Ahead of today’s CPI Investors would not really buy But neither would they Sell short, as they weigh If Jay is a foe or ally Meanwhile, amongst pundits it seems The world is split into extremes Some see prices falling And for cuts, are calling While others fear price rise regimes

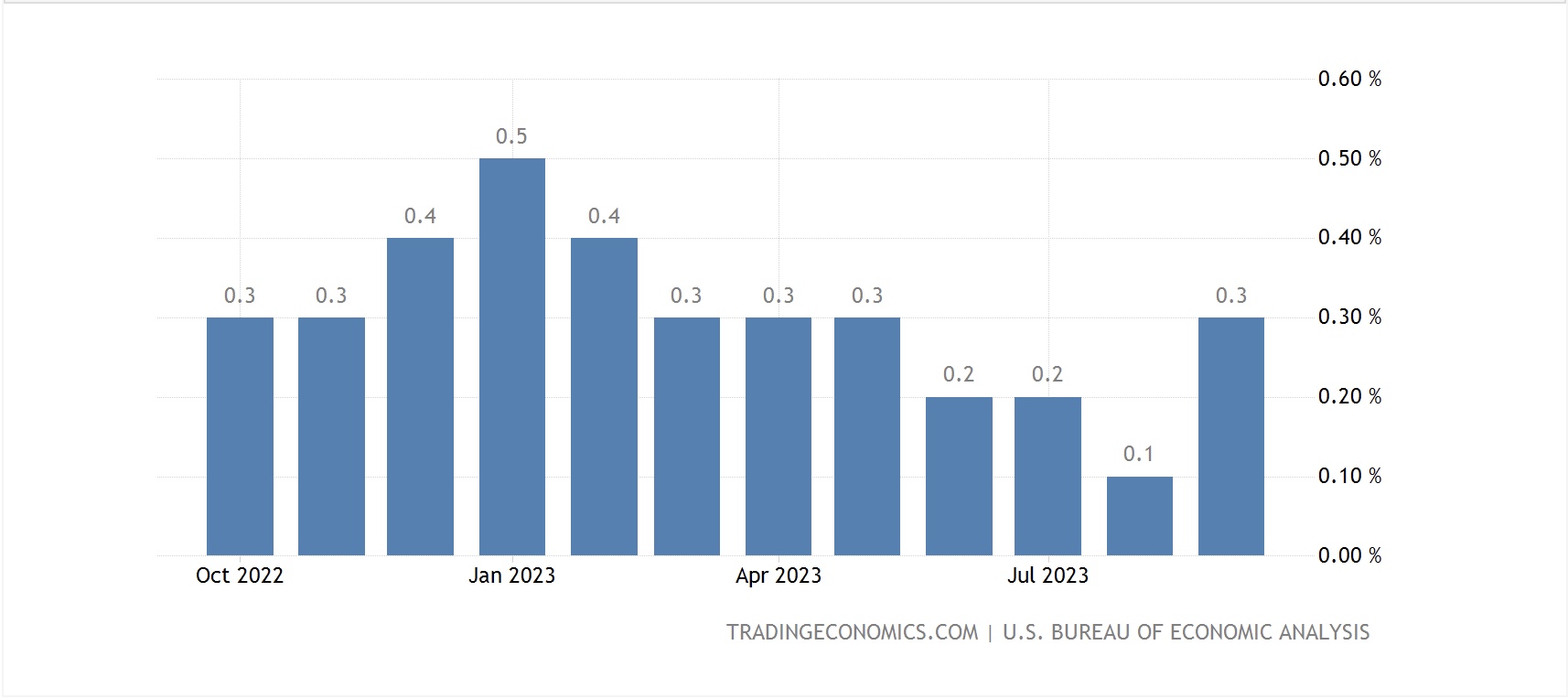

Market activity has been subdued overnight as we all await this morning’s big CPI report. Currently the consensus views are for a 0.1% rise in the headline, leading to a 3.3% Y/Y number, down substantially from last month’s 3.7% reading, and a 0.3% rise in the core, leading to an unchanged Y/Y reading of 4.1%. Here’s the thing, as can be seen in the below chart of core CPI, although it is clear inflation appears to be trending lower, it is still a LONG way from where anybody is comfortable.

Something else to remember is the different ways in which we all experience, and think about, inflation. When writing about inflation, all analysts look at the rate of change of a percentage move as an indicator of what is happening. But when you go to the grocery store, or your favorite restaurant, or when you order stuff on-line, especially things that you regularly buy, the price changes over the past two years have been so substantial, and taken place in such a short time, that we all remember the pre-covid prices. The fact that prices may not be rising as fast as they did last year does not make the stuff any cheaper this year. I would contend that is why virtually all of us consider the inflation data to be suspect, because the package of toilet paper that used to cost $4.99 now costs $8.99, and while it may not go higher anytime soon, it is still nearly double what we remember. This perception is critical, in my mind, to understanding the national mood, and it is one that nobody in the Fed, or likely the administration, considers. We know this because there are so many articles in the mainstream media about how things are really great, and people just don’t understand how good a job those two groups are doing.

