All eyes are on Chairman Jay Powell

And if he will throw in the towel

Or will he still fight

Inflation? Oh, right

He caved as the hawks all cried foul!

So, twenty-five’s baked in the cake

While fifty would be a mistake

If fighting inflation

Is his obligation

Though half may, Trump’s thirst, somewhat slake

Well, it’s Frabjous Fed Day and there will be a great deal of commentary on what may happen and what it all means. Of course, none of us really knows at this point, but I assure you by this afternoon, almost all pundits will explain they had it right.

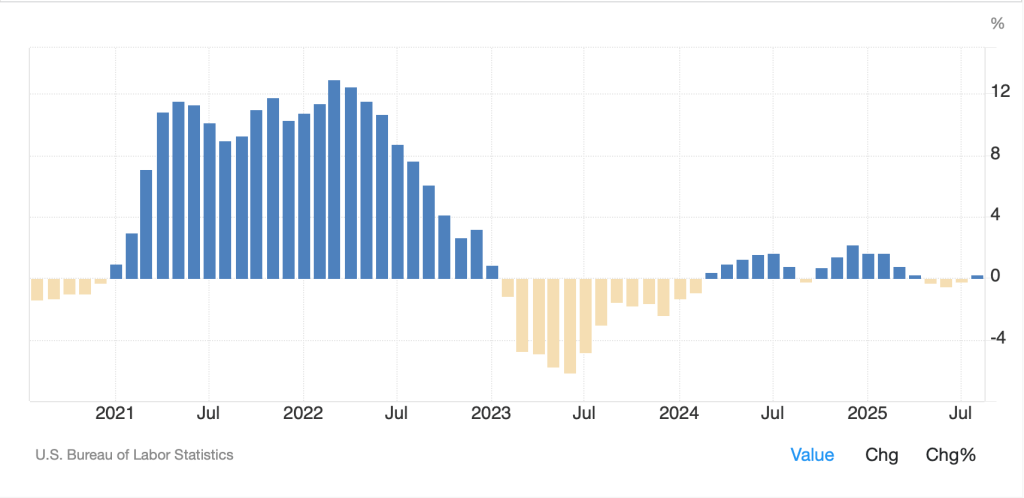

At any rate, my take is as follows, FWIW. I believe the huge revision to NFP data has got the FOMC quite concerned. Prior to that, they were smug in their contention that patience was a virtue and their caution because of the uncertain price impact of tariffs was warranted given the underlying strength in the jobs market. Now, not only has that underlying strength been shown to be a mirage, but the import price data released yesterday, showing that Y/Y, import prices are flat, is further evidence that tariffs have not been a significant driver of inflation. If you look at the chart below of Y/Y import prices for the past 5 years, you can see that since April’s ‘Liberation Day’ tariff announcements, they have not risen at all.

Source: tradingeconomics.com

With that in mind, if you are the Fed, and you are data dependent, as they claim to be, and the data shows weakening employment and stable prices in the area you had been highlighting, you have no choice but to cut. The question then becomes, 25bps or 50bps? While the market is pricing just a 6% probability of a 50bp cut, given there are almost certainly three Governor votes for 50bps (Waller, Bowman and Miran) and the underlying central bank tendency is toward dovishness, I am going to go out on a limb and call for 50bps. Powell and the Fed have already been proven wrong, and the only thing worse for them than seeming to cave to pressure from the White House would be standing pat and being blamed for causing a recession.

With that in mind, my prognostications for market responses are as follows:

- The dollar will weaken pretty much across the board with a move as much as -1% possible

- Precious metals will rally sharply, making new highs for the move as this will be proof positive that the Fed has tacitly raised its inflation target from the previous 2%. In fact, my take is 3% is the new 2%, at least until we spend a long time at 4%.

- Equity markets will take the news well, at least initially, as the algos will be programmed to buy, but the concern will have to grow that slowing economic activity will impair earnings going forward, and multiples will suffer with higher inflation. I continue to fear a correction here.

- Bonds are tricky here as they have been rallying aggressively for the past six weeks and that could well have been ‘buying the rumor’ ahead of the meeting. So, it is not hard to make the case that bonds sell off, and long end yields rise in response to 50bps.

On the other hand, if they cut 25bps, and sound hawkish in the statement or Powell’s presser, I don’t imagine there will be much movement of note. I guess we’ll see in a while.

Until then, let’s look at the overnight price action. Yesterday’s modest declines in US equities looked far more like consolidation after strong runs higher than like the beginning of the end. The follow on in Asia was mixed with Tokyo (-0.25%) after export data was weak, especially in the auto sector, while HK (+1.8%) and China (+0.6%) both rallied on the prospect of reduced trade tensions between the US and China based on the upcoming meeting between Presidents Trump and Xi. Elsewhere in the region, Korea, Taiwan and Australia fell while India, Malaysia and Indonesia all rallied, the latter on the back of a surprise 25bp rate cut by Bank Indonesia.

