Ahead of today’s CPI

The markets continue to fly

Though prices keep rising

The pace is surprising-

Ly slower than pundits decry

Perhaps now it’s time to review

How old models all misconstrue

The world of today

As their results stray

From outcomes we’re all living through

Let’s start with this morning’s CPI data where expectations are for M/M rises of 0.3% for both headline and core readings which translate to 2.7% and 3.0% for the annual numbers. In both cases, that would be the highest reading since February and will put a crimp in the inflation slowing trend as both the 3-month and 6-month trend data will stop declining. I assure you that the immediate culprit will be defined as the tariffs, although it is probably still too early to make an accurate reading on that. Nonetheless, you can be sure that, especially if the bond market sells off, the cacophony will be extreme as to President Trump’s policies are destroying the nation.

Personally, I would disagree with that take. In fact, something I theorized last week was that a likely impact of the tariffs was that corporate margins would be hit, not necessarily that prices would rise. Apparently, somebody much smarter than me agrees with that view, a well-respected analyst, @super_macro on X, who made that point this morning. But all we can do is wait and see the data and response.

Yesterday, as well, I touched on how bond yields around the world were rising which remarkably seems to be a theme in the mainstream media this morning. I wonder if they’re secretly reading fxpoetry?

Ok, but let’s move on. I have consistently expressed my view that the current macroeconomic models in use, which are almost entirely Keynesian based, are simply no longer relevant to the world as it currently exists. I made the point about economic statecraft, as defined by Michael Every (@TheMichaelEvery), the Rabobank analyst who has been far more accurate in his forecasts of likely political outcomes. Well, in the financial space, another Michael, Green (@profplum99), is also ahead of the pack in my view. He was on a podcastlast week that is well worth the hour (40 minutes if you listen at 1.5X speed).

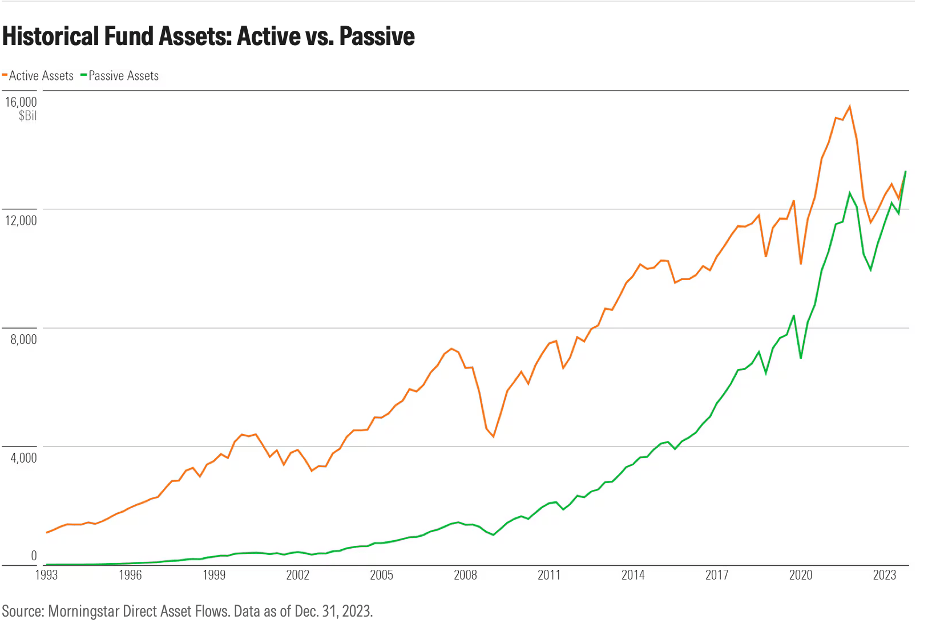

The essence of his work is that the rise in passive investing has had major consequences for equity markets, and by extension other financial markets. When John Bogle founded Vanguard with the goal of popularizing passive index investing, it represented a tiny fraction of the market and so, its low fees made it an excellent source of capturing market beta unobtrusively. However, in the ensuing 50 years, and especially in the last 20 when 401K plans were flipped from opt-in to opt-out by government regulation, things have changed dramatically.

This is the most recent chart I can find showing how passive investments (e.g., index funds and target date funds) have grown dramatically in size relative to the overall market (notice the inflection in 2006 when the opt-in regs changed). In fact, they currently represent about 50% of equity market assets.

