The data from China is still Desultory and likely will Result in support In order, quite short, Lest Xi’s plans go further downhill Perhaps, though, he’ll find a reprieve If Jay and his brethren perceive Employment is slowing And risks are now growing Recession they’re soon to achieve

Poor President Xi. Well, not really, but you have to admit his plans for widespread prosperity in China have certainly not lived up to the hype lately. Last night, PMI data was released, and like the Flash PMI data we saw last week in Europe and the US, it remains quite weak. Specifically, Manufacturing PMI printed at 49.7, slightly better than expectations but still below the key 50.0 level. Non-manufacturing PMI printed at 51.0, continuing its slide toward recession and indicative that there is no strong growth impulse coming from any portion of the economy there.

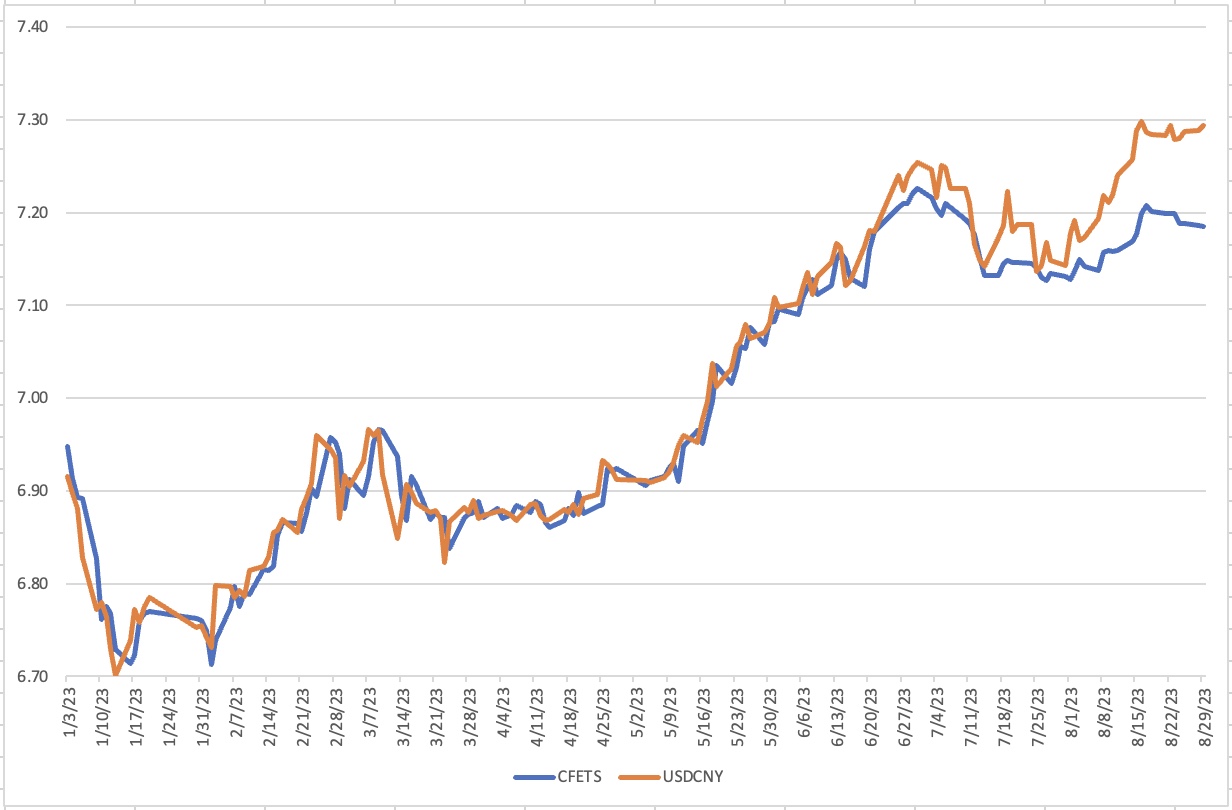

Remember, manufacturing remains a much larger piece of the Chinese economy (28%) than that of the US economy (11%), so weakness there is really problematic for the overall economic situation. And while the PBOC continues to try to prevent excessive weakness in the renminbi, Chinese exporters clearly need the support of a weaker currency to thrive. Finally, given the slowing economic situation in Europe, which is now China’s largest export market, demand for their products is simply weak.

