A century hence

The BOJ’s equities

May well have been sold

But policy rates

Were left unchanged yet again

What of inflation?

Finishing up our week filled with central bank meetings, the BOJ left rates untouched last night, as universally expected, and really didn’t indicate when they might consider the next rate hike. Ueda-san has the same problem as Powell-san in that inflation continues to run hotter than target while the economy appears to be struggling along. In addition, the political situation in Tokyo is quite uncertain as PM Ishiba has stepped down and a new LDP leadership election is set to be held on October 4th with the two leading candidates espousing somewhat different views of the future. If I were Ueda, I wouldn’t do anything about rates either. Interestingly, there were two dissents on the BOJ board with both calling for another rate hike.

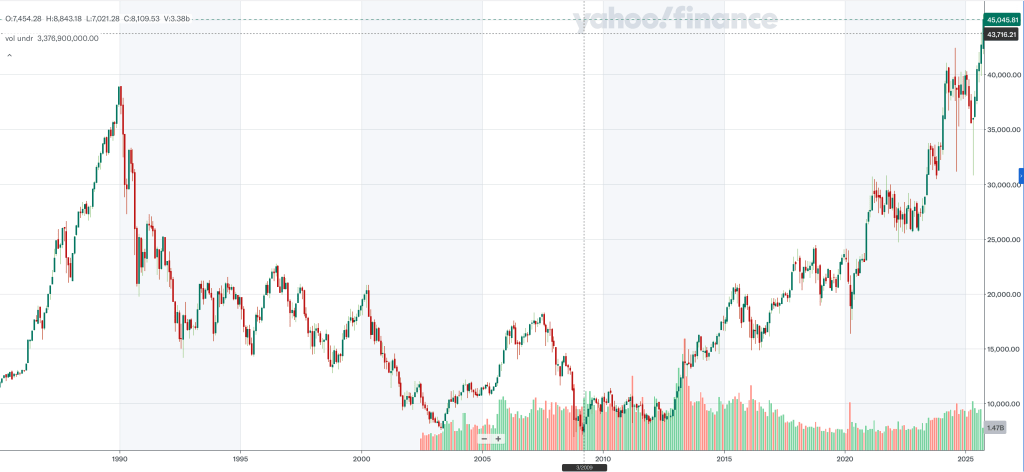

But there was a policy change, albeit one that does not feel like it is going to have a significant impact for quite some time. The BOJ has decided to start to sell its equity and ETF holdings, which currently total about ¥37.2 trillion, at the annual rate of…¥330 billion. At this pace, it will take almost 113 years for the BOJ to unwind the “temporarily” purchased equities acquired during the GFC to support the market. While the Nikkei initially fell about 2% after the announcement, it rebounded over the rest of the session to close lower by a mere -0.6%. However, in a strong advertisement for the concept of buy and hold, a look at the below chart shows when they started buying and how well the BOJ has done.

Source: finance.yahoo.com

There is no indication that the BOJ has unrealized losses on their balance sheet like the Fed does!

