According to those in the “know”

It’s certain that tariffs will grow

But now some are saying

The timing is straying

From instant to something more slow

In what has been a generally quiet evening in the markets, the story that President-elect Trump is considering imposing all those tariffs on a gradual basis, rather than instantaneously when he is inaugurated, was taken as a bullish sign by investors. This seems to have been the driving force behind yesterday afternoon’s modest rebound in equity markets as the current market narrative is tariffs = bad, no tariffs = good. From what I can determine, these are anonymous comments not directly attributed to Trump or his incoming economics team and, in fact, Trump denied that possibility.

But the market impact was real as not only did equity markets rebound a bit, but the dollar, which had soared yesterday, has given back some of those gains and is modestly lower this morning. If we learned nothing else from President Trump’s first term, it should be clear that there is frequently a great deal of bombast emanating from the White House and responding to each and every comment is a recipe for exhaustion and disaster. While this cannot be ruled out, if one were to ascribe a Trumpian gospel it would be that tariffs are beautiful so slow-rolling them doesn’t really accord with that view. I guess we will all find out more next week.

Now, turning to data releases

This week its inflation showpieces

Today’s PPI

Is tipped to be high

While Wednesday the core rate increases

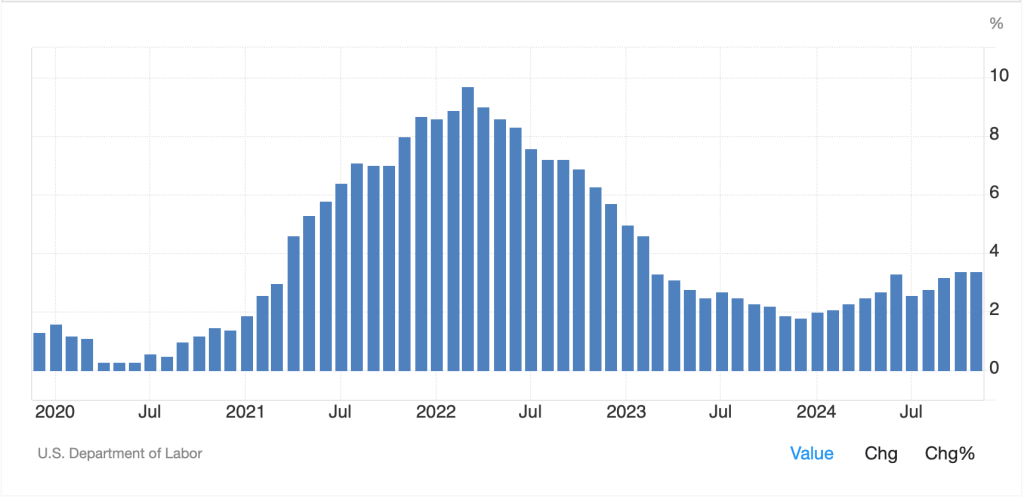

Away from that story, though, there has been little else of note overnight. As such, let’s focus on the PPI data this morning and CPI tomorrow as they ought to help inform our views on the Fed’s actions going forward. Expectations are for headline to rise to 3.4% Y/Y while core jumps to 3.8% Y/Y. It is difficult to look at a chart of these readings and not conclude that the bottom is in and the trend is higher.

Source: tradingeconomics.com

This is not to say that we are going to see price rises like we did back in 2022 as the waves of Covid spending washed through the economy, but the Fed’s mantra that inflation is going to head back to 2.0% over time is not obvious either. In fact, if I were a betting man, I would estimate that we are likely to continue to see inflation run between 3.5% and 4.5% for the foreseeable future. There is just nothing around to prevent that in the short run. Now, if we do see significant productivity enhancements, those numbers will decline, but my take is the best opportunity for that, more effective and widespread use of AI, is still several years away.

