The warmups in Davos for Trump

With Howard and Scott on the stump

Quite clearly explained,

While WEFers complained,

The US was, no more, the chump

The globalist world that existed

Is no longer to be assisted

Instead, US goals

Align with Trump’s polls

No matter the words WEF has twisted

As we await President Trump’s address in Davos this morning, it is worth recapping the highlights from yesterday’s US speakers, Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent. Starting with Lutnick, he explained the White House view as follows; “The Trump Administration and I are here to make a very clear point—globalization has failed the West and the United States of America. It’s a failed policy… and it has left America behind.” The video is linked above in his name. It is hard to misunderstand what he is saying, and that is very clearly US policy.

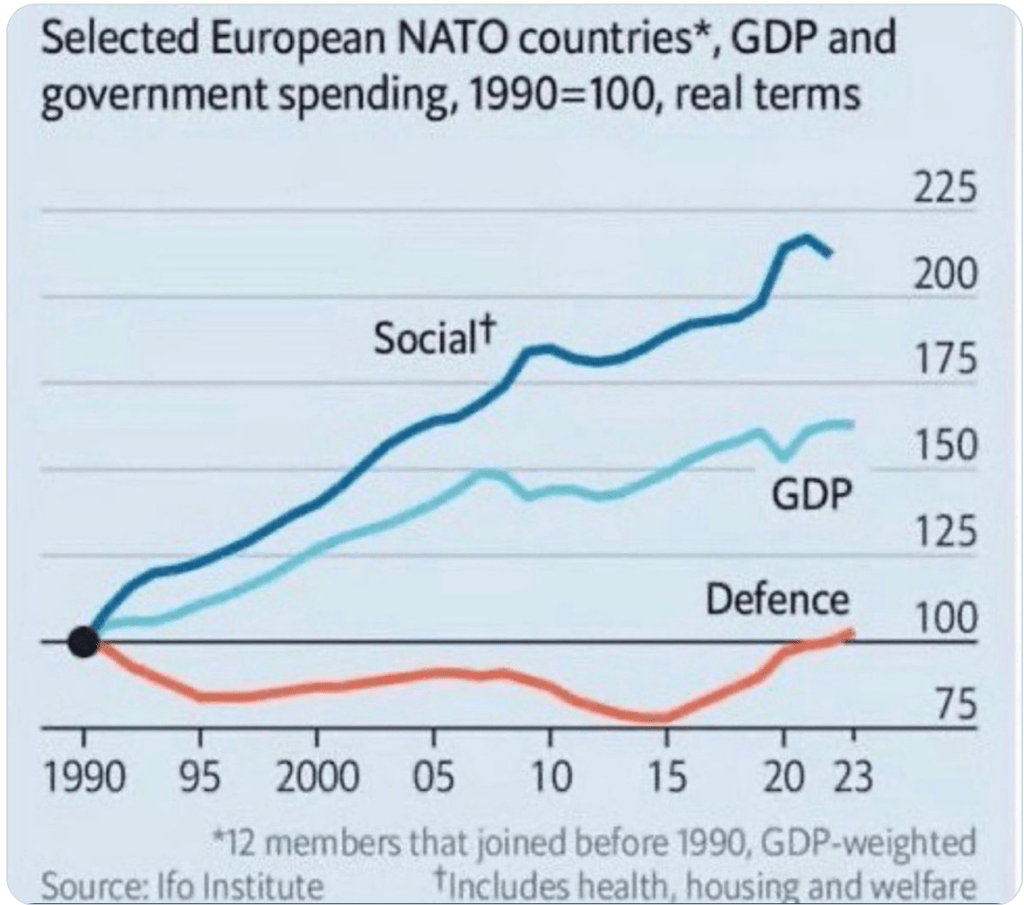

Turning to Secretary Bessent, he explained that the US has spent $22 trillion more than the rest of NATO since 1980 on defense while Europe and Canada created their welfare states. “The Europeans have been spending the money on social welfare, on roads, on education, and it’s time for them to pay more, which they’ve agreed to do.” The video clip is linked to his name in the first stanza. The below graph is telling:

At the same time, Europe continues to buy Russian oil, funding Russia’s war against Europe.

Needless to say, Europeans were unhappy with the commentary as they appeared to be coming under attack from the US. The market narrative quickly framed around President Trump going too far and how it was going to destroy the US as nobody will want to invest in the US. That is the explanation for yesterday’s decline in US equities (although they fell around the world), the dollar and Treasury bonds (although bonds, too, fell everywhere, notably in Japan).

Yesterday I sought to disabuse you of the notion that Europe is going to sell all their Treasuries to hurt the US as the results would likely be either irrelevant or horrific for Europe. So, the narrative pivoted to Trump is bad and destroying the US.

And yet, remarkably, the world did not end either yesterday or last night, despite what many have explained is inevitable. This morning markets are somewhat less catastrophic. It makes sense that markets are going to remain volatile as the underlying theses for international relations adjust to the new reality of power politics and economic statecraft from the previous “Rules Based Order”. And at this stage, there is no way to know which outcomes are most likely. The only thing of which I am confident is that we have not seen the end of this play out.

I must admit, that while I don’t think President Trump cares much about France and President Macron’s comments seeking more Chinese investment in that nation, I suspect that PM Carney’s efforts to cozy up to President Xi will be less welcome based on the Donroe Doctrine of US dominance in the Western Hemisphere. But I also believe that the power structure between the US and Canada is such that it will ultimately bend to the US’s will.

