The punditry’s now out in force

As they hope, their views, we’ll endorse

When tariffs arrive

On Wednesday they’ll strive

To claim they were right, but of course

The problem is nobody knows

Exactly what Trump will propose

So, models will fail

While Trump haters wail

More chaos is all that he sows

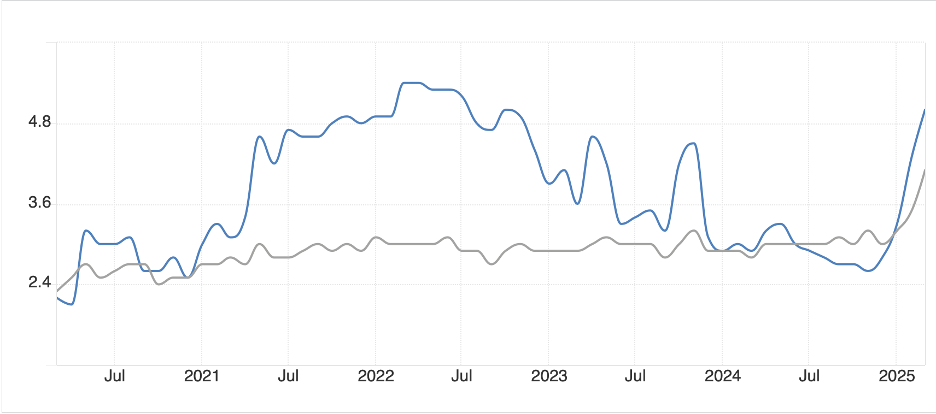

Well, folks, it’s month and quarter end today and many are decrying that President Trump’s policies have derailed the bull market in risk assets. And they are almost certainly correct. Yet, at the same time, there has been a broad recognition across a wide spectrum of analysts and politicians that the situation he inherited was unsustainable. Whether the 7% budget deficits, the $36+ trillion in government debt or the ongoing inflationary pressures, the only people who were happy were those who saw their equity portfolios rise against all odds. (I guess the gold holders have been pretty happy too, in fairness.)

However, the underlying reality of a situation is rarely enough to alter a good story, or a story that somebody wants to tell. For instance, the Michigan Consumer Survey was released on Friday, and it fell more than expected to a reading of 57.0, its lowest reading since July 2022, when inflation was peaking.

Source: tradingeconomics.com

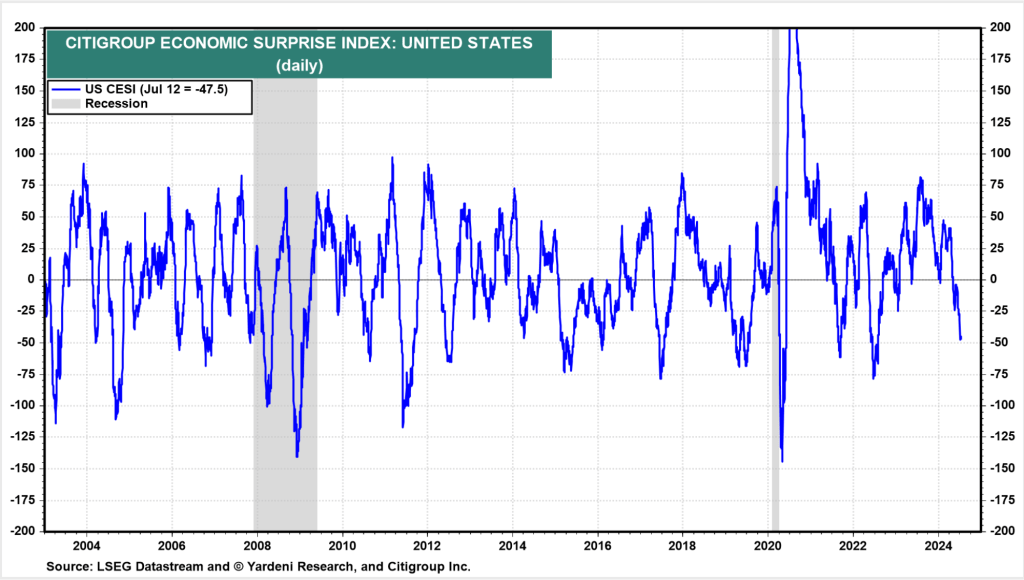

But the story that has been getting all the press is the extraordinary rise in inflation expectations. As you can see below, both 1-year (blue line) and 5-year (grey line) have risen sharply in 2025. Conveniently for the mainstream media this has been blamed on President Trump’s policies given their efforts to discredit everything the president does.

However, the Michigan Survey, while having a long pedigree, isn’t that large a survey. As such, it is possible that non-economic factors may be impacting the results. For instance, when the survey is taken, the respondents’ political leanings are asked as well. Now, take a look at the data when split by political views as per the below. Perhaps, we need to take this survey with a grain or two of salt as it appears the question may be seen as a way to express one’s opinion about the current administration rather than unbiased views of future inflation.

This is especially true when we look at other measures of expected inflation, like the NY Fed’s Consumer inflation survey shown below with the green line compared to that Michigan survey in red.

Source: zerohedge.com

My point is, we need to be careful to notice the non-economic factors that enter into things like expectations surveys. As well, the idea that inflation expectations are a critical driver of future inflation, although a staple of current central bank thinking, does not have much empirical backing. For instance, my friend Mike Ashton, the Inflation Guy™, explained in this article way back in 2015, that inflation expectations do not have much empirical proof of effectively forecasting future inflation. But perhaps, if you don’t believe him, you will consider a scholarly paper by a Fed economist, Jeremy Rudd, written in 2021 that is pretty damning with respect to the idea that the Fed relies on this data as part of their policy toolkit.

In the end, the one truism of which I am highly confident is that pretty much all the models that have been utilized for the past twenty plus years are no longer reflective of the reality on the ground today. Not just for inflation, but for growth and trade and every other aspect. President Trump has not merely upset the applecart; he has broken it into pieces and burned them all to cinders. All the fiscal problems mentioned above are still extant, but President Trump appears set on changing them in the direction desired by almost all mainstream economists. They don’t like his methods, but it’s not clear how changes of this magnitude can be made smoothly. So, perhaps the proper question is just how rough things are going to be. If the overnight session is any indication, they could get pretty rough.

The dominant feature today

Is fear is what’s now holding sway

As markets decline

More pundits consign

The blame on Trumps tariff pathway

Investors have risk indigestion this morning, as their appetite to own equities anywhere in the world has significantly diminished. After a rough week ending session on Friday in the US, equity markets in Asia have almost universally declined led by Tokyo (-4.05%) but with sharp declines seen in Korea (-3.0%), Taiwan (-4.2%), Australia (-1.75%), Malaysia (-1.45%) and Thailand (-1.5%). Chinese (-0.7%) and Hong Kong (-1.3%) shares also fell, although perhaps not quite as far as others. The entire conversation today is about President trump’s promise to impose tariffs around the world on Wednesday, with many analysts trying to estimate what damage will occur despite no clarity on the size and breadth of the tariffs. But investors have decided that havens are a better place to hide for now.

European bourses are also sharply lower, although more in the -1.7% to -2.0% range, with every major index in Germany, France, Spain and Italy down by those amounts. There continues to be a great deal of discussion amongst the European leadership about how they will respond to the mooted tariffs, but of course, like everybody else, they have no idea exactly what they will be. As to US futures, at this hour (6:45) the picture is grim with declines between -0.6% (DJIA) and -1.3% (NASDAQ). Right now, the only people who are happy are those holding puts.

Of course, in this risk-off environment, it should be no surprise that bond yields have slipped a bit as, at the margin, investors are flocking to own Treasuries (-5bps) and European sovereigns (Bunds -3bps, OATs -2bps, Gilts -4bps). Even JGBs (-5bps) saw yields decline last night with any thoughts of the BOJ hiking rates in the near term fading away completely.

On the other hand, commodities are finding a lot more interest this morning with gold (+1.15%) leading the way higher and proving itself to continue to be one of the most consistent safe havens available. Interestingly, oil (+0.5%) is rallying this morning despite a number of Wall Street analysts upping their estimate of the probability of a US recession. However, offsetting the potential future demand weakness is the news that President Trump is “pissed off” at Vladimir Putin for his ongoing aggression in Ukraine and seeming unwillingness to move to a ceasefire. This has raised the specter of further sanctions on Russian oil output, potentially reducing supply. As well, the Trump administration continues to tighten the noose on both Iranian and Venezuelan oil sales, so potentially reducing supply even further. I guess this morning, the supply story is bigger than the demand story.

Finally, as we turn to the currency markets, the dollar is generally firmer this morning, although by widely varying amounts depending on the currency. For instance, in the G10, NOK (-0.75%) is the laggard despite oil’s gains, followed by AUD (-0.6%) and NZD (-0.55%), with all three of these being major commodity producers at a time when commodities are doing well. As to the rest of this bloc, JPY (+0.35%) is off its best levels, but behaving as a haven, and the others are just marginally changed from Friday’s closing levels. In the EMG bloc, ZAR (+0.25%) is the exception this morning, clearly benefitting from gold’s ongoing run to new all-time high prices, but otherwise, most of these currencies are modestly softer (MXN -0.2%, PLN -0.2%, KRW -0.25%).

Speaking of currencies, though, there is an article on this morning’s Bloomberg website that is worth reading, I believe, for everyone involved in the FX market. The gist of the article is something that I have been discussing for the past several years, the fact that market liquidity here, despite the extraordinary volumes that trade on average each day (currently estimated by the BIS at $7.5 trillion across all FX products) is not nearly as deep as might be anticipated.

My observation from my time on bank desks was that while there was a great deal of electronic flow, likely driven by HFT firms seeking to extract the last tenth of a pip out of thousands of transactions, when a real client, generally a corporate, had a need to do something specific to address a business need, and that amounted to more than $100 million equivalent, the liquidity situation was far more suspect.

My personal theory was as follows: bank consolidation reduced the net amount of risk-taking appetite as larger banks did not increase their risk-taking commensurate with the reduction that occurred by small banks being gobbled up. Combining this with the introduction of high-frequency trading firms in the business, who had no underlying client base to whom they owed a price, and therefore, could turn off their machines in a difficult market, further reducing liquidity, led to a situation where liquidity was a mile wide and an inch deep. My point is for all the corporates out there who have significant transactions to execute, you must carefully consider the best way to approach the situation to avoid a potentially significant increase in execution costs.

Turning to the data, before we look at this week, which ends with NFP, a quick word on Friday’s core PCE data, which came in at a hotter than expected 0.4% taking the YY number to 2.8%. The Fed cannot be happy with this outcome as a quick look at the recent readings makes it hard to accept inflation is continuing its decline from the 2022 highs. Rather a look at the below chart, at least to my eye, shows me a stability in Core PCE of somewhere between 2.5% and 3.0%, well above the Fed’s target range, and hardly a cause to cut rates further.

Source: tradingeconomics.com

As this note has already gotten a bit longer than I like, I will list the week’s data tomorrow but note that Chicago PMI (exp 45.4) is the only noteworthy data point to be released today.

Absent a complete reversal of Trump’s tariff plans, I see nothing positive on the horizon for risk assets, and expect that equities will maintain, and probably extend the overnight losses while gold and bonds both rally, at least for now. As to the dollar, my take is it will not benefit universally in this risk-off scenario, although there are currencies that will clearly suffer. Remarkably, despite the performance of Aussie and Kiwi overnight, I do believe the commodity bloc has the best prospects for now.

Good luck

Adf