The story on everyone’s lips

A central bank apocalypse

If Trump fires Powell

The markets will howl

With yields rising numerous bips

However, said Trump, it’s farfetched

Despite plans that he’d clearly sketched

Thus, markets reversed

While bears, losses, nursed

And “right-thinking” people all kvetched

If you had Trump fires Powell on your White House Bingo card, congrats, it looked like a winner. That was the story all morning yesterday, overshadowing PPI data that was quite benign, printing at 0.0% M/M for both headline and core, as the punditry postulated the problems with Trump doing that. At this point, we are all familiar with the fact that the Fed Chair can only be fired for “cause” although exactly what “cause” represents is unclear. Too, we know that in Trump’s efforts to reduce the size of the government, the Supreme Court gave him authority to remove the heads of many departments but explicitly carved out the Fed from that process.

In the end, though, despite rampant rumors that he had composed a letter for just such an occasion, at a press conference with Bahraini Crown Prince, Salman bin Hamad Al Khalifa, he said it was “highly unlikely” he was going to fire Powell, although he once again castigated him for not cutting rates. Most markets, after getting all excited about the prospects of this action, reverted to the previous solemnitude of doing nothing over the summer. The below chart of the S&P 500 was replicated in virtually every market.

Source: finance.yahoo.com

It is also no surprise that the Fed Whisperer was out in the WSJ this morning defending his bread-and-butter relationship, but my take is this is just a feint on the president’s part to move the discussion away from issues he doesn’t like. Given that Supreme Court protection and given that the Supreme Court has been very good for Mr Trump, I’m pretty confident that Powell will serve out his full term as Chair and be replaced next year. I would, however, look for a candidate to be announced at the earliest possible time.

While that was the story that sucked up all the oxygen yesterday, life still goes on and this morning, arguably the biggest news is that UK Unemployment rose to 4.7% with earnings slipping and the Claimant count rising. The punditry continues to harp on how the US is set to go into stagflation because of Trump’s tariffs which are driving inflation higher while weakening the economy (despite all evidence to the contrary) while ignoring the UK which saw inflation rise faster than expected yesterday, to 3.6% while Unemployment is rising. That feels a lot closer to the stagflation story than in the US, and as we heard from BOE Governor Bailey yesterday, it’s all Trump’s fault because of the tariffs. Talk about deflection. However, a little sympathy for the Guv is in order as he really doesn’t know what to do. After today’s data, there is more discussion of another rate cut by the BOE when they next meet on August 7th. Certainly, the pound (-0.1%) is behaving as though a rate cut is coming as evidenced by the chart below.

Source: tradingeconomics.com

However, remember that the UK government of PM Starmer has proven its incompetence on virtually every issue it has addressed, both domestically and on an international basis, so the pound’s decline could well be a general exit from the UK by investors. Speaking of currencies, the dollar is having quite a positive day across the board. Aussie (-0.9%) is the laggard across both G10 and EMG blocs as its employment situation report showed a much weaker economy than expected, although the yen (-0.4%) is starting to feel real pressure as the Upper House Election approaches. In fact, there is growing talk that USDJPY above 150 is likely if the PM Ishiba’s LDP loses their majority in the Upper House, or even if it wins given the amount of increased deficit spending they are promising. Does anyone remember all the talk of the end of the yen carry trade and how the yen was going to rise dramatically? There’s a theme that did not age well. As to the rest of the currency market, the dollar is rising vs. everybody with a rough average gain of ~ 0.4%. The dollar is not dead yet.

Heading back to equities, despite all the angst about Powell yesterday, US indices all managed a gain on the day. In Asia, most markets performed well with Japan (+0.6%) and China (+0.7%) indicative of the movement. Australia (+0.9%) responded to its jobs data with growing expectations of an RBA rate cut and there were many more regional exchange gainers than losers overnight. In Europe, green is also today’s theme, with both the CAC (+0.9%) and DAX (+0.8%) having very nice sessions and most of the rest of the continent climbing around 0.5%. The only data of note was the final CPI reading for the Eurozone, which was right on the button at 2.3% core. However, at this hour (7:00) US futures are essentially unchanged.

