about 0.5%, basically wiping out the gains it had achieved prior to the vote.

Source: tradingeconomics.com

Will this matter in the long run? I believe that a weakened Germany, which is likely the outcome of this situation, will simply undermine the euro’s value. As such, while I still believe the dollar has further to decline, the euro will probably not be a major winner. Look for other currencies to outperform the euro going forward.

Ok, I think those are the real stories as we head into today’s session with most market participants remaining tentative in the face of the ongoing confusion over policies, counter policies and macroeconomic data. Remember, too, we have the Fed tomorrow and the BOE on Thursday, so despite the fact that fiscal policy has been the driver, the Fed’s opinions still carry weight amongst the fixed income community, at the very least.

Looking at the price action overnight, the Nikkei (+1.0%) gained on some solid earnings data from Japanese companies as well as increased hopes that the US-Japan trade talks will be successfully completed by June. Apparently, there is also some faith that the US and China will begin talking soon on this subject. Hong Kong (+0.7%) also benefitted from these discussions, but the rest of the region showed very little movement overall, with gains or losses on the order of 0.3% or less. As we have already discussed Europe, a look at US futures shows they are pointing lower by about -0.5% at this hour (7:10).

Bond markets remain very dull these days with Treasury yields edging higher by 1bp this morning after climbing 3bps yesterday. European sovereign yields are also higher. By 1bp to 2bps although there is neither data nor a story that seems to have had much impact. The Services PMI data that was released this morning was very much in line with expectations and continues to hover around 50.0 for the continent as a whole. Meanwhile, JGB yields were unchanged last night and sit at 1.25%, well below the levels seen back in late March and having really gone nowhere for the past month. It strikes me that JGB yields will respond to any trade deals but are likely to be quiet in the interim.

Commodity prices are rallying this morning with oil (+2.2%) rebounding from its level yesterday which happen to come quite close to touching the lows from April 9th. It should be no surprise that there are up days in this market, but if the Saudis and OPEC are going to continue increasing production, I expect that prices have further to fall. In the metals markets, gold (+1.4%) is having another blockbuster day, now having gained $150/oz in the past three sessions and bouncing off the correction lows. Demand for the barbarous relic continues to come from Asia mostly with all signs showing that US investors are not interested in this trade. As to silver (+1.7%) and copper (+0.6%), they are both still along for the ride.

It should be no surprise with the commodity markets showing strength that the dollar is under pressure this morning. while we’ve discussed the euro already, the pound (+0.5%) is looking quite solid as it continues its rally from the lows seen in mid-January. But the yen (+0.5%), SEK (+0.45%) and NOK (+0.35%) are all gaining today as well. Interestingly, the impact in emerging markets is far less noticeable with none of the major EMG currencies moving even 0.2% this morning.

On the data front, there is very little hard data this week although we do have the Fed on Wednesday and then a whole bunch of Fed speakers on Friday.

| Today | Trade Balance | -$137.0B |

| Wednesday | FOMC Rate Decision | 4.50% (unchanged) |

| Consumer Credit | $9.5B | |

| Thursday | BOE Rate Decision | 4.25% (-0.25%) |

| Initial Claims | 230K | |

| Continuing Claims | 1890K | |

| Nonfarm Productivity | -0.7% | |

| Unit Labor Costs | 5.1% |

Source: tradingeconomics.com

Today’s trade data is for March, prior to the tariff impositions, so will reflect significant tariff front-running. But really, it’s about the Fed this week, and since they have lost much of their cachet lately, I think the market is really going to continue to look to the White House for trade news and react to that. Net, I continue to believe that the dollar’s FX rate will be part of many trade discussions, like we saw with Taiwan (which by the way did reverse 3% of yesterday’s gain overnight) and that means further weakness is in our future.

Good luck

Adf