The ‘conomy grew a bit faster

Than ‘spected by every forecaster

Consumers are rocking

While AI is Grokking

Though prices could be a disaster

The question this data incites

Is why cut rates from current heights?

With stocks on a tear

And ‘flation still there

The risk is the long bond ignites

Yesterday’s GDP data indicated that both consumer spending and AI investment were larger than expected with the result being GDP activity increased more than economists had forecast. Most would consider this good news, and the equity markets clearly saw the benefits as they continue their slow march higher. Surprisingly, despite the positive economic data, the Fed funds futures market did not reduce the probability of a rate cut next month. Arguably that was because Governor Waller, one of the two who voted for a cut in July, spoke yesterday and reiterated his views that a cut was appropriate to prevent a worse outcome in the employment situation. Frighteningly, he said, “I am back on Team Transitory.” I fear that the transitory phenomenon is going to be the reduction in inflation we have experienced over the past two years, not the initial peak seen in 2022. (As an aside, if inflation is your concern, USDi is one way to maintain the purchasing power of your funds as it mechanically tracks CPI, rising in step with the index.)

Perhaps the futures market is starting to expect that Governor Lisa Cook’s days are truly numbered with a third instance of potential mortgage fraud surfacing yesterday, a situation that has a bad look for a Fed governor. If she is forced out soon, that would be yet another Fed governor that President Trump will get to appoint, and the tension in the Marriner Eccles building will certainly grow at that September meeting. After all, if Trump seats two more governors, and has 4 votes for a rate cut on the board, the question will not be should they cut, but how much they should cut with 50 basis points on the table regardless of the economics.

But all that is still three weeks away and based on the fact that if I look at almost every market, price action has been consolidating for the entire summer, it is hard to get excited in the short-term. In fact, I think it is worthwhile to look at some charts so you can get a sense of just how little is going on.