At any rate, if pressed, I would say that there are more deflationistas these days, who believe that inflation is going to quickly head back to 2% and that the Fed is going to be cutting rates early next year to prevent overtightening of policy. The crux of their argument is that M2 is declining at a record pace (as can be seen in the below chart), and therefore is highly deflationary.

I would counter that argument, though, with the fact that the velocity of money (see chart below) is rising at a record pace, offsetting those declines, and supporting ongoing inflationary tendencies.

As some of us may remember from our macroeconomics classes, the identity to describe growth and inflation is:

MV = PQ

The argument that a decline in M2 money supply (the “M”) will lead to lower prices assumes the velocity of money (the “V”) remains stable. But as you can clearly see from the second chart, the velocity of money is rising sharply. I would contend there is little chance that deflation is coming to a screen near you at any point in the next several years absent a depression brought on by a collapse in the bond market. And ultimately, that means that the price of all those things we buy regularly is not going to retreat to pre-covid levels.

Away from the CPI drama, there were two things of note overnight. First, Japanese FinMin Suzuki was on the tape explaining the government would take all possible steps necessary to respond to currency moves. The market response was a very short-term rise in the yen, with the currency popping 0.35%, but giving back most of those gains within the hour and currently, it sits largely unchanged on the session. There has been no evidence that the BOJ has intervened since October 2022, but it appears that 152.00 may be a sensitive spot right now. The other thing he said was they were preparing a package to help citizens cope with the weakening yen which is driving inflation there. That said, there is no indication yet they are going to raise the deposit rate from its current -0.10% level. Net, I still think the yen has further to decline, at least until policy changes in Tokyo.

The other noteworthy occurrence was word from China that they were considering an additional CNY 1 trillion of support for the housing market as things on the mainland continue to slow despite Xi’s best efforts. It seems when you blow a 20-year property bubble of such enormous proportions, such that the property sector consumes > 25% of your growing economy, slowing that down without collapsing the economy is a tough job. I continue to think of King Canute and his command that the tide recedes every time I think about KingPresident Xi trying to stop the property market collapse. At any rate, as can be seen by the fact that equity markets in China and Hong Kong did virtually nothing last night, the market is not excited by the prospects of more Chinese money sloshing around.

As to the rest of the equity markets, yesterday’s trading in the US was pretty limited with modest gains and losses in the indices while the Nikkei managed to gain 0.3% overnight. European bourses are also mixed, with the continent a bit firmer while the UK is under some pressure. Perhaps the marginally better than forecast German ZEW reading of 9.8 vs 5.0 expected and -1.1 last month is the driver on the continent, while UK employment data was arguably a bit better than forecast, with the Unemployment Rate remaining unchanged at 4.2% rather than ticking higher as expected, and so hopes for a quick BOE rate cut have faded a bit.

Too, in the bond market, activity has been extremely subdued with Treasury yields 2bps softer this morning while European sovereign yields are essentially unchanged across the board. Last night in Asia, we saw little movement as well, with JGB yields slipping just 1bp and hanging around their new home at 0.85%.

While commodity prices managed to rally a bit yesterday, this morning, what little movement there is across energy and metals markets is ever so slightly lower. Yesterday saw the EIA raise its forecast for oil demand slightly, and there is word that the administration is bidding for 1.2 million barrels of oil to start to refill the SPR, but sentiment in this space is clearly negative with the recession fears the driving force across all these markets.

Finally, the dollar, too, is very little changed this morning which should be no surprise given the lack of movement elsewhere. If anything, it is trending a bit softer, but only just, as the deflationistas seem to be preparing themselves for a soft CPI print and want to get on board for that first Fed rate cut. As we currently stand, at least according to the Fed funds futures market, the first cut is priced in for the June meeting, although the first hints of a cut show up in March. That said, the probability of a rate hike in December has edged higher to 15% from below 10% last week. There is still a great deal of confusion as to how market participants believe this is going to play out over time.

Aside from the CPI data, we hear from 3 more Fed speakers today, Barr, Mester and Goolsbee, while Governor Jefferson, in a speech in Zurich early this morning, didn’t really touch on current monetary policy, rather he was discussing uncertainty in a broad manner. I suspect that the 3 speakers will generally reiterate Powell’s message from last week that the future is uncertain but higher for longer is the way forward. As such, it is all about the data. A hot print, certainly a M/M of 0.2% headline or 0.4% core will likely see bonds sell off along with stocks while the dollar rallies. However, anything else, meaning a soft print or even an as expected print, will likely encourage risk buying and dollar selling. We shall see,

Good luck

Adf