The reason this matters is because the term passive is no longer very descriptive of what these funds do. As Mr Green explains, they work on the following algorithm, if funds flow in, they buy more stocks and if funds flow out they sell them. Since they are following cap weighted indices, they basically reflect that since funds flow from every 401K into the market throughout every day, they continue to buy the largest stocks (Mag7) out there regardless of any concept of value. If you think this through, the main factor in the markets is no longer how a company performs, but how many people have jobs where they have some portion of their incomes allocated to 401K plans. So, as long as people have jobs, and if employment is growing, equity prices have a price-insensitive base of support. The upshot is equity markets are no longer forward-looking systems, as has been the belief since early financial market theories, but rather they are indicators of the employment situation. And it is key to remember that the unemployment rate is a lagging macroeconomic indicator

This matters because the Fed, and frankly most major financial institutions and analysts, continue to model the economy with an input from equity markets. Consider the Index of Leading Economic Indicators, which has the S&P 500 explicitly in the calculation as an example. Now, if the Fed is looking at models which discount changes in the equity market, clearly a part of their process, it means they are looking in the rear-view mirror. This is a very cogent explanation as to why the Fed’s models have grown so out of touch with reality, which if you consider how important they are to monetary policy, and by extension the economy as a whole, is quite concerning.

Concluding, Mr Green has eloquently explained what I have observed over the past months and years, the Fed’s (and most of Wall Street’s) models are simply no longer fit for purpose. Add to this the concept of fiscal dominance, where government spending overwhelms monetary policy as has been the case for the past several years, and we all can see why the Fed is flying blind.

With that cheery thought, let’s see how markets are behaving. Yesterday’s modest US rally was followed by some strength in Asia (Nikkei +0.55%, Hang Seng +1.6%) although mainland shares were unchanged. Chinese data overnight surprised on the upside regarding GDP, with an annualized outcome of 5.2%, and it saw IP rise 6.8% Y/Y, also better than expected but Retail Sales (4.8%) and Fixed Asset Investment, which is housing driving (2.8%) both disappointed. The upshot is that domestic demand continues to flag although they have been working hard to export lots of stuff. The rest of the region saw a very positive day with almost all markets gaining. In Europe, the picture is more mixed as tariff concerns continue to weigh on nations there with today’s price action a mix of small gains (CAC, DAX) and losses (IBEX, FTSE 100) and nothing more than 0.3%. US futures, though, are pointing higher at this hour (7:20) by 0.5% or so.

In the bond market, yesterday’s modest rise in yields is seeing a reversal with Treasury yields slipping -1bp, but European sovereigns having a good day with yields down between -5bps and -6bps. Inflation data from Spain confirmed that the overall inflation situation there is ebbing, and market participants are now pricing one more rate cut by the end of this year which would take the ECB rate down to 1.75%. As it happens, JGB yields were unchanged overnight, but there is still growing angst over their recent rise.

In the commodity arena, oil (-0.5%) reversed course yesterday and sold off more than $2/bbl as per the below chart.

Source: tradingeconomics.com

This makes more sense to me given the apparent growth in supply, but there seems to be an awful lot of calendar and crack spread activity in the market, most of which I do not understand well enough to describe, but which can impact pricing of the front futures contract. I would suggest looking on substack at market vibesfor a real education. I keep trying to learn. However, from a macro view, I continue to believe that prices have further to decline than rise from current levels. As to the metals markets, gold (+0.5%) and silver (+0.4%) continue to find consistent support and I see no reason for them to reverse course anytime soon.

Finally, the dollar continues to do very little overall. For now, the more aggressive downtrend appears to have been halted, as per the chart of the DXY below, but it is hard to get too excited about a significant rebound based on the macro data and interest rate outlook. The one thing working in the favor of a dollar rebound is the extreme short dollar positions that exist in the hedge fund and CTA communities.

Source: tradingeconomics.com

In addition to the CPI data, we will see the Empire State Manufacturing Index (exp -9.0) and we will hear from four Fed speakers today (Bowman, Barr, Collins and Logan). Absent a major shock in the CPI data, it strikes me that there is limited reason for any of these speakers to change their personal tune. So, Bowman is calling for cuts, while the other three have not done so, at least not yet. In fact, if we start to hear a more dovish take from any of them, that would be news.

And that’s it for this morning. Market activity is pretty dull overall, and trends remain in place. Remember, the trend is your friend.

Good luck

Adf