By now, each of you is aware

More tariffs, the Prez did declare

Some nations will scream

While others will scheme

To Trump, though, in war all is fair

The market reaction was swift

With equities in a downshift

While Treasuries rallied

Pure gold, lower, sallied

And everyone worldwide’s quite miffed

Once again, President Trump did exactly what he told us he was going to do from the start. He applied reciprocal tariffs on virtually every nation in the world, although at a rate claimed to be ~50% of their tariffs on the US, (as calculated by the White House and which included quotas and non-tariff barriers as well.) In addition to Israel, which pledged to reduce tariffs to 0% on US goods if the US would do the same, it appears Canada has also agreed that deal. I expect that we will hear different responses from nations all around the world, but remember, the one thing the president has made clear is that retaliation by other nations will be met with a significantly higher response from the US. I expect that smaller nations may find themselves in very difficult straits, although larger ones have more potential to respond. But, in the end, the US remains the consumer of last resort, and every nation on the list realizes that losing the US market will not help their economies.

The market response was immediate with US equity futures plummeting on the open of the evening session and sharp declines in Asian equities as well. Treasury yields fell along with the dollar, while gold after an initial rally, reversed course and is now lower on the day as well.

Analysts around the world are out with early forecasts of the “likely” impacts of these tariffs although I would take them with a grain of salt. Remember, analyst macro models have been pretty useless for a while, ever since the underlying conditions changed as I described earlier this week, so it is not clear to me that applying broken models to a new event is likely to offer accurate estimates of future activity. However, there is a pretty clear consensus, which is that inflation is going to rise while economic activity is going to decline, probably into a recession. Personally, I am confused by this analysis as every one of these analysts continues to believe that a recession drives prices lower and reduces inflation, but I’m just reporting on what I have seen.

If pressed, I expect that we will see several nations reduce their tariff structures in response to this, similar to Canada and Israel, and US tariffs will decline there as well. Other nations will dig in their heels and trade activity between the US and those nations will decline. But I will not even hazard a guess as to which nations will do what. Political pain is a funny thing, and different leaders respond differently.

My sincere hope is that now that the tariffs have been imposed, we can move on with our lives and discuss other issues because frankly, I am really tired of this topic.

Masked by the tariff mania was news that the US Senate has moved forward on its budget resolution bill which if passed and combined with the House, will allow the process to start to legislate for fiscal year 2026. Both versions maintain the 2017 tax cuts, both seek unspecified spending reductions and while each has a different price tag, my take is this process will be completed before too long. It would truly be miraculous if Congress actually submitted department spending bills on a timely basis, rather than the omnibus bills that have been the norm for quite a while. That would be true progress in how the government works.

Anyway, let’s see where things stand this morning. The one thing we know is that despite President Trump’s constant discussion on tariffs, market participants were not prepared. Ironically, yesterday saw modest gains in US equity indices but as of now (6:40) US futures are sharply lower (NASDAQ -3.8%, SPX -3.6%, DJIA -2.6%). Of course, the damage has been significant everywhere with equities lower worldwide.

In Asia, Vietnam (-7.2%) was the worst hit index, actually the worst in the world, as tariffs there rose to 46%. Given Vietnam has been a way station for exports from China to the US, I expect that we will see some swift action by the government there to address the situation. But elsewhere in Asia, while the losses were universal, they were not as bad as might be expected. Tokyo (-2.6%) led the way lower with Chinese shares (Hang Seng -1.5%, CSI 300 -0.6%) also falling, but not collapsing. Korea (-0.8%) and India (-0.4%) fell but were also not devastated.

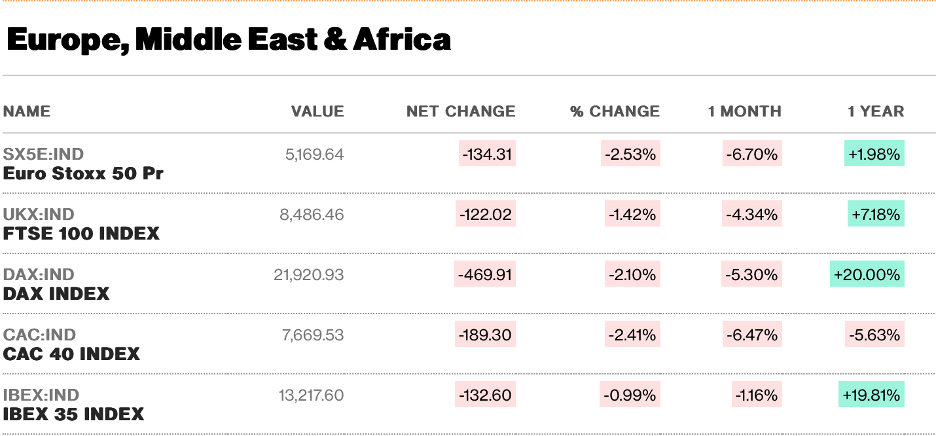

In Europe, though, the pain is more consistent and larger, net, than Asia as per the below snapshot from Bloomberg. This will be the most interesting thing to watch as there has been a great deal of huffing and puffing about a response, but will European nations, who sell a great deal into the US, risk a worse outcome, or will they reduce their own tariffs?

