While AI is clearly the rage Where Mag 7 try to engage Consider the fact That during this act They’re fighting each other backstage

Just a little aside regarding the situation in equity markets, which in the US really means the Magnificent 7 these days. One of the key features of their cumulative success was that these companies had no significant overlap regarding their business models. Online shopping, iphones, EV’s, search, GPUs, streaming services and a social network clearly intersected to some extent, but the main focus of all these companies was spread out in different directions. Yes, Amazon prime competes with Netflix, as does Apple TV, and yes, Amazon Web Services, Microsoft Azure and Google Cloud are all in the same business, but there is a huge amount in that particular segment that is still unfulfilled, so competition but not cutthroat.

But AI is a different kettle of fish. All of them are actively investing in their own AI programs and working to integrate them into their current services and products. And we are already seeing announcements of new GPU’s to directly compete with Nvidia and bring that supply chain in-house for the other users. The point is, there is going to be a lot more investment, if not overinvestment, in this space with, arguably, quite a while before whatever AI does starts to really help the bottom line. In other words, do not be surprised to see margins start to decline in these companies which is unlikely to help drive their share prices higher. As well, with investment focused on this new area, we need to expect to see a reduction in share repurchases, removing one of the key bids to the market.

All I’m saying is that even in a soft or no landing scenario, it strikes me that the Magnificent 7 may be running out of room to continue their amazing run of share price gains. And if they start to stumble, just the very nature of the equity indices, where their capital weightings are so large combined, > 30%, I suspect the indices themselves may find themselves under a lot of pressure, regardless of whether the Fed cuts rates or not. And if the Fed cuts rates because the economy is slipping into recession, or has already gotten there, that cannot be good for margins either. While timing is everything in life, this is something that needs to be on everyone’s radar, because it will change the risk narrative, and that matters for all markets. Just sayin’.

While last week was mercif’ly free Of Fedspeak, the FOMC This week will explain Again and again Why higher for longer’s the key

As the market returns to full strength, at least from a staffing perspective, post the Thanksgiving holiday, things are opening fairly quietly. A quick recap of the data since I last wrote shows that the mix of good and bad continues to leave prospects uncertain going forward. This has allowed both the soft/no landing camp and the recession camp to point to specific things and claim they are on the right track. So, Durable goods were pretty lousy in October and Michigan Sentiment also fell sharply, but Initial Claims fell as well, indicating that the labor market remains robust overall. In other words, uncertainty continues to reign.

One of the interesting things is that different markets appear to be pricing very different outcomes. For instance, commodity markets, or at least energy markets, are clearly in the recession camp as oil prices remain under pressure, falling another 1.5% this morning as the market awaits the outcome of Thursday’s delayed OPEC+ meeting. Talk is that there could be another 1 million bbl/day production cut to help support prices, but nothing is yet certain. At the same time, both copper and aluminum remain under pressure, sliding a bit further last week and this morning while gold (+0.5%) is back firmly above $2000/oz, hardly a sign of a positive future.

However, as dour as the commodity markets feel, equity markets remain quite resilient overall. Although this morning, we are seeing modest declines around the world, with European bourses lower by -0.2% or -0.3%, and US futures are currently (8:00) down by -0.15%, the month of November has been a big winner almost everywhere. Gains, ranging from 5% – 11% are the order of the month as equity investors have gone all-in on the idea of a soft landing and that the major central banks are going to be slowly reducing interest rates to ensure economic growth continues.

In truth, bond markets are of a similar mind as equities with 10-year yields lower by between 25bps and 40bps during November throughout the G10 (Japan excepted but even there lower by 10bps). Clearly, all this can be traced back to the QRA released back on November 1st when Treasury Secretary Yellen let it be known that there would not be as much coupon issuance as had been anticipated, and that more of the Federal government’s borrowing would take place in the T-Bill market. That was the starting gun for the bond market rally and the ensuing stock market rally.

So, which of these two views is correct? That, of course, is the $64 trillion question, and one with no clear answer yet. As I have written numerous times, and as we saw last week, the data continues to be mixed, with both positive and negative signs. While the Fed, and virtually every other G10 central bank continues to harp on the idea that they will not be cutting rates anytime soon, markets are pricing in rate cuts starting in early Q2 of 2024.

Ultimately, there will be a winner of this battle, but the game is still afoot. FWIW, while I have long been concerned that the imbalances in the economy were going to lead to a more significant correction in equity prices, there is another side to the story that is worth exploring, and that is the concept of fiscal dominance.

According to the St Louis Fed, a good definition of fiscal dominance is: “…the possibility that accumulating government debt and deficits can produce increases in inflation that dominate central bank intentions to keep inflation low.” The corollary here is that the Fed is losing its power over one of its key mandates, stable prices, because the Federal government’s fiscal impulse is so great as to overwhelm the Fed’s actions.

With 2024 a presidential election year, and with the TGA currently at $725 billion plus negotiations for more spending on Ukraine, Israel and the southern border, there will be no shortage of additional Federal moneys flowing into the economy. Add to this the fact that the surge in T-Bill issuance will move savings from a “dead zone” in the standing RRP facility, which is still at $935 billion, to more active money, able to be used in the real economy, and it is easy to see how economic activity is going to be supported throughout 2024. Whatever your views on the appropriateness of these policies, the reality on the ground is that the current administration will do everything in its power to be re-elected and that includes spending as much money as possible. Remember, too, that there is no operable debt ceiling, so they can issue as much debt as they want to fund whatever they can get legislated.