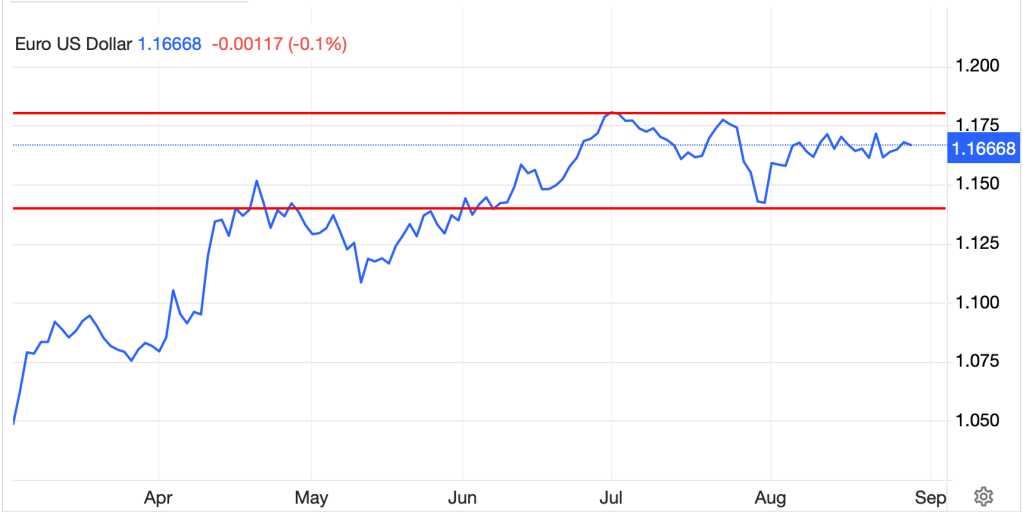

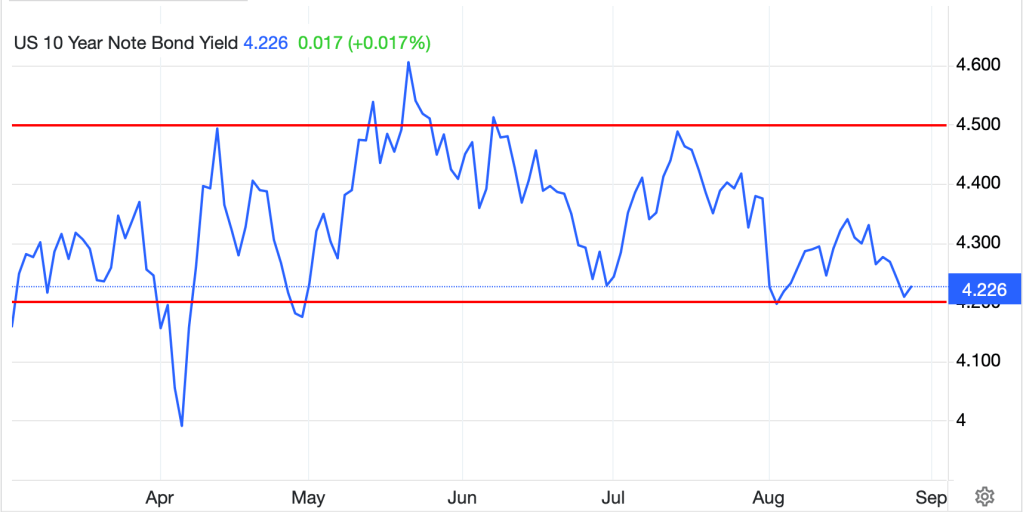

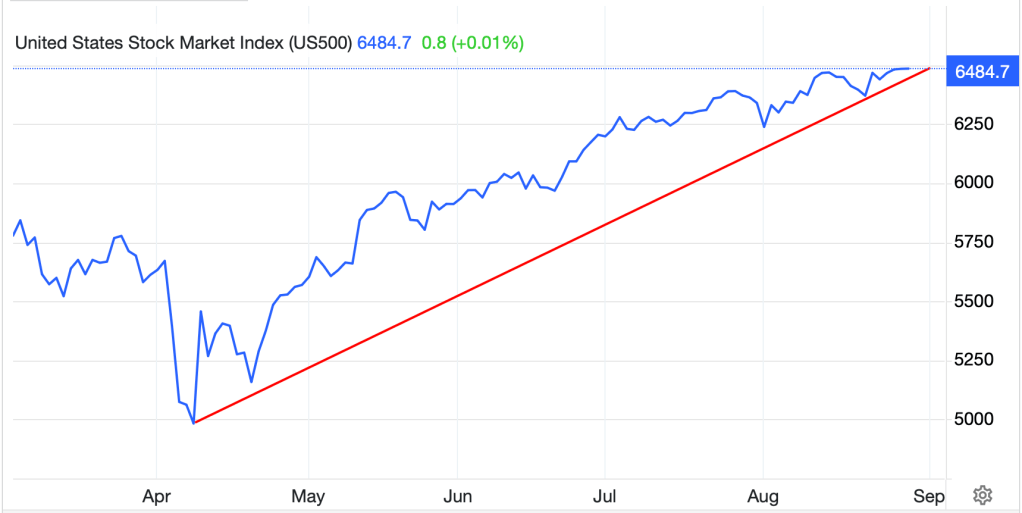

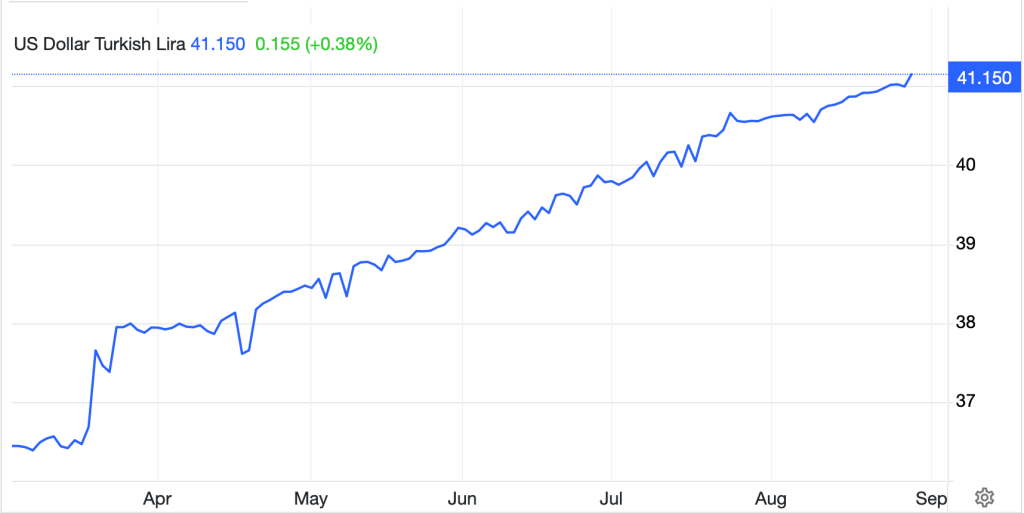

All these charts are from tradingeconomics.com and I have drawn in some recent ranges to show that over the past 6 months, only one asset class has shown any trend of note. See if you can guess which that is. I’ll start with the EURUSD since, after all, I am an FX guy, but go to bonds, oil, gold and equities.

Since late April, the euro has chopped back and forth despite many stories of the dollar’s incipient demise and the euro’s upcoming rally as investors flock to European equity markets. Maybe not.

Treasury yields have also been largely range bound, and if anything, look like they are heading lower despite fears being flamed regarding massive amounts of issuance having trouble finding buyers as foreigners pull out of the market. Maybe not.

Crude has been the choppiest, and of course we did have the bombing of Iran’s nuclear facilities which inspired some fears of the beginning of a new Middle East war. But Russia keeps pumping, OPEC put 2.2 million barrels per day of production back into the market and it appears, that for now, the market has found a balance. I still see oil sliding over time, but for now, the range is king.

The barbarous relic has just started to pick up and broke above the $3400 range cap just two days ago but has not yet shown signs of a major breakout. However, if the Fed cuts, especially if they go 50bps for some reason, I would look for this to change and gold (and all precious metals) to rally sharply as inflation re-enters the conversation.

However, if we look at the US equity market, the picture is very different. The only other market moving like this is USDTRY as the Turkish Lira steadily depreciates amid massive monetary expansion there with inflation rising sharply. In fact, this is what many foresee for the dollar going forward, but even if the Fed cuts, it seems a bit of an exaggeration.

