The pundits, when looking ahead

All fear that their theses are dead

‘Cause bitcoin’s imploding

And that is corroding

The views they have tried to embed

The thing is, it’s simply not clear

What caused this excessive new fear

But those with gray hair

Know markets ain’t fair

And force us to all persevere

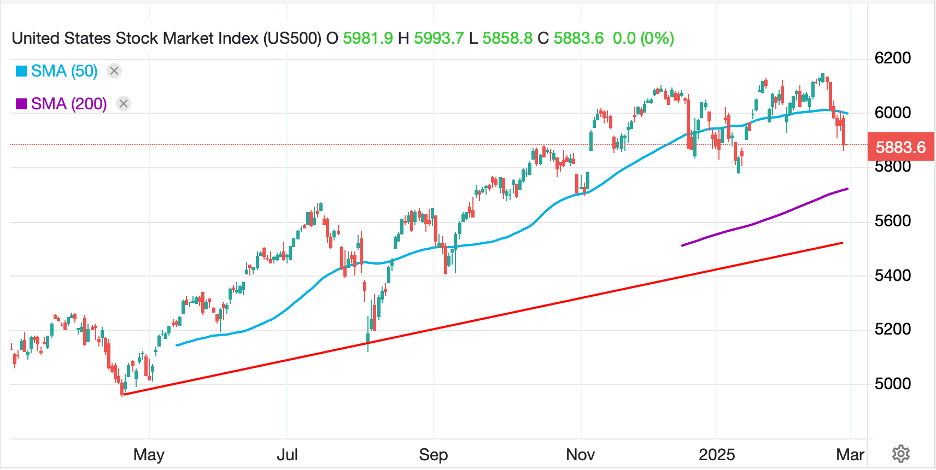

It all came undone yesterday around 10:45 in the morning for no obvious reason. There was no data released then to drive trader reaction nor any commentary of note. In fact, most of the punditry was still reveling in the higher Nvidia earnings and planning which Birkin bag they were going to buy for their girlfriends wives. But as you can see from the NASDAQ chart below, in the ensuing two hours, the index fell by 4% and then slipped another 1% or so from there into the close, the level that is still trading at 6:30 this morning

Source: tradingeconomics.com

As a member in good standing of the gray hair club, I have seen this movie before, and I have always admired the following image as a perfect example of the way things work in markets.

And arguably, this is all you need to know about how things work. Sure, there are times when a specific data release or Fed comment is a very clear driver of market activity, but I would contend that is the exception rather than the rule. The day following Black Monday in 1987, the WSJ asked noted Wall Street managers what caused the huge decline. Former Bear Stearns Chairman, Ace Greenberg said it best when he replied, “markets move, next question.” And that is the reality. While I believe that macroeconomics offers important information for long-term investing theses, on any given day, anything can happen. Yesterday is a perfect example of that reality.

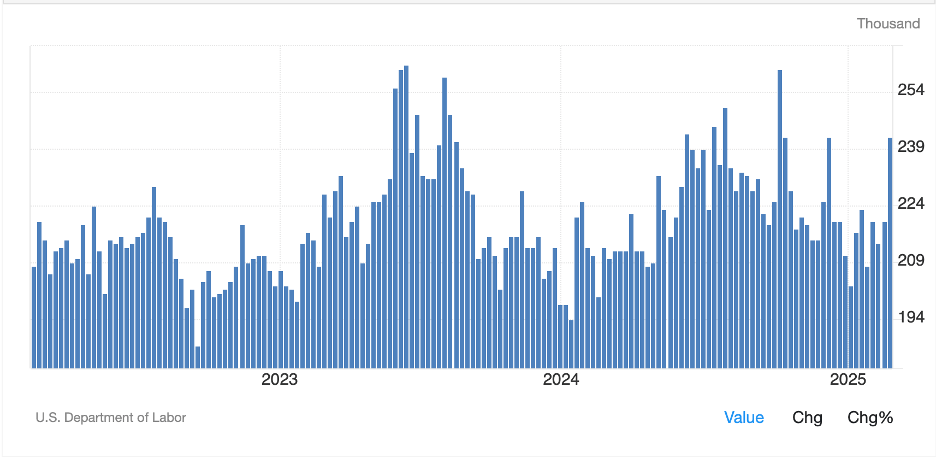

But let us consider what we know about the overall financial situation. The Damoclesian Sword hanging over everything is excessive leverage across the board. I have often discussed the idea that global debt is more than 3X global GDP, a clear an indication that there will be repayment problems going forward. And something that seems to have been driving recent equity market gains has been an increase in margin buying of stocks and leverage in general. After all, the fact that there are ETFs that offer 3X leverage on a particular stock or strategy is remarkable. But a look at the broad levels of leverage, as shown by the increase in margin debt in the chart below from Wolfstreet.com (a very worthwhile follow for free) tells me, at least, that when things turn, there is going to be an awful lot of selling that has nothing to do with value and everything to do with getting cash for margin calls.

