JGB yields have

Risen to multi-year heights

Is this why stocks fell?

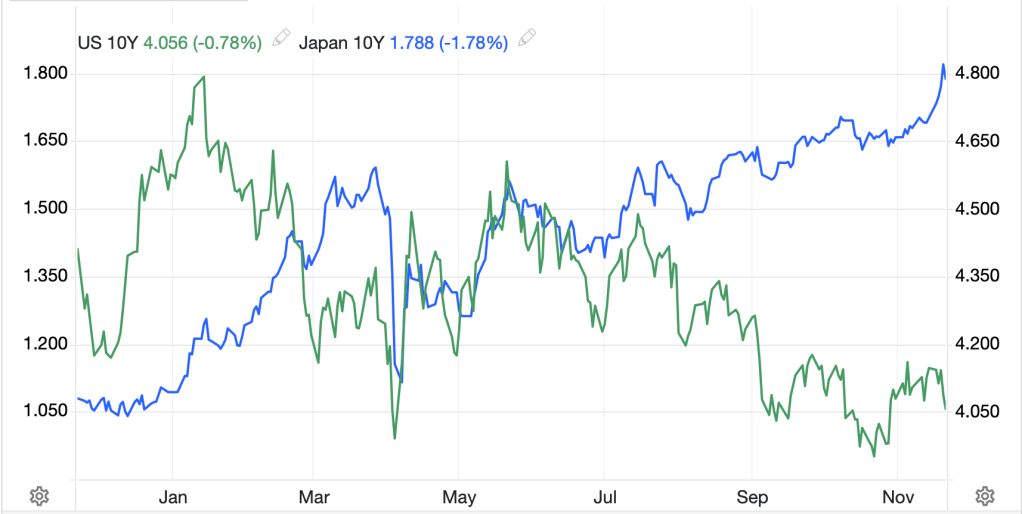

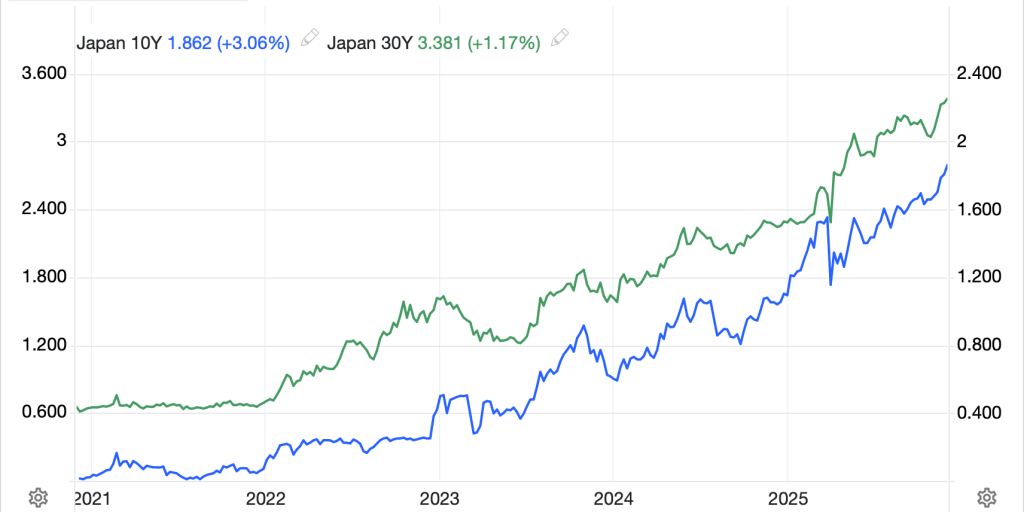

Yesterday I highlighted that 10-year JGB yields had risen to their highest level since 2008. As you can see below, the same is true for 30-year JGBs and essentially the entire curve there.

Source: tradingeconomics.com

Ostensibly, this move was triggered by comments from BOJ Governor Ueda indicating that a rate hike was coming this month. However, the thing I find more interesting is that this move in JGB yields has become the bête noire of markets, now being blamed for every negative thing that happened yesterday.

