There’s no one surprised that the Fed

Did nothing, and here’s what Jay said

We’re not in a hurry

To cut, but don’t worry

If things change, we can cut ahead

The narrative now has returned

To Trump, which has many concerned

That in the short run

The things that he’s done

Will leave many traders heartburned

As universally expected, the Fed left policy unchanged yesterday. Everything we had heard from FOMC members prior to the quiet period indicated they had to be patient to see how things played out regarding the impact of tariffs. Apparently, Chairman Powell used the term “wait” or some version of that idea 22 times in the press conference. Tomorrow, the Fed speakers hit the circuit again, but absent some change in data, which will take at least another month or two, I don’t see that the Fed is relevant again for a while.

I will note that the market is currently pricing only about a 17% chance of a cut at the June 18 meeting though they are still pricing in 3 cuts for the year. It appears that the idea of a H2 recession is gaining ground amongst both the punditry and the futures market.

However, contra to that message, the bigger news of the day is that President Trump will be announcing, at 10am, the first trade deal in the new era, this one with the UK. It strikes me that this should be the easiest of trade deals to negotiate since both economies produce the same types of things. Neither has a labor cost advantage, and there is great commonality between them with respect to the overall culture. Arguably, the biggest advantage the US has is its energy sector has not been destroyed by the government, something PM Starmer is working hard to accomplish on his end. Realistically, the trade deal here is going to be more about services than goods I suspect, given that’s what drives both economies. I guess we will learn later today.

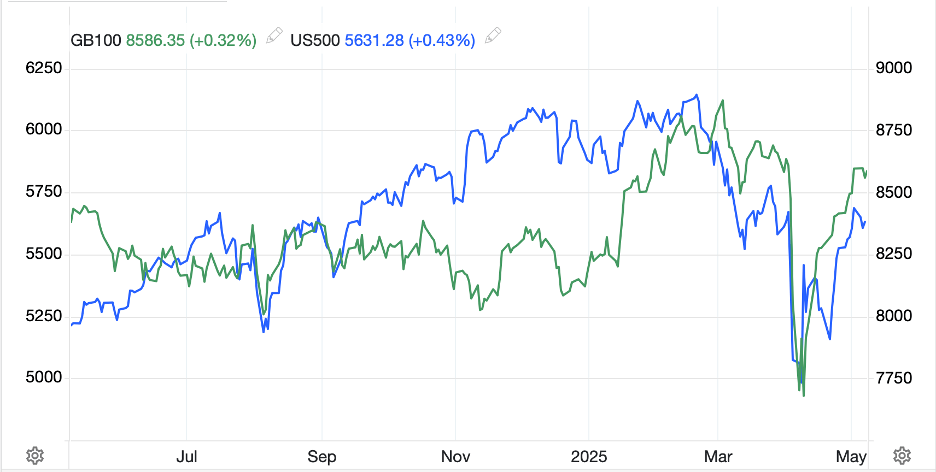

In a modest surprise, UK equities (FTSE 100 +0.4%) do not seem to see the benefits of such a deal, as they lag most of the rest of Europe. Too, the BOE is expected to cut its base rate by 25bps this morning, which in isolation would ordinarily be seen as a positive for stock markets. Perhaps, this is why the UK is the first to say yes, things there may be worse than meet the eye. After all, the stock market there is higher by just 2% in the past year, hardly a breathtaking performance. In fact, as you can see below, the FTSE 100 and S&P 500 have had very similar performances this year, tracking each other closely, although despite all the angst about recent volatility in US markets, the S&P is still 8% higher in the past year, decently outperforming the UK.

Source: tradingeconomics.com

Stepping back for a moment from individual markets, my take is the following: President Trump is keen to sign a number of key trade deals in this 90-day window. If they agree deals with the UK, Japan, South Korea, Taiwan, Canada and Mexico, all of which seem quite possible, it will reduce the uncertainty and accompanying stress in markets. If, as well, Congress can get the ‘big, beautiful budget bill’ passed, thoughts of recession will quickly dissipate. Obviously, the China trade talks will still be outstanding, but both sides need to find a solution here. While the punditry in the US will continue to harp on how those tariffs are going to kill the US economy, China has already shown they are having problems and need to come to an agreement. It is quite possible that Mr Trump can be successful in his aims to reorder the nature of world trade such that the US reduces its deficits without destroying the world. I think I am going to take the over on this question.

In the meantime, let’s see how markets have behaved overnight. Yesterday saw US equity markets rally modestly after the Fed and that followed through in Asia, with modest gains being the best description. The Nikkei (+0.4%), Hang Seng (+0.4%) and CSI 300 (+0.5%) all seemed to benefit from the US and hopes for a reduction in trade anxiety. Of note in Asia was India (-0.5%) and perhaps more tellingly Pakistan (-6.0%) as the escalation in military conflict between those two nations has grown even hotter. I expect that market impact will remain more isolated as neither market is a key destination of foreign capital, at least if the actual military conflict doesn’t spread into other areas.