In Europe, the picture is also mixed with Germany (-0.2%), France (-0.4%) and Italy (-1.2%) all under pressure, with Italy noticeably feeling the pain of potential domestic moves that will hurt bank profitability with increased taxes there to offset tax cuts for individuals. Spain is flat and the UK (+0.25%) slightly firmer after inflation data there showed 3.8% Y/Y headline, and 3.6% Y/Y core, as expected and still far higher than the BOE’s 2.0% target. While the BOE meets tomorrow, and no policy change is expected, if the Fed cuts 50bps, do not be surprised to see 25bps from the Old Lady. US futures at this hour (7:30) are essentially unchanged.

In the bond market, Treasury yields continue to creep lower ahead of the meeting, slipping another 2bps this morning and now trading at 4.01%, the lowest level since Liberation Day and the initial fears of economic disaster in the US.

Source: tradingeconomics.com

You can see the trend for the past six months remains lower and appears to be accelerating right now. Meanwhile, as is often the case, European sovereign yields are following Treasury yields and they are lower by between -1bp and -2bps across the board. Nothing to see here.

Commodity markets have seen the most movement overnight with oil (-0.7%) topping a bit while gold (-0.65%), silver (-2.5%) and copper (-1.8%) have all seen some profit taking ahead of the FOMC meeting. Now, there are plenty of profits to take given the 10% rallies we have seen in gold and silver in the past month. In fact, I lightened up some of my gold position yesterday as well!

Finally, the dollar, which fell pretty sharply yesterday is bouncing a bit this morning. Using the DXY as proxy, it came close to the lows seen back on July 1st, as you can see in the chart below.

Source: tradingeconomics.com

But remember, as you step away from the day-to-day, the dollar is hardly weak. Rather, it is much closer to the middle of its long-term price action as evidenced by the longer view below.

Source: finance.yahoo.com

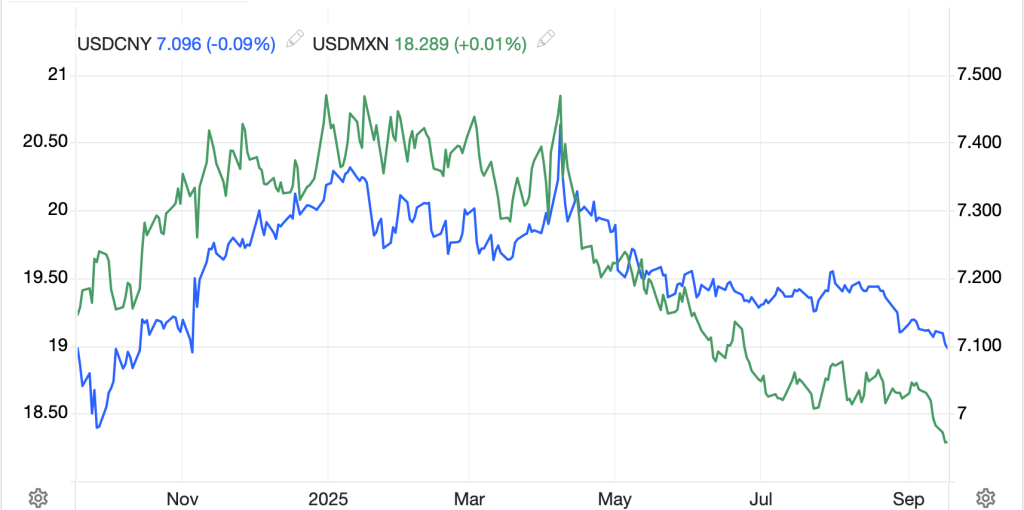

There is a lot of discussion on FinX (nee FinTwit) about whether we are about to bounce or if the dollar is going to collapse. But it is hard to look at the chart directly above and get the feeling that things are out of hand in either direction. Now, relative to some other currencies, there are trends in place that don’t impact the DXY, but matter. Notably, CNY and MXN have both been strengthening slowly for the bulk of the year and are now at levels not seen for several years. given the importance of both these nations with respect to trade with the US, this is where Mr Trump must be happiest as it clearly is weighing on their export statistics.

Source: tradingeconomics.com

Ahead of the FOMC meeting, we do get a few data points, with Housing Starts (exp 1.37M) and Building Permits (1.37M) leading off at 8:30. Then at 9:45 the BOC interest rate decision comes, with a 25bp cut expected and finally the Fed at 2:00. Housing will not have any impact on the market in my view but the BOC, if they surprise, could matter, especially if they pre-emptively cut 50bps as that will get the juices flowing for the Fed to follow suit. But otherwise, we will have to wait for Powell and friends for the next steps.

Good luck

Adf