For instance, Treasury yields yesterday rose 7bps despite ISM data indicating that manufacturing activity remains sluggish at best. In fact, the initial response to that data was that it confirmed the Fed will be cutting rates next week. But the narrative seems to be that Japanese investors are now willing to repatriate funds, selling Treasuries to buy JGBs, in order to invest locally because they are finally getting paid to do so. Certainly, looking at the chart above shows that Japanese yields had been tantamount to zero for a long time prior to 2024, and even then, have only started to show any real value in the most recent few months. Of course, real 10-year yields in Japan remain significantly negative based on the latest inflation reading of 3.0%. The upshot is, rising JGB yields are deemed the cause of Treasury market weakness.

Turning to risk assets, the story is the same for both stocks (which saw US equities decline across the board yesterday) and cryptocurrencies, notably Bitcoin. Ostensibly, the rise in yields, and the prospect of a rate hike by the BOJ (to just 0.75% mind you) has been cited as the driver of an unwinding in leveraged trades as hedge funds seek to get ahead of having their funding costs rise thus crimping their margins.

There is no doubt in my mind that the yen has been a critical funding currency for a wide array of carry trades, that is true. In fact, that has been the case for several decades. But is 25 basis points really enough to destroy all the strategies that rely on that process? If so, it demonstrates a remarkable fragility in markets, and one that portends much worse outcomes going forward.

If we look at the relationship between Bitcoin and 10-year JGBs, it appears that there has been a significant change in tone. For the past two months, while JGB yields have continued to climb, BTC has broken its correlation with JGBs and has fallen dramatically instead. (see below chart from tradingeconomics.com). When it comes to crypto, I am confident that leverage levels are higher than anywhere else, in fact that seems part of the attraction, so it should not be as surprising to see something of this nature. But again, it speaks to a very fragile market situation given there was no discernible change in the Japanese yield trend to drive a Bitcoin adjustment.

The upshot here, too, is that rising JGB yields are claimed to be the reason Bitcoin is declining. In fact, nearly all the commentary of late seems to be focusing on JGBs as the driver of everything. While I concede that Japanese yields are an important part of the USDJPY discussion, it is difficult for me to assign them blame for everything else. I have seen numerous commentators explaining that the Japanese have been selling Treasuries because they don’t trust the US, and this has been ongoing for years. I have also seen commentators explain that because Japanese surpluses had been invested internationally for years and funding so much of the world’s activity, now that they can invest at home, liquidity everywhere will dry up, and asset prices will fall.

Responding to the first issue, especially with new PM Sanae Takaichi, I do not believe that is a concern at all. If anything, I expect that the relationship between the US and Japan will deepen. As to the second issue, that may have more import but the one thing of which we can be sure is that central banks around the world will not allow liquidity to dry up in any meaningful fashion. Remember, the Fed ended QT yesterday and it won’t be long before the balance sheet starts to grow again, adding liquidity to the system. One thing I have learned in my many years observing and trading in markets is, there doesn’t need to be a catalyst for markets to move in an unexpected direction. Certainly not a big picture catalyst.