It is this process that drives down the good with the bad and as you can see in the chart, happens regularly. I’m not saying that we are looking at a major reversal ahead, but as I wrote earlier this week, a correction seems long overdue. Perhaps yesterday was the first step.

One last thing. I mentioned Bitcoin at the top and I think it is worthwhile to look at the chart there to get a sense of just how speculative assets behave when times are tough. Since its peak on October 6th, 46 days ago, it has declined ~45% as of this morning. That, my friends, is a serious price adjustment!

Source: tradingeconomics.com

Ok, let’s see how other markets are behaving in the wake of this, as well as the recent news. Remember, yesterday we saw a slew of old US data on employment, but it is all we have, so probably has more importance than it deserves. After all, it is pre-shutdown and things have clearly changed since then.

Starting in Asia, it wasn’t pretty with the three main markets (Nikkei, Hang Seng, CSI 300) all declining by -2.40%. Korea (-3.8%) and Taiwan (-3.6%) fared even worse but the entire region was under pressure. The narrative that is forming as an explanation is that there is trouble in tech land, despite the Nvidia earnings, and since Asia is all about tech, you can see why it fell.

Meanwhile, the antithesis of tech, aka Europe, is also lower across the board this morning, albeit not as dramatically. Spain’s IBEX (-1.3%) is leading the way down but weakness is pervasive; DAX (-0.8%), CAC (-0.4%), FTSE 100 (-0.4%), as all these nations also released their Flash PMI data which came in generally softer across the board. But there is one other thing weighing on Europe and that is the publication of a 28-point peace plan designed to end the Russia/Ukraine war. The plan comes from the US and essentially ignored Europe’s views as it is patently clear they are not interested in peace. In fact, it appears peace will be quite the negative for Europe as it will undermine their rearmament drive and likely force governments there to focus on domestic issues, something which, to date, they have proven singularly incompetent to address. In fact, if the war really ends, I suspect there are going to be several governments to fall in Europe with ensuing uncertainty in their economies and markets. As to the US futures markets, at this hour (7:30) they are basically unchanged to leaning slightly higher. Perhaps the worst is past.