If the Fed has lost control of the narrative, and it does appear to be slipping through their fingers, then we will need to start to focus elsewhere to find market drivers. Of course, if the Fed is losing its grip, do not think for a moment they will go meekly into the sunset. Instead, I could see several more rate hikes as they continue to try to fight for price stability amid an economy flush with cash. In other words, this story is nowhere near finished.

At this point, let’s take a look at this week’s data, which will bring updated GDP and PCE readings amongst other things.

| Today | New Home Sales | 723K |

| Dallas Fed Manufacturing | -17 | |

| Tuesday | Case Shiller Home Prices | 4.0% |

| Consumer Confidence | 101.0 | |

| Wednesday | Q3 GDP | 5.0% |

| Goods Trade Balance | -$85.7B | |

| Thursday | Initial Claims | 220K |

| Continuing Claims | 1872K | |

| Personal Income | 0.2% | |

| Personal Spending | 0.2% | |

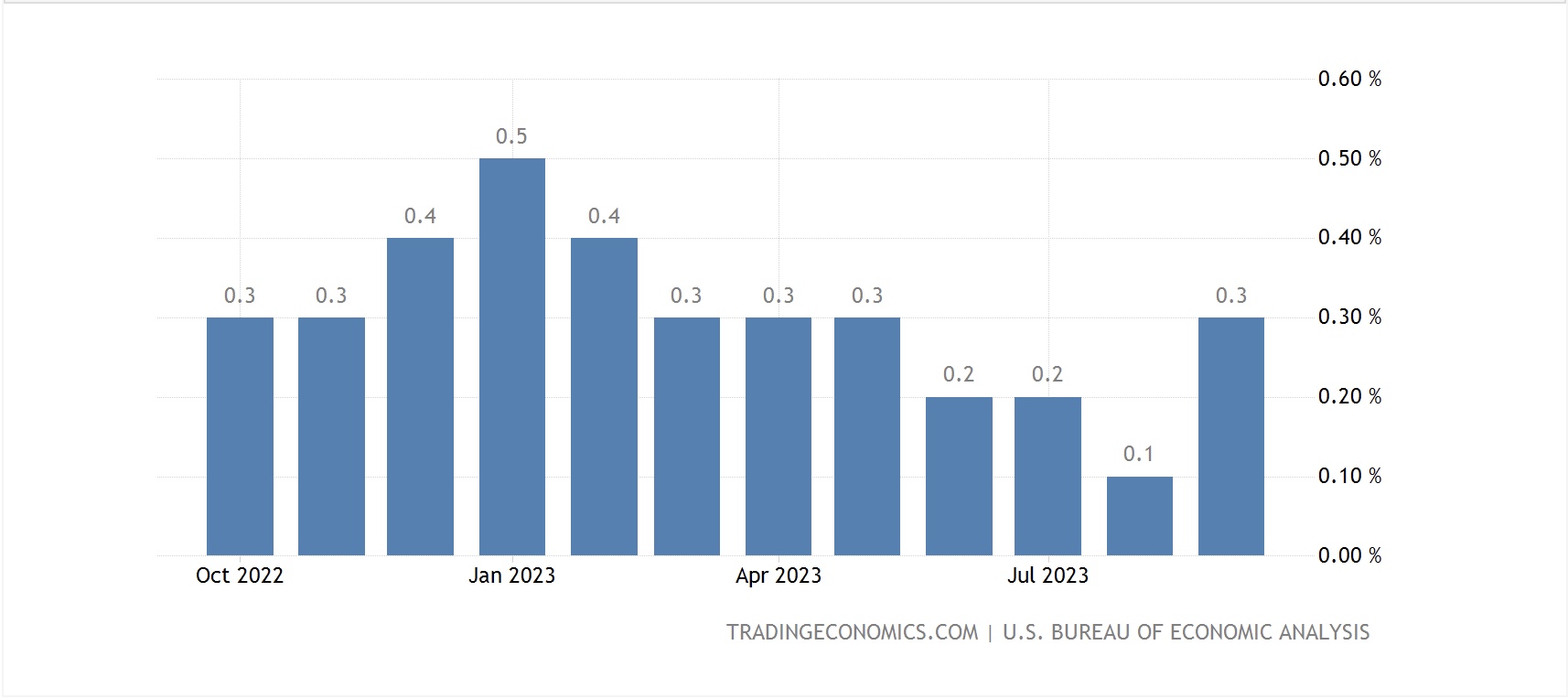

| Core PCE | 0.2% (3.5% Y/Y) | |

| Chicago PMI | 45.4 | |

| Friday | ISM Manufacturing | 47.6 |

Source: Tradingeconomics.com

Despite Friday being the first of December, payrolls are not released until next week due to the holiday last week. Plus, in addition to the data above, we hear from seven different Fed speakers over ten venues including Chairman Powell Friday morning. That will be the last Fed speaker until the next FOMC meeting, so it will be keenly watched. However, I would wager a great deal it will continue to harp on progress made but higher for longer to prevent any resurgence in inflation.

As to the dollar, right now, it is softening as market participants focus on the idea of Fed cuts and simultaneously reduce large, long USD positions. For now, I feel like lower is the way forward, but if we start to see increased hawkishness again because there is no landing, merely continued growth, look for the dollar to return to its winning ways.

Good luck

Adf