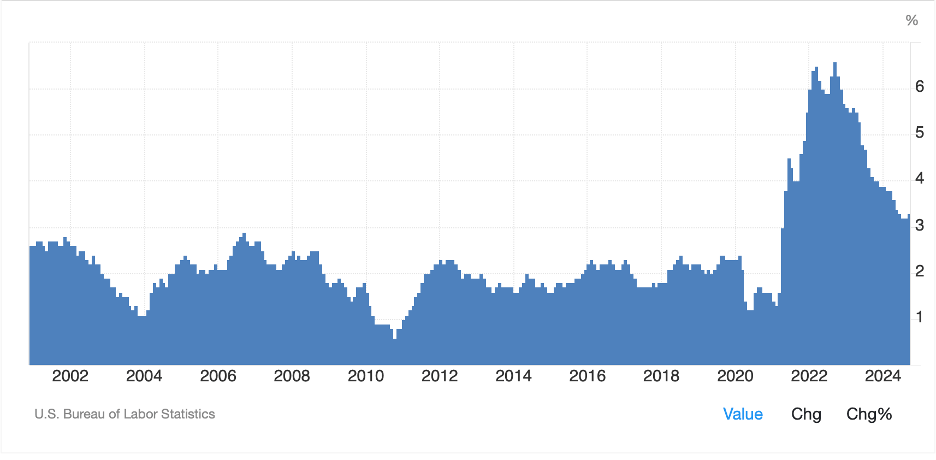

Remember, too, that the government writ large, whether headed by R’s or D’s is all-in on inflation as it is the only opportunity they have to reduce the real value of the outstanding government debt. Perhaps the Trump administration will take a different tack, but it is not clear they will be able to do so. The only time inflation is a concern is when it becomes a political liability. For the two decades leading up to Covid, it was not a daily concern of the population and central banks around the world were terrified of deflation! In fact, there are so many comments by folks like Yellen, Bernanke and other Fed governors and presidents decrying the fact that their key regret was not getting inflation high enough, it is difficult to count them. But as evidenced by the chart below of CPI, we no longer live in that world.

Source: tradingeconomics.com

Summing up, the current situation is that inflation has likely bottomed, the government continues to run massive fiscal deficits and given the $36 trillion in debt outstanding, the government needs to reduce the interest rate they pay on their debt. If pressed, I would expect that we will see synthetic yield curve control (YCC) enabled by regulatory changes requiring banks and insurance companies to own a greater percentage of Treasury notes and bonds in their portfolios to ensure there is sufficient demand for issuance. That can have the effect of turning long-term real yields negative, exactly the outcome the government wants. Remember, from 1944-1951, the Fed enacted YCC directly and it worked wonders in reducing the debt/GDP ratio. They know this tool and will not be afraid to use it.

Ok, let’s take a look at what little action there was overnight. After yesterday’s late rebound resulted in a mixed close with the NASDAQ still lower but the other two indices closing in the green, Asian equity markets also had a mixed picture. The Nikkei (-1.8%) was the laggard, seemingly following last week’s US market movement after reopening from a holiday weekend. However, Chinese shares (Hang Seng +1.8%, CSI 300 +2.6%) rallied sharply on the latest news that more Chinese stimulus was coming soon. This time the Ministry of Commerce claimed they would be looking to boost consumption this year, but neglected to mention how they will do so. Regardless, investors liked the story and when added to the gradual tariff story, it was all green.

European bourses are also in fine fettle this morning with gains across the board (CAC +1.2%, DAX +0.8%, IBEX +0.6%) and even the FTSE 100 (+0.1%) has managed to rally a bit. This price movement, and that of the rest of Asia where gains were seen, seems all to be a piece with the slower tariff story discussed above. As to US futures markets, at this hour (6:40), they are pointing modestly higher, 0.45%.

In the bond market, the only place where yields have moved significantly today is in Japan, where JGB yields have jumped 5bps and are now at their highest point since February 2011. This followed comments from Deputy Governor Himino that the board was likely to debate a rate hike at their meeting next week and market pricing has a 60% probability priced in for the move. There is much talk of wage increases in Japan, and Himino-san also raised questions about what the Trump administration will do and how it will impact yields. Interestingly, despite the more hawkish rhetoric, the yen (-0.25%) actually declined today, not necessarily what you would expect. As to the rest of the bond market, everything is within 1bp of Monday’s closing levels.

In the commodity markets, oil (-0.3%), which has been rocking lately on the increased Russia sanctions, is consolidating this morning although remains higher by nearly 6% this week and 12% in the past month. (As an aside, I don’t understand the Biden theory that sanctions driving up prices is going to be a detriment to Putin as he will make up for the loss of volume with higher prices, but then, I’m not a politician.). Meanwhile, NatGas (-3.2%) has backed off its recent highs as storage concerns ebb, although the ongoing cold weather appears to have the opportunity to push prices higher again. As well, the latest dunkelflaute throughout Europe is driving demand for LNG. In the metals markets, yesterday’s declines have been arrested, and we are basically unchanged this morning.

Finally, the dollar is mixed this morning, edging higher against some G10 counterparts (GBP -0.3%, JPY -0.4%) but sliding against others (NZD +0.6%). Versus the EMG bloc, again the picture is mixed today with gainers (ZAR +0.4%, KRW +0.3%) and laggards (CZK -0.2%) although overall, I would argue the dollar is a touch softer on the back of the gradual tariff story.

On the data front, this morning’s PPI data (exp 0.3% M/M, 3.4% Y/Y) headline and (0.3% M/M, 3.8% Y/Y) core is the extent of what is to come. Interestingly, the NFIB Index jumped to 105.1, the highest print since October 2018, as small businesses are clearly excited about the prospects of a Trump administration and the promised regulatory cuts.

Right now, both the dollar and Treasury yields are pushing to levels that have caused market problems in the past. If these trends continue, be prepared for some more significant price action. That could manifest as a sharp decline in equity markets, or some surprising Fed activity as they try to address any potential market structural problems that may arise. But there is nothing due to stop the trends right now.

Good luck

Adf