There once was a Fed Chair named Jay

Who fought ‘gainst the prez every day

He tried to explain

That tariffs brought pain

So higher rates needed to stay

But data turned out to expose

The job market, which had no clothes

So, he and his friends

Were forced, in the end

To cut ere recession arose

The Fed cut 25bps yesterday, as widely expected (although I went out on a limb and called for 50bps) and markets, after all was said and done by Chair Powell, saw equities mixed with the DJIA rising 0.6% while the S&P 500 and NASDAQ both slipped slightly. Treasury yields rose 5bps which felt much more like some profit taking after a month-long rally, than the beginning of a new trend as per the chart below.

Source: tradingeconomics.com

Gold rallied instantaneously on the cut news, trading above $3700/oz, but slipped back nearly 2% as Powell started speaking and the dollar fell sharply on the news but rebounded to close higher on the day as per the below chart from tradingeconomics.com. See if you can determine when the statement was released and when Powell started to speak.

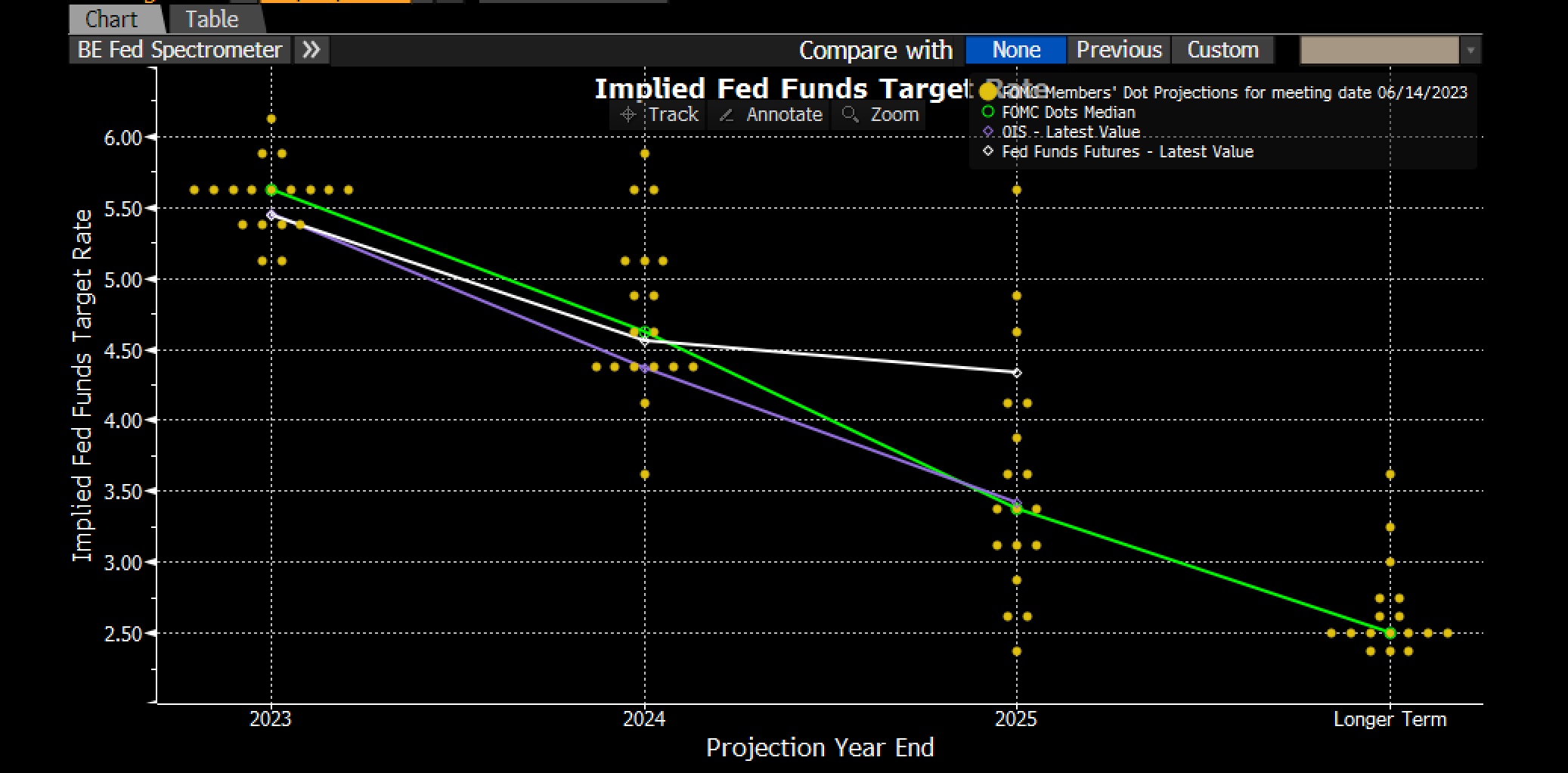

Did we learn very much from this meeting? I think we learned two things, one which is a positive and one which is not. On the positive side, there is clearly a very robust discussion ongoing at the Fed with respect to how FOMC members see the future evolving. This was made clear in the dot plot as even the rest of 2025 sees a major split in expected outcomes. But more importantly, looking into the future, there is certainly no groupthink ongoing, which is a wonderful thing. Simply look at the dispersion of the dots for each year.