To date, the Chinese government has not really provided substantial support to the economy, certainly there has been no fiscal ‘bazooka,’ and monetary efforts have been at the margin. In the current environment, it remains hard to make a case for China’s natural rebound until the rest of the global economy rebounds. And woe betide Xi if (when) the US goes into recession. Things there will only get worse. The FX market is uninterested in the PBOC’s views of where USDCNY should trade, maintaining a 1.5% dollar premium vs. the daily fixing rate. At some point, the PBOC is going to have to relent and USDCNY will go higher, in my view to 7.50 or beyond.

Speaking of recession, while the Atlanta Fed’s GDPNow forecast for Q3 is at 5.90% (a remarkably high number in my view), yesterday we saw Q2 GDP revised lower to 2.1%, with the Personal Consumption component falling to 1.7%. At the same time, Gross Domestic Income (GDI) in Q2 was released at +0.5%, substantially lower than GDP. (GDI and GDP are supposed to measure the same thing from different sides of the equation. GDP represents expenditures while GDI represents income. Eventually, they must be equal, by definition, but the estimates until all the data is finally received can vary. In fact, looking at GDI, it was negative in Q4 and Q1 and is just barely growing now. This is another reason many are looking for a US recession soon.)

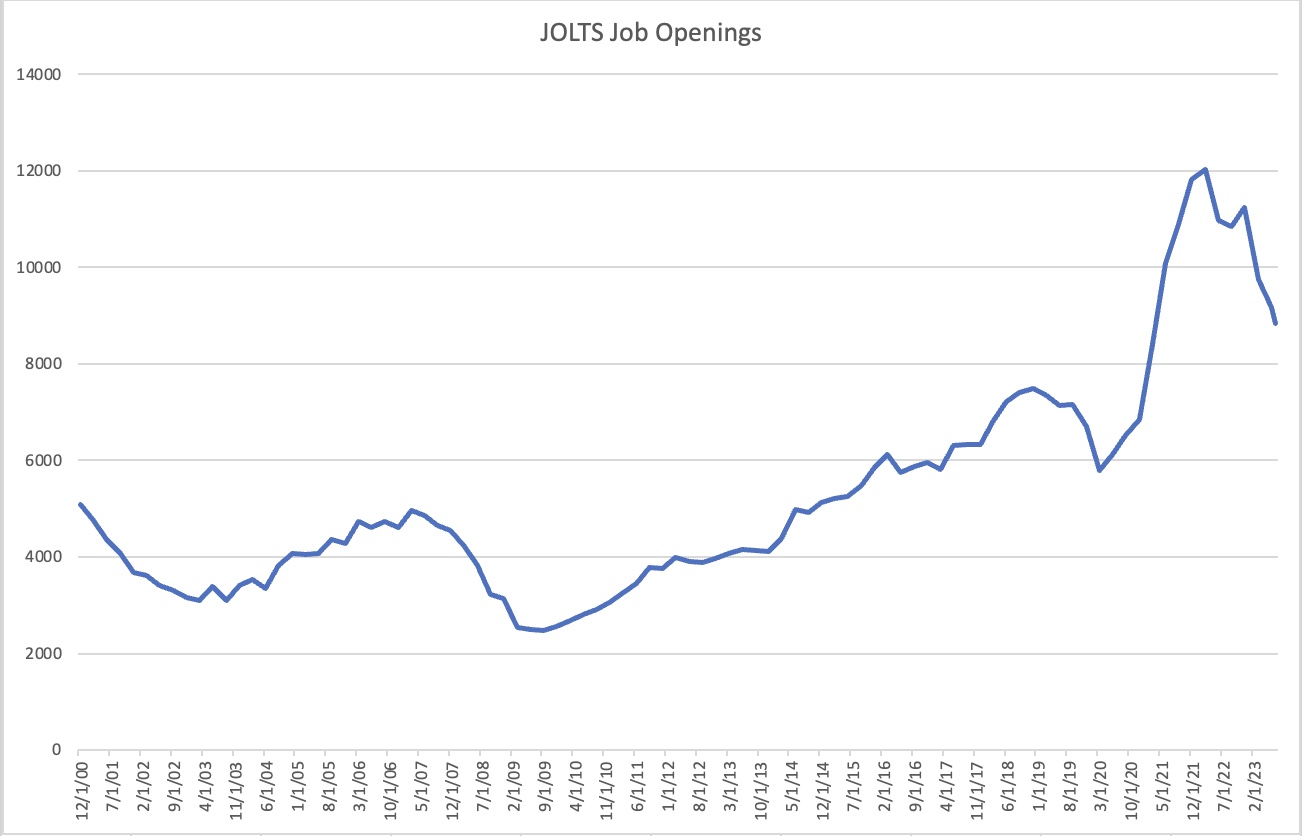

In this vein, Richmond Fed president but non-voter, Raphael Bostic, in a speech overnight in South Africa said, “I feel policy is appropriately restrictive. We should be cautious and patient and let restrictive policy continue to influence the economy, lest we risk tightening too much and inflicting unnecessary economic pain. However, that does not mean I am for easing policy any time soon.” So, this is not exactly the same message we heard from Chairman Powell last week, but the caveat of not cutting is certainly in line. I suspect, especially if we start to see weaker labor market data, that more FOMC members are going to feel comfortable that rates have gone high enough. At least that will be the case as long as inflation remains quiescent. However, if it starts to pick up again, that will be a different story.

Ok, let’s look at the overnight session. It should be no surprise, given the Chinese data, that equity markets there were underwater, with losses on the order of -0.6% in Hong Kong and on the mainland. However, the Nikkei (+0.9%) was the star performer across all markets on the strength of strong Retail Sales data. As to Europe, the DAX (+0.5%) is managing some gains, but the rest of the space is little changed on the day. It seems the CPI data that has been released from Europe, showing higher prices in Germany, France and Italy despite weakening growth has raised concerns about another ECB rate hike. As to US futures, at this hour (7:30) they are little changed to slightly higher.