Something else that has declined sharply is bond yields around the world. Treasury yields are lower by a further -6bps, and that is the basic decline seen across Europe as well. Asia saw even greater drops in yields with JGB’s (-12bps) breaking the trendline that had been in place since the BOJ first started hiking rates last year and Governor Ueda made clear his intention to continue to do so.

Source: tradingeconomics.com

It appears that investors are anticipating a global recession, at least based on the movements in government bond yields around the world.

In the commodity space, oil (-4.7%) has reversed much of its recent gains as the recession narrative has eclipsed the Iran war/sanctions narrative. However, despite the sharp decline, oil remains nearly $3/bbl above the lows seen at the beginning of March, just one month ago. In the metals market, gold, which initially traded to new highs on the tariff announcement reversed course about lunchtime in Asia and is now down by more than -2.0%. My take is this is a short-term impact as investors sell liquid assets with gains to cover margin calls, rather than any negative feelings about gold in the wake of the news. Instead, I suspect that the barbarous relic will regain its footing shortly as the ultimate haven asset in difficult times, and clearly many now see difficult times ahead. Silver (-3.9%) and copper (-0.4%) are also softer, much more on the economic concerns than the risk concerns.

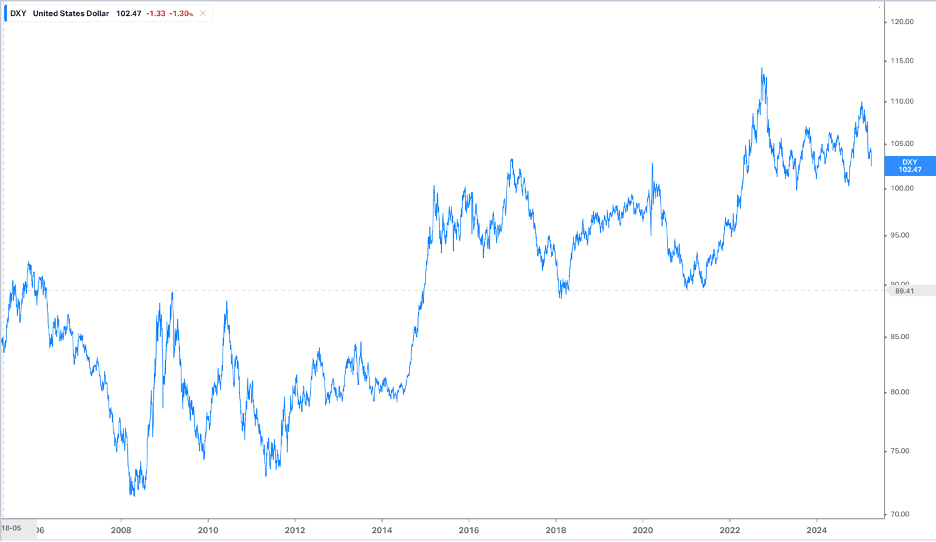

Finally, the dollar, shockingly, is broadly lower this morning. While we have been consistently informed that a very clear response to the US imposing tariffs would be other currencies weakening vs. the dollar to offset the impact, apparently that model is also broken. Versus it’s G10 counterparts, the dollar is under severe pressure today. EUR (+1.75%), JPY (+1.7%), CHF (+2.1%), SEK (+2.1%) and even NOK (+1.1%) despite the collapse in oil prices, have all moved to within 1% of the dollar’s lows seen last September. But to keep things in perspective, I don’t know that I would call the dollar “weak” here. The below chart of DXY shows that even over the past 20 years, the dollar has been MUCH lower and only spent a relatively small amount of time above current levels.

Source: Koyfin.com

Interestingly, other than the CE4, which track the euro closely, most EMG currencies have not seen the same boost vs. the dollar, although most are somewhat higher. MXN (+0.6%), KRW (+0.6%) and INR (+0.5%) have all gained modestly. ZAR (0.0%) and CNY (-0.2%) are the only currencies that have bucked the trend and followed the economic theory.

Turning to the data, this morning brings the weekly Initial (exp 225K) and Continuing (1860K) Claims as well as the Trade Balance (-$123.5B) at 8:30. Then at 10:00 we see ISM Services (53.0). The thing about this data is it ought to have no impact whatsoever as last night’s tariff announcements completely changed the playing field. So whatever things were, they are not representative of the future, at least the near future. There are also a couple of Fed speakers, but again, there is no way they can determine how they will react until the real economic effects of these tariffs start to play out.

There have been many analysts who continue to believe that President Trump will not be able to tolerate a substantial decline in the equity market despite the fact that he has not discussed it at all, and he, along with Treasury Secretary Bessent have consistently said their goal is a lower yield on 10-year Treasuries. Well, they are getting their wish right now, regardless of the reason.

The president has done virtually everything he said he was going to do regarding the border, government efficiency and now tariffs. There are many skeptics who believe that he is out to force economic change on the backs of the bottom 90% of earners to benefit himself and others in the top 1%. But he has consistently said his goal is to help the middle class. His view of reindustrialization and more self-sufficiency while reduced international adventures continues to be the driving force of his policies. There is no reason to believe he is going to change that view. Do not look for a reversal of what he has done simply because the S&P 500 declines. I think the trend is going to be for the dollar to continue to decline along with interest rates, while commodities rally. Equity markets are going to be a tale of two markets, likely with previous highflyers suffering and previously overlooked companies benefitting.

The world is changing a lot, so the best thing you can do is maintain your hedges to mitigate the impact.

Good luck

Adf