The data today on inflation

Will help tweak the latest narration

But arguably

There’s little to see

As CPI’s lost in translation

And too, central bankers have learned

Their comments leave folks unconcerned

Today’s BOC

Where rate cuts will be

The outcome will ne’er be discerned

It is Donald Trump’s world, and we are all just living in it. Virtually everything that happens in any financial market these days is a result of something that President Trump has either said or done. Obviously, tariffs are a major player, but so are the peace talks in Ukraine (good news that Ukraine has agreed a cease fire to get things started) and his domestic initiatives regarding DOGE and the shake up that has come to government from that project. You cannot look at a business journal without reading a story about how corporate America’s CEO’s are very concerned because of all the activity as they are having difficulty planning their strategies.

While this poet endeavors to track the macroeconomic issues and how they impact markets, and one can argue that tariffs are a macro issue, the ongoing back and forth as to which products will get tariffed and when is occurring far more rapidly than is worth reporting on a daily outlook. After all, nobody has any idea what today will bring on that front.

With that in mind, one of the other things I have discussed has been the demotion of central bankers from their previous preeminence in the world of financial markets. Now, every one of them is simply left to respond to whatever President Trump says that day. Consider, the Fed entered their quiet period last Friday and the fact that we have not heard a word from them is entirely inconsequential. The Fed funds futures market is currently pricing just a 3% probability of a rate cut next week and a total of 75bps of cuts by the end of the year, but that has been true for the past several weeks. Despite an increase in the talk of a US recession, the markets are not indicating that is a concern.

Now, that doesn’t mean that other central banks aren’t doing things, but when the BOC cuts rates by 25bps this morning, taking their base rate to 2.75%, 150 basis points below the US, nothing is going to happen in the market. It is already widely assumed. I guess it is possible that Governor Macklem could make some comments of note, but given that Canada remains a bit player on the world stage, does whatever he says really matter? In fact, the only reason people are discussing Canada now is because of President Trump and his trolling former PM Trudeau and calls to make it the 51st state. Let’s face it, the economy there is ticking along fine for now, although if their exports to the US are impaired by tariffs it will definitely hurt them. Meanwhile, other than a huge housing bubble, nobody really notices them. After all, their economy is roughly $2.3 trillion, smaller than that of Texas.

We have also heard from Madame Lagarde recently as she tries to calm European leaders’ nerves while the ECB tries to manage their policy around US fiscal gyrations. However, the most concerning information from there has been her confirmation that the ECB is pushing forward with their central bank digital currency (CBDC) project, looking to get things started in October of this year. This contrasts with President Trump’s EO that the US will not pursue a CBDC and there is currently legislation in Congress to enshrine that into law. My personal view is a CBDC would be very concerning given its inherent reduction in individual liberties. While the current setup is for the euro to rise relative to the dollar, it is not clear to me that will remain the case in the event the digital euro comes into being. In fact, it would not surprise me if many Europeans decided that holding dollars was a much better idea than holding euros in that environment. But that is a story for the future.

As to today, CPI is set to be released with the following median expectations; headline (0.3%, 2.9% Y/Y) and core (0.3%, 3.2% Y/Y). Both of those annualized numbers are one tick lower than last month’s outcomes, so would help the Fed narrative that inflation is falling back to their target. But again, absent a major discrepancy, something like a 0.1% or 0.5% reading on the core number, I don’t think it will have any market impact across any market. Data is just not that important these days.

Let’s turn to the overnight session to see how things are behaving in the wake of yesterday’s late US equity rebound, where while the indices all finished lower, they were well off the daily lows. In Asia, the picture was very mixed with some major gainers (Korea +1.5%, Indonesia +1.8%, Taiwan +0.9%) and some major laggards (Thailand -2.5%, Malaysia -2.3%, Australia -1.3%, Hong Kong -0.8%) with both Japan and mainland China showing little movement. In Europe, after a down day yesterday, this morning is seeing a solid rebound across most major markets with the DAX (+1.8%) leading the way followed by the CAC (+1.4%) and FTSE 100 (+0.6%). Some solid earnings reports and ongoing hope belief that European defense spending will ramp up seems to be the drivers. As to US futures, at this hour (7:30) they are firmer by 0.8% ish across the board.

In the bond market, after Treasury yields climbed 7bps yesterday, this morning they have edged a further 1bp higher. The big domestic story is the continuing resolution which was just passed by the House and now sits at the Senate. If it is not passed by Friday, the government will shut down, although it is not clear to me how that can be more disruptive than the way things have been operating for the past 6 weeks! Meanwhile, European sovereign yields are also edging higher with German bunds (+4bps) leading the way as the ongoing discussion over breeching the debt brake continues and concerns over massive new issuance remain front and center. Elsewhere in Europe, yields have risen as well, but generally by only 1bp or 2bps. Last night, JGB yields didn’t move at all.

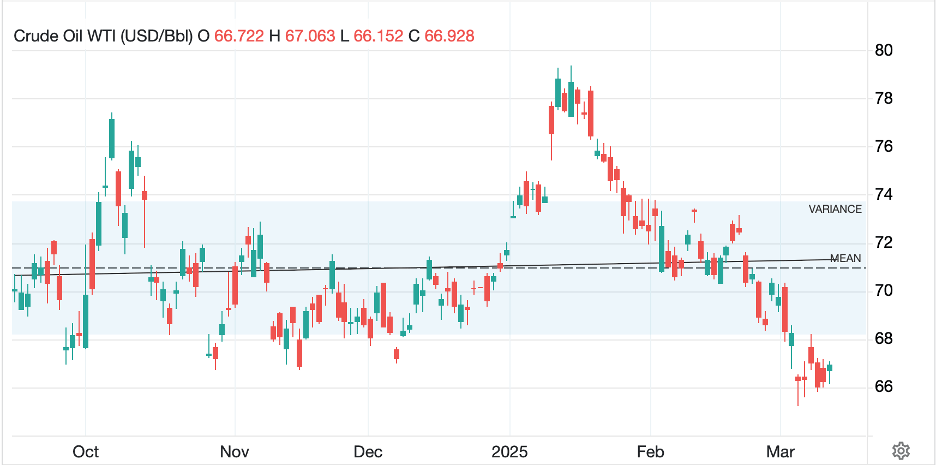

In the commodity bloc, oil (+1.1%) is continuing to bounce along the bottom of its trading range as per the below chart.

Source: tradingeconomics.com

A look at the trend line there shows that, at least based on the past 6 months, there has not been any net movement of note. The question of whether the Ukraine war ends and that allows Russian oil back into the market, out in the open, is also current, with no clear answer in sight. Meanwhile, the metals markets continue to ignore the recession calls with silver (+0.7%) and copper (+2.3%) both strong although gold is unchanged on the day.

Finally, the dollar is bouncing slightly this morning after declining sharply in 5 of the past 7 sessions with the other two basically unchanged. This has all the hallmarks of a trading pause as there is nothing that has altered the idea that President Trump wants the dollar lower, and his policies are going to push it in that direction. The one big outlier this morning is CLP (+0.9%) which is tracking copper’s rally, but otherwise, the yen (-0.6%) is the only mover of note, and that also seems a trading response, certainly not a fundamental change.

And that’s really it. CPI is the only data for the day and there are no Fed speakers. Of course, tape bombs are the new normal and we never have any idea what President Trump or Secretary Bessent may say at any given time. However, with that in mind, the bigger picture remains intact. I remain negative the equity space overall as changes continue, while the dollar is likely to remain under pressure as well. This should help the bond market, and commodities.

Good luck

Adf