Today, for the first time in weeks

Comes news that will thrill data geeks

It’s CPI Day

So, what will it say?

We’ll soon see what havoc it wreaks

The forecast is zero point three

Too high, almost all would agree

But Jay and the Fed

When looking ahead

Will cut rates despite what they see

Spare a thought for the ‘essential’ BLS employees who were called back to the office during the shutdown so that they could prepare this month’s CPI report. The importance of this particular report is it helps define the COLA adjustments to Social Security for 2026, so they wanted a real number, not merely the interpolation that would have otherwise been used. Expectations for the outcome are Headline (0.4% M/M, 3.1% Y/Y) and Core (0.3% M/M, 3.1% Y/Y) with both still well above the Fed’s 2% target. As an aside, we are also due Michigan Sentiment (55.0), but I suspect that will have far less impact on markets.

If we consider the Fed and its stable prices mandate, one could fairly make the case that they have not done a very good job, on their own terms, when looking at the chart below which shows that the last time Core CPI was at or below their self-defined target of 2.0% was four and one-half years ago in March 2021. And it’s not happening this month either.

Source: tradingeconomics.com

Now, when we consider the Fed and its toolkit, the primary monetary policy tool it uses is the adjustment of short-term interest rates. The FOMC meets next Tuesday and Wednesday and will release its latest statement Wednesday afternoon followed by Chairman Powell’s press conference. A quick look at the Fed funds futures market pricing shows us that despite the Fed’s singular inability to push inflation back toward its own target using its favorite tool, it is going to continue to cut interest rates and by the end of this year, Fed funds seem highly likely to be 50bps lower than their current level.

Source: cmegroup.com

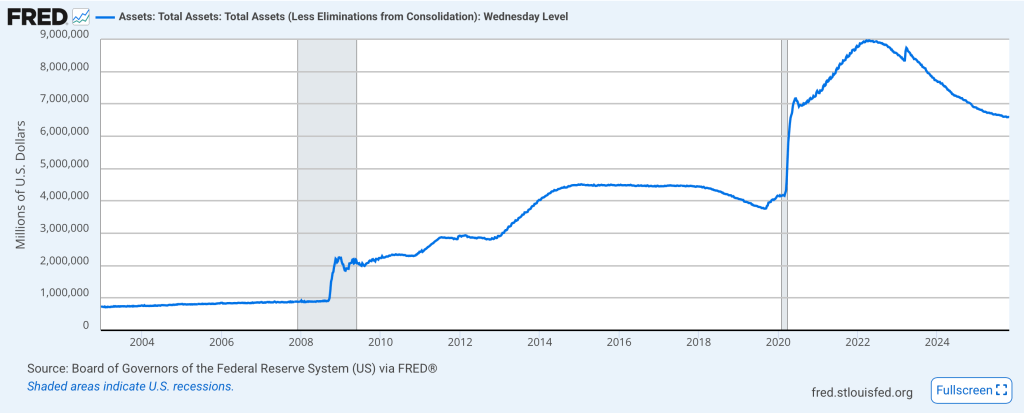

The other tool that the Fed utilizes to address its monetary policy goals is the size of its balance sheet, as ever since the GFC and the first wave of ‘emergency’ QE, buying (policy ease) and selling (policy tightening) bonds has been a key part of their activities. As you can see from the chart below, despite the 125bps of interest rate cuts since September of 2024 designed to ease policy, they continue to shrink the balance sheet (tighten policy) which may be why they have had net only a modest impact on things in the economy. Driving with one foot on the gas and one on the brake tends to impede progress.

But now, the word is the Fed will completely stop balance sheet shrinkage by the end of the year, something we are likely to hear next Wednesday, as there has been much discussion amongst the pointy-head set about whether the Fed’s balance sheet now contains merely “ample” reserves rather than the previous description of “abundant” reserves. And this is where it is important to understand Fedspeak, because on the surface, those two words seem awfully similar. As I sought an official definition of each, I couldn’t help but notice that they both are synonyms of plentiful.

These are the sorts of things that, I believe, reduces the Fed’s credibility. They sound far more like Humpty Dumpty (“When I use a word, it means just what I choose it to mean – neither more nor less.”) than like a group that analyses data to help in decision making.

At any rate, no matter today’s result, it is pretty clear that Fed funds rates are going lower. The thing is, the market has already priced for that outcome, so we will need to see some significant data surprises, either much weaker or stronger, to change views in interest rate sensitive markets like bonds and FX.

As to the shutdown, there is no indication that it is going to end anytime soon. The irony is that the continuing resolution passed by the House was due to expire on November 21st. it strikes me that even if they come back on Monday, they won’t have time to do the things that the CR was supposed to allow.

Ok, let’s look at what happened overnight. Yesterday’s rally in the US was followed by strength in Japan (+1.35%) after PM Takaichi indicated that they would spend more money but didn’t need to borrow any more (not sure how that works) while both China (+1.2%) and HK (+0.7%) also rallied on the confirmation that Presidents Trump and Xi will be meeting next week. Elsewhere, Korea and Thailand had strong sessions while India, Taiwan and Australia all closed in the red. And red is the color in Europe this morning with the CAC (-0.6%) the main laggard after weaker than forecast PMI data, while the rest of Europe and the UK all suffer very modest losses, around -0.1%. US futures, though, are higher by 0.35% at this hour (7:20).

In the bond market, Treasury yields edged higher again overnight, up 1bp while European sovereigns have had a rougher go of things with yields climbing between 3bps and 4bps across the board. While the French PMI data was weak, Germany and the rest of the continent showed resilience which, while it hasn’t seemed to help equities, has hurt bonds a bit. Interestingly, despite the Takaichi comments about more spending, JGB yields slipped -1bp.

In the commodity space, oil (+0.7%) continues its rebound from the lows at the beginning of the week as the sanctions against the Russian oil majors clearly have the market nervous. Of course, despite the sharp rally this week, oil remains in the middle of its trading range, and at about $62/bbl, cannot be considered rich. Meanwhile, metals markets continue their recent extraordinary volatility, with pretty sharp declines (Au -1.7%, Ag -0.9%, Pt -2.1%) after sharp rallies yesterday. There seems to be quite the battle ongoing here with positions being flushed out and delivery questions being raised for both futures and ETFs. Nothing has changed my long-term view that fiat currencies will suffer vs. precious metals, but the trip can be quite volatile in the short run.

Finally, the dollar continues to creep higher vs. its fiat compatriots, with JPY (-.25%) pushing back toward recent lows (dollar highs) after the Takaichi spending plan announcements. But, again, while the broad trend is clear, the largest movement is in PLN (-0.4%) hardly the sign of a major move.

And that’s all there is today. We await the data and then go from there. Even if the numbers are right at expectations, 0.3% annualizes to about 3.6%, far above the Fed’s target and much higher than we had all become accustomed to in the period between the GFC and Covid. But remember, central bankers, almost to a wo(man) tend toward the dovish side, so I think we all need to be prepared for higher prices and weaker fiat currencies, although still, the dollar feels like the best of a bad lot.

There will be no poetry Monday as I will be heading to the AFP conference in Boston to present about a systematic way to more effectively utilize FX collars as a hedging tool. But things will resume on Tuesday.

Good luck and good weekend

Adf