So, let’s review market activity overnight as we await President Trump’s comments, which I understand have been delayed until 11:30 EST this morning. Yesterday’s sharp declines around the world have been followed by less dramatic activity last night and so far today. In Asia, Tokyo (-0.4%) slipped a bit further, but hardly dramatically, as FinMin Katayama focused on the JGB market in comments made in Davos. “Since last October, our fiscal policy has consistently been responsible and sustainable, not expansionary, and the numbers clearly demonstrate that. I’d like everyone in the market to calm down.” I’m sure she would. And it worked with JGB yields slipping -8bps and 30yr yields falling -17bps. Elsewhere in Asia, China was flat, HK (+0.4%) rallied a bit along with Korea (+0.5%) while Taiwan (-1.6%) led the way lower across numerous other regional markets.

In Europe, red is today’s color led by Germany (-0.7%) and Spain (-0.5%) although France and the UK have both only ceded -0.1% so far during the session. The discussion here continues to revolve around President Trump, the trade deal, and potential new tariffs on nations that try to prevent the US from its Greenland desires. As to US futures markets, at this hour (6:45) they are slightly firmer, +0.1%, so not yet, at least, indicating the end of the American investment thesis.

As to the rest of the bond market, away from Japan, yields are basically -1bp lower across Treasuries and European sovereigns as investors await Mr Trump’s comments. Again, the mooted collapse in the US bond market has yet to appear. However, there is a popular meme about the Danish pension fund, Akademikerpension, which has announced that it will sell all its US Treasuries by the end of the month, a total of $100 million, due to its perception of increased credit risk. This has been fodder, though, for those who continue to believe that Europe is going to ditch their Treasuries, and many are calling it a signal. While certainly a trendy decision, I see it as noise, not signal.

Turning to commodities, one cannot be but impressed with gold’s consistency of late. It has risen another 2.1% this morning and is now nearing $4900/oz. I guess $5000/oz is right around the corner. Looking at the long-term chart below, we have seen a monster rally for the past two years.

Source: tradingeconomics.com

FWIW, which may not be much, I continue to see this as a commentary on all fiat currencies, not the dollar per se as evidenced by the table I created from data on goldbroker.com. While you can see that the dollar has definitely underperformed during the past year (which we already knew given the early year 10% decline vs. the euro and pound, over time, it is hard to make the case that other currencies are any better. In fact, I find it particularly surprising that the rand has performed so poorly given its seeming benefits when gold rallies. And of course, it is no surprise that the yen which has been having a really tough time, is the worst of the lot.

| Historical Returns of Gold | ||||

| Currency | 1 Month | 1Year | 5 Year | 10 Year |

| EUR | 9.54% | 54.22% | 164.28% | 300.85% |

| JPY | 10.02% | 76.45% | 288.91% | 481.02% |

| USD | 9.62% | 73.45% | 154.49% | 331.44% |

| GBP | 9.13% | 59.31% | 160.26% | 357.37% |

| MXN | 7.04% | 47.93% | 127.14% | 305.03% |

| ZAR | 7.35% | 53.89% | 179.88% | 327.69% |

As to the other metals, silver (0.0%) seems to be getting tired after its move and has done little over the past several sessions. Platinum (+1.0%) seems to still have life as does copper (+0.75%). Turning to energy markets, oil (+0.3%) is trying to figure out whether the geopolitics is going to blow up or fade away and remains right around $60/bbl. But given the temperature here in New Jersey is 1° this morning, we cannot be surprised that NatGas (+21.5%) has exploded (no pun intended) higher.

Finally, the dollar is a touch softer this morning, but not very much. The euro is unchanged, and the pound, after some lousy inflation data, has fallen -0.2%. But JPY (+0.2%) is offsetting that, arguably responding to FinMin Katayama’s comments, although elsewhere, KRW (+1.1%) rebounded after comments from President Lee Jae Myung sought to sooth investors and explain that the government would continue to work to boost economic growth with new policies. But once again, my recent favorite chart of the DXY shows that this is not a USD story.

Source: tradingeconomics.com

On the data front, aside from the President’s speech today, nothing but tomorrow brings the real data.

| Thursday | Q3 GDP | 4.3% |

| Q3 Price Index | 3.7% | |

| Initial Claims | 212K | |

| Continuing Claims | 1880K | |

| Personal Spending (Nov) | 0.5% | |

| Personal Income (Nov) | 0.4% | |

| PCE (Nov) | 0.2% (2.8% Y/Y) | |

| Core PCE (Nov) | 0.2% (2.8% Y/Y) | |

| Friday | Flash PMI Manufacturing | 52.1 |

| Flash PMI Services | 52.8 | |

| Michigan Sentiment | 54.0 |

Source: tradingeconomics.com

Don’t forget that next week the FOMC meets, but on the Fed story, today Governor Cook’s case about dismissal will be heard at the Supreme Court, which is, potentially, a much bigger deal. If the Fed is not protected from Presidential authority, that will certainly change many views on the future, and likely initially, see the dollar and bond markets decline while stocks rally. But that decision won’t come for months, and remember, we are still awaiting the tariff decision.

There is much we don’t know and volatility remains the most likely outcome. Be careful out there.

Good luck

Adf