To aid the American Dream

The most recent Trumpian scheme

Is new Trump Accounts

In proper amounts

To help stocks become more mainstream

One likely effect of this act

Is stocks will be forcefully backed

Though problems extant

May come back to haunt

For now, bearish plays will get whacked

Financial market news remains mostly uninspiring these days as the Fed story has largely gone back to a cut is coming next week (89.2% probability) thus the hawkish phase has passed. AI is still the magical future, while precious metals continue to garner support overall as concerns rise about the ongoing debasement of fiat currencies. Elsewhere, the war in Ukraine rages on as peace talks in Moscow were described as ‘constructive’ but have yet to resolve the issues.

The other piece of the Fed story, regarding the next Chair, has taken a modest turn as a series of interviews by the finalists in the process (allegedly Hassett, Warsh and Waller) with VP Vance, were suddenly canceled for no apparent reason. As well, the president continues to hint that Mr Hassett is going to be the one.

But one of President Trump’s strengths is his ability to keep his ideas in the news, and nothing exemplifies that better than the new Trump Accounts. This is the idea that the government should start investing in the next generation by way of establishing investment accounts in the name of children at birth with $1000 of seed money from the government. If these accounts are invested in the S&P 500, for instance, with a historically average return of roughly 10%, by the time the child turns 18, the initial investment will have grown more than 5-fold. As well, these accounts are eligible for additional contributions each year, up to $5000, so can really build some value in that circumstance.

In addition, the news that Michael and Susan Dell will be donating $6.25 billion to add $250 to those accounts, tax free to the recipient, is another boon. Estimates are that the total could rise to $4 billion/year of outlays, all of which will be required to go into the stock market. It’s almost as though President Trump wants the government to support the stock market, but I’m sure that is a secondary consideration!