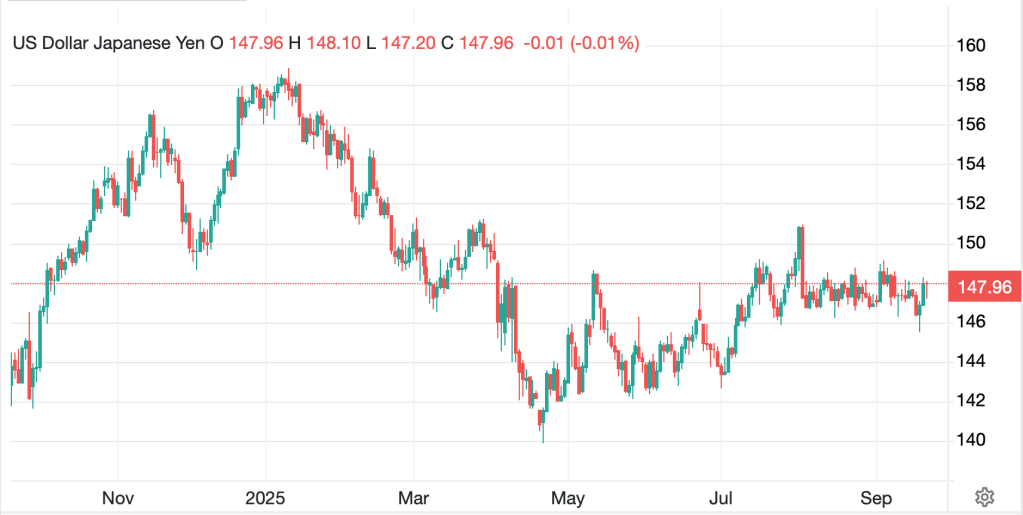

What of USDJPY you might ask? And the answer is, nothing. It is essentially unchanged on the day and in truth, as you can see from the chart below, it has done very little for the past 5+ months, trading at the exact same level as prior to the Liberation Day tariff announcements. While there was an initial decline in the dollar then, that was a universal against all currencies, but we are back to where we were.

Source: tradingeconomics.com

Consider, too, that over the course of the past year, the Fed has cut Fed funds by 125bps while the BOJ has raised their base rate by 60bps, and yet spot USDJPY is effectively unchanged. Perhaps, short-term interest rate differentials aren’t always the driver of the FX market after all.

In fact, there is a case to be made that the driver in USDJPY is the capital flowing out of Japan by fixed income investors as they seek a less chaotic situation than they have at home. This could well be the reason for the ongoing rise in long-dated JGB yields to record after record, while Treasury yields seem to have found a top. Recall, in the latest 10-year auction, dealers took down only 4% of the auction with foreign interest rising to 71%. While there has been much discussion amongst the punditry of how nobody wants to buy Treasuries and they are no longer the haven asset of old, the nobody of whom they speak are foreign central banks. But foreign private investors seem pretty happy to scoop them up and are doing so at a remarkable pace. I think there are a few more years left before the dollar disappears.

Ok, let’s tour the markets here as we reach the end of the week. Record highs across the board in the US yesterday as investors apparently decided that the Fed was just like Goldilocks, not too hawkish and not too dovish. And the hits keep on coming this morning as futures are all higher by about 0.25% at this hour (7:15). As to Asia, we discussed Japan already, and both China and HK were unchanged. But elsewhere in the region, the euphoria was not apparent as Korea, India, Taiwan, Singapore and Thailand all fell by at least -0.3% or more while Australia, New Zealand and Indonesia were the only gainers, also at the margin on the order of 0.3% or so.

Europe this morning is also mixed with the DAX (-0.2%) lagging after weaker than expected PPI data indicated that economic activity is slowing more rapidly than anticipated, while both the CAC (+0.2%) and IBEX (+0.4%) are edging higher absent any new data. There was a comment by an ECB member, Centeno from Portugal, that the ECB needs to be wary of “too low” inflation, a particularly tone-deaf comment after the past several years! But I guess that is the first hint that the ECB is ready to cut again.

In the bond market, Treasury yields have been bouncing since the FOMC meeting and are now higher by 13bps since immediately after the FOMC statement. Again, my view is this is a case of selling the news after the market was pricing in the rate cut ahead of the meeting. I would argue that no matter how you draw the trend line of the decline in yields over the past several months, we are nowhere near testing it.

Source: tradingeconomics.com

And in what cannot be a surprise, European sovereign yields are all rising alongside Treasuries, with today’s bump up of another 1bp to 2bps adding onto yesterday’s 5bp to 7bp raise across the board. As well, we cannot ignore JGBs which have jumped 4bps after the BOJ meeting last night. I guess Japanese investors didn’t get any warm and fuzzy feelings about how Ueda-san is going to fight inflation.