At this point I should note that there is one currency that is outperforming the dollar right now, the Chinese renminbi. It appears that as trade negotiations are ongoing, the Chinese (and the Koreans amongst others) have gotten the message that they need to adjust their currency’s value if an agreement is going to be reached.

To conclude, ranges remain the situation in most markets other than equities which continue to rally based on hopes and prayers that central bank spigots are never turned off. With Labor Day on Monday, perhaps we will begin to see more real activity reenter the market as traders and investors come back from summer vacation. But we will need a real catalyst to break those ranges, whether that is a shocking NFP number, a reescalation of Middle East conflict or something else (China laying siege to Taiwan?). While I don’t know what that catalyst will be, history tells us something will come along, that’s for sure.

As we look to the NY opening, we do get more important data as follows: Personal Income (exp 0.4%); Personal Spending (0.5%); PCE (0.2%, 2.6% Y/Y); Core PCE (0.3%, 2.9% Y/Y); Goods Trade Balance (-$89.5B); Chicago PMI (46.0); and Michigan Sentiment (58.6). There are no Fed speakers on the docket, but you can be sure that the Lisa Cook story will remain front and center, especially as I read that the judge initially selected to oversee the case was Ms Cook’s sorority sister, potentially a disqualifying factor that would cause her recusal and a new appointment. In fact, I suspect that story will have more traction than whatever the data says today.

As to the dollar, it is hard to get excited at this point. If PCE data is softer than forecast, though, I would look for the dollar to sell off and the probability of that Fed funds rate cut to rise from its current 85%.

Good luck and have a good holiday weekend

Adf