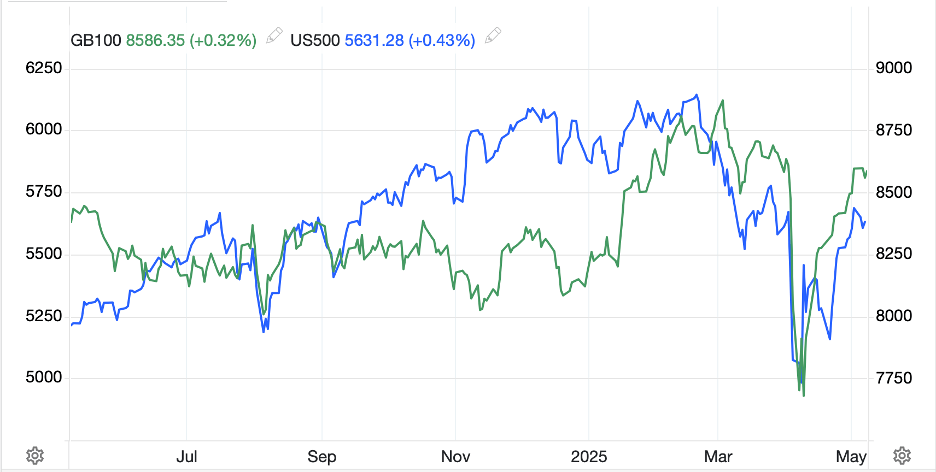

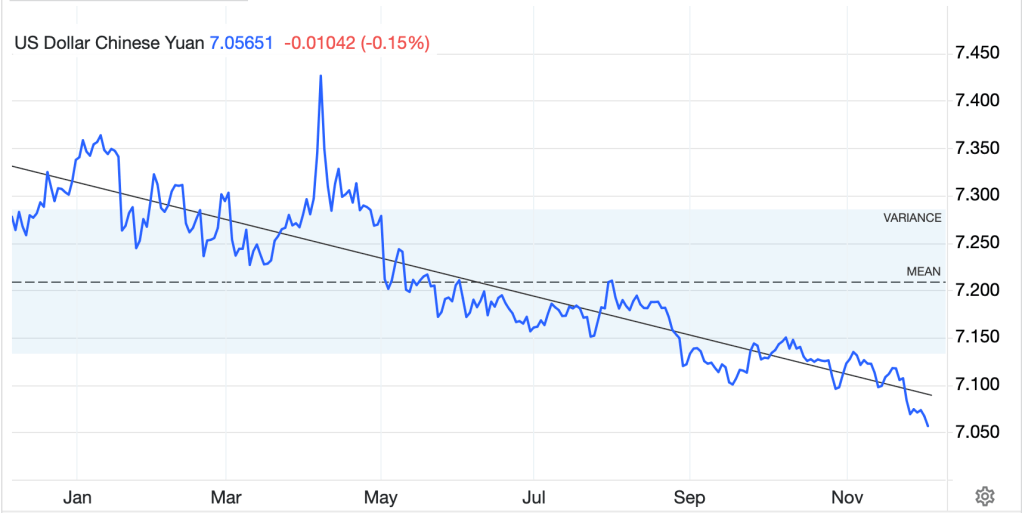

But away from that, the news has been sparse, so let’s look at market activity overnight. yesterday’s US session played out like the opening, modest gains, and futures at this hour (7:15) indicate more of the same is on the way today. In Asia overnight, while Tokyo (+1.1%) had a solid session, China (-0.5%) and HK (-1.3%) were far less fortunate. Chinese PMI data continues to be soft but perhaps of more import is the fact that the yuan (+0.15%) continues to gradually strengthen, as it has been for the past year (see chart below).

Source: tradingeconomics.com

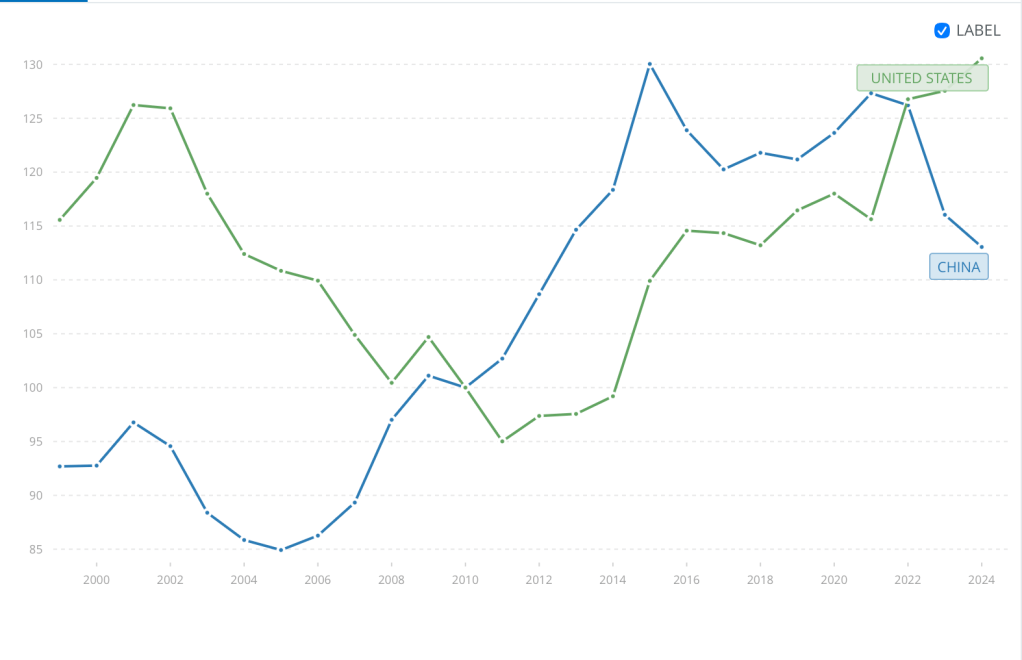

In fact, the yuan has reached its strongest level since September 2024. The thing about a strong CNY is that it has definitive negative impacts on Chinese exporters. While there has been very little discussion of the yuan regarding the trade talks between the US and China, the steady appreciation of the currency will certainly hurt Chinese company earnings, and by extension stock prices there. One thing to note is that despite its recent strength, the yuan remains undervalued vs. the dollar based on a Real Effective Exchange Rate calculation by the World Bank as per the below chart, with the current USD value at 130.6 while the CNY sits at 113.1. That is a substantial undervaluation that, if corrected, would likely have a significant impact on the respective economies of each nation as well as, maybe, the political rhetoric.

Elsewhere in the region, India was little changed even though the rupee (-0.4%) traded through 90.00 for the first time as the RBI has decided not to waste more reserves on supporting the currency. It appears that capital outflows are driving the rupee, but that does not bode well for stocks there. The rest of the region was mixed with more gainers (Korea, Taiwan, Australia, New Zealand) than laggards (Philippines, Thailand, Malaysia).

