The Minutes according to Jay Explained more rate hikes are in play At least that’s the spin From media kin But could that lead us all astray?

Yesterday’s key news was the release of the FOMC Minutes. The market read, at least the headline read, was that they were hawkish which played a key role in the equity market decline in the afternoon, as well as the bond market decline leading to the highest 10yr yields since 2008. Below is what I believe is the key paragraph from the Minutes with my emphasis.

“With inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see significant upside risks to inflation, which could require further tightening of monetary policy. Some participants commented that even though economic activity had been resilient and the labor market had remained strong, there continued to be downside risks to economic activity and upside risks to the unemployment rate; these included the possibility that the macroeconomic effects of the tightening in financial conditions since the beginning of last year could prove more substantial than anticipated. A number of participants judged that, with the stance of monetary policy in restrictive territory, risks to the achievement of the Committee’s goals had become more two sided, and it was important that the Committee’s decisions balance the risk of an inadvertent overtightening of policy against the cost of an insufficient tightening.”

It strikes me that based on the fact we have already heard from two FOMC voting members, Harker and Williams, that rate cuts are on their mind for 2024, and the lines I have highlighted above, the once unanimous view of a hawkish Fed is beginning to fall apart. Now, if the data continues to outperform expectations like it has recently (consider the Retail Sales data from Tuesday) I expect the FOMC to maintain their hawkishness. The Atlanta Fed’s GDPNow forecast has just risen to 5.75%, far above trend growth and certainly no implication for the end of tightening. But remember, that is a volatile series, and we are a long way from the end of Q3. Ultimately, I suspect that a growing number of FOMC members are starting to get queasy over the higher for longer mantra given the equity market’s recent shudders. We shall see.

The Chinese are starting to feel That Xi’s given them a raw deal The yuan keeps on falling While growth there is stalling And values of homes are unreal

The PBOC was pretty vocal last night as they explained all the things they are going to do to manage a clearly deteriorating situation in China. Here are some of the comments they released:

PBOC: TO MAKE CREDIT GROWTH MORE STABLE, SUSTAINABLE

PBOC: TO USE VARIOUS TOOLS TO KEEP REASONABLY AMPLE LIQUIDITY

PBOC: TO RESOLUTELY PREVENT OVER-ADJUSTMENT IN EXCHANGE RATE

PBOC: TO OPTIMIZE PROPERTY POLICIES AT APPROPRIATE TIME

PBOC: CHINA IS NOT IN DEFLATION RIGHT NOW

PBOC: LOCAL FISCAL BALANCE PRESSURE INCREASING

PBOC: HAS EXPERIENCES, TOOLS TO SAFGUARD STABLE FOREX MARKET

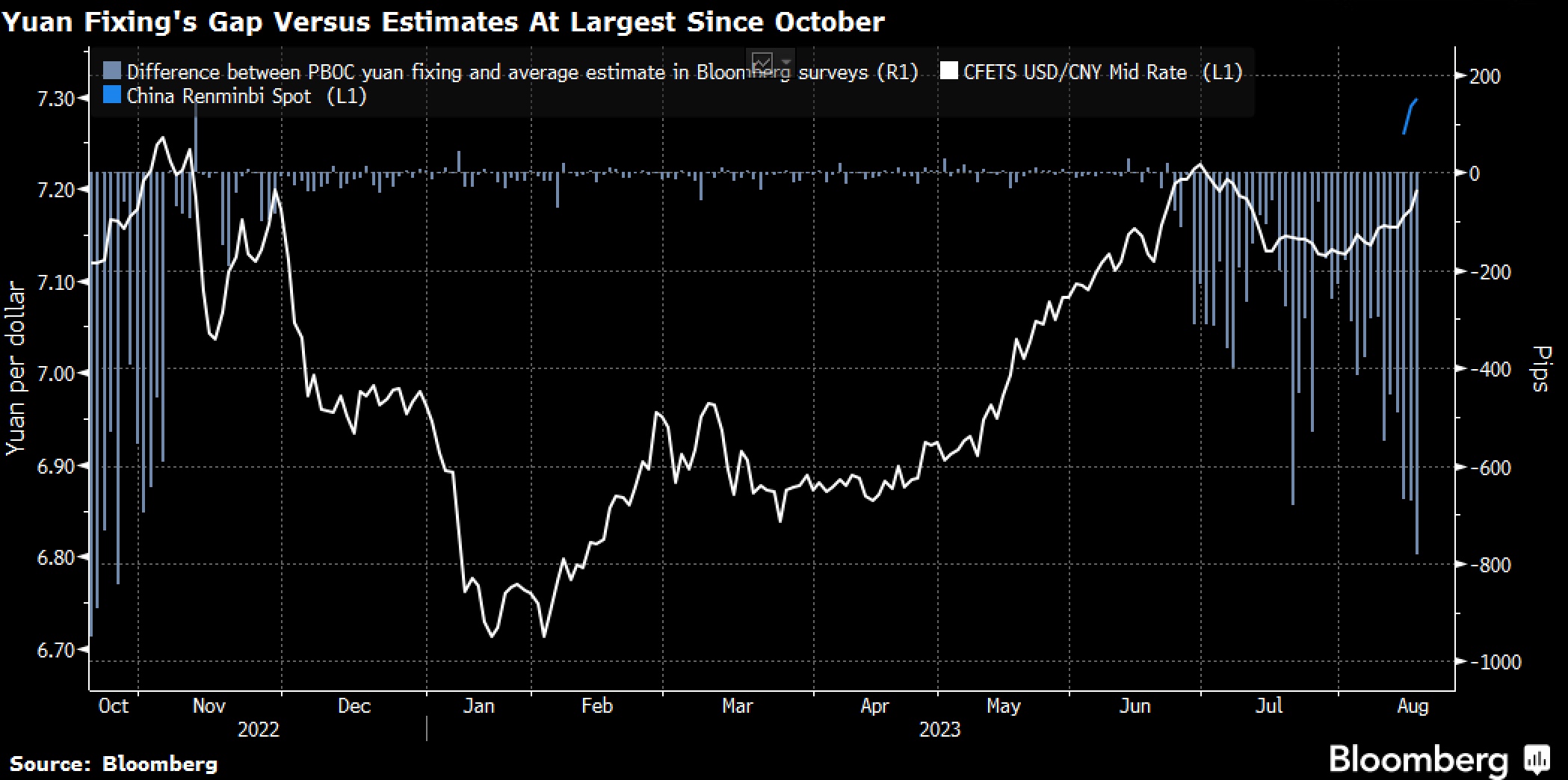

Which was followed by the following headline, CHINA TOLD STATE BANKS TO ESCALATE YUAN INTERVENTION THIS WEEK.

Add it all up and the Chinese are getting increasingly worried. There is a great chart in Bloomberg today that shows the change in house prices across China, which puts paid to the official narrative that prices have fallen just 2.4% from the August 2021 highs. They have clearly fallen a lot more as evidenced by this chart and the comments above.

In the end, the Chinese have a lot of work to do to keep their economy going. While they remain concerned over the weakening CNY, it is clearly one of the best relief valves they have, and it will slowly weaken further. Money is leaving the country.

An attitude change Is becoming apparent No JGBs please!

And finally last night the BOJ auctioned off some 20yr JGBs and the auction results were awful. The tail was the widest, at nearly 8bps, since 1987, while the spread between 10yr and 20yr bonds widened by nearly 5bps. It seems that demand was not nearly as robust as had been expected. Given that nominal yields in the 20yr are 1.35% and CPI is 3.2% core, it is not that surprising. Bonds everywhere are losing their luster, at least longer duration bonds, and I see no reason for that trend to end until economic activity is clearly declining. China’s woes have not yet bled to either the US or Japan, while inflation remains sticky. Today, globally yields are higher by between 4bps and 6bps. This process still has more to go in my estimation.

Which brings us to the rest of the overnight session, where after another weak equity performance in the US, we saw Japan and non-China Asia soften, although Chinese markets held in on the back of the PBOC comments and promises of more support for the economy there. European bourses are somewhat softer this morning but nothing dramatic and at this hour (7:30) US futures are higher by about 0.25% across the board.

Oil prices (+0.9%) have rebounded and after a brief foray below $80/bbl have recaptured that key level. Metals prices are also firmer this morning across the board as both base and precious varieties see demand. This seems largely in line with the fact the dollar is under modest pressure this morning.

And the dollar is under modest pressure this morning, at least vs. the G10, where every currency is firmer, but the moves are very small. NOK (+0.4%) is the leader on the back of the oil move, but everything else is higher by between 0.1% and 0.25%. In the emerging markets, the picture is a bit more mixed, with some gainers (ZAR +0.45%, HUF +0.35%) and some laggards (MYR -0.55%, PHP -0.5%) with both those currencies feeling pressure from concerns their respective central banks will not maintain the inflation fight.

On the data front, we see Initial (exp 240K) and Continuing (1700K) Claims as well as Philly Fed (-10.4) and Leading Indicators (-0.4%). The data continues to have both highs and lows with yesterday’s IP jumping 1.0%, much better than expected, but the Empire Mfg data on Tuesday a very weak -19. There are no Fed speakers today so I expect much will depend on whether or not dip buyers emerge in the equity markets. It feels like we are teetering on the edge of a bigger risk-off move with another 10% down in equities entirely possible. In that event, I do like the dollar to show resolve.

Good luck

Adf