Turning to commodities, oil (-0.4%) remains firmly within its recent range, ignoring Russai/Ukraine news as well as inventory data and economic statistics. I don’t know what it will take to change this equation, but it certainly seems like we will be in this range for a while yet. Peace in Ukraine maybe does it, or a major escalation there. Otherwise, I am open to suggestions. Gold (+0.2%) continues to be accumulated by central banks around the world as well as retail investors in Asia, although Western investors appear oblivious despite its remarkable run. Silver (+0.7%) too is rallying and has been outperforming gold of late. Perhaps of more interest is that the precious metals are doing so well despite the dollar’s rebound in the FX markets.

Speaking of which, this morning the dollar is firmer by 0.25% to 0.4% vs most of its G10 counterparts although some of the Emerging Market currencies are holding up better. So, the euro (-0.25%), pound (-0.5%), AUD (-0.25%), CHF (-0.35%) and SEK (-0.6%) are defining the G10 with only the yen (0.0%) bucking the trend. As to the EMG currencies, HUF (-0.65%), KRW (-0.6%) and PLN (-0.3%) are the laggards with the rest showing far less movement. However, while short dollar positions are rife, there is not much joy there lately. I grant that the trend in the dollar is lower, and we did see a new low for the move print in the immediate aftermath of the FOMC meeting, but it appears that people have not yet abandoned the greenback entirely. Perhaps the lure of more new record highs in the stock market is enough to get foreigners to reconsider their “end of American exceptionalism” idea.

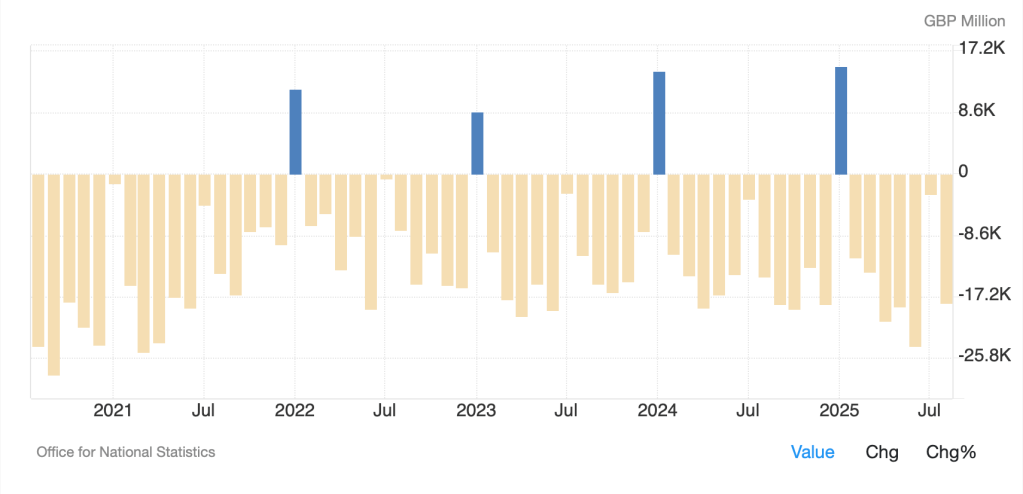

There is no data today nor are any Fed speakers on the calendar. Perhaps the most notable data we have seen is UK Public Sector Net Borrowing, which fell to -£17.96B, a massive jump from last month and much worse than expected. As you can see from the chart below, while there is much angst over US budget deficits, at least the US has the reserve currency on which to stand. The UK has nothing, and the fiscal situation there is becoming more dire each day. Yet another reason that the Starmer government can fall sooner rather than later.

Source: tradingeconomics.com

It is hard to look at that chart and think, damn, I want to buy the pound!

For all the hate it gets, the dollar is still the cleanest dirty shirt in the laundry, and while it may trade somewhat lower in the near term, it will find its legs and rebound.

Good luck and good weekend

Adf