In Europe, both Spain (+1.5%) and Italy (+0.7%) are having solid sessions although much of the rest of the continent is less robust. The story is that European defense companies have benefitted today based on the absence of a peace agreement, although Eurozone inflation readings coming in a tick hotter than forecast have put paid to any idea of an ECB cut anytime soon.

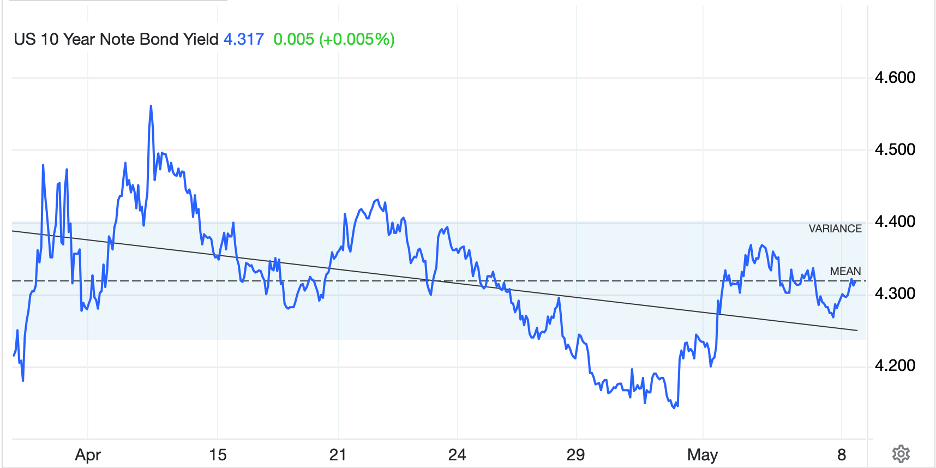

Moving on to bonds, Treasury yields (-3bps) have backed off a touch from highs yesterday and that has dragged European sovereigns down with them, with the entire continent seeing yields decline -1bp or so. Overnight, JGB yields ticked up another 3bps, to further new highs for the move, as there is no indication that government spending is going to slow down while expectations of a BOJ hike remain in full force.

Commodity markets continue to show the most volatility with both oil (+1.3%) and NatGas (+2.3%) rising this morning, the former on the lack of peace talks, the latter on the expanding polar vortex which is driving cold weather in the Northeast. Too, I would be remiss if I didn’t mention that European demand for US LNG is running at record rates as they try to wean themselves from Russian gas supplies. FYI, NatGas is back to its highest level since late 2022, where it skyrocketed in the wake of the initial Russian invasion. In the metals markets, after a bit of profit taking in yesterday’s session, both gold and silver have edged higher by 0.1% this morning as both continue to be accumulated by Asian central banks and Asian investors although Western investors don’t seem to believe in the idea. Something to note is that silver has risen 102% so far in 2025, that’s a pretty big move! Copper (+1.45%) has jumped on the back of news that Chinese smelters have reduced activity and inventories at the LME are limited. Add to that the underlying electrification story, and demand seems likely to be pretty robust for a while yet.

Finally, the dollar is under pressure this morning with the DXY, though still in its range, trading below 99.00 for the first time in 3 weeks. But looking at actual currencies, the euro (+0.4%), pound (+0.7%), NOK (+0.6%), SEK (+0.5%) and CHF (+0.4%) are all nicely higher this morning. The rest of the G10 are in a similar state, albeit with slightly smaller gains. In the EMG bloc, CLP (+0.5%) is climbing on the back of copper’s rise, while the CE3 are all following the euro higher rising in step. ZAR (+0.1%), BRL (+0.1%) and MXN (+0.2%) are underperforming this morning, likely because the metals markets, other than copper, are underperforming.

Turning to the data, this morning brings ADP Employment (exp 10K), IP (0.0%), Capacity Utilization (77.3%) and then ISM Services (52.1) at 10:00. Given the IP data is old, I expect ADP to be the number with the most possible influence. But, given the market is already assuming a cut next week, it would have to be a dramatic negative number to change any views.

The big picture remains the same, run it hot, fiat currency debasement and the dollar should be the best of a bad lot, but on any given day, much can happen that doesn’t fit that story. Today is one of those days.

Good luck

Adf