Bond yields are falling today, especially in Europe where they are lower by about 5bp-6bp across the board. It seems that there is more concern over the growth story, or lack thereof, than the inflation story right now. In the Treasury market, yields are lower by 2bps as well, although remain well above the 4.0% level. This has been a response to yet another weak headline labor number with yesterday’s ADP Employment figure reported at 177K. It seems that the huge revision higher to the previous month, a 47K increase, was ignored. However, this is setting the stage for tomorrow’s NFP, that’s for sure.

Oil prices (+0.8%) continue to rebound after another huge inventory draw last week and despite concerns over an impending recession. Gold (+0.1%) has been performing extremely well given the dollar’s rebound, but the base metals remain recession focused, or at least focused on Chinese weakness, and are under pressure again today.

Finally, the dollar is firmer this morning, with only the yen (+0.2%) gaining in the G10 bloc as even NOK (-0.65%) is falling despite oil’s rally. In fact, this move looks an awful lot like a risk-off move, especially when considering the rally in Treasuries, except the equity market didn’t get the memo. In the emerging markets, the situation is similar, with many more laggards than gainers and much larger movement to the downside. ZAR (-0.75%) is the worst performer followed by HUF (-07%) and CZK (-0.6%) although the entire EEMEA bloc is down sharply. However, these currencies are simply showing their high beta attachment to the euro, which is lower by -0.5% this morning. Again, given the data from Europe, this can be no surprise.

On the US data front, this morning brings the weekly Initial (exp 235K) and Continuing (1706K) Claims data as well as Personal Income (0.3%), Personal Spending (0.7%), the all-important Core PCE (0.2% M/M, 4.2% Y/Y) and finally Chicago PMI (44.2). Yesterday’s data was soft and if that continues into today’s session, I suspect the ‘bad news is good’ theme will play out. That should entail a further decline in yields and the dollar while equities continue higher. However, any strength is likely to see the opposite. Remember, too, tomorrow is the NFP report, so given the holiday weekend upcoming, it seems likely that positioning is already quite low and trading desks are thinly staffed. In other words, liquidity could be reduced and moves more exaggerated accordingly. However, until we see that recession and drop in inflation, my default view remains the dollar is better off than not.

Good luck

Adf