Turning to Europe, both Germany (+1.1%) and France (+1.0%) are having very good days with both markets ostensibly responding to the news of the impending UK trade deal and perhaps some hopes there will be one with the EU. As well, German IP data was released at a much better level than expected (3.0% vs. 0.8% expected), an indication that companies there are gearing up for all that mooted military spending. As to US futures, at this hour (7:00) they are all higher by at least 1.0% with the NASDAQ higher by 1.6%.

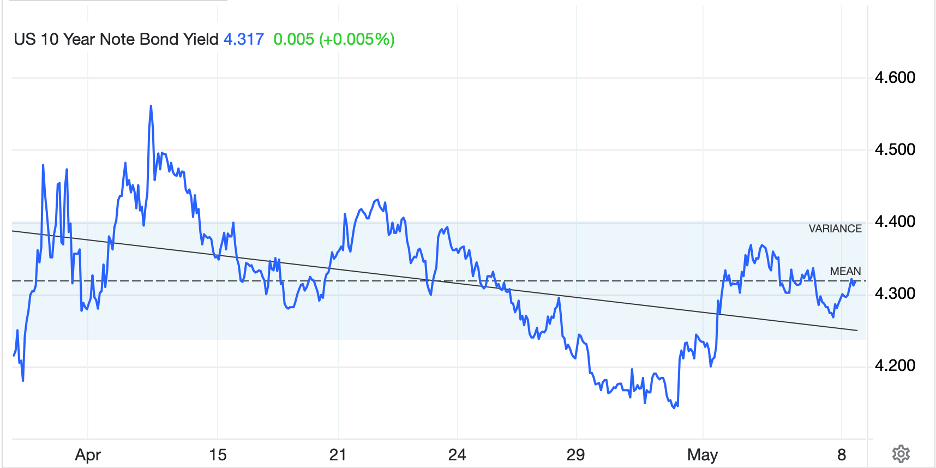

In the bond market, Treasury yields are higher by 4bps this morning, having recouped the declines yesterday. But still, the 10-year hovers either side of 4.30% and has done for the past month as you can see in the chart below. If anything, it appears that the trend remains toward modestly lower rates.

Source: tradingeconomics.com

In Europe, sovereign yields are also climbing slightly, higher by between 2bps and 3bps this morning and we saw similar movement in JGB markets overnight. Frankly, bond markets have not been very exciting lately.

In the commodity markets, oil (+1.6%) is continuing its recent bounce from the lows seen Sunday night, but WTI remains below $60/bbl. There is growing talk that at current prices, capex is going to decline and supply along with that, but you cannot look at what is happening in Guyana, for instance, as they seek to exploit the massive new oilfield discovered in their coastal waters last year and think that oil supply is going to shrink. As well, OPEC+ looks set to produce all out. I do not see a good case for higher oil prices in the near term. Meanwhile, gold (-1.0%) is giving back some of its recent rebound gains, but nothing about the recent price action indicates to me that the bigger picture trend higher is over. However, today, it is weighing on both silver (-0.2%) and copper (-0.8%).

As aside about copper. The red metal has been nicknamed Dr Copper given its importance in industrial activity. Hence, when demand is strong, it foretells strong economic activity and vice-versa. With that in mind, what does the below chart of copper tell you about economic activity?

Source: tradingeconomics.com

What it tells me is that this, too, is a former economic signal that had been reliable in the old world view but has lost its way as a signpost of future activity in the new world view.

Finally, the dollar is modestly stronger this morning, most notably vs. the yen (-0.6%) and INR (-0.8%). The latter is clearly suffering on the impacts of some negative military news, having lost several fighter jets and drones, while the former seems to be responding to the story that Mr Trump will not lower tariffs with China ahead of the first meetings that are upcoming this weekend, and that had been demanded requested by the Chinese to start talking. Too, NZD (-0.6%) is softer but elsewhere, there is far less of interest overall with the euro unchanged and the pound edging higher by 0.25% after the BOE cut rates 25bps, as expected, but the vote was 7-2, with two MPC members voting for no change, a slightly more hawkish outcome than expected.

On the data front, this morning brings the weekly Initial (exp 230K) and Continuing (1890K) Claims data as well as Nonfarm Productivity (-0.7%) and Unit Labor Costs (5.1%). Yesterday’s EIA oil inventory data showed modest draws, as expected and didn’t seem to matter much to the market. It is difficult to get too excited about much these days as the landscape remains highly uncertain. If, and it’s a big if, President Trump can come to agreement on trade deals with a number of countries, I suspect that we will see uncertainty wane and markets continue higher. But the Fed won’t be cutting rates in that scenario. Ultimately, though, I do believe that a lower dollar will be part of many of these deals, and for now, a lower dollar still seems the most likely outcome.

Good luck

Adf