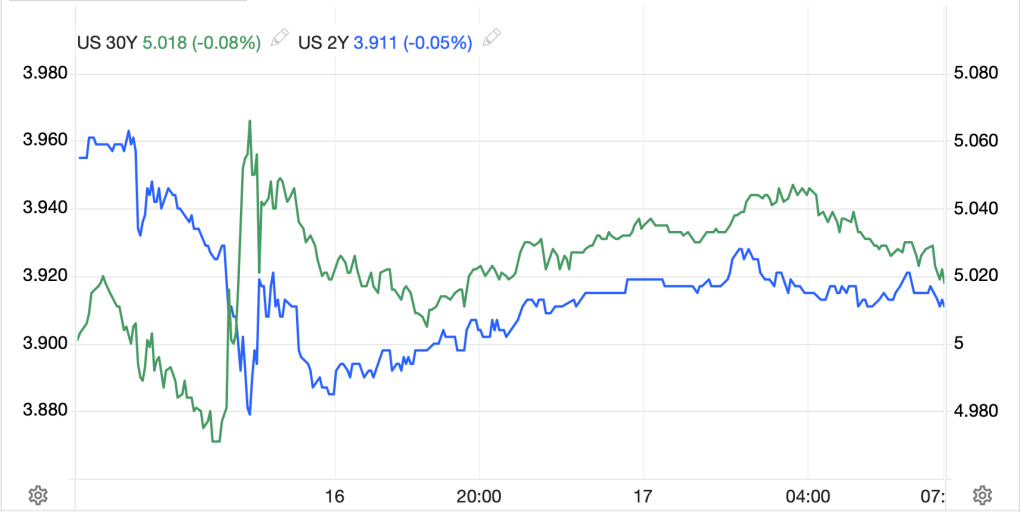

Bonds were actually the biggest concern yesterday on the Powell news with a huge divergence between the 2-year and 30-year as the rumors flew, although most was forgiven after Mr Trump said he would not be firing Powell. The Chart below shows that divergence and the retracement although 2-year notes did remain lower for the session.

Source: tradingeconomics.com

But that was yesterday. This morning, 10-year Treasury yields have edged higher by 1bp, and European sovereigns have largely followed suit. In Asia, though, it is noteworthy that Australian government bonds saw yields decline -5bps after the data, and JGB yields slid -2bps as election promises seem to imply more QE, not less.

Lastly, commodity prices also got the whipsaw treatment on the Powell story, but this morning, with the dollar showing strength across the board, we see metals prices slipping (Au -0.6

%, Ag -0.25%, Cu -0.15%) although oil (+0.5%) is finding a bottom it seems as per the below chart from tradingeconomics.com.

On the data front, in addition to the weekly Initial (exp 235K) and Continuing (1970K) Claims data, we also get Retail Sales (0.1%, 0.3% ex autos) and Philly Fed (-1.0). We hear from one Fed speaker, Governor Kugler, but if anything, after yesterday’s Powell drama, I expect everybody we hear from to rally round the Chair, so there will be no talk of rate cuts. Aside from yesterday’s PPI data, the Fed’s Beige Book indicated modest economic growth, again, not a reason to cut interest rates.

Let me leave you with a thought experiment though. Last night, the Senate passed the first (of many we hope) rescission bill to actually reduce spending. Tariff income has grown as evidenced by last month’s budget surplus. What if Trump and his team are correct, and through reduced regulations as well as tariff and increased inward investment, the private economy grows more strongly and the budget deficit declines far more than current estimates, perhaps achieving Secretary Bessent’s goal of 2%? Will yields rise or fall? Will the dollar rise or fall? Will equities rise or fall? On the White House Bingo card, I would suggest very few believe in this outcome and are not managing their portfolios to address this. But I would also suggest it is a non-zero probability, although not my base case. Just remember, stranger things have happened.

Good luck

Adf