Though Trump has been leading the news

With folks asking who he will choose

As agency chiefs

That share his beliefs

For markets, today brings new cues

Inflation will soon be released

And though Jay claims he killed this beast

The data this morning

May well be a warning

Inflation, in fact, has not ceased

Source: tradingeconomics.com

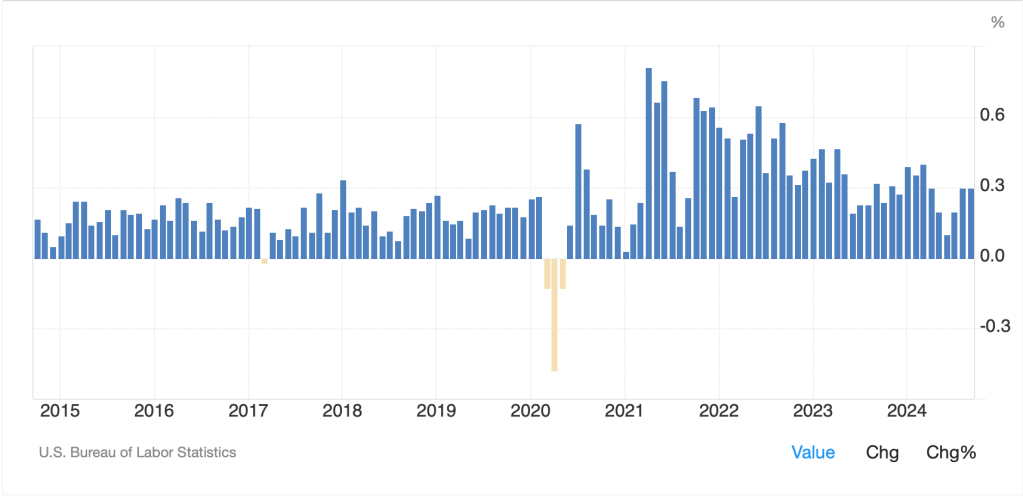

Beauty (and everything else) is in the eye of the beholder. So, what are we to make of the above chart which shows the past ten years’ worth of monthly Core CPI readings prior to this morning’s release. Some eyes will travel to the peak in April 2021 (0.812%) and see a downward sloping line from there. The implication is that the trend is your friend and that things are going well. Others will gravitate to the June 2023 print (0.195%) and see that except for a blip lower in June 2024 (0.1%), the series looks like it may have bottomed and, if anything, has found a new home.

Remember, that if the monthly print is 0.3%, that annualizes to 3.7% Core CPI. That seems pretty far above the 2.0% target that the Fed is shooting for and would call into question exactly why they are cutting interest rates. In fact, you can look at the above chart and see that prior to the pandemic, core CPI on a monthly basis was below 0.3% every month except one, with many clearly down near the 0.1% level.

As much as Powell and his minions want to convince us that inflation is heading back to their goal and everything is ok, the evidence does not yet seem to be pointing in that direction. For today, current median analyst expectations are for a headline of 0.2% M/M, 2.6% Y/Y and a core of 0.3% M/M, 3.3% Y/Y. Even if the data comes as expected, it would seem very difficult to justify continuing to cut rates given the equity market remains essentially at all-time highs, while Treasury yields (-1bp today, +12bps yesterday) seem like they are starting to price in higher long-term inflation.

However, something interesting seems to be happening with the Fed speakers. Richmond Fed President Barkin yesterday explained that things look pretty good, but declined to even consider forecasting where things will go. As well, Minneapolis Fed President Kashkari indicated that while inflation has declined, it does not yet seem dead. The Fed funds futures market is now pricing just a 62% probability of a rate cut in December. One month ago, it was pricing an 84% probability. As I have maintained, it seems increasingly difficult for the Fed to make the case that rate cuts are necessary given the economic data that we continue to see. I understand that there are still a large group of pundits who believe things are much worse when you dig under the surface of the data, and I also understand that most people in the country don’t believe that things are going that well, hence the landslide election results for Mr Trump. However, based on the data that the Fed allegedly follows, rate cuts seem difficult to support. Today will be another piece of the puzzle. If the data is hot, I expect risk assets to suffer more and the dollar to continue its rally. If the data is soft, look for new records in stocks while the dollar retraces some of its recent gains.

With that in mind, let’s look at what happened overnight in markets. Yesterday’s modest declines in the US market were followed by more selling than buying in Asia with the Nikkei (-1.7%) leading the way lower but weakness also seen in Australia (-0.75%), Korea (-2.65%), India (-1.25%) and Taiwan (-0.5%) as an indication of the general sense in the time zone. The outlier here was mainland China (+0.6%) where hope remains eternal that the government will fire their bazooka. In Europe, though, this morning is seeing a hint of red with most major indices lower by just -0.1% and Spain’s IBEX (+0.2%) even managing a small gain. The commentary from the continent is over fears of how things will evolve with the new Trump administration and his threat of more tariffs on European exports.

But here’s something to consider. If Trump is successful in quickly negotiating an end to the Russia/Ukraine war, won’t that be a huge benefit to Europe? After all, if the war is over, they will be able to restart imports of cheap Russian NatGas which should have an immediate impact on their overall cost of energy, especially Germany, and help the economies there substantially. I know they love to scream because they all hate Trump, but it seems like he could help them a lot if they would let him. Oh yeah, US futures are a touch lower, -0.2%, at this hour (7:10).

Anyway, in the bond market, after yesterday’s rout in the US, yields are little changed this morning but in Europe, yields are climbing as they weren’t able to keep up with US yields yesterday. So, on the continent, yields are higher between 2bps and 4bps after rising 4bps – 6bps yesterday. In Asia, JGB yields jumped 4bps on the global rise in bond yields and are now back above 1.0%. However, that has not been nearly enough to help the yen (-0.2%), which continues to weaken and is pushing back above 155.00 this morning.

In the commodity markets, oil (+0.2%) is edging higher, but that seems to be consolidation after what has been a pretty awful week for the black sticky stuff. OPEC reduced its demand forecasts for the 4th consecutive month, something else that is weighing on the price and, of course, the Trump administration is going to seek to make it much easier to explore for and produce more oil. In the metals markets, gold (+0.5%) seems to have found a temporary bottom along with silver (+0.8%) although the damage has been substantial this week. However, copper and aluminum remain under pressure as fears over continued weakness in China seem to be weighing on the price.

Finally, the dollar has stopped rising sharply, although it is not really declining very much, at least not vs. the G10 currencies. In fact, vs. the G10, the dollar is softer by just 0.1% or so vs. the entire bloc other than the yen mentioned above. However, vs. the EMG bloc, the dollar has ceded some more gains with KRW (+0.7%) the leader but MXN (+0.4%), CNY (+0.35%) and ZAR (+0.6%) all bouncing back after a week of substantial declines. We all know nothing goes up or down in a straight line, so this consolidation is just that, it is not a trend change by any stretch. A quick look at the MXN chart below, which is essentially what we have seen everywhere, explains just how insignificant the overnight movement has been relative to the recent trend.

Source: tradingeconomics.com

On the data front, aside from the CPI data, we hear from three more Fed speakers (Logan, Musalem and Schmid) so it will be interesting to see if they are starting to change their sense of how things are going to progress. Of course, all eyes will be on Powell’s speech Thursday afternoon, but perhaps there are some clues to be had here.

It is not clear to me that anything has changed in the big picture. The US economy continues to be the strongest one around and now has the added impetus of expectations for more positivity with the change in the administration. In that environment, my long-term view on the dollar remains it has further to run.

Good luck

Adf