Source: federalreserve.gov

The negative, though, is that Chairman Powell is very keen to spin a narrative that seems at odds with the data that they released in the SEP. In other words, the flip side of the idea that there is a robust discussion is that nobody there has a clue about what is happening in the economy, or at least Powell is not willing to admit to their forecasts, and that is a problem given their role in policy making.

It was a little surprising that only newly seated Governor Miran voted for 50bps with last meeting’s dissenters happy to go with 25bps. But I have a feeling that the commentary going forward, which starts on Monday of next week, is going to offer a variety of stories. If guidance from Fed speakers contradicts one another, exactly where is it guiding us? (Please know I have always thought that forward guidance was one of the worst policy implementations in the Fed’s history.)

Moving on, the other central banks that have announced have done exactly as expected with both Canada and Norway cutting 25bps. Shortly, the BOE will announce their decision with market expectations for a 7-2 vote to leave rates on hold, especially after yesterday’s 3.8% CPI reading. Then, all eyes will turn to Tokyo tonight where the BOJ seems highly likely to leave rates on hold there as well.

If you think about it, it is remarkable that equity markets around the world continue to rally broadly at a time when central banks around the world are cutting rates because they are concerned that economic activity is slowing and they seek to prevent a recession. Something about that sequence seems out of sorts, but then, I freely admit that markets move for many reasons that seem beyond logic.

Ok, having reviewed the immediate market response to the Fed, let’s see how things are shaping up this morning. Asian equity markets had both winners (Tokyo +1.15%, Korea +1.4%, Taiwan +1.3%, India +0.4%) and laggards, (China -1.2%, HK 1.4%, Australia -0.8%, Malaysia -0.8%) with the rest of the region seeing more laggards than gainers. The China/HK story seems to be profit taking related while the gainers all alleged that the prospect of another 50bps of cuts from the Fed this year is bullish. Meanwhile, in Europe, while the UK (+0.2%) is biding its time ahead of the BOE announcement, there has been real strength in Germany (+1.2%), France (+1.15%) and Italy (+0.85%) while Spain (+0.25%) is only modestly firmer. While there was no data of note released, we did hear from ECB VP de Guindos who said the ECB may not be done cutting rates. Clearly that got some investors excited. As to US futures, at this hour (6:55), they are solidly higher, on the order of 0.8% or more.

In the bond market, Treasury yields are backing off the highs seen yesterday and have slipped -4bps, hovering just above 4.0% on the 10-year. European sovereign yields are essentially unchanged this morning as were JGB yields overnight. It seems investors were completely prepared for the central bank actions and had it all priced in. I guess the real question is are those investors prepared for the fact that the Fed is no longer that concerned about inflation and will allow it to rise further? My guess there is they are not, but then, that’s where QE/YCC comes into play.

In the commodity markets, oil (-0.25%) is slightly lower this morning despite Ukraine attacking two more Russian refineries last night. What makes that particularly interesting is that the EIA inventory data showed a massive net draw of oil and products last week of more than 11 million barrels, seemingly a bullish signal. But hey, I’m an FX guy so maybe supply and demand in oil markets works differently! In metals, gold (+0.2%) and silver (+0.4%) continue to rebound from their short-term lows from yesterday. It is abundantly clear that there is growing demand for alternatives to fiat currencies.

Speaking of which, in the fiat world, rumors of the dollar’s demise remain greatly exaggerated. After yesterday afternoon’s gyrations discussed above, it is largely unchanged this morning with some outlier moves in smaller currencies, NZD (-0.5%), ZAR (+0.3%), KRW (-0.3%) while amongst the true majors, only JPY (-0.25%) has moved any distance at all.

***BOE Leaves rates on hold, as expected, with 7-2 vote, as expected.***

Turning to this morning’s data, we see the weekly Initial (exp 240K) and Continuing (1950K) Claims as well as Philly Fed (2.3), then at 10:00 we get Leading Indicators (-0.2%). Something I read was that last week’s Initial Claims number of 263K was caused by a data glitch in Texas, implying it was overstated. I imagine we will find out more on that this morning.

Recapping all we learned yesterday and overnight, the Fed seems reasonably likely to cut at both of their last two meetings this year, but expect only one cut in 2026, which is at least 50bps less of cuts than had been expected prior to the meeting. Meanwhile, equity markets don’t seem to care and continue to rally while bond investors remain under a spell, believing the Fed will fight inflation effectively. Gold is under no such spell, and the dollar is the outlet for all of it, toing and froing on the back of various theories of the day. If forced to guess, I do believe there is a bit more weakness in the dollar in the near-term, but do not look for a collapse. In fact, I suspect that as investment flows into the US pick up, we will see a reversal of note by the middle of next year.

Good luck

Adf