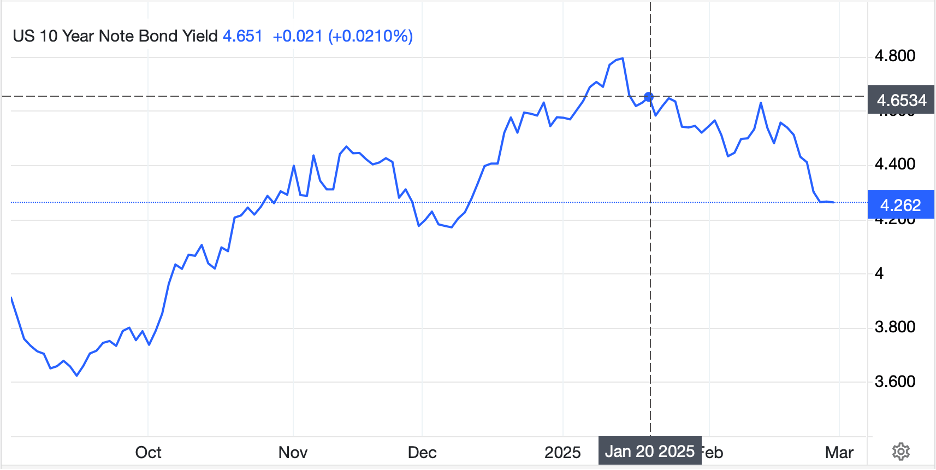

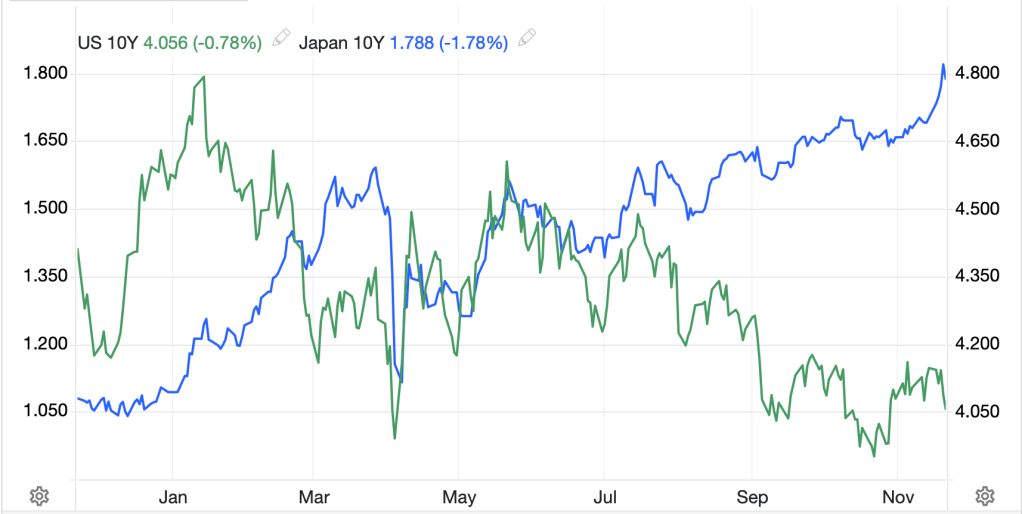

In the bond market, yields are lower across the board led by Treasuries (-4bps) while European sovereign yields have slipped -2bps to -3bps. Certainly, the European data does not scream inflationary growth, but I have a feeling this is more about tracking Treasuries than anything else. I say that because JGB yields also fell -4bps despite the passage of an even larger supplementary budget than expected, ¥21.7 trillion, which is still going to be paid for with more borrowing. That is hardly the news to get investors to buy JGBs and I suspect yields will climb higher again going forward. I think it is worth looking at the trend in US vs. Japanese 10-year yields to get a fuller picture of just how different things are in the two nations. Of course, there is one thing that is similar, inflation continues to remain above their respective 2.0% targets and is showing no signs of returning anytime soon.

Source: tradingeconomics.com

You will not be surprised to know that commodity prices remain extremely volatile. Oil (-1.0%) had a bad day yesterday and is continuing lower this morning although as you can see from the chart below, it is off its worst levels of the session. But the one thing that remains true despite the volatility is the trend remains lower.

Source: tradingeconomics.com

Metals markets also suffered yesterday and are under pressure this morning with gold (-0.4%) and silver (-2.5%) sliding. One thing to remember is that when margin calls come, traders/investors sell what they can, not what they want, and given the liquidity that remains in both gold and silver, they tend to get sold to cover margin calls. Too, today is the weekly option expiry in the SLV ETF and as my friend JJ (writes at Market Vibes) regularly explains, there is a huge amount of silver activity driven by the maturing positions.

Finally, the dollar continues to remain solidly bid, although is merely consolidating recent gains as it trades just above the key 100 level in the DXY. Two things of note today are JPY (+0.5%) which responded to comments from not only the FInMin, but also Ueda-san explaining that a weak yen is driving inflation higher and might need to be addressed. Step 4 of the dance toward intervention? As to the rest of the G10, movement has been minimal. But in the EMG bloc, INR (-1.1%) fell to record lows (dollar highs) after the RBI stepped away from its market support. It sure seems like it is going to break through 90 soon and I imagine 100 is viable. As well, ZAR (-0.7%) is suffering on the weaker metals prices, along with CLP (-0.5%) while BRL (-0.5%) slipped as talk of a more dovish central bank stance started percolating in markets.

Today’s data brings US Flash PMI (exp 52.0 Manufacturing, 54.6 Services) and Michigan Sentiment (50.5). We hear from five more Fed speakers, with a mix of hawks and doves. It will be interesting to see how the doves frame yesterday’s better than expected September NFP report as their entire thesis is softening labor growth is going to be the bigger problem than rising prices.

I, for one, am glad the weekend is upon us. For today, I am at a loss for risk assets. The case can be made either way and I have no strong insight. However, the one thing that I continue to believe is the dollar is going to find support. Remember, when things get really bad (and they haven’t yet) people still run to T-bills to hide, and that requires buying dollars.

Good luck and good weekend

Adf