Although it’s the number two nation

Of late its shown real desperation

Seems Xi did appraise

The recent malaise

And ordered growth maximization

So, mortgage rates there have been sliced

And refi’s are now getting priced

It’s different this time

The bulls, in sync, chime

As Xi seeks a brand new zeitgeist

As China gets set to head off for a week-long holiday, President Xi wanted to make sure everybody there felt great and would start to spend money again. His latest move came via the PBOC where they loosened the regulations regarding refinancing of home mortgages, now allowing them for everybody starting November 1st. The key housing rate in China is the 5-year Loan Prime Rate, and while that has fallen steadily over the past two years, down nearly 1%, all the people who were swept up in the property bubble that began to burst three years ago have not been able to take advantage of the lower rates. This is what is changing, and I presume there will be quite a bit of refi activity for the rest of the year.

So, to recap what China has done in the past week, they have cut interest rates across the board, guaranteed loans to be used for stock repurchases, changed regulations to allow lower down payments on mortgages for first and second homes and now allowed more aggressive refinancing of existing mortgages. As well, they reduced the RRR, freeing up capital for banks, and relaxed rules for regional governments to be able to spend more. Now matter how this ultimately ends up, you must give Xi full marks for finally figuring out that in a command economy, he needed to command some more stimulus. The latest mortgage news has simply excited the equity market even more and there was another huge rally last night (CSI 300 +8.5%), which when looking at a chart of that index shows an impressive rally in the past two weeks, slightly more than 27%!

Source: tradingeconomics.com

However, before we get too carried away, a little perspective may be in order. The below chart is the 5-year view, and while the recent rebound is quite impressive, it simply takes us back to the level from July 2023 and remains more than 30% below the highs seen in February 2021. I might argue that even if all of these policies work out as planned, something which rarely ever happens, until the economic data start to prove it out, things here feel a bit overbought for now. Putting an exclamation on the last point, last night China released its monthly PMI data which showed just why Xi has become so aggressive. Every reading, from both Caixin and the National Bureau of Statistics, was weaker than last month and weaker than expected. Xi certainly needed to do something.

Source: tradingeconomics.com

Gravity remains

An unyielding force, even

For Japanese stocks

Now, a quick mea culpa from Friday’s note as I was in error on my analysis of the Japanese stock market in the wake of the election of Ishiba-san. It seems that the announcement of his victory was not made until after the cash equity market was closed for the day. At that time, Sanae Takaichi remained the odds-on favorite to win the vote, and the market was anticipating a more dovish approach to things. Hence, the idea of the return to Abenomics and a much slower policy tightening was welcomed by the equity market at the same time the yen weakened. But with Ishiba-san’s surprise victory, all of that got tossed out the window.

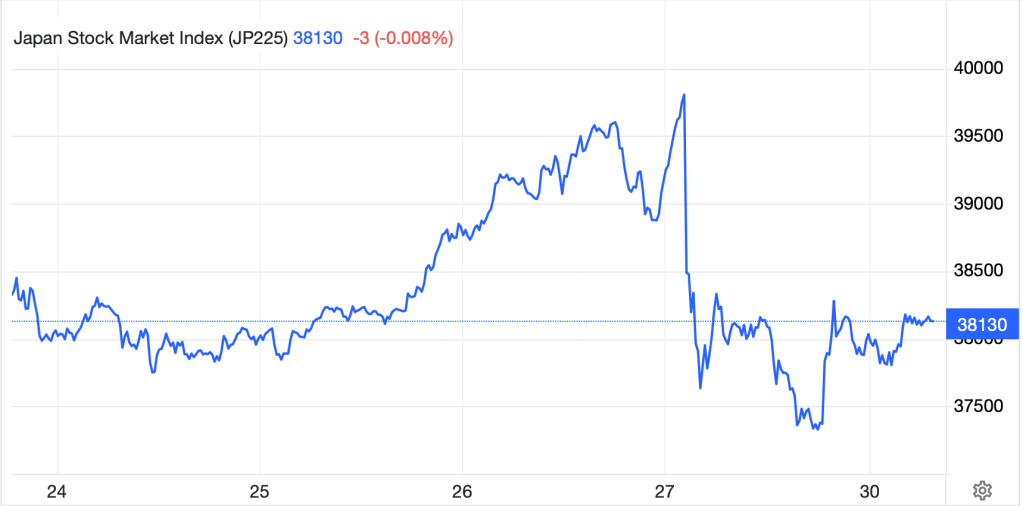

Of course, USDJPY was able to respond instantly, hence the sharp reversal in the market I showed in a chart on Friday. However, the futures market sold off sharply on the election news and now that has been reflected in the overnight session with the Nikkei (-4.8%) giving back all the gains it had made in the previous two sessions in anticipation of a dovish turn. So, as you can see in the below chart for the Nikkei 225 over the past week, we are basically exactly where things started before the Takaichi expectations built. Truly much ado about nothing.