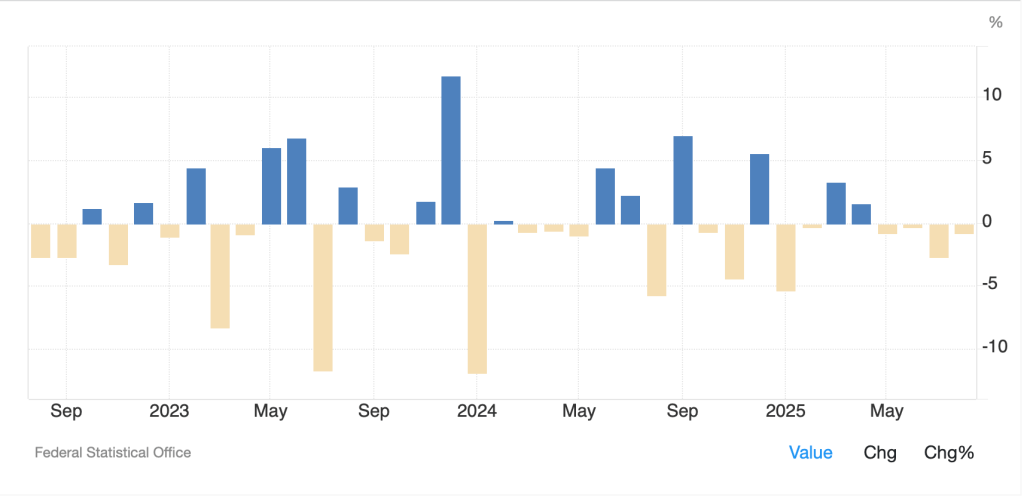

And with that, let’s look at how markets responded overnight to yesterday’s risk-off session in the US. Looking at the bond market first, yesterday’s rise in yields was nearly universal with European sovereigns all following the Treasury market’s lead. And this morning, across the board sovereigns are higher by 1bp, the same as Treasury yields. While JGB yields didn’t budge overnight, we did see Australia and other regional yields catch up to yesterday’s rise. I fear bond investors are stuck as they see the potential for inflation, but they also see weakening economic activity as a moderator there. As an example, the OECD just reduced its US GDP forecast for 2026 to 2.9% this morning, from 3.2%. Personally, I don’t think anything has changed the run it hot scenario.

In the equity markets, Asian bourses were mixed with Korea (+1.9%) and Taiwan (+0.8%) the notable gainers while elsewhere movement was much less substantial (Japan 0.0%, HK +0.2%, China -0.4%). There was no single story driving things there. As to Europe, things are brighter this morning led by Spain (+1.0%) and Italy (+0.5%) although there is no single driving issue here either. US futures are edging higher at this hour as well, +0.2%, so perhaps yesterday was more like a little profit taking after last week’s strong rally, than anything else.

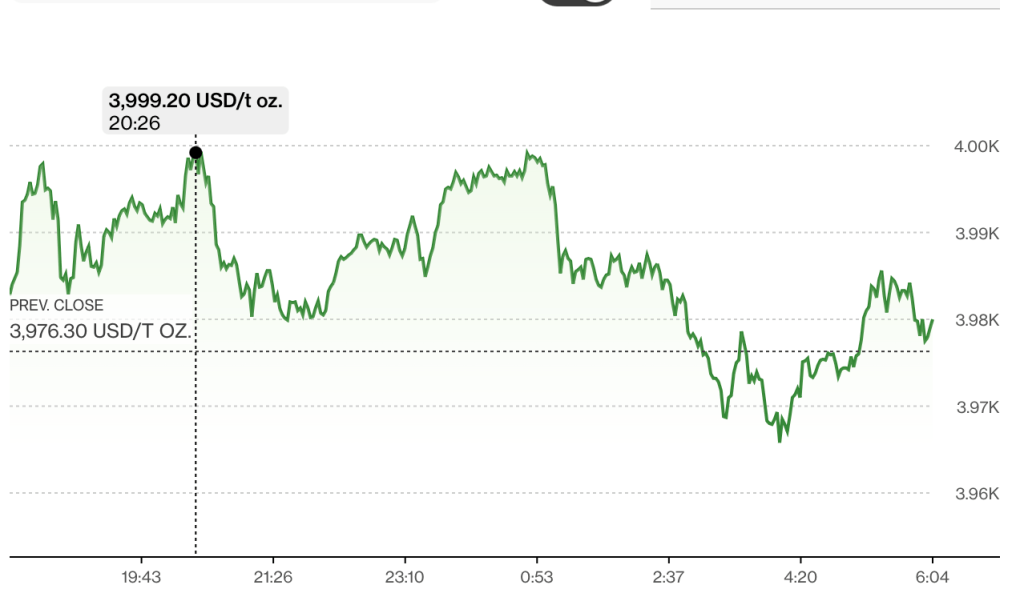

In the commodity sector, oil (-0.3%) is slipping after yesterday’s rally. I suppose the potential peace in Ukraine is bearish, but that story has been dragging on for a while so I’m not sure when it will come to fruition. In the metals markets, after a gangbusters rally yesterday, with silver trading to $59/oz, we are seeing a modest retracement this morning across the board (Au -0.6%, Ag -1.2%, Pt -2.0%) although copper (+0.4%) is holding its gains. Nothing indicates that these metals have topped.

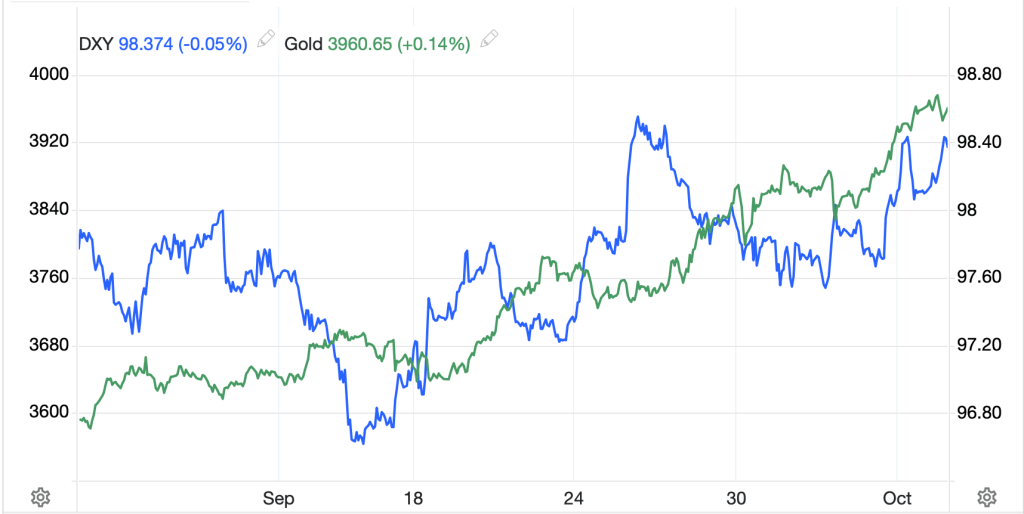

Finally, the dollar is little changed as I write, giving back some early modest strength. JPY (-0.3%) continues to be amongst the worst performers, and although it has bounced from its recent lows, remains within a few percent of those levels. My take here is we will need to see both a more aggressive Fed and a more aggressive BOJ to get USDJPY back to 150 even, let alone further than that. If we look at the DXY, it is sitting at 99.45, and still well within its trading range for the past 6+ months as per the below. For now, the dollar remains a secondary story.

Source: tradingeconomics.com

On the data front, here’s what comes the rest of this week:

| Wednesday | ADP Employment | 10K |

| IP | 0.1% | |

| Capacity Utilization | 77.3% | |

| ISM Services | 52.1 | |

| Thursday | Initial Claims | 220K |

| Continuing Claims | 1960K | |

| Trade Balance | -$65.5B | |

| Friday | Personal Income (Sep) | 0.4% |

| Personal Spending (Sep) | 0.4% | |

| PCE (Sep) | 0.3% (2.8% Y/Y) | |

| -ex food & energy | 0.2% (2.9% Y/Y) | |

| Michigan Expectations | 51.2 | |

| Consumer Credit | $10.5B |

Source: tradingeconomics.com

As the Fed is in its quiet period, there are no Fed speakers until Powell at the presser next week. Given the age of the PCE data, I don’t see it having much impact. Rather, ADP and ISM are likely the things that matter most for now.

Ultimately, I believe more liquidity is going to come to the market via central banks around the world, and that will support risk assets, as well as prices for the things we buy. Nothing has changed in my view of the dollar either.

Good luck

Adf