Source: tradingeconomics.com

As to the rest of the overnight session, beyond the Chinese data, we saw German state CPI readings which continue to fall as the German economy continues to slow appreciably. We also saw UK GDP data, which was slightly softer than forecast, although at 0.9% Y/Y, still well ahead of Germany’s pace. But otherwise, not very much else. Last Friday’s PCE data was largely in line and quite frankly, most of the market seems to be focused on China right now, not the US, as that has become the newest idea on how to get rich quick.

So, here’s a quick recap of the session thus far. Away from China and Japan, we saw more weakness than strength in Asia with both Korea and India falling more than -1.0%, although the rest of the region was mixed with much smaller moves. Australia (+0.8%), though, benefitted from the China story as the price of iron ore, one of its major exports, rose 11% overnight on the idea that Chinese construction was coming back. However, European bourses are under pressure this morning led by the CAC (-1.6%) with the rest of the continent also soft on the back of weaker earnings forecasts and announcements from European companies. As to US futures, at this hour (7:20), they are pointing lower by -0.25%.

In the bond market, with all the excitement over renewed growth in China and continued tightening in Japan, yields are backing up slightly with virtually every G10 government seeing yields higher by 2bps this morning. Ultimately, for Treasuries my fear is with the Fed cutting rates now and no real sign that the economy is slowing rapidly, we are going to see a quicker rebound in inflation than they are anticipating and that will not help the long end of the curve at all.

In the commodity markets, we are following Friday’s declines with further moves lower this morning as oil (-0.55%) continues to struggle on the weak demand story (this time from Europe, not China) while metals markets are also under pressure with all three biggies down (Au -0.75%, Ag -1.4%, Cu -0.7%). This is a bit confusing for two reasons. First, with the euphoria that the Chinese reflation story has generated, I would have expected copper to continue to rally alongside iron ore, but second, the dollar is softer today, and that generally supports the metals markets.

So, a quick look at the dollar shows the DXY is looking to test 100.00, a level it last briefly touched in July 2023 but spend most of 2020 and 2021 below. This is concurrent with the euro (+0.3%) testing 1.12 and the pound (+0.3%) testing 1.35, with the former showing virtually the same pattern as the DXY and the latter making new highs for the past two years. But there is some schizophrenia in the G10 with JPY (-0.2%), CHF (-0.3%), NOK (-0.35%) and SEK (-0.2%) all under pressure today. While NOK and SEK make sense given the commodity moves, that doesn’t explain gains in AUD and NZD. Some days are just like that. In the EMG bloc, in truth, the dollar is showing more strength than weakness with ZAR (-0.35%), CNY (-0.2%) and KRW (-0.15%) although MXN (+0.3%) is bucking that trend. On the one hand, it is quite confusing to see so many contrary moves amongst the currencies that typically track closely together. On the other, though, none of the moves are very large, so there can be idiosyncratic explanations for all of this without changing the big picture story.

On the data front, we get a bunch of stuff culminating in NFP on Friday.

| Today | Chicago PMI | 46.2 |

| Dallas Fed Manufacturing | -4.5 | |

| Tuesday | ISM Manufacturing | 47.5 |

| ISM Prices Paid | 53.7 | |

| JOLTS Job Openings | 7.67M | |

| Wednesday | ADP Employment | 120K |

| Thursday | Initial Claims | 220K |

| Continuing Claims | 1837K | |

| ISM Services | 51.6 | |

| Factory Orders | 0.1% | |

| Friday | Nonfarm Payrolls | 140K |

| Private Payrolls | 120K | |

| Manufacturing Payrolls | -5K | |

| Unemployment Rate | 4.2% | |

| Average Hourly Earnings | 0.3% (3.8% Y/Y) | |

| Average Weekly Hours | 34.3 | |

| Participation Rate | 62.9% |

Source: tradingeconomics.com

As well as all that, we hear from nine different Fed speakers over 13 different speeches this week, including Chairman Powell this afternoon at 2:00pm. It’s not clear that we have learned enough new information for Powell to change his tune although given all of China’s moves there could be some belief that the Fed doesn’t need to be so aggressive. Now, as of this morning, the Fed funds futures market is pricing a 41% probability of a 50bp cut in November and a 50:50 chance of a total of 100bps by the end of the year. but, if China is easing so aggressively, does the Fed need to as well?

Right now, the story is all China. However, I still detect a lot of positive sentiment in the US and expectations that the Fed is going to continue to ease and boost growth, inflation be damned. It still strikes me that you cannot be bullish both stocks and bonds here as they are going to respond quite differently to the future. As to the dollar, it is clearly on its back foot as the pricing of further Fed ease undermines it for now, but remember, as other central banks follow the Fed more aggressively, any dollar declines will